Introduction

Chatbots and virtual assistants are revolutionizing banking.

With conversational AI, mundane tasks like checking your balance or making a payment are now just a quick chat away.

But how exactly do these bots work their magic? And how can they improve customer service while cutting costs? This post has the answers.

We'll explore the benefits of conversational AI in banking, from boosting efficiency to enhancing the customer experience.

You'll learn how chatbots handle routine inquiries and provide personalized service 24/7. We'll also cover best practices for implementation, like starting small and using partners.

The future looks bright for banking bots. With advancements in AI, conversations will only get smoother. Stick around as we unpack everything you need to know about conversational AI in banking.

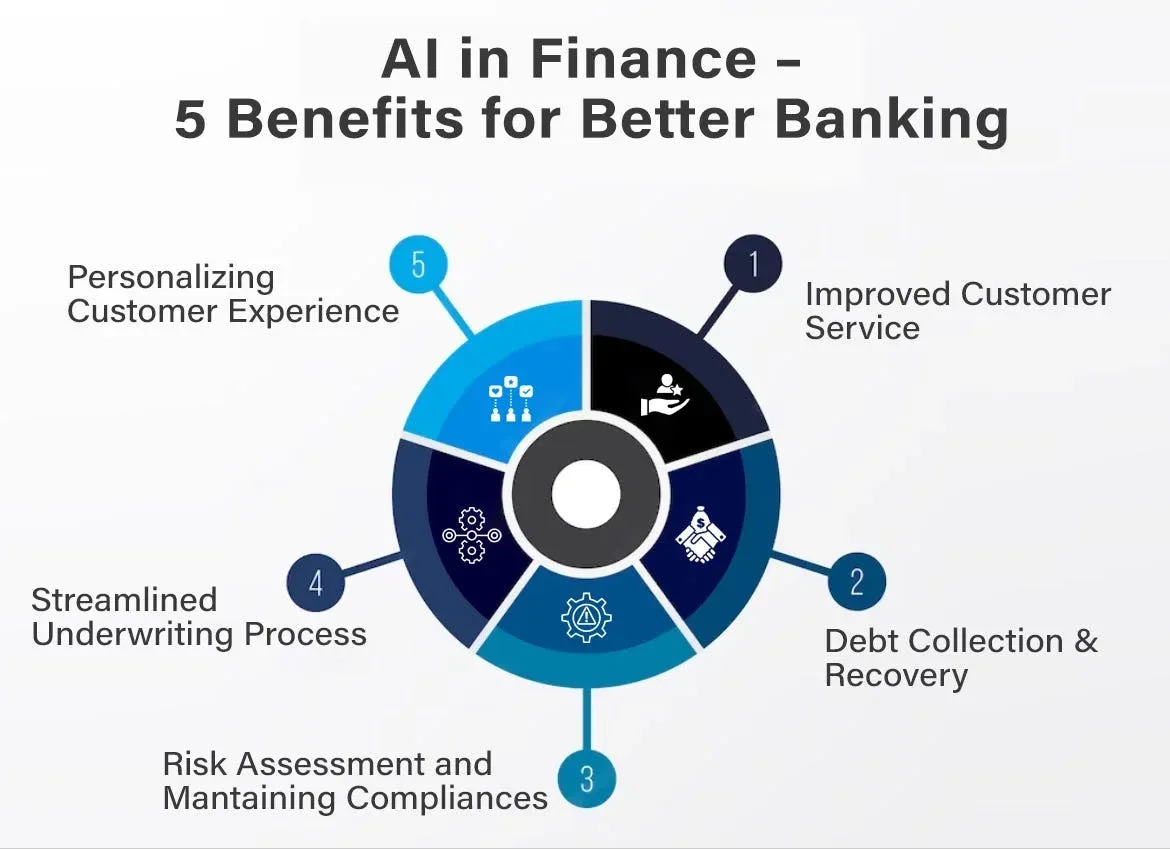

Benefits of Conversational AI In Banking

Banks are changing. Chatbots now answer questions quickly and at any time. They help more people faster, without making mistakes. Staff can focus on complex tasks.

