Introduction

Financial institutions are embracing conversational AI to enhance customer experience and drive operational efficiencies.

According to Juniper Research, over $7 billion in cumulative cost savings will be achieved by banks leveraging chatbots for customer service by 2023.

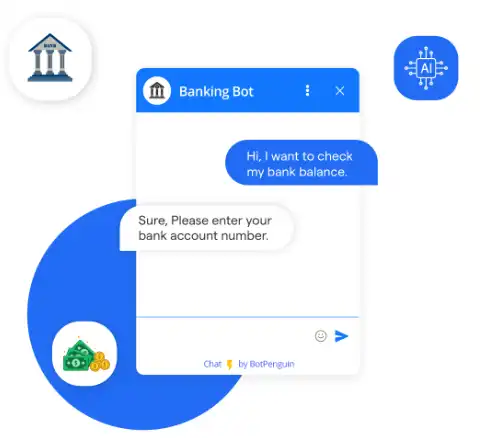

On the front end, chatbots in banking enable self-service for common queries on transactions, card activation, loan eligibility, and account balance checks. It also offers always-on support.

Internally, chabots automate repetitive compliance and data entry tasks, liberating bank staff for advisory roles. Recent stats indicate banks can contain 70% of queries at the chatbot level itself with advanced NLP and prevent 30% of calls from reaching call centers.

With rising digital engagement post-pandemic, chatbots in banking present a $300 million revenue opportunity for retail banking alone according to McKinsey. Major players like Bank of America, Wells Fargo, and Capital One are rolling out smart virtual assistants offering 24/7 assistance via messaging apps.

By blending intelligent interfaces with integrated workflows, banks can enable quick, transparent self-service while optimizing operations. So continue reading to know more about it.

Benefits of Chatbots in Banking

This section will emphasize how chatbots in banking offer numerous benefits, making them a valuable addition to the banking industry.

Improved customer experience

With chatbots in banking, customers can have personalized interactions. As the chatbot can analyze their preferences and past interactions to offer tailored solutions.

Moreover, chatbots in banking are available 24/7. Thus allowing customers to access assistance at any time, even outside of regular banking hours. This adds convenience and provides a quick resolution to their queries or concerns.

Reduced costs and increased efficiency

By automating routine tasks, such as checking account balances or transferring funds, chatbots free up human resources. It enables banks to allocate their staff to more complex or value-added tasks. This helps reduce costs and increase overall efficiency within the banking operations.

Additionally, chatbots in banking improve customer service turnaround time by providing prompt responses to customer inquiries, resulting in enhanced customer satisfaction.

Enhanced security

Chatbots in banking can authenticate users and provide secure transactions. It can highlight users through various methods, such as multi-factor authentication or biometric verification. Thus ensuring secure access to banking services.

Moreover, chatbots in banking are designed to handle transactions securely, protecting sensitive customer information and preventing fraudulent activities.

Use Cases of Chatbots in Banking

Chatbots in the banking sector serve many use cases. So, let’s see the use cases:

Virtual assistants for basic banking queries and account inquiries

Chatbots in banking have become invaluable tools in the banking industry. It offers a range of use cases that enhance the customer experience. One primary use case is the role of virtual assistants for basic banking queries and account inquiries.

With chatbots in banking, customers can easily obtain information about their account balance, transaction history, and other account-related details. Instead of waiting on hold or navigating through complex menus on a bank's website, customers can simply chat with a virtual assistant to get quick and accurate responses to their queries.

Transaction support: Assistance with fund transfers, bill payments, and account balances

Another important use case is transaction support. Chatbots in banking can assist customers with various financial transactions such as fund transfers, bill payments, and checking account balances. By interacting with a chatbot, customers can initiate and complete transactions seamlessly.

The banking chatbot can guide them through the necessary steps, ensuring that transactions are executed accurately and efficiently. This eliminates the need for customers to visit a physical bank branch or use separate banking applications, providing them with a convenient and streamlined banking experience.

Personal financial management: Budgeting advice and financial insights

Banking Chatbots offer personal financial management capabilities, providing customers with budgeting advice and financial insights. Customers can seek guidance from these chatbots to track their expenses, set financial goals, and receive personalized recommendations for managing their finances.

