What is Customer Lifetime Value?

CLV is the total predicted revenue a business can derive from the entire future relationship with a customer.

It's a foresight tool that goes beyond the value of a single transaction - it takes into account the customer journey, from onboarding to possible churn or customer loyalty.

Importance and Role of CLV

Not only does CLV let a business understand the financial worth of a customer, but it also enables it to formulate action plans to optimize this value, deal with customer churn and enhance customer retention strategies.

Without a grasp on CLV, companies risk spending too much on customer acquisition while neglecting customer retention.

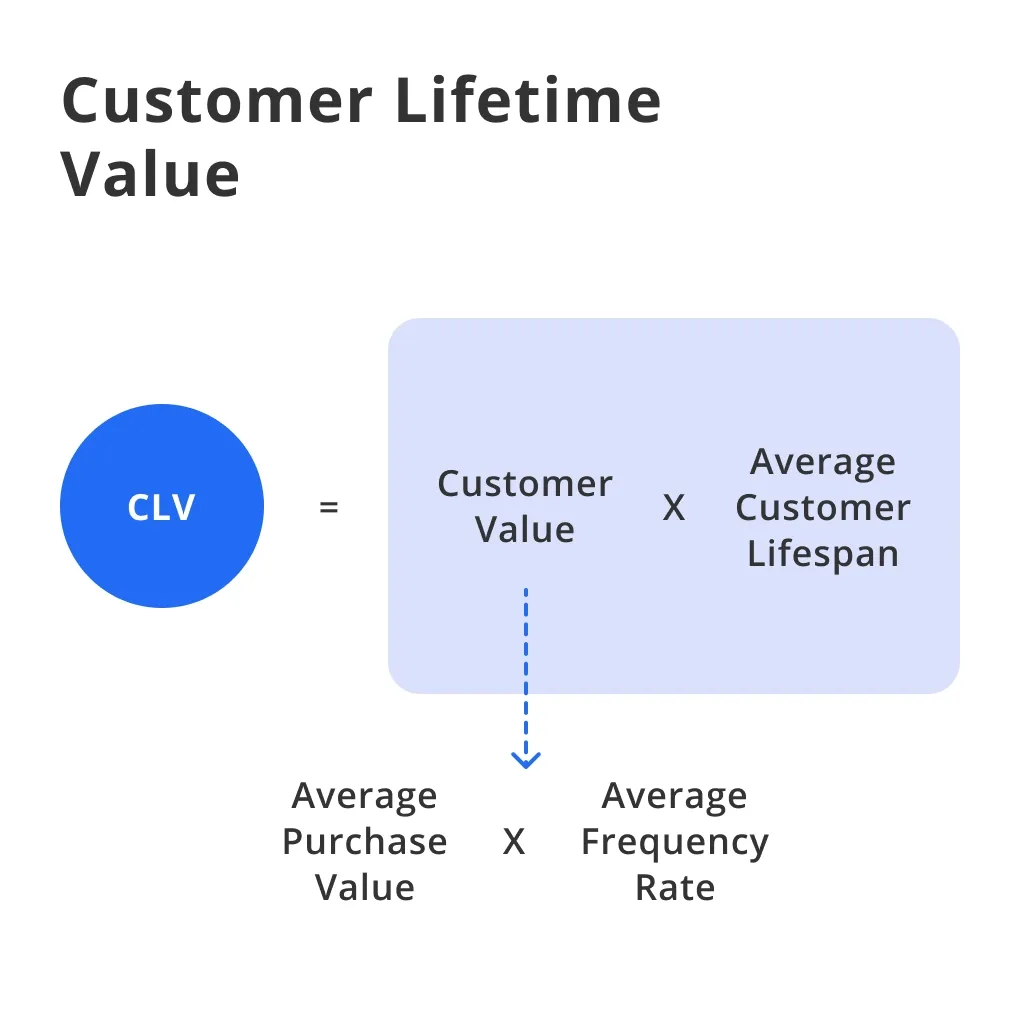

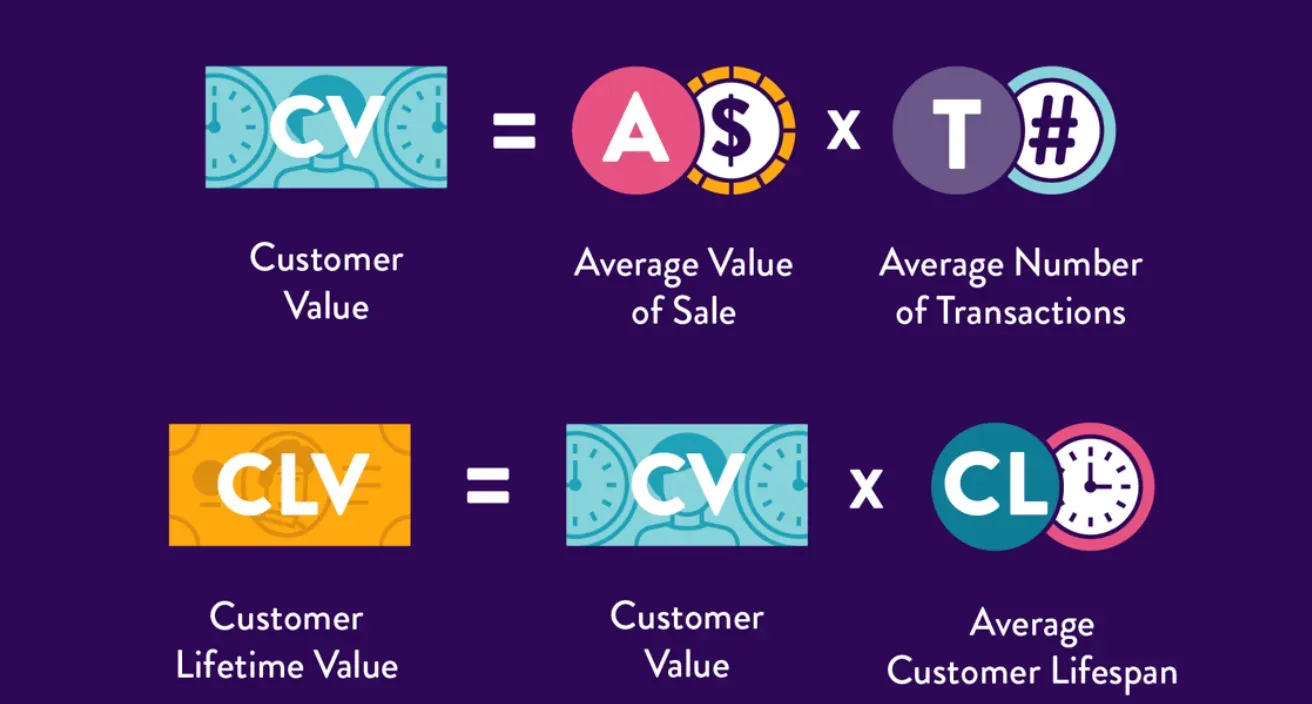

The Math Behind CLV - How to Calculate?

Sure, calculations can be intimidating, but the basic formula for computing CLV is pretty straightforward. Put simply, CLV is the sum of the net profits from each customer purchase, discounted back to present value.

Several methods exist to calculate CLV, including historical, predictive, traditional and cohort analysis, but they all boil down to the basic concept of revenue minus costs.