Costs go down, too. Read on to learn how conversational AI improves customer service, boosts efficiency, and saves money.

Enhanced Customer Experience

Conversational AI in banking can provide customers with immediate and personalized assistance, enhancing their overall experience.

Virtual assistants and chatbots powered by conversational AI can understand natural language and context, allowing customers to interact with the bank more intuitively and efficiently.

AI use in banking can improves customer satisfaction and loyalty by providing quick and accurate responses to inquiries and guiding customers through various banking processes.

Increased Operational Efficiency

AI use in banking enables banks to automate routine and repetitive tasks, reducing the workload of human agents and increasing operational efficiency.

Without human intervention, chatbots can handle many customer inquiries, such as balance inquiries, transaction history, and account management.

This frees human agents to focus on more complex tasks, improving productivity and reducing response time.

Conversational AI also enables faster data processing and analysis, allowing banks to make better-informed decisions and optimize their operations.

Cost Savings

By using conversational AI, banks can achieve significant cost savings.

Virtual assistants and chatbots can handle a large volume of customer inquiries simultaneously, eliminating the need for additional human resources to handle the same workload.

Moreover, the automated nature of ai use in banking reduces operational costs associated with human errors and inconsistencies in customer interactions.

Banks can also save costs by utilizing conversational AI for tasks like customer onboarding, loan applications, and fraud detection, which would otherwise require human intervention.

In the next section, we will cover the use cases of conversational AI in banking.

Use Cases of Conversational AI in Banking.

These use cases of conversational AI in banking showcase how the technology is being applied to improve customer interactions, automate routine processes, and provide personalized banking experiences.

By using virtual assistants, chatbots, and voice-powered interactions, banks can enhance customer satisfaction, operational efficiency, and differentiate themselves in the competitive banking industry.

