Banks are embracing Conversational AI and analytics to bring about significant changes in the banking sector. Conversational banking is reshaping how banks engage with customers and manage operations, primarily by automating tasks, improving customer support, and strengthening security measures.

An OpenText survey targeting financial services professionals revealed that an impressive 80% of banks are well aware of the significant advantages that AI brings to the table. Many banks are actively strategizing the deployment of AI-driven solutions.

Banks unlock valuable insights into customer needs, preferences, and behavior by harnessing customer data and advanced analytics tools. With this data-driven knowledge, banks can tailor their services and product offerings to meet customer expectations precisely.

This data-centric strategy is propelling banks to elevate the customer experience. It translates into personalized service, improved product portfolios, and optimized customer journeys, fundamentally reshaping the banking landscape.

Let’s begin.

What is Conversational AI?

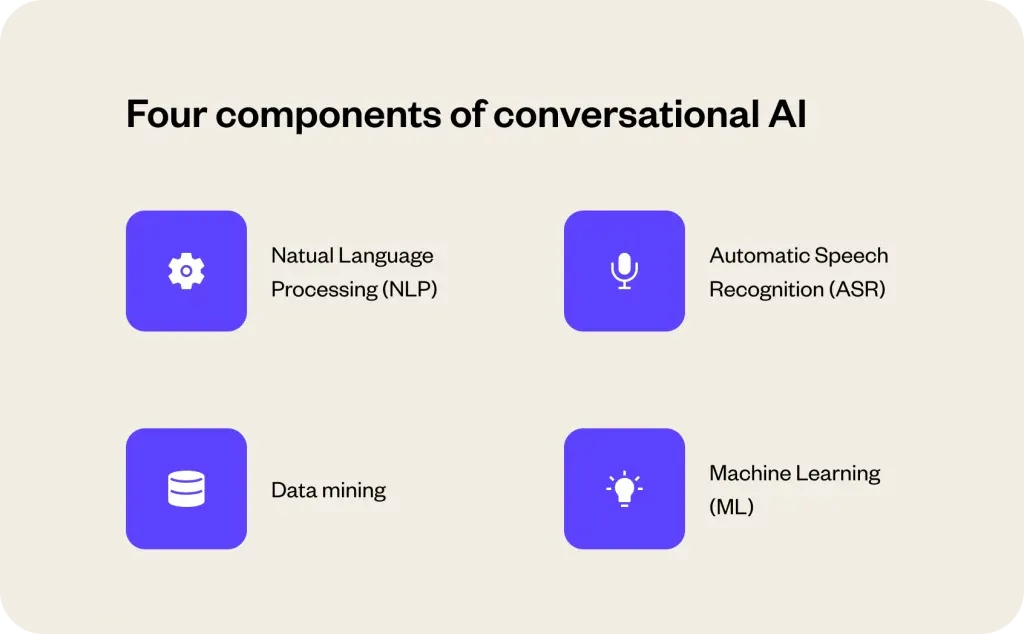

Conversational AI, short for Conversational Artificial Intelligence, is a technology that enables computers to engage in human-like conversations with users. It combines natural language processing (NLP), machine learning, and other AI techniques to understand, interpret, and generate human language text or speech.

Why Conversational AI in Banking?

Conversational AI profoundly reshapes the banking industry by introducing transformative changes and enhancing various customer interaction and service delivery aspects. Here's why:

Enhanced Customer Engagement

Conversational AI enables banks to engage customers in natural, text, or voice-based conversations. This improves customer interactions, 24/7 support availability, and enhanced accessibility, fostering better engagement and trust.

Efficient Customer Service

AI-powered chatbots and virtual assistants handle routine customer queries, transactions, and account inquiries. This reduces the workload on human agents, enabling them to focus on complex tasks, ultimately leading to quicker query resolution and more efficient customer service.

Personalized Experiences

Conversational AI leverages customer data and AI algorithms to provide personalized product recommendations, financial advice, and tailored services. This enhances the customer experience and increases cross-selling and upselling opportunities for banks.

Cost Reduction

By automating routine tasks and processes, conversational AI reduces operational costs for banks. Fewer human agents are needed for basic inquiries, leading to significant cost savings in customer support and back-office operations.

Data-Driven Insights

Conversational AI collects and analyzes vast amounts of customer interaction data. Banks can use this data to gain insights into customer behavior, preferences, and pain points. These insights inform product development, marketing strategies, and customer journey optimizations.

Risk Mitigation

AI-powered chatbots can detect fraudulent activities in real-time by monitoring transactions and customer behavior patterns. This proactive approach enhances security and reduces financial risks for banks and customers.

Competitive Advantage

Banks that embrace conversational AI gain a competitive edge. They are committed to modern, technology-driven customer service, attracting tech-savvy customers and differentiating themselves in a crowded market.

24/7 Accessibility

Conversational AI operates round the clock, ensuring customers can access banking services and information anytime. This enhances convenience and accessibility, particularly for global or night-time customers.

The 5W's of Conversational AI in Banking

The 5W's of Conversational AI in Banking are:

What is Conversational AI in Banking?

Conversational AI in banking refers to using artificial intelligence (AI) technologies to enable human-like conversations between customers and digital interfaces like chatbots and virtual assistants. It's a technology that allows banks to interact with customers naturally, answering queries, assisting with transactions, and providing personalized services.

Why is Conversational AI Important in Banking?

Conversational AI is crucial in banking because it enhances customer service, automates routine tasks, and provides personalized experiences. It enables banks to offer round-the-clock support, reduce operational costs, and stay competitive by delivering modern, tech-savvy services.

Suggested Reading:

When Did Conversational AI Start Making an Impact in Banking?

Conversational AI began significantly impacting banking in recent years, with growing adoption starting around the mid-2010s. Advances in AI and natural language processing have made it possible to create more sophisticated and effective conversational banking solutions.

Where is Conversational AI Implemented in Banking?

Conversational AI is implemented across various touchpoints in banking, including websites, mobile apps, and customer service channels. It can also be used for tasks like account inquiries, transaction processing, loan applications, etc.

Who Benefits from Conversational AI in Banking?

Conversational AI benefits both banks and customers. Banks gain from cost savings, improved efficiency, and better customer insights. Customers benefit from enhanced service, faster query resolution, and personalized recommendations, leading to a more satisfying banking experience.

Conclusion

Overall, conversational banking has improved the customer banking experience by providing personalized, fast, and secure banking services.

Conversational AI and Analytics are assisting banks in increasing customer engagement and loyalty while cutting costs and enhancing efficiency with the capacity to deliver personalized, 24/7 service via chatbots and virtual assistants.

Conversational AI will become an ever more vital component of the banking industry as technology advances, changing how banks and their clients communicate and do business.

BotPenguin is a robust conversational AI platform that allows you to build and deploy no-code chatbots for various platforms.

Our omnichannel chatbot answers inquiries across 55+ channels with ease. We provide effective automation with simple deployment and fantastic live chat.

BotPenguin's AI-powered virtual agent provides 24/7 automated customer care. It improves efficiency by facilitating lead creation, scheduling, and marketing automation. We ensure that compliant, personalized interactions lead to customer pleasure and loyalty.

Get rid of your expensive, erratic manual processes.

The future is conversational and automated, and BotPenguin is leading the way.

Our adaptable, user-friendly platform provides world-class automated CX. Contact us today to learn more about how we can help you enhance your customer journey!

Suggested Reading: