Introduction

Claims don’t need humans anymore. That might sound strange, but it’s true.

Automation is rapidly changing how insurance claims are processed, eliminating much of the traditional paperwork and manual steps.

If you think it’s just about speeding things up, think again. According to a recent report by MarketsandMarkets, the global claims processing automation market is expected to grow from $11.2 billion in 2022 to $17.8 billion by 2027, at a CAGR of 9.7% during the forecast period.

Automated claims processing can reduce errors, cut costs, and improve customer experience in ways you wouldn’t expect. But how does it all work?

And what do you need to know to understand this shift? Don't worry, this guide will walk you through the basics, making the complex world of automated claims processing simple and clear. Let’s get started.

What is Automated Claims Processing?

Automated claims processing is the use of technology to handle claims without human intervention. Instead of relying on manual input, systems powered by artificial intelligence (AI) manage the entire process.

From evaluating the claim to determining payout eligibility, everything is done through claims processing automation.

How Automation Works

Claims process automation can handle large amounts of data quickly. For example, AI tools like a chatbot for insurance can help policyholders submit claims, reducing wait times. These tools are not just for customer service but for streamlining the entire claims process.

AI-powered chatbots for insurance companies provide 24/7 assistance. In fact, AI chatbots for the insurance sector are becoming standard, improving customer experience while reducing operational costs.

By adopting automated claims processing, companies can increase efficiency, lower errors, and provide a smoother experience for their clients.

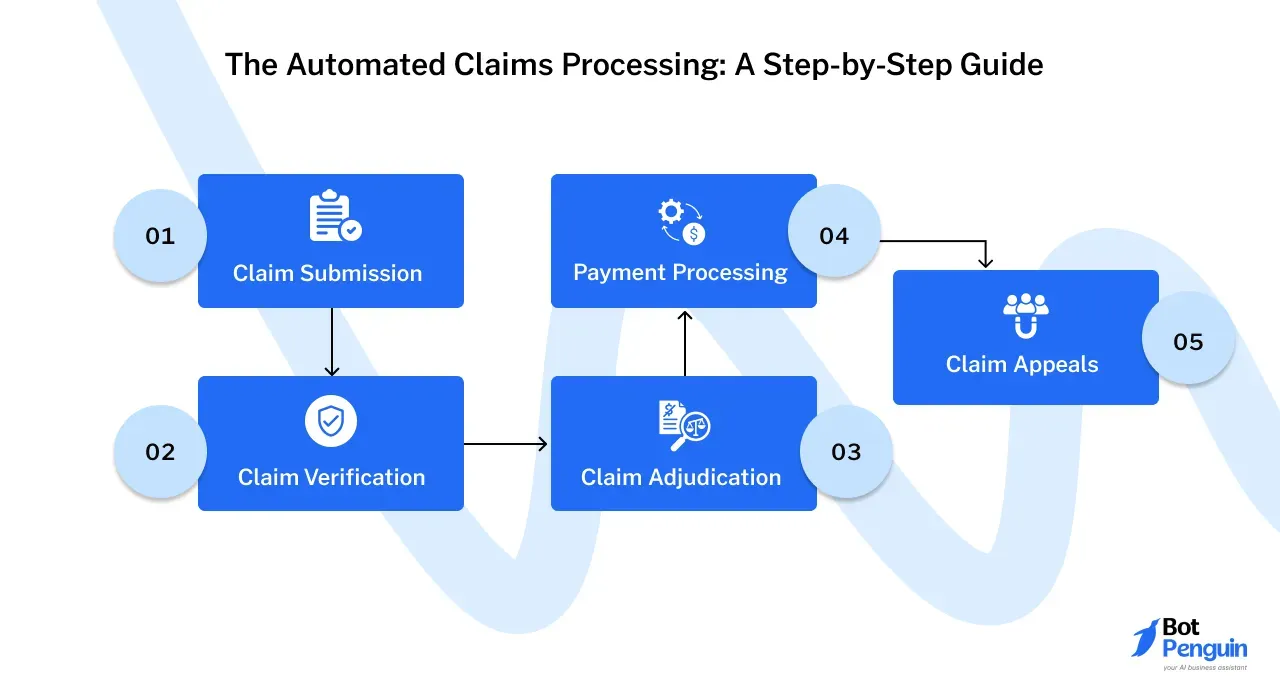

The Automated Claims Processing: A Step-by-Step Guide

Claims processing automation transforms each step by removing manual tasks and human error.

