Generative AI is changing the game, especially in banking. It's great at learning from big data and making smart decisions. This tech can handle information, find trends, and simplify complex tasks.

Using generative AI in banking is a big step forward. It combines the power of AI with human creativity, leading to exciting advancements.

According to Juniper Research, generative AI could save banks up to $40 billion annually by 2025.

In banking, generative AI helps with tasks like verifying customer identities, spotting suspicious behavior, and giving personalized recommendations. It's also great at catching fraud by recognizing unusual patterns.

Generative AI has huge potential in banking, changing the industry.

Let's dive into the details.

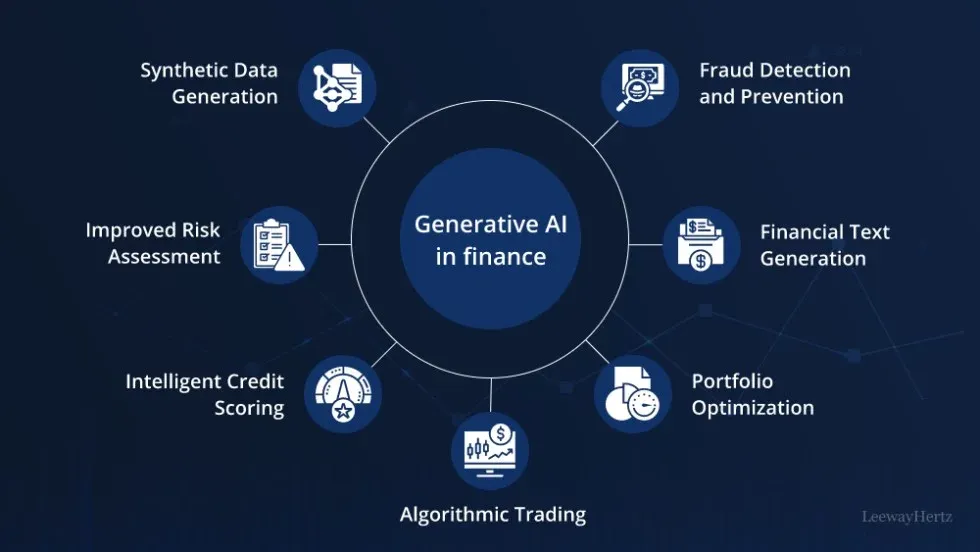

The Potential Applications of Generative AI in Smart Banking

As the banking industry continues to evolve, integrating new technologies is essential to remain competitive, and generative AI is at the forefront of this revolution.

Here are some of the potential applications of generative AI in smart banking:

Enhancing Customer Experience through Personalized Interactions

Personalization is one of the most critical aspects of the banking experience, and AI is making it possible to tailor interactions seamlessly.

Generative AI algorithms can analyze data from various sources, including transaction history, location data, and customer feedback. This information allows banks to offer recommendations and solutions based on customers' needs and preferences.

Automating Financial Tasks and Processes with Accuracy and Efficiency

Automation is another critical area where AI can transform the banking industry. With generative AI, banks can automate several financial tasks with high accuracy and efficiency, including loan approvals, fraud detection, and investment recommendations.

This automation can significantly reduce the time it takes to complete these tasks, freeing staff to focus on other essential business operations.

Fraud Detection and Prevention with Advanced AI Algorithms

Fraud prevention is one of the most critical functions of banks. With generative AI, banks can enhance their fraud prevention measures by using advanced machine learning algorithms to detect patterns and anomalies in customer behavior.

This technology can detect and flag the most subtle anomalies for further investigation, reducing the risk of fraudulent activities.

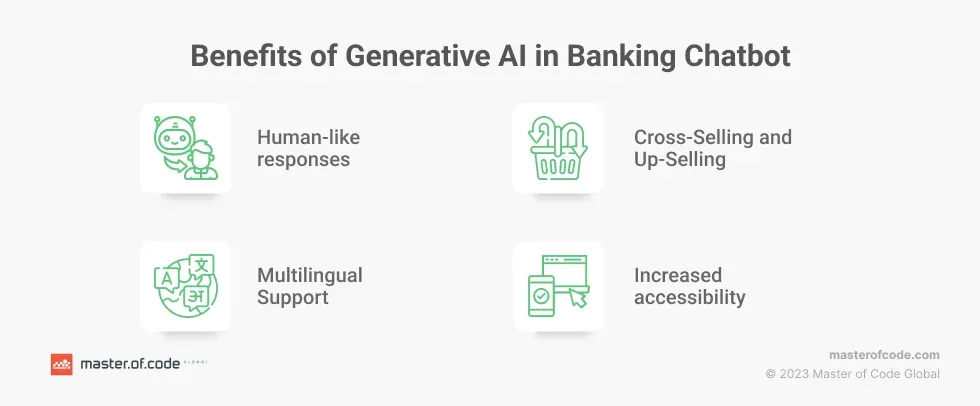

The Benefits of Generative AI in Smart Banking

This advanced technology is transforming the industry, offering new possibilities for banks that were previously unimaginable.

Generative AI offers several benefits to the banking industry, including:

Improved Customer Satisfaction and Engagement

Personalization is critical in improving customer satisfaction and engagement, and generative AI excels in this area.

By providing customers with personalized recommendations and tailored experiences, banks can improve the overall satisfaction and engagement of their customers.

Streamlined Banking Operations Leading to Cost Savings

Automation is a powerful tool that can drastically cut the time and resources needed for manual tasks, leading to substantial cost savings for banks.

For example, automating loan approval processes can significantly expedite the procedure, allowing staff to redirect their efforts toward other crucial business activities.