Utilization of CLV in Business

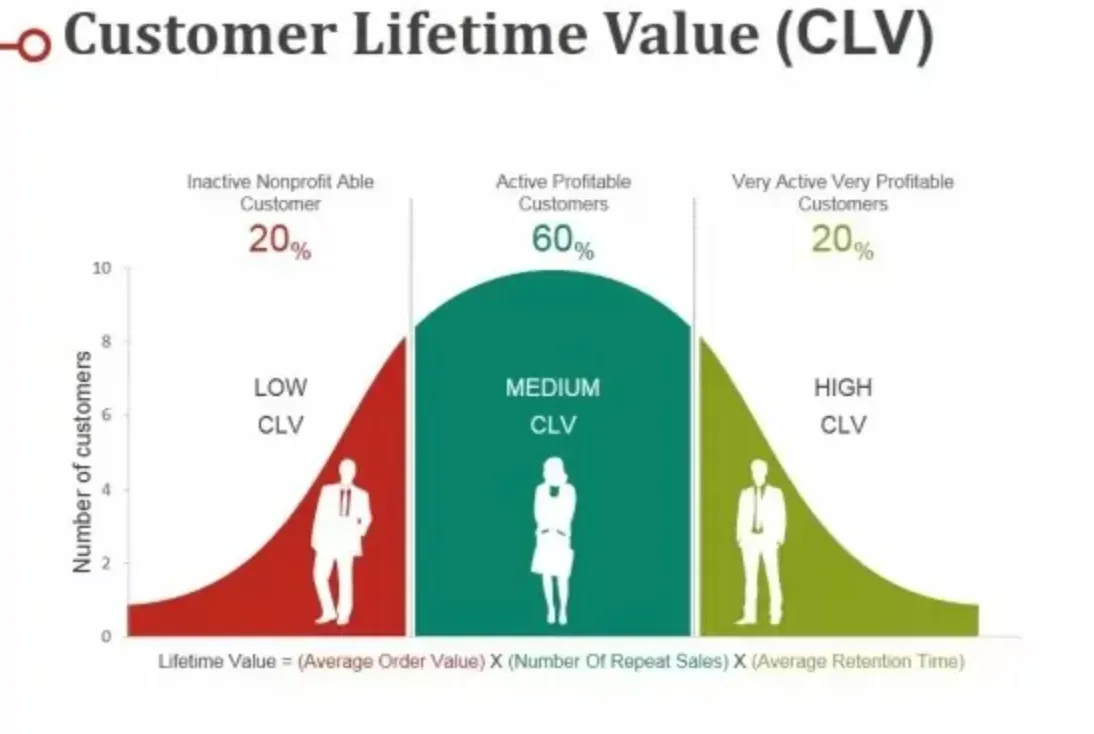

Businesses can use this metric to identify their most valuable customers and segment their customer base accordingly.

By doing so, they can focus their marketing and customer service efforts on these high-value customers, resulting in improved business revenue and customer satisfaction.

The Limitations of CLV

While CLV is a significant metric, it isn't perfect. Predicting future customer behavior can be difficult, and constantly changing market conditions can disrupt the accuracy of these predictions.

Who Benefits from a Grasp on CLV?

The value of understanding CLV isn't exclusive to any particular department or role. From marketing to sales, customer service to management, understanding CLV can provide vital insights.

The Marketing Department

CLV allows marketers to design customer-centric campaigns focusing on retention rather than mere acquisition, increasing the return on marketing investment.

The Sales Team

Sales representatives often use CLV to prioritize leads that are more likely to turn into high-value customers, thus optimizing their sales pipeline.

Product Developers

Knowing the CLV aids product developers in shaping their product features, enhancing an offering to increase user engagement and loyalty, ultimately raising the CLV.

Customer Service

The customer service department uses CLV to identify high-value customers and provide premium service to them, resulting in increased customer lifetime value.

Leadership and Management

For executives and decision-makers, CLV serves as an invaluable metric in strategic decision-making; particularly in matters related to policy formulation, budget allocation, and risk management.

Why do Businesses Need to Study CLV?

Knowing the CLV of a customer is crucial to maximize company profits. It allows businesses to shift their focus from merely acquiring new customers to retaining existing ones. CLV proves helpful in providing personalized experiences to customers and guiding resource allocation and strategic planning.

Boost Profits

Businesses can optimize their profits by concentrating on clients with high initial CLV and working on strategies to improve the CLV of other clients too.

Focus on Retention

With CLV, businesses understand the importance of customer retention. It's usually more cost-effective to maintain existing customers than it is to acquire new ones.

Step Up Personalization

CLV unearths opportunities for businesses to offer more personalized products or services to their loyal customers, thereby enhancing customer satisfaction and loyalty.

Resource Optimization

Resource optimization is a significant setback for most businesses. With the clarity of CLV, businesses can make informed decisions about resource allocation, ensuring profitable returns.

Strategic Decision Making

CLV can affect long-term business strategies. It helps adjust acquisition and retention efforts, refines the product or service roadmap, and guides financial decisions.

Where is CLV Applicable in the Business Landscape?

Customer Lifetime Value is versatile and favorably adaptable across different sectors. Whether it's eCommerce or B2B, CLV has a role to play.

eCommerce

With the vast personalized data that eCommerce companies can collect, they are well-positioned to compute and make use of CLV to augment their marketing efforts and boost sales.

Subscription-Based Businesses

CLV is pivotal for subscription businesses because it can guide strategies to reduce churn and increase customer loyalty.

Traditional Retailers

Brick-and-mortar retailers can benefit from understanding CLV by identifying their loyal customers and offering personalized services to improve loyalty and increase profits.

Software and Tech Companies

For SaaS businesses and tech companies where a recurring revenue model operates, understanding the CLV of each customer can shape product development and customer support, leading to enhanced profitability.

B2B Businesses

CLV can form the backbone of B2B relationships, helping businesses understand which relationships to invest in and foster.

Best Practices for Maximizing CLV

There are several effective strategies to maximize the Customer Lifetime Value. Here are some of the most critical strategies you might want to consider.

Improving Customer Experience

The quality of the customer experience directly impacts the CLV. Here's how you can enhance it:

Quality Interactions

Every interaction with a customer should demonstrate the company's commitment to meeting their needs. This includes providing high-quality products, superior customer service, and clear and valuable communication.

After-sales support

Providing consistently excellent after-sales support can turn one-time customers into loyal ones, significantly improving CLV.

User-friendly Interfaces

A seamless and intuitive user interface across all touchpoints (be it websites, apps, or physical stores) can elevate customer satisfaction and increase customer retention, thereby boosting CLV.

Personalized Communication

Personalized and regular communication helps make the customer feel valued, encouraging long-term customer relationships.