Here’s how automated claims processing works, from claim submission to payment, and even in the appeals process.

Step 1

Claim Submission

Automated claims processing begins when a policyholder submits a claim. In the past, this was a manual, paperwork-heavy task.

Today, with automated claims processing, this step can be streamlined for quicker results.

Different Methods of Claim Submission

Claim submission can happen in various ways, including online portals, mobile apps, or through a chatbot for insurance. Automated systems can receive claims in seconds, whereas manual submissions can take days or even weeks.

For instance, many insurance companies now rely on AI-powered chatbots for insurance sector tasks, allowing policyholders to interact and submit their claims instantly.

Electronic vs. Paper Claims

There are two main types of claim submissions: electronic and paper-based. Electronic claims, often facilitated by claims process automation, are faster and more accurate.

Paper claims, on the other hand, require manual data entry, which increases the chance of errors. With automated claims processing, insurers favor electronic submissions for their efficiency.

Step 2

Claim Verification

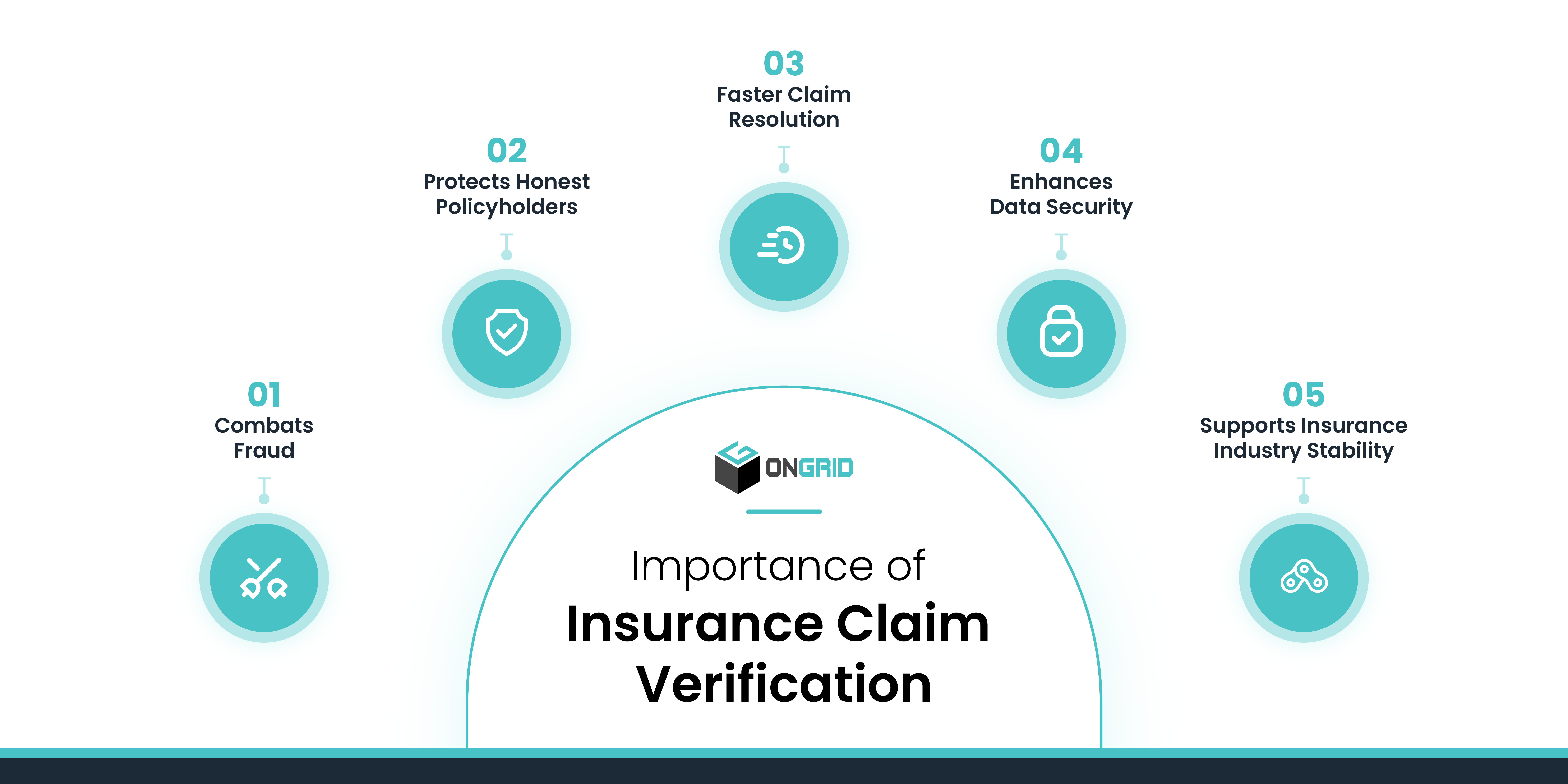

Once a claim is submitted, it needs to be verified. This step ensures the claim is valid and all the necessary data is accurate and complete.

Data Validation and Accuracy Checks

In the verification process, data must be cross-checked for accuracy. Claims processing automation systems validate the data by comparing it with stored records.

Automated claims processing ensures all information—such as policy details and coverage—is accurate, reducing the risk of errors.

Eligibility Verification

Next, the system checks whether the claim meets eligibility requirements. This involves confirming that the policyholder’s coverage is still active and that the claim falls within the policy’s terms.

AI-powered chatbots for insurance companies assist with eligibility verification, improving speed and reducing delays.

Step 3

Claim Adjudication

After verifying a claim, it moves to adjudication. This is where the insurance company decides how much to pay the policyholder based on the terms of the policy.

Determining Claim Benefits

Claims process automation helps in calculating the benefits the claimant is entitled to receive.

