As an entrepreneur, the customer's experience is crucial. AI and machine learning can now analyze data to understand their needs truly.

With predictive insights, you have to anticipate problems and exceed expectations. Automating repetitive tasks with chatbots frees your team to focus on strategic growth.

This future of CRM sounds like a smart investment to foster loyalty and drive the business forward.

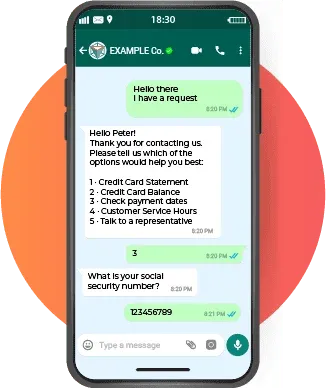

In this blog, we will explore how leading financial institutions are automating a wide range of processes to deliver fast, convenient, and personalized banking experiences for their customers around the clock.

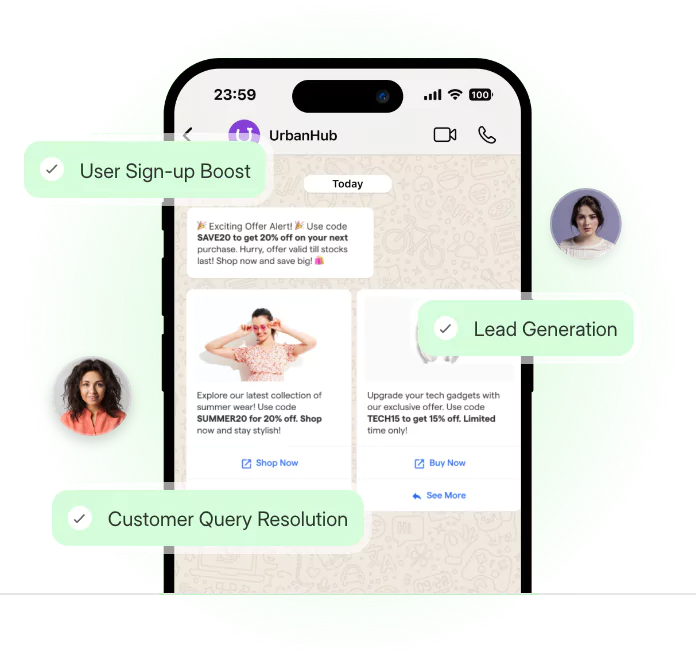

We'll cover the key benefits of WhatsApp chatbots, such as enhanced customer service, 24/7 availability, and lower costs.

We will also look at how chatbots streamline processes, facilitate payments, and provide instant support.

Finally, we'll examine the future potential of these chatbots with advancements in security, personalization, and voice capabilities.

So, let us start with the emergence of Chatbots in Banking.

The Emergence of Chatbots in Banking

In the banking sector, chatbots have changed the game by improving customer service and expediting procedures.

These clever virtual assistants can now handle a variety of queries and offer tailored support to banking clients thanks to developments in artificial intelligence and natural language processing.

In the past, customers had to wait in long queues or spend significant time navigating through automated phone menus to get assistance from their banks.

But with chatbots, banking services have become more accessible and convenient for customers.

Whether checking their account balance, making transactions, or seeking financial advice, chatbots are available 24/7 for prompt and accurate responses.

Implementing WhatsApp chatbots in banking services brings many benefits for both customers and financial institutions. Let's delve into some of the key advantages:

Benefits of Using WhatsApp Chatbots for Banking

Are you curious about how chatbots are transforming the industry? Read on to discover top benefits like reduced wait times, tailored solutions, and strategic decision-making based on behavioral analytics.

Nowadays, WhatsApp chatbots give banks a competitive edge.

Enhanced Customer Experience

WhatsApp chatbots offer a conversational and interactive interface, making banking services more user-friendly and approachable.

Customers can interact with the chatbot in a natural language without navigating complex menus, resulting in a seamless and satisfying experience.

24/7 Availability

WhatsApp chatbots operate round the clock, enabling customers to access banking services anytime, anywhere.