Developing Feedback Loops

Feedback loops allow a business to learn from its customers, and take corrective measures for weaknesses, thereby improving customer satisfaction, retention, and therefore, CLV.

Using Data and Analytics

Leveraging data and analytics is key to understanding and improving CLV, and includes:

Customer Behavior Analysis

Analyzing patterns in customer behavior can help predict future behavior and facilitate intervention, if needed, to reduce the chances of churn.

Segmentation Strategies

Segmentation allows businesses to cluster customers with similar characteristics (like purchasing behavior, and preferences), and devise targeted strategies to boost their CLV.

Predictive Modeling

Predictive models take into account several customer behavioral data to forecast their CLV, allowing businesses to proactively plan and optimize strategies.

A/B Testing

This is a useful method to determine what works and what doesn't, in terms of increasing engagement and thus improving CLV.

Continuous Monitoring

Regular tracking of CLV and related metrics is crucial to understanding if the strategies implemented are effective or need amendment.

Encouraging Customer Loyalty

Fostering customer loyalty is a sure-fire way to boost CLV.

Loyalty Programs

Offering rewards based on the value a customer brings to your business can incentivize further spending and greater loyalty.

Exclusive Offers

Undertaking exclusive offers (like early access to new products, special discounts) to loyal customers can strengthen the relationship and increase CLV.

Creating Engaging Content

Providing customers with valuable and relevant content establishes your business as a trusted advisor, deepening customer relationships.

Building Customer Communities

A customer community encourages customers to interact, and sharing experiences and advice that can increase customer engagement and loyalty.

Focused Customer Service

High-value customers should receive excellent customer service, which can make a significant difference in encouraging repeat business and referrals.

Personalized Customer Journey

The more personalized the customer journey, the better the CLV.

Tailored Recommendations

Recommendations based on the customer's previous behavior or preferences feel personal, build customer relationships, and encourage further spending.

Customized Marketing Messages

Personalized communication makes customers feel valued, enhancing their long-term relationship with the business.

Prioritization of High-Value Customers

Spending proportionately more resources on your high-value customers can significantly impact CLV.

Identifying High-Value Customers

High-value customers can be more profitable and cost-effective. Identifying them can play a role in maximizing CLV.

Creating Strategic Engagement

Businesses can cultivate relationships with high-value customers by engaging with them strategically and regularly through personalized content, offers, and excellent customer service.

Challenges Faced When Maximizing CLV

Despite the benefits of CLV, companies may face challenges while strategizing it.

Ensuring Data Quality and Integration

The use of inaccurate or outdated data can result in flawed CLV calculations. Hence, businesses should have robust systems in place to collect data accurately across all platforms, analyze it in real-time, maintain privacy, and overcome integration challenges.

Keeping Up with Evolving Customer Expectations

One of the biggest challenges in maximizing CLV comes from evolving customer expectations.

Businesses need to continually stay updated with trends, provide personalized experiences at scale, and adopt new technologies to meet these expectations.

Competing in Terms of Customer Experience

To improve the customer experience and increase CLV, businesses need to differentiate themselves from competitors, offer consistent experiences across channels, innovate and adapt digitally, and take customer feedback into account.

Maintaining Profit Margins

Focusing too aggressively on increasing CLV can impact profit margins, if not managed carefully.

Businesses need to control costs and formulate a strong value proposition, develop effective pricing strategies, and build efficient service delivery and supplier relationships.

Scaling Personalization

While personalization is crucial, scaling it efficiently can be a challenge. It requires robust technology infrastructure, data analytics capabilities, organizational alignment, creative content, and operational efficiency.

Emerging Trends in CLV

With advancements in technology and changing consumer expectations, several new trends are emerging in CLV, including advancements in artificial intelligence, omnichannel strategies, social responsibility and brand values, the subscription economy, and a mobile-first approach.

By incorporating these trends into their strategies, businesses can proactively cater to their customers' needs, deliver superior customer experiences, and ultimately improve customer lifetime value.

Frequently Asked Questions (FAQs)

How does increasing Customer Satisfaction affect CLV?

Enhancing customer satisfaction boosts loyalty, leading to repeated business and referrals, which significantly increase Customer Lifetime Value (CLV).

Can upselling strategies influence CLV?

Absolutely, by effectively upselling, companies can increase the average transaction value, thereby improving the overall Customer Lifetime Value.

What role does Customer Feedback play in CLV?

Customer feedback identifies satisfaction and pain points, guiding improvements that enhance experience and loyalty, boosting CLV in the process.

How do Retention Rates correlate with CLV?

Higher retention rates mean customers stay longer, increasing their value over time. Thus, retention directly impacts and boosts CLV.

Does Brand Perception impact CLV?

Positive brand perception fosters trust and loyalty, which are crucial for repeat purchases and long-term customer relationships, directly influencing CLV.