Automated claims processing use pre-set rules to quickly determine the right payout, avoiding the need for lengthy human review.

Applying Coverage Rules and Policies

The system also applies the insurance company’s coverage rules to the claim.

Every policy has specific conditions, and automated claims processing ensures these are consistently applied. By automating this step, insurers minimize errors and reduce processing times.

Step 4

Payment Processing

Once the claim is adjudicated, the next step is to issue the payment to the policyholder. The payment method can vary, depending on the insurer and the policyholder’s preferences.

Remittance of Payments

Automated systems can process payments faster than manual methods. Claims processing automation ensures that the correct amount is paid out, based on the adjudicated claim.

These payments can be sent almost immediately, speeding up the settlement process.

Direct Deposit vs. Check

There are two main methods for issuing payments: direct deposit and paper checks.

With claims process automation, direct deposit is the faster option, allowing policyholders to receive funds within days. Paper checks, while still in use, take longer to process and can involve delays in mailing.

Step 5

Claim Appeals

Not every claim gets approved, and in some cases, the policyholder may disagree with the decision. This is where the appeals process comes into play.

Understanding the Appeals Process

If a policyholder believes their claim was wrongly denied or undervalued, they can file an appeal.

Many insurance companies now offer digital solutions, including AI chatbots for insurance, to help policyholders navigate the appeals process.

Grounds for Appeals

Common grounds for appeals include disputes over coverage, benefit amounts, or policy misinterpretation.

AI-powered chatbots for the insurance sector can help policyholders understand their options and guide them through the steps of filing an appeal, offering clarity and support throughout the process.

Technologies Behind Automated Claims Processing

The technologies driving automated claims processing play a crucial role in eliminating manual errors, speeding up workflows, and ensuring accuracy at every step.

Artificial Intelligence (AI)

AI is a major player in modern claims process automation, offering capabilities far beyond simple automation. It improves how claims are processed, analyzed, and verified.