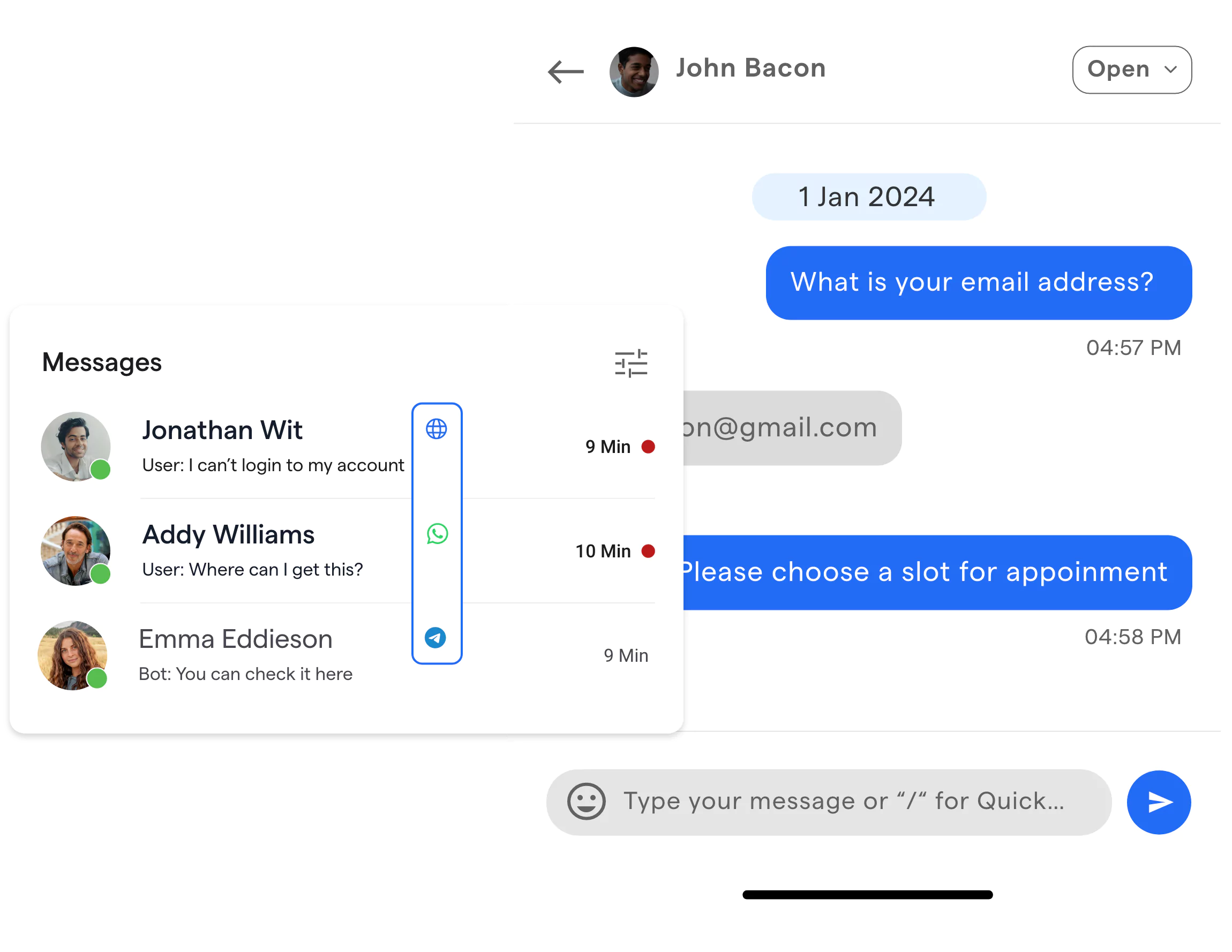

Virtual Assistants for Customer Support

Virtual assistants powered by conversational AI are used by banks to provide customer support round the clock.

AI use in banking can understand natural language and context, allowing customers to interact with them through chat or voice.

They can assist customers with various inquiries, such as account balances, transaction history, bill payments, and product information.

Virtual assistants provide immediate responses and personalized assistance, enhancing the customer support experience and reducing the need for human agents to handle routine inquiries.

Chatbots for Handling Routine Inquiries

Chatbots for handling routine inquiries: Chatbots are another common use case of conversational AI in banking.

They are designed to handle routine and frequently asked questions from customers. Chatbots can assist customers in tasks such as account inquiries, account statements, fund transfers, and card activations.

AI use in banking can provide quick and accurate responses, guiding customers through various banking processes.

Chatbots can be integrated into banking websites, mobile apps, and messaging platforms, making them easily accessible and available to customers anytime, anywhere.

Voice-Powered Interactions for Personalized Banking

Advances in natural language processing and voice recognition technology have enabled voice-powered interactions in banking.

Customers can now interact with their banking applications through voice commands, allowing for a personalized and hands-free banking experience.

For example, customers can check their bank account balance, make payments, or transfer funds by simply speaking to their smart device or virtual assistant.

Voice-powered interactions provide convenience and a more natural way of interacting with banking services, enhancing the overall customer experience.

In the next section we will cover some challenges ad consideration of implementing conversational AI in banking.

Challenges and Considerations of Implementing Conversational Ai in Banking

Data quality, integration with old systems, and regulations all impact success.

Read on for a clear look at issues and ideas to help ensure customers get the service they expect in the future.

Data quality and availability

Conversational AI systems heavily rely on accurate and comprehensive data.

Banks need to ensure that the data used to train and improve models is of high quality, up-to-date, and properly integrated from various sources.

Ensuring data availability and accessibility can be a challenge, as data in banking systems may reside in different formats and locations.

Integration with existing systems

Integrating conversational AI systems with existing banking systems can be complex.

Different systems may have varying compatibility requirements and data exchange formats.

Adequate integration is crucial to ensure accurate and real-time responses to customer inquiries and actions.

Compliance with regulations

Banks must comply with data privacy, security, and consumer protection regulations when implementing conversational AI.