Whether early morning or late at night, customers can send a message and get real-time assistance without waiting for the bank's working hours.

Prompt and Accurate Responses

Chatbots provide instant responses to customer inquiries, eliminating the need for customers to wait for a human agent.

These chatbots are equipped with sophisticated algorithms that ensure accurate and relevant information is shared with the customers, minimizing the chances of errors or misinformation.

Cost-Effective Solution

Implementing WhatsApp chatbots can significantly reduce the operational costs for banks.

By automating a wide range of customer services, banks can optimize their resources and allocate human agents to more complex and value-added tasks.

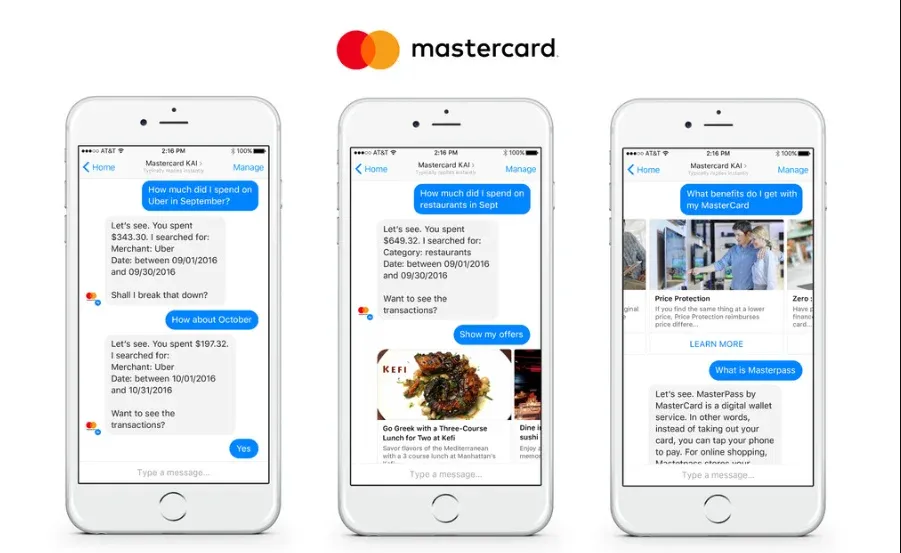

Personalized Banking Services

With WhatsApp chatbots, banks can provide personalized recommendations and offers to customers based on their preferences and banking history.

These chatbots can analyze customer data and offer tailored solutions, leading to a more personalized banking experience.

Data-Driven Insights

Chatbots collect and analyze a vast amount of customer data, offering valuable insights to banks.

This data can help banks identify customer trends, preferences, and pain points, enabling them to enhance their services and offerings accordingly.

WhatsApp chatbots are undoubtedly changing the banking industry by automating processes, improving customer experience, and reducing operational costs.

As more and more customers embrace digital banking, integrating chatbot technology is crucial for banks to stay competitive and meet customer expectations.

Now let us see the role of WhatsApp chatbot in banking.

Suggested Reading:

The Role of WhatsApp Chatbots in Banking

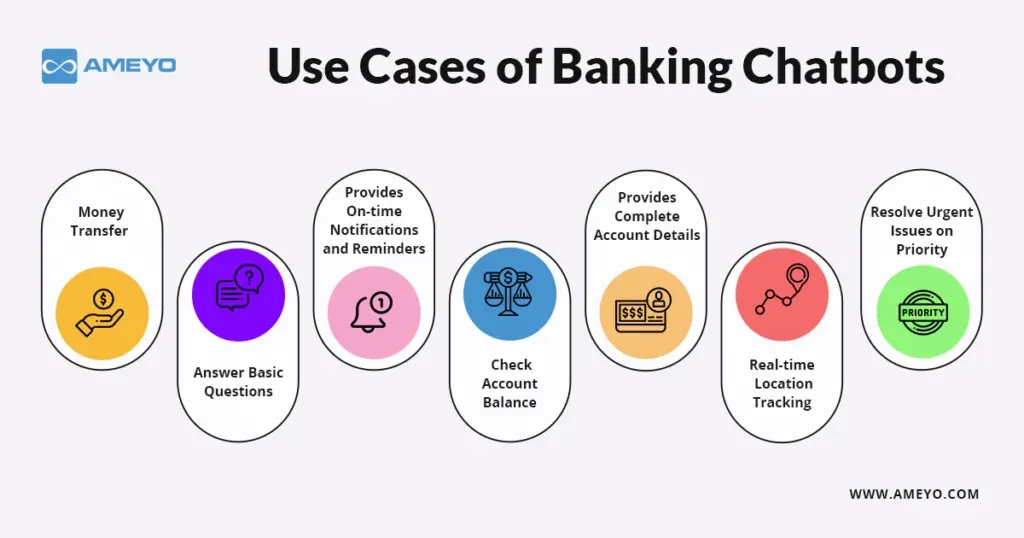

WhatsApp chatbots play a significant role in automating various banking services, providing convenience, efficiency, and personalized customer experiences.

Let's explore some of the key roles that these chatbots play in the banking industry:

Streamlining Banking Processes

WhatsApp chatbots can handle several routine banking tasks, reducing the workload on human agents.

They can assist customers with balance inquiries, transaction history, and account statements, allowing customers to access and manage their financial information quickly.

Account Management and Support

Chatbots can assist customers in opening new bank accounts, updating personal information, and managing account settings.

These bots provide a simple and efficient way for customers to navigate through account-related services without requiring lengthy forms or visits to a physical branch.

Fund Transfers and Payments

One of the most essential functions of WhatsApp chatbots is facilitating fund transfers and payments.

Customers can easily transfer money between their accounts, pay bills, and even make peer-to-peer transfers by simply interacting with the chatbot on WhatsApp.

This eliminates the need for customers to visit a bank branch or use a separate banking application.

Customer Service and Support

WhatsApp chatbots serve as virtual customer service representatives, providing instant support and guidance to customers.

They can address customers' inquiries, resolve common issues, and provide step-by-step instructions for various banking processes.

This ensures that customers receive timely assistance, leading to higher satisfaction levels.

After looking into roles now let us see the implementation of whatsApp chatbot in banking.

Suggested Reading:

Implementation of WhatsApp Chatbots in Banking

Implementing WhatsApp chatbots in banking services requires careful planning and integration to ensure a seamless experience for customers.

Here are the key steps involved in implementing WhatsApp chatbots:

Define Objectives and Use Cases

Financial institutions should clearly define their objectives for implementing WhatsApp chatbots.

They need to identify the specific use cases where chatbots can add the most value, such as answering frequently asked questions, enabling transactions, or providing product information.

Build and Train the Chatbot

The chatbot must then be built and trained after the use cases have been determined. The bank has the option of working with a third-party chatbot provider or developing the chatbot internally.

The chatbot has to be properly educated to comprehend and react to a range of client inquiries.

Integrate with Existing Systems

To ensure the seamless flow of information, the chatbot needs to be integrated with the bank's existing systems and databases.

This lets the chatbot access customer information, transaction history, and other relevant data in real-time, enabling personalized responses and accurate account management.

Test and Iterate

Before deploying the chatbot, thorough testing is essential to ensure its functionality and effectiveness.

The chatbot should be tested for different scenarios and user input to fine-tune its responses. User feedback should also be collected to iterate and refine the chatbot's capabilities.

Promote and Train Users

Once the chatbot is ready for deployment, the bank needs to promote its usage and train customers on how to interact with the chatbot effectively.

Educational materials, tutorials, and automated onboarding processes can be provided to ensure customers embrace and utilize the chatbot to its full potential.

And if you are finding the whole process tough, to begin with, then meet BotPenguin- the home of chatbot solutions.

With BotPenguin you can easily train your WhatsApp chatbot on custom data and offer human-like conversational support to your customers.

And that's not it! BotPenguin makes sure to offer custom WhatsApp chatbot development for your specific business needs:

- Marketing Automation

- WhatsApp Automation

- Customer Support

- Lead Generation

- Facebook Automation

- Appointment Booking

Future Outlook for WhatsApp Chatbots in Banking

WhatsApp chatbots have already made a significant impact on the banking sector, but their potential for growth and development is immense.