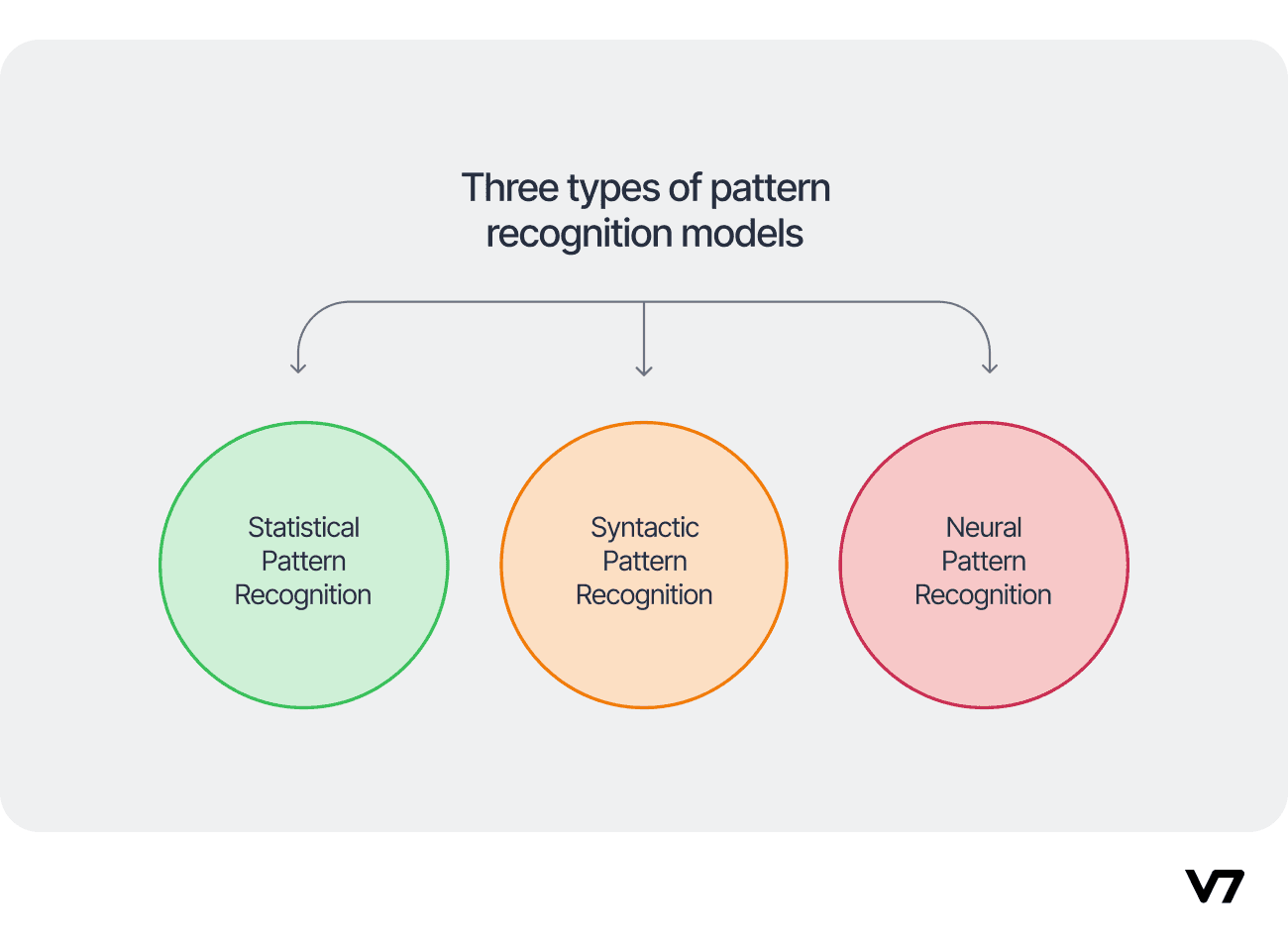

Machine Learning for Pattern Recognition

One way AI helps in automated claims processing is through machine learning.

Machine learning algorithms can recognize patterns in large datasets, making it possible to predict fraud, identify errors, and optimize decision-making. This means that insurers can flag questionable claims faster and more accurately.

Natural Language Processing for Document Understanding

Natural language processing (NLP) is another important AI tool. It helps systems understand and interpret human language, allowing automation to extract relevant data from documents like medical reports or claim forms.

With NLP, AI-powered systems can process documents more efficiently than humans, saving time and reducing errors.