Compliance requirements may differ across jurisdictions, making it essential to ensure that the system adheres to relevant regulations at all times.

Now, in the next section, we will cover best practices for AI use in banking.

Suggested Reading:

Best Practices for Successful Implementation

Start small, define your use cases clearly and work with partners. Learn how to smoothly implement conversational AI and improve over time.

Discover our tips to make the most of this technology.

Start Small and Scale Up

Begin with a pilot program or limited deployment to test the conversational AI system's functionality and effectiveness.

Gradually expand the implementation based on user feedback and ensure continuous improvement.

Clearly Define the Use Case

Define the specific use case(s) for conversational AI in banking.

This allows for focused development and customization of the system to effectively meet customer needs.

Understanding the use case(s) also ensures a clear direction for the development team.

Leverage Technology Partners

Collaborating with experienced third-party technology vendors can expedite the implementation process.

These partners possess expertise in conversational AI technologies and can provide guidance on system design, integration, and optimization.

Last but not least let us see the future trends and opportunities of Conversational AI in banking.

Future Trends and Opportunities

These advancements in conversational AI will provide the banking industry with numerous opportunities, including enhanced customer experiences, improved operational efficiency, increased personalization, and better fraud detection.

As technology continues to evolve, conversational AI will become an indispensable tool that transforms the way customers interact with their banks, offering more intuitive and seamless experiences.

Here are some Emerging Technologies and Advancements In Conversational AI

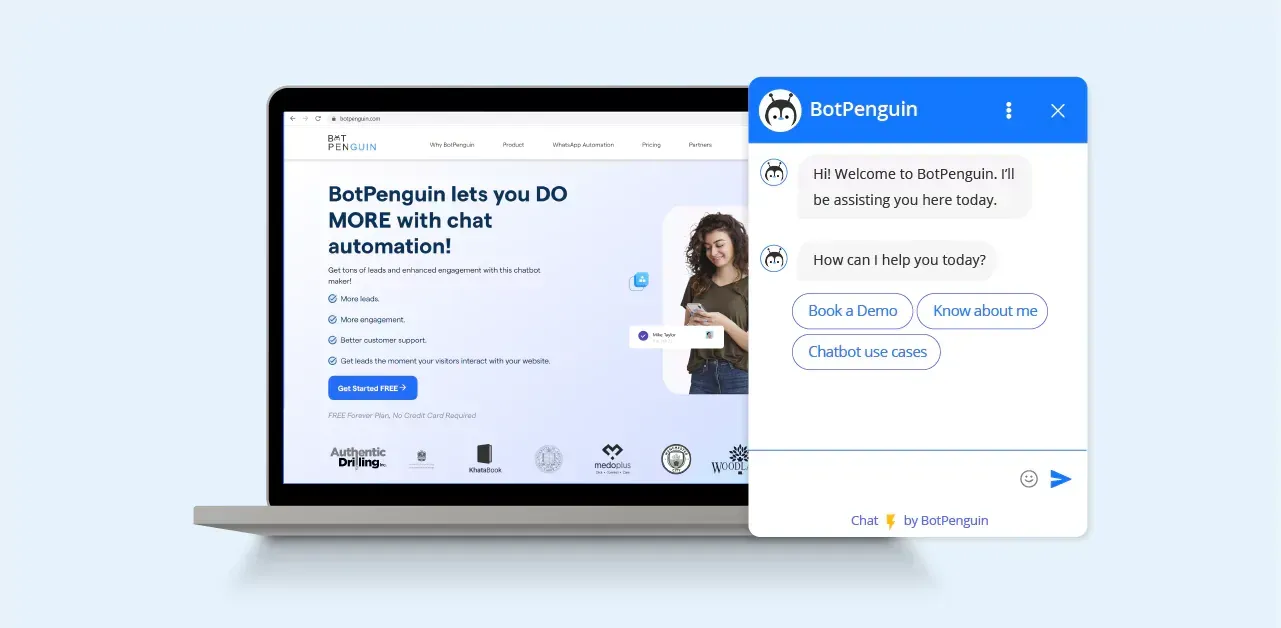

With the combined benefits of CRM and Chatbots, BotPenguin makes automation services like lead generation and customer support more effective by unifying marketing and sales efforts in one place:

- Marketing Automation

- WhatsApp Automation

- Customer Support

- Lead Generation

- Facebook Automation

- Appointment Booking

Natural Language Understanding (NLU)

NLU is a core component of conversational AI that enables systems to understand and interpret human language more accurately.