Banking Chatbots can analyze spending patterns, alert customers of potential overspending, and offer suggestions for saving and investing. This empowers customers to make informed financial decisions and take control of their financial well-being.

Challenges in Implementing Chatbots in Banking

From ensuring accuracy and reliability in responses to maintaining customer trust and privacy, banks need to address these challenges:

Ensuring accuracy and reliability in responses

Banking Chatbots rely on artificial intelligence and natural language processing algorithms to understand and respond to customer queries. However, there is still a risk of providing incorrect or incomplete information.

Banks must invest in robust training data and regularly update and refine their chatbot algorithms to improve accuracy and ensure reliable responses.

Maintaining customer trust and privacy

Banking Chatbots handle sensitive customer information, such as account details and transaction history. Banks must prioritize data security and privacy to build and maintain trust with their customers.

Implementing strong encryption protocols, multi-factor authentication, and stringent data management practices are crucial to protect customer data and alleviate concerns about privacy breaches.

Suggested Reading:

Conversational AI in Banking for Operational Excellence

Balancing self-service with human interaction

While banking chatbots offer a convenient and efficient way for customers to obtain information and perform transactions, some customers may still prefer human interaction for complex or sensitive matters.

Banks must ensure that their chatbot solutions seamlessly integrate with human support channels, such as call centers or live chat, to provide customers with the option to escalate their queries or concerns to a human agent when necessary. This balance allows banks to provide a personalized and holistic customer experience.

Best Practices for Chatbot Implementation in Banking

By following these best practices, banks can provide seamless and personalized experiences to their customers. They can also leverage the full potential of chatbot technology in the banking sector.

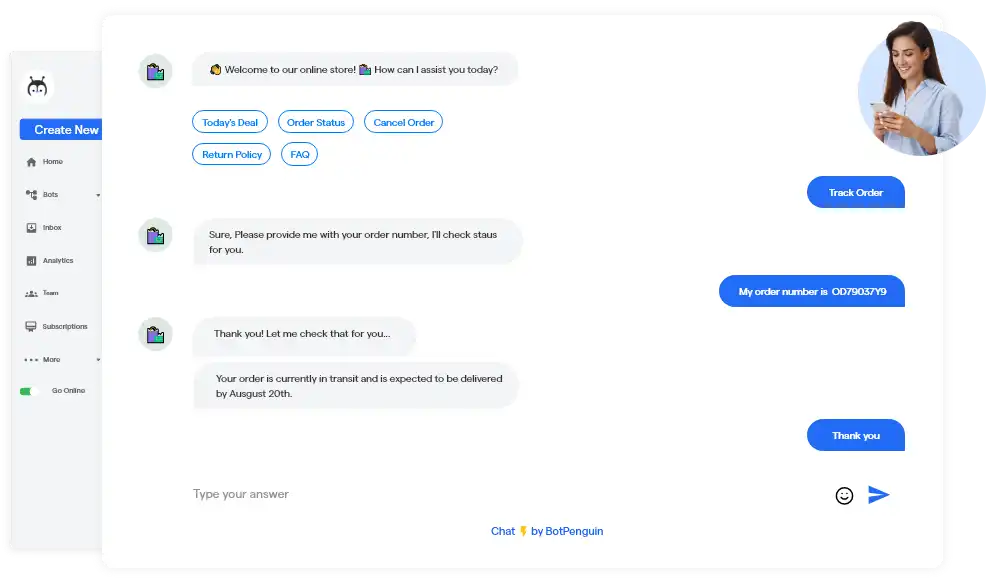

Designing intuitive and conversational user interfaces

The first best practice is to design intuitive and conversational user interfaces. Chatbots should be easy to use and understand, mimicking human conversation as closely as possible.

A well-designed user interface will enable customers to interact with the chatbot effortlessly, allowing them to ask questions, initiate transactions, and conversationally receive information. This intuitive design will enhance the overall user experience and encourage the adoption of the chatbot.

Constantly improving and updating chatbot capabilities

Another best practice is to constantly improve and update chatbot capabilities. The banking industry is dynamic, and customer needs and expectations evolve. It is crucial for banks to regularly analyze customer interactions with chatbots and identify areas for improvement.

Feedback from customers can provide valuable insights into the effectiveness of the chatbot and areas for enhancement. This continuous improvement process ensures that the chatbot remains up-to-date, accurate, and capable of meeting the changing needs of customers.

Seamlessly integrating chatbots with existing banking systems

Additionally, seamlessly integrating chatbots with existing banking systems is essential for a successful implementation. Chatbots should be able to access and retrieve data from core banking systems to provide accurate and personalized responses to customer queries.

By integrating with backend systems, chatbots can offer real-time information, such as account balances or transaction statuses. This integration enhances the efficiency of the chatbot and ensures that customers receive accurate and up-to-date information.

And taking your first step toward chatbot integration isn't that tough. Meet BotPenguin- the home of chatbot solutions. With all the heavy work of chatbot development already done for you, move forward to setting up a top-notch chatbot for your business with features like:

- Marketing Automation

- WhatsApp Automation

- Customer Support

- Lead Generation

- Facebook Automation

- Appointment Booking

Future Trends and Outlook for Chatbots in Banking

The future of chatbots in banking is bright. So, let’s check the future trends and outlook for chatbots in banking:

Integration with voice assistants and other emerging technologies

Voice-activated smart devices like Amazon Echo or Google Home are becoming increasingly popular, and integrating chatbot capabilities with these voice assistants will further enhance the convenience and accessibility of banking services. Customers will be able to interact with chatbots using voice commands, making banking transactions and inquiries even more seamless.

The role of chatbots in shaping the future of customer engagement in banking

Chatbots will play a pivotal role in shaping the future of customer engagement in banking. With the rise of digitalization, customers expect fast, convenient, and personalized interactions with their banks. Chatbots provide 24/7 availability, instant responses, and personalized experiences.

As chatbot technology continues to advance, banks can leverage these virtual assistants to provide proactive notifications, personalized recommendations, and tailored financial insights. This will not only improve customer engagement but also foster a stronger connection and loyalty between banks and their customers.

Conclusion

Chatbots are fundamentally altering banking by enabling personalized, instant, and transparent self-service for customers while optimizing operations. Early movers are already noting major gains - over $7 billion in projected cost savings by 2023 and $300 million additional revenue potential from retail banking alone as per leading forecasts.

With benefits spanning CX improvements, 24/7 availability, lower costs, and higher productivity, BotPenguin is leading innovation in building tailored financial chatbots. This no-code platform makes it easy for institutions of any size to deploy AI-powered bankers offering round-the-clock assistance.

Seamless integration into existing banking systems facilitates real-time query resolution and workflow automation while robust analytics empower continuous optimization. Advanced NLP and conversations tailored to banking users' needs promote engagement across channels.

Financial institutions have a historic opportunity to shape the future with next-gen intelligent interfaces. Let BotPenguin help you deliver the 21st-century banking experience your consumers demand - anywhere, anytime. The possibilities of purpose-built financial chatbots are immense - let's explore them!

Suggested Reading:

Automate your Banking Services with WhatsApp Chatbots

Frequently Asked Questions (FAQs)

What are chatbots in banking and why are they revolutionizing the industry?

Chatbots in banking are virtual assistants that use artificial intelligence to interact with customers and provide personalized services. They are revolutionizing the industry by offering 24/7 availability, instant responses, and efficient customer service.

How do chatbots enhance customer experience in banking?

Chatbots enhance customer experience by providing instant responses, personalized recommendations, and round-the-clock availability. They streamline banking transactions, offer real-time information, and deliver proactive notifications, improving overall convenience and satisfaction for customers.

Are chatbots secure for banking transactions?

Yes, chatbots in banking prioritize security and employ encryption protocols to protect customer information. They adhere to strict data privacy regulations and utilize authentication techniques, ensuring secure and reliable banking transactions.

What is the future potential of chatbots in the banking industry?

The future potential of chatbots in banking is vast. With advancements in AI, chatbots will become even more intelligent and capable, offering proactive notifications, personalized insights, and seamless integration with voice assistants and other emerging technologies.

How can chatbots improve operational efficiency in banking?

Chatbots improve operational efficiency by automating routine tasks, reducing the burden on human agents, and enabling them to focus on more complex and strategic activities. This allows banks to serve more customers simultaneously, leading to time and cost savings.