Robotics Process Automation (RPA)

Robotic Process Automation (RPA) is a technology designed to handle repetitive, rule-based tasks.

In claims processing automation, it performs actions that would normally require human input, such as data entry or document management.

Automating Repetitive Tasks

RPA automates the time-consuming, repetitive tasks often involved in claims process automation.

These tasks might include uploading documents, validating data, or triggering responses based on preset rules. By automating such tasks, insurance companies can significantly reduce processing times.

Improving Efficiency and Accuracy

RPA doesn’t just speed things up; it also improves accuracy. Human errors in data entry or document handling can lead to delays or costly mistakes.

With RPA, insurers ensure that tasks are completed without errors, leading to faster claims processing and improved accuracy.

Blockchain Technology

Blockchain technology is increasingly being used in the insurance industry, particularly in automated claims processing, for its ability to enhance security and transparency.

Ensuring Data Security and Transparency

Blockchain’s decentralized ledger ensures that data cannot be altered without detection, providing a secure environment for sensitive insurance information.

This is especially valuable when dealing with claims process automation, where data integrity is crucial. Blockchain also adds transparency, as all parties involved in the claim can view the same data without risk of tampering.

Streamlining the Claims Process

Blockchain can also help streamline the claims process by automating the flow of information between insurers, customers, and third-party providers.

This reduces delays and increases efficiency, ensuring that the claim process is not only faster but also more reliable.

Benefits of Automated Claims Processing

Automated claims processing revolutionizes the traditional claims workflow, making it more efficient, accurate, and customer-friendly.

Improved Efficiency

Automated claims processing drastically improves the efficiency of the claims process automation by reducing the time it takes to handle claims and eliminating repetitive manual tasks.

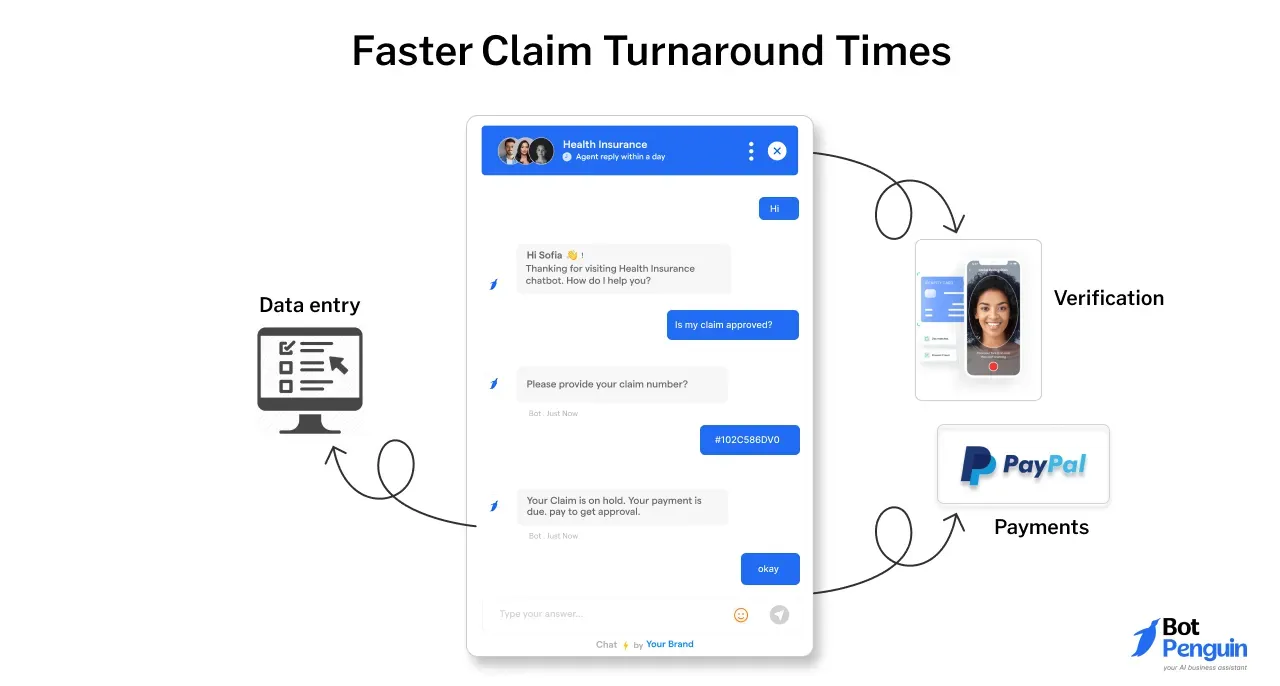

Faster Claim Turnaround Times

With automated claims processing, insurers can process claims much faster than before. Tasks like data entry, verification, and payment, which could take days, are now completed within hours.