Advancements in NLU will lead to improved understanding of complex queries, nuances, and context, allowing conversational AI to provide more refined and accurate responses.

Contextual Understanding

Context is crucial in conversations, and advancements in conversational AI are focused on improving contextual understanding.

Future developments will enable systems to retain and recall context from previous conversations, making interactions more personalized and seamless.

Emotional Intelligence

Conversational AI is evolving to incorporate emotional intelligence, enabling systems to recognize and respond to the emotional state of users.

Understanding emotions such as frustration, satisfaction, or urgency will help conversational AI provide more empathetic and personalized responses.

Multimodal Interaction

Conversational AI will increasingly support multimodal interactions, including voice, text, gestures, and facial expressions.

This advancement will enable users to interact with banking systems in the most natural and intuitive way possible, further enhancing the user experience.

Explainability and Transparency

As conversational AI becomes more sophisticated, the need for explainability and transparency becomes essential.

Advancements in AI explainability techniques will enable banks to provide transparent and understandable explanations for AI-generated decisions, building user trust.

Hybrid Approaches

Emerging trends indicate the adoption of hybrid approaches combining rule-based systems with machine learning techniques.

This allows for more flexible and accurate responses, combining the best of both rule-based and machine learning-based conversational AI systems.

Integration of domain-specific knowledge

Conversational AI will be integrated with domain-specific knowledge bases, allowing for more accurate and specialized responses.

This integration will enable conversational AI to provide highly tailored and specific information to users, such as tax-related queries or investment advice.

Conclusion

Conversational AI is transforming banking, enabling more intuitive customer experiences.

As we've seen, the benefits range from enhanced service to increased efficiency. Now you can bring these same advantages to your bank with BotPenguin.

Our cutting-edge platform harnesses the power of Generative AI to deliver dynamic, natural conversations that delight users.

Forget clunky chatbots of the past. BotPenguin's human-like interactions drive engagement and automate repetitive tasks to boost productivity.

Join the leaders and transform customer service with BotPenguin's intelligent conversational AI. The future of banking is conversational - make it happen with BotPenguin.

Suggested Reading:

Frequently Asked Questions (FAQs)

What is conversational AI in banking?

Conversational AI refers to the use of technologies such as chatbots, virtual assistants, and natural language processing (NLP) to enable natural, human-like interactions between banking systems and customers for improved customer experience and operational excellence.

How does conversational AI drive operational excellence in banking?

Conversational AI streamlines routine banking tasks, automates processes, and delivers cost savings via increased efficiency and productivity.

By minimizing the need for manual intervention, banks can improve speed, accuracy, and profitability in their operations.

What are the benefits of conversational AI in banking?

Conversational AI enhances customer experience by providing 24/7 support, quick and accurate responses, and personalized interactions.

It also improves operational efficiency by streamlining processes, reducing errors, and lowering costs.

What security measures are in place for conversational AI in banking transactions?

Conversational AI is secured with encryption and authentication technologies and reinforced with multi-factor authentication and biometric security methods for enhanced customer data and transaction protection.

What are the key considerations for implementing conversational AI in banking?

Banks need to identify appropriate use cases, select suitable technology, integrate it with existing banking systems, and train and monitor it for optimal performance.

They should also ensure their staff is equipped to handle complex queries and edge cases.

What are the future trends and opportunities in conversational AI for banking?

Future trends include complex financial tasks like investment advice and personalized recommendations, multilingual support, automation of identity verification, and enhanced fraud detection capabilities powered by conversational AI.