Introduction

Automated claims processing has become a cornerstone of efficiency in the insurance industry, with recent statistics highlighting its growing importance.

According to a 2023 report by McKinsey, insurers that have implemented claims process automation have seen up to a 30% reduction in processing times and a 50% decrease in operational costs.

Claims processing automation not only streamlines workflows but also enhances customer satisfaction. A 2024 study by Accenture revealed that 76% of insurance customers prefer automated claims processing over traditional methods.

This shift has led to a surge in the adoption of AI chatbots for insurance, with the market for these technologies expected to grow at a CAGR of 25.4% from 2023 to 2028, according to Allied Market Research.

As automated claims processing continues to evolve, chatbots for insurance companies are becoming increasingly sophisticated.

These AI-powered chatbots for the insurance sector can handle complex queries, assess claims, and even detect fraud, making them indispensable tools for modern insurers seeking to optimize their claims process automation strategies.

What is Automated Claims Processing?

Automated claims processing is a system that uses advanced technologies to handle insurance claims automatically.

By leveraging AI and machine learning algorithms, the system can quickly and accurately analyze claim information, determine the validity of the claim, and process payments to policyholders.

Benefits of Automated Claims Processing

Given below are the advantages of Automated claims processing :

Increased Efficiency

Automated claims processing can significantly increase efficiency in the insurance sector.

By automating repetitive tasks such as data entry, claims verification, and document processing, insurance companies can streamline their operations and handle a larger volume of claims in a shorter amount of time.

This means faster processing times for customers, leading to improved satisfaction and retention rates.

Cost Savings

One of the key benefits of automated claims processing is the cost savings it can bring to insurance companies.

By reducing the need for manual labor and streamlining workflows, companies can save on operational costs and allocate resources more effectively.

Additionally, automation can help minimize errors and fraud, further reducing financial losses for insurers.

Reduced Errors

Manual claims processing is prone to errors, which can result in delays, financial losses, and dissatisfied customers.

Automated claims processing systems are designed to minimize human error by accurately processing and verifying claims data.

By implementing automated systems, insurance companies can reduce the risk of costly mistakes and improve overall accuracy in automated claims processing.

Improved Customer Satisfaction

In the insurance sector, customer satisfaction is key to retaining clients and building a positive reputation.

Automated claims processing plays a crucial role in enhancing customer satisfaction by speeding up claim processing times, reducing errors, and providing a more seamless experience for policyholders.

With quicker resolutions and fewer complications, customers are more likely to trust the insurance company and remain loyal to the brand.

Steps to Implement Automated Claims Processing

Automated claims processing streamlines the traditionally manual and time-consuming claims management workflow by leveraging advanced technologies like AI, machine learning, and RPA (robotic process automation).

This process improves efficiency, reduces errors, and enhances customer satisfaction by speeding up approvals and payouts.

Here are the essential steps to successfully implement automated claims processing in your organization.

Step 1

Assessing Your Current Claims Process

When you're considering automated claims processing, the first step is to carefully evaluate how your current claims process operates.

By examining the existing procedures, you can identify potential areas for improvement and determine where enhancements can be made to streamline the process.

Analyzing Existing Processes

To begin the assessment, it is essential to comprehensively analyze how claims are currently processed within your organization.

By mapping out each step from claim submission to settlement, you can gain a thorough understanding of the entire process.

Identifying Areas for Improvement

After dissecting the current processes, the next step is to pinpoint areas that could be optimized.

Look for bottlenecks, redundancies, or inefficiencies that may be hindering the efficiency of the claims process.

By identifying these pain points, you can focus on implementing targeted solutions to enhance overall performance.

Step 2

Define Objectives and Goals

When embarking on the journey to implement automated claims processing, it is crucial to define clear objectives and set achievable goals for the new system.

By establishing these targets, you can effectively measure the success of the automation process and ensure that it aligns with your organization's needs and priorities.

Goal Setting

Start by determining what you aim to accomplish by introducing automated claims processing.

Are you looking to streamline the claims process, reduce processing times, improve accuracy, or enhance customer satisfaction?

Clearly outline your objectives, ensuring they are specific, measurable, achievable, relevant, and time-bound (SMART).