For instance, using a chatbot for insurance allows customers to submit claims in real-time, speeding up the submission process and allowing for quicker evaluations.

Reduced Manual Errors

Automated claims processing also reduces the risk of human error.

By eliminating manual data entry and document handling, claims process automation ensures that fewer mistakes occur during claim processing. This leads to fewer rework cycles and faster resolutions.

Enhanced Accuracy

One of the biggest advantages of automated claims processing is its ability to significantly improve the accuracy of claims management.

Minimized Data Entry Errors

Human errors, especially during data entry, can cause delays or even result in denied claims.

With claims processing automation, data is automatically captured and validated, minimizing the chances of errors. This not only speeds up the process but also ensures that claims are handled correctly from the start.

Increased Claim Accuracy

Automated claims processing applies consistent rules and policies when adjudicating claims, leading to more accurate outcomes.

AI-powered tools, such as AI-powered chatbots for insurance sector processes, are designed to apply policy guidelines correctly, reducing the need for manual checks and ensuring claims are settled with precision.

Cost Savings

Cost-efficiency is another major benefit of implementing automated claims processing.

By automating repetitive tasks, insurance companies can reduce operational expenses while reallocating resources more effectively.

Reduced Operational Costs

With fewer human resources required for manual tasks, claims process automation significantly lowers operational costs.

Automated systems handle tasks like claim entry, verification, and approval, cutting down on labor expenses and reducing the need for extensive back-office support.

Improved Resource Allocation

By automating routine tasks, insurers can allocate their resources more effectively.

Employees can focus on more complex and value-driven tasks, such as customer service and handling exceptions, while automation handles repetitive activities. This helps reduce overhead costs and boosts productivity.

Better Customer Experience

The end goal of automated claims processing is to improve the overall customer experience, making the claims journey smoother and faster.

Faster Claim Payments

With faster claim adjudication and payment processing, policyholders benefit from receiving their payouts more quickly.

In some cases, claims process automation enables direct deposits within a matter of days, significantly reducing the waiting period for customers.

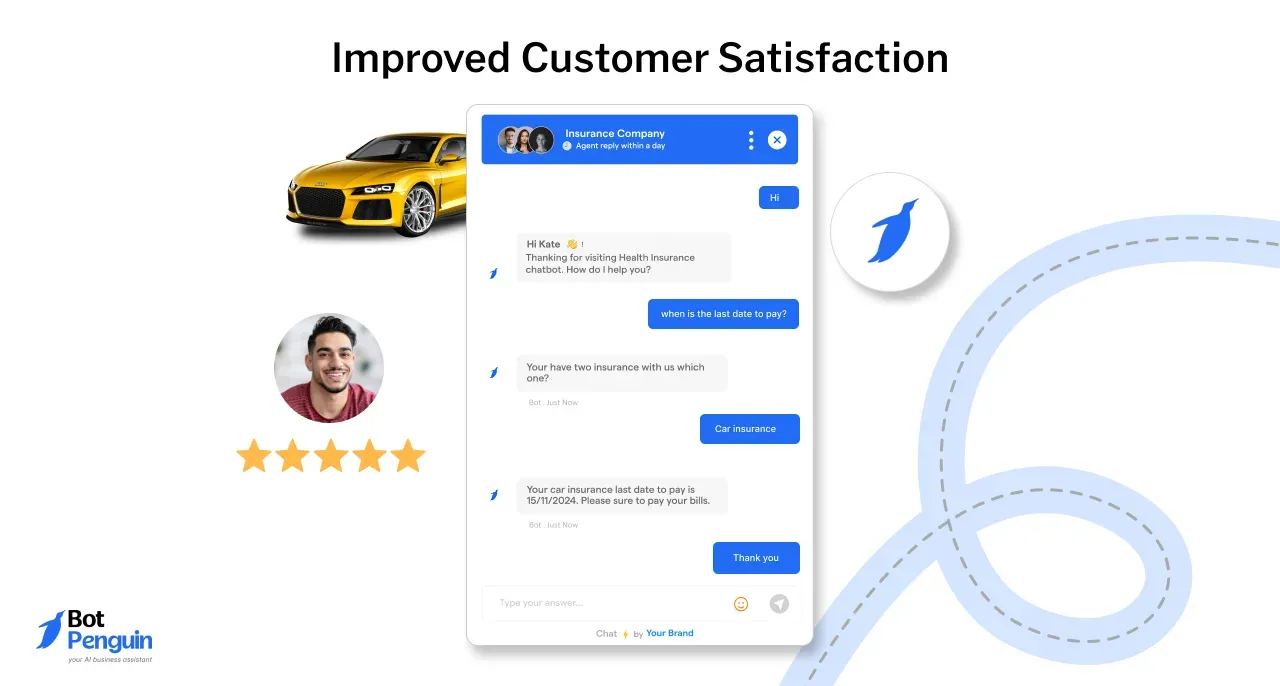

Improved Customer Satisfaction

Automated claims processing allows insurers to provide a more seamless and user-friendly experience.

Tools like AI chatbot for insurance give customers real-time updates on their claims, answer questions, and simplify the submission process. This leads to higher customer satisfaction, as policyholders experience less frustration and quicker resolutions.

Challenges and Considerations of Automated Claims Processing

To fully realize the potential of automated claims processing, insurers must address several challenges related to data management, system integration, and security.

Data Quality and Integrity

The foundation of any claims process automation system is reliable data.

Without accurate and consistent information, automation can lead to errors and misjudgments in claims handling.

Ensuring Accurate and Consistent Data

For automated claims processing to work effectively, data must be accurate and consistent across all systems.

Inaccurate data can result in delays, incorrect claim payouts, or even denied claims. Insurers must ensure robust data validation processes to maintain high-quality input and output.

Addressing Data Privacy Concerns

Another important consideration is data privacy. Insurers handle large volumes of personal information, and protecting this data is critical.

With AI-powered chatbots in the insurance sector use, ensuring that sensitive customer information is secure is a growing concern.

Companies must implement strong encryption and follow data protection standards to maintain customer trust.

System Integration

To fully implement claims processing automation, systems must integrate seamlessly with existing infrastructures and databases.

Integrating with Existing Systems and Databases

One challenge insurance companies face is integrating automated claims processing with older systems.

Legacy systems often don’t communicate well with newer automation technologies. Insurers must invest in updating or modifying their systems to ensure smooth integration, allowing data to move efficiently between platforms.

Ensuring Seamless Data Flow

Another concern is ensuring that data flows seamlessly between various systems, from claims submissions to adjudication.

Any bottlenecks or breakdowns in communication between systems can disrupt the claims process automation and slow down claims handling, affecting the overall efficiency.