Here are some future outlooks for WhatsApp chatbots in banking:

Enhanced Personalization

With artificial intelligence and machine learning, WhatsApp chatbots can provide even more personalized customer experiences.

They can analyze customer data and preferences to offer tailored recommendations, product suggestions, and targeted promotional offers.

Integration with Voice Assistants

As voice assistants like Siri and Alexa continue to gain popularity, integrating WhatsApp chatbots with these platforms will become more common.

Customers can engage with the chatbot through voice commands, providing an additional layer of convenience and accessibility.

Suggested Reading:

Advanced Security Features

As security concerns remain a top priority in the banking industry, future WhatsApp chatbots will incorporate advanced security features.

These may include two-factor authentication, biometric recognition, and enhanced encryption protocols to ensure customer information remains safe and secure.

Expanded Range of Services

WhatsApp chatbots will continue to evolve and offer an expanded range of services beyond basic banking functions.

They may integrate with third-party applications like booking flights, ordering food, or scheduling appointments, creating a more holistic and convenient customer experience.

Increased Adoption by Financial Institutions

With the proven benefits and growing customer demand, more financial institutions will embrace WhatsApp chatbots in their banking services.

This increased adoption will lead to further advancements in chatbot capabilities and a wider range of options for customers to interact with banks through WhatsApp.

Conclusion

WhatsApp chatbots have changed the way in digital banking by automating routine tasks and providing personalized, around-the-clock assistance to customers.

As artificial intelligence progresses, these chatbots will become even more intuitive and capable of understanding complex customer needs.

Both large banks and nimble fintech startups recognize the value of conversational interfaces in enhancing customer experience.

With growing adoption, chatbots promise to make banking as seamless and effortless as chatting with friends on WhatsApp.

While security and privacy will remain top priorities, the future of banking interactions is increasingly chat-based.

WhatsApp provides a popular and universal platform for this vision to become a reality.

Say goodbye to messy appointment and hello to smooth sailing with BotPenguin! Our clever WhatsApp bots make scheduling a breeze through natural chats.

They'll find your opening, update your calendar, then keep everyone in the know.

No more juggling calls or emails - just happy customers getting the assistance they need.

Plus your team can take on more without expanding headcounts. Sign up today to let our customizable chatbots streamline your booking bliss!

Suggested Reading:

Frequently Asked Questions (FAQs)

Are WhatsApp Chatbots secure for banking transactions?

Yes, WhatsApp Chatbots ensure security through end-to-end encryption and multi-factor authentication. They comply with industry-standard security protocols, protecting sensitive information and transactions from potential threats.

What banking services can be automated using WhatsApp Chatbots?

A variety of banking services can be automated, including balance inquiries, fund transfers, bill payments, account management, transaction history, and customer support. These services streamline the banking experience, making it more convenient for users.

Can Customers apply for loans and credit cards through WhatsApp Chatbots?

Yes, many banks offer the facility to apply for loans and credit cards through WhatsApp Chatbots. The process is simplified and allows users to submit necessary documents and information, making the application process more accessible and efficient.

How can banks ensure seamless integration of WhatsApp chatbots with their existing banking infrastructure?

Integration should be carefully planned, ensuring compatibility with the current banking systems, APIs, and databases. Conduct thorough testing to guarantee smooth data flow, real-time updates, and minimal disruptions to the existing banking operations.

What are the potential cost-saving benefits associated with implementing WhatsApp chatbots in banking services?

By automating routine tasks, reducing manual intervention, and optimizing customer support, banks can significantly cut operational costs, improve efficiency, and allocate resources more effectively, leading to overall cost savings and enhanced profitability.

What strategies should banks adopt to ensure effective onboarding and training for WhatsApp chatbot usage?

Conduct comprehensive training sessions for both customers and employees, offer easy-to-understand tutorials, and provide continuous technical support to ensure a smooth transition to using the chatbot, fostering user confidence and maximizing adoption rates.