Efficiency and Cost Savings

One of the primary goals of implementing claims processing automation is to enhance operational efficiency.

Define how much time and resources you aim to save through automation and set measurable targets for reducing turnaround times and costs associated with manual processing.

Accuracy and Compliance

Ensure that your goals include improving the accuracy of claim assessments and increasing compliance with industry regulations and internal policies.

Define specific metrics for accuracy rates, error reduction, and adherence to regulatory requirements to measure the success of the new system.

Step 3

Choose the Right Technology

When it comes to choosing the right technology for automated claims processing, it's essential to find tools that align perfectly with your needs.

Here are some steps you can take to ensure you're making the best choice for your organization:

Research available solutions

Start by looking at what options are available. Several software solutions and platforms are designed to streamline claims processing.

Research each one thoroughly to understand its features, benefits, and potential drawbacks.

Select software that fits your needs

Once you have a good understanding of the available options, narrow down your choices based on what aligns best with your organization's specific requirements.

Consider factors such as ease of use, cost-effectiveness, scalability, and compatibility with your existing systems.

Consider claims process automation tools

Claims process automation tools can significantly improve the efficiency and accuracy of your claims processing workflow.

These tools leverage technologies like artificial intelligence (AI) and machine learning to streamline repetitive tasks, reduce manual errors, and enhance overall productivity.

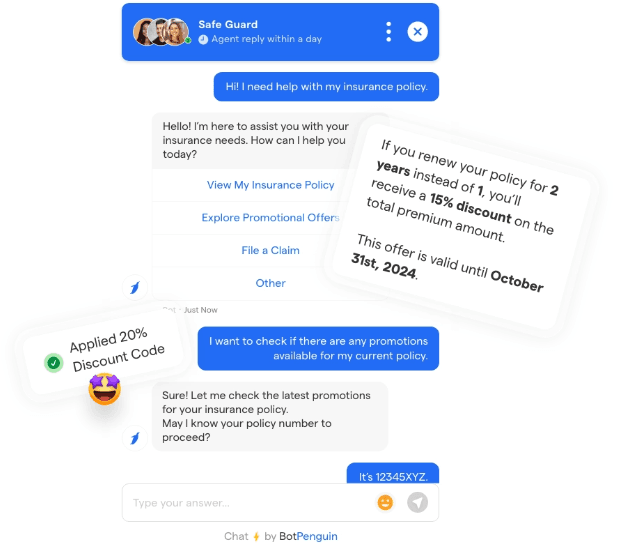

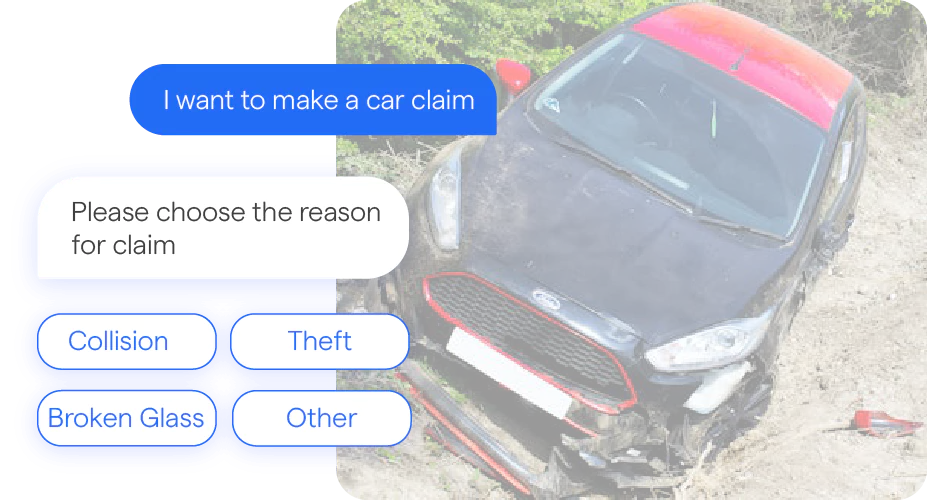

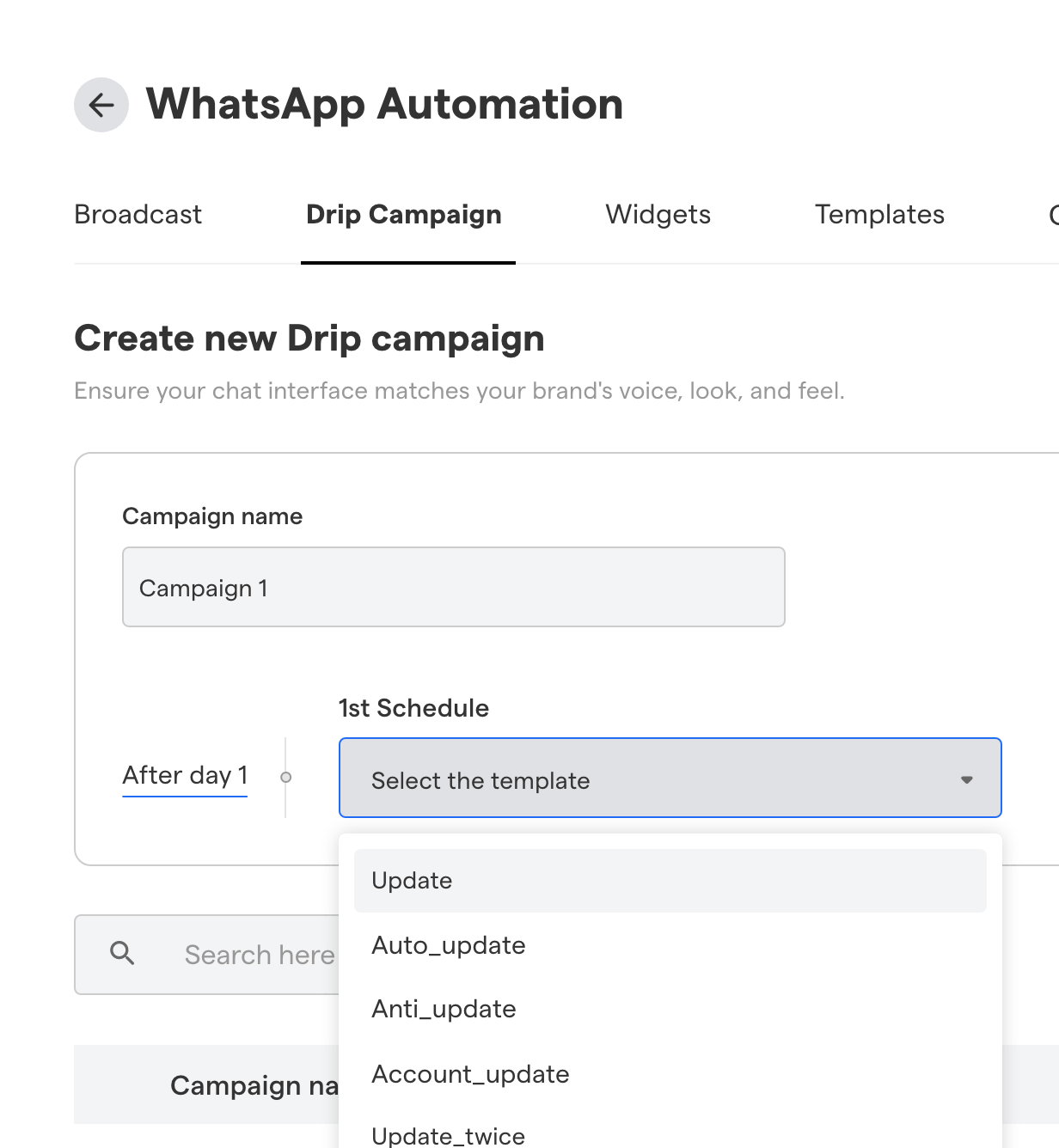

Evaluate chatbot for insurance companies

Another valuable technology to consider is chatbots for insurance companies. AI-powered chatbots can handle customer inquiries, process claims, provide policy information, and even assist with premium calculations.

Integrating a chatbot into your claims processing system can improve customer service and free up your team to focus on more complex tasks.

Step 4

Plan the Implementation

To successfully implement automated claims processing into your workflow, it is essential to have a detailed plan in place.

This roadmap will outline the steps to be taken, assign roles and responsibilities, and establish a timeline for the transition.

By following a clear plan, you can ensure a smooth and efficient implementation process.

Steps to Follow:

- Identify Key Stakeholders: Before diving into the implementation process, it is crucial to identify the key stakeholders who will be involved in the transition.

This includes team members from various departments such as IT, operations, and management.

- Develop a Detailed Timeline: Once the stakeholders are identified, create a timeline that reflects the different phases of the implementation process.

This timeline should include milestones, deadlines, and checkpoints to track progress.

- Assign Roles and Responsibilities: Clearly define the roles and responsibilities of each team member involved in the implementation process.

This will ensure that everyone knows what is expected of them and can contribute effectively to the project.

- Communicate Effectively: Communication is key during the implementation phase. Regular updates, meetings, and emails should be used to keep all team members informed about the progress of the project and any changes that may arise.

- Training Plan: Develop a comprehensive training plan that outlines how team members will be trained on the new system.

This could include online modules, in-person training sessions, and hands-on practice with the software.

- Risk Management: Identify potential risks that may arise during the implementation process and develop a plan to mitigate these risks.

This could include technical issues, resistance from team members, or data security concerns.

- Monitoring and Evaluation: Establish a system for monitoring and evaluating the implementation process.

This could involve regular reviews of progress, feedback from team members, and performance metrics to track the success of the transition.

Step 5

Data Integration and Management

Data integration and management play a crucial role in the success of any automated claims processing system.

Making sure that your new system seamlessly interacts with existing ones is essential for a smooth transition. Additionally, safeguarding the accuracy and security of your data is paramount to avoid any potential issues down the line.

Integrating with Existing Systems

When implementing a new automated claims processing system, compatibility with your current IT infrastructure is key.

The new system should be able to communicate with your existing databases, software, and applications without causing any disruptions.

This integration ensures a harmonious flow of information across different platforms and maintains the continuity of your operations.

Ensuring Data Accuracy and Security

Data accuracy is vital in the realm of claims processing automation. Errors in data entry or transmission can lead to delayed processing times, incorrect payments, and dissatisfied customers.

Implementing data validation processes and quality assurance measures can help maintain the integrity of your information and minimize the risk of errors.

Step 6

Test the System

When it comes to automated claims processing, testing is a crucial step in ensuring the smooth operation of your new system.

Before going live, it's essential to put your new setup through its paces to identify and rectify any issues that may arise.

By conducting thorough testing, you can address potential bugs and ensure that your claims processing automation functions seamlessly.

Types of Testing

The types of testing are the following:

- Functionality Testing: This type of testing focuses on checking whether all functions of the system work as intended.

It involves validating each feature of the system to ensure it performs correctly.

- Integration Testing: In integration testing, the focus is on how well different components of the system work together.

This step ensures that data is being transferred accurately between different modules of the system.

- Performance Testing: Performance testing assesses the system's responsiveness and stability under varying workloads.

It helps in determining how the system performs in different scenarios and if it meets the required performance criteria.

- Security Testing: Security testing is essential to identify vulnerabilities within the system that could potentially compromise the data integrity and confidentiality.

This type of testing ensures that sensitive information is adequately protected.

Steps for Conducting Testing

The steps for conducting testing are:

- Develop Test Cases: Create detailed test cases that cover all aspects of the system, including functionality, integration, performance, and security.

These test cases will serve as a roadmap for evaluating the system.

- Execute Test Cases: Follow the test cases meticulously to ensure thorough testing of the system. Document any issues encountered during testing for further analysis and resolution.

- Bug Tracking and Resolution: Keep track of any bugs or issues identified during testing and work towards resolving them promptly.

Communication between testers and developers is crucial in ensuring a smooth resolution process.

- Regression Testing: After resolving bugs, perform regression testing to ensure that the changes do not introduce new issues or disrupt existing functionalities.

This step helps in maintaining the overall system stability.

- User Acceptance Testing: Finally, involve end-users in the testing process to gather feedback on the system's usability and functionality.

User acceptance testing helps in validating that the system meets the user's requirements and expectations.

Step 7

Train Your Team

To train your team in automated claims processing, follow:

Teach Your Team Efficiently

Training your team on the new automated claims processing system is essential for a successful transition.

Ensuring that everyone understands how to use the system effectively will maximize its benefits and streamline your workflow.

Provide Comprehensive Training

It's crucial to provide comprehensive training to all team members. From claims processors to managers, everyone should be well-versed in using the new system.

Offer a mix of hands-on training sessions, online tutorials, and reference guides to accommodate different learning styles.

Encourage Collaboration

Promote a collaborative environment where team members can share knowledge, ask questions, and support each other during the training process.

Encouraging collaboration will foster teamwork, enhance learning, and create a sense of community among team members.

Consider organizing group training sessions or workshops to facilitate interaction and engagement.

Step 8

Monitor and Evaluate

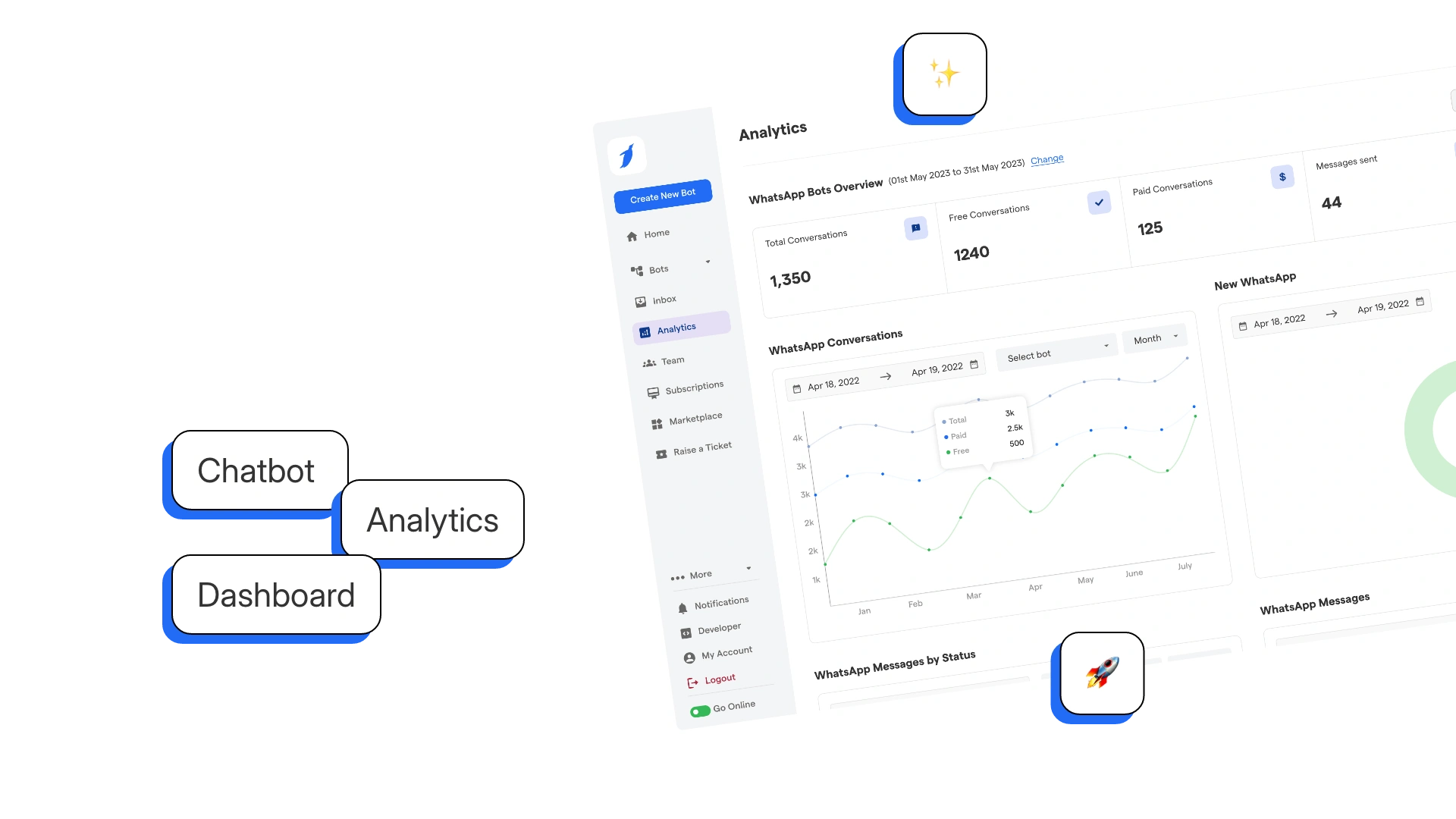

Monitoring and evaluating the performance of your automated claims processing system is crucial to ensure smooth operations and optimal outcomes.

By keeping a close eye on how things are going and being proactive in making necessary adjustments, you can continuously enhance your workflow efficiency and effectiveness.

Track Performance

One of the fundamental steps in monitoring your automated claims processing system is to track its performance.

Regularly assess key performance indicators (KPIs) to measure the system's efficiency, accuracy, and overall effectiveness. Some essential metrics to consider include:

- Processing Time: Measure the time it takes for claims to be processed from submission to settlement. Identify any bottlenecks or delays in the process that may impact efficiency.

- Accuracy Rate: Evaluate the accuracy of the system in processing claims without errors or inaccuracies. Monitor the percentage of claims that are resolved correctly to ensure data integrity.

- Customer Satisfaction: Obtain feedback from clients regarding their experience with the automated claims processing system. Assess satisfaction levels and identify any areas for improvement based on customer feedback.

Make Adjustments as Needed

When monitoring the performance of your automated claims processing system, be proactive in identifying any issues or inefficiencies that may arise.

If something is not right, take immediate action to tweak the system until it meets your expectations. Some strategies for making adjustments include:

- Root Cause Analysis: Identify the root causes of any performance issues or discrepancies in the system.

Conduct a thorough analysis to determine the underlying factors contributing to the problem.

- Implement Changes: Based on your findings, implement necessary changes or modifications to the automated claims processing system.

This may involve updating software settings, redefining workflows, or providing additional training to staff.

Conclusion

Implementing automated claims processing is a strategic imperative for insurance companies seeking to stay competitive.

By leveraging claims processing automation, insurers can significantly reduce turnaround times, minimize errors, and enhance customer satisfaction.

The key to successful implementation of automated claims processing lies in a phased approach, starting with process analysis and gradual integration of AI-powered technologies.

Claims process automation should be complemented by the deployment of chatbots for insurance, which can handle routine inquiries and guide customers through the claims journey.

These AI chatbots for insurance companies not only improve efficiency but also provide 24/7 support, crucial in times of crisis.

Ultimately, the success of automated claims processing depends on a holistic approach that combines technology, process reengineering, and employee training.

By embracing these innovations, insurance companies can transform their operations, reducing costs while delivering superior service in an increasingly competitive market.

Frequently Asked Questions (FAQs)

What is automated claims processing?

Automated claims processing uses software to handle claims tasks, reducing manual effort and errors.

It speeds up the process, enhances accuracy, and improves customer satisfaction by automating data extraction, validation, and workflow management.

How does automated claims processing improve efficiency?

Automated claims processing streamlines the workflow, reduces manual errors, and speeds up the approval process.

It ensures quicker, more accurate claims management, enhancing overall operational efficiency and customer satisfaction.

What are the key features of an automated claims processing system?

Key features of automated claims processing include data extraction and validation, workflow automation, real-time tracking and reporting, and seamless integration with existing systems.

These features collectively enhance the efficiency and accuracy of claims processing.

How do I choose the right automation software for automated claims processing?

Consider user-friendliness, scalability, security features, and compatibility with existing systems.

Evaluate multiple options through demos and trials to ensure the software meets your specific needs and objectives.

What are the steps to implement automated claims processing?

Steps include assessing your current process, defining goals, selecting suitable software, planning the implementation, and training staff.

Continuous monitoring