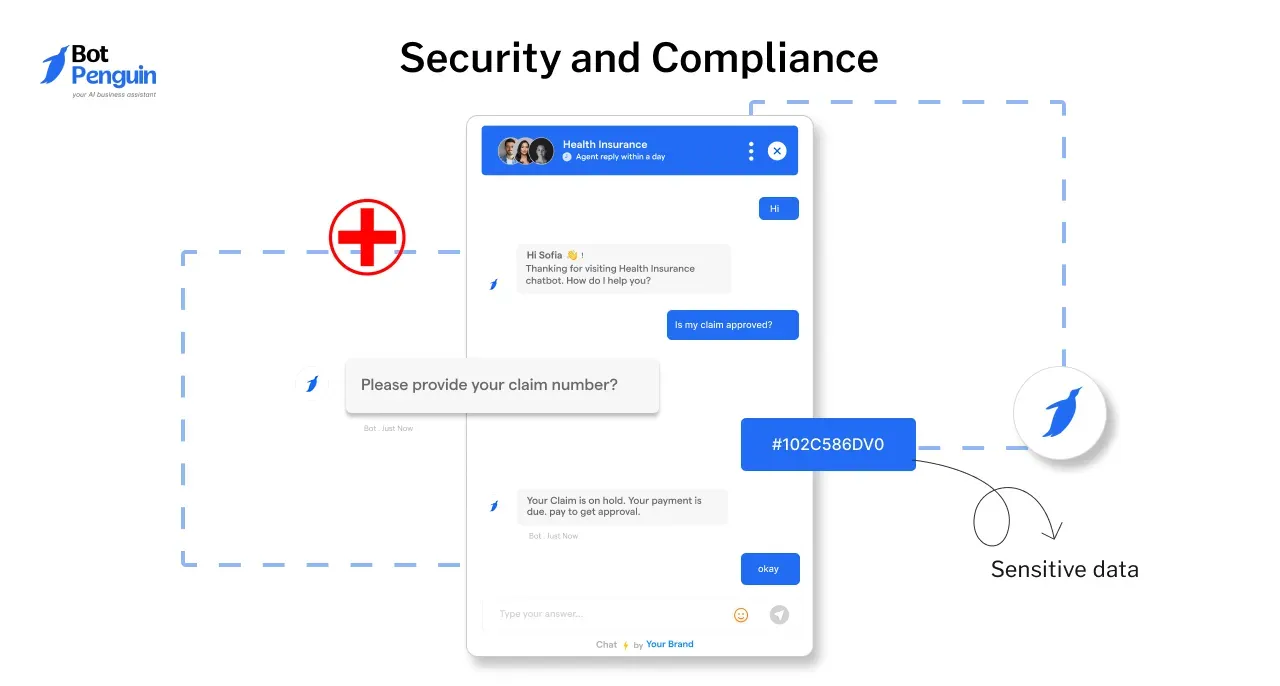

Security and Compliance

Security is always a top priority in the insurance industry, especially when handling sensitive data.

Protecting Sensitive Patient Data

Insurance companies handle personal and medical information, making data security a critical consideration.

Automated systems, including chatbots for insurance companies, must be designed to safeguard against unauthorized access and breaches, ensuring that sensitive patient data remains protected.

Adhering to Regulatory Requirements

Regulatory compliance is another essential consideration. Insurance companies must comply with laws governing data protection and privacy, such as GDPR or HIPAA.

Implementing claims process automation requires careful attention to ensure all regulatory requirements are met.

Conclusion

In conclusion, automated claims processing is revolutionizing the insurance industry by improving efficiency, accuracy, and customer satisfaction while reducing operational costs.

By leveraging technologies like AI, RPA, and blockchain, insurers can streamline their workflows and offer faster, more reliable services to policyholders.

However, challenges such as data integrity, system integration, and security must be carefully managed to fully realize these benefits.

As automated claims processing continues to evolve, insurance companies that embrace claims processing automation will stay ahead, delivering better experiences and outcomes for their clients in an increasingly competitive market.

Frequently Asked Questions(FAQs)

What is automated claims processing?

Automated claims processing uses technology, often powered by AI, to handle insurance claims without human intervention, improving efficiency, accuracy, and reducing manual tasks.

How does claims processing automation improve accuracy?

Claims processing automation reduces human error by automating data entry and verification, ensuring consistent application of rules, which leads to more accurate and reliable outcomes.

What technologies power automated claims processing?

Technologies that power automated claims processing, like artificial intelligence (AI), robotic process automation (RPA), and blockchain, are used to streamline tasks, enhance data security, and improve decision-making in automated claims processing.

Can the chatbot for insurance companies be used for insurance claims?

Yes, AI-powered chatbots for the insurance sector help policyholders submit claims, provide real-time updates, and guide them through the process, improving customer experience and reducing wait times.

What are the benefits of automated claims processing?

Automated claims processing offers faster claim turnaround times, reduced manual errors, cost savings, increased claim accuracy, and better customer satisfaction.

What challenges are associated with automated claims processing?

Challenges of automated claims processing include maintaining data quality, ensuring system integration with legacy platforms, addressing data privacy concerns, and meeting regulatory compliance for secure claims management.