Enhanced Security and Fraud Prevention Measures

Banks consider fraud prevention a top priority, and generative AI bolsters these efforts. It uses advanced machine learning algorithms to identify patterns and anomalies in customer behavior.

This proactive approach minimizes the risk of fraudulent activities and elevates security measures within the banking sector.

Suggested Reading:

The Implications of Generative AI in Smart Banking

Generative AI, particularly in the context of smart banking, has several implications that can significantly impact the industry. Here are some of the key implications:

Impact on Employment and the Future of Banking Jobs

With the rise of Generative AI, there is no denying that it will profoundly impact employment within the banking industry.

While it is true that certain routine tasks may become automated, leading some to fear job displacement, it is important to consider the bigger picture.

Generative AI has the potential to empower banking professionals in their decision-making processes, allowing them to focus on more complex and value-added tasks.

By automating repetitive processes such as transaction verification and fraud detection, Generative AI frees up time for banking professionals to work on strategic initiatives and build meaningful customer relationships.

So, rather than replacing jobs, Generative AI is more likely to redefine the roles and responsibilities of banking professionals. It's an opportunity to upskill and adapt to the industry's changing landscape.

Data Privacy Concerns and Ethical Considerations

As with any advanced technology, data privacy concerns and ethical considerations come hand in hand.

Generative AI relies heavily on vast data to learn and generate insights. This raises questions about the ownership and usage of customer data. Financial institutions must foster a culture of trust, transparency, and responsible data usage.

Protecting customer data from unauthorized access or breaches should be a top priority. This means implementing robust security measures, investing in cybersecurity infrastructure, and ensuring compliance with relevant data protection regulations.

Additionally, financial institutions must establish clear ethical guidelines for using Generative AI, ensuring that customer privacy is respected and that any potential biases in the generated insights are detected and addressed.

Regulatory Challenges and Legal Frameworks

With the rapid advancement of Generative AI in the banking sector, regulatory challenges and the establishment of legal frameworks are paramount.

As technology evolves, regulatory bodies must adapt and create a conducive environment that encourages innovation while safeguarding customers' interests and the financial system's stability.

Financial institutions must collaborate closely with regulatory bodies to ensure that the implementation of Generative AI aligns with existing regulations and compliance requirements.

This promotes trust and confidence among customers and mitigates potential risks associated with the technology. A transparent and collaborative approach will lay the foundation for the successful integration of Generative AI into the banking sector.

Suggested Reading:

The Future of Smart Banking: A Generative AI Revolution

Now that we have explored the implications of Generative AI in smart banking let's take an exciting leap into the future and envision the possibilities.

Generative AI May Shape the Way We Bank

Generative AI has the potential to transform the way we interact with banks. Here's how it may shape the future of banking:

- Virtual Banking Assistants: Say hello to virtual banking assistants powered by Generative AI! These assistants will be capable of handling routine inquiries, providing personalized financial advice, and executing transactions on customers' behalf.

- Real-Time Financial Insights: Through Generative AI, financial institutions can generate real-time insights on customer behavior, market trends, and investment opportunities. This will empower banking professionals to make informed decisions and offer tailored solutions to customers.

- Proactive Risk Management: With the ability to analyze large volumes of data in real time, Generative AI can help identify potential risks and anomalies before they escalate. This will enable financial institutions to mitigate risks and protect customer assets proactively.

Opportunities and Challenges for Financial Institutions Embracing Generative AI Technology

Financial institutions that embrace Generative AI technology will have a competitive advantage in the evolving banking landscape. However, it's crucial to be aware of the opportunities and challenges that come with it.

Opportunities include improved operational efficiency, enhanced customer experiences, and the ability to provide personalized financial services at scale.

Financial institutions that successfully integrate Generative AI into their operations will be able to cater to the changing expectations of customers in a rapidly evolving digital era.

On the other hand, challenges include data privacy concerns, regulatory compliance, and addressing potential biases in the generated insights.

Financial institutions must invest in robust cybersecurity measures, establish ethical guidelines, and collaborate closely with regulators to navigate these challenges effectively.

Conclusion

In short, even though many other technologies exist, Generative AI is a powerful technology that can potentially transform the banking business. It strengthens its ability to analyze data and react to changing circumstances.

Banks can improve customer service, reduce fraud, and deliver personalized suggestions to clients by utilizing generative AI.

Generative AI can be applied in the banking business to improve customer service, detect fraud, and deliver personalized suggestions to users. As technology advances, so does the mystery around it. Take care with this technology.

Suggested Reading:

Frequently Asked Questions (FAQs)

What are the potential benefits of incorporating Generative AI into banking operations?

Generative AI can enhance customer experiences, automate tasks, improve fraud detection, and enable personalized financial recommendations in smart banking.

How does Generative AI assist in fraud prevention and security in smart banking?

Generative AI can analyze vast datasets to detect unusual patterns and anomalies, helping banks proactively identify and mitigate fraud risks.

Can Generative AI-powered chatbots provide real-time customer support in smart banking?

AI-driven chatbots can offer 24/7 support, answer inquiries, and guide customers through transactions, improving accessibility and convenience.

What privacy concerns should customers be aware of in smart banking with Generative AI?

Customers should be aware of data privacy and consent issues, ensuring their personal information is used securely and transparently.

How can Generative AI be utilized for credit scoring and loan approval in smart banking?

Generative AI can assess broader data points, leading to more accurate credit assessments and faster loan approval processes.

Are there any regulatory challenges associated with implementing Generative AI in banking?

Yes, compliance with data protection and financial regulations is crucial, and banks must ensure that their AI systems meet legal requirements.

Can Generative AI adapt to smart banking's changing market conditions and customer preferences?

Generative AI can continuously learn and adapt, helping banks stay agile and responsive to evolving customer needs and market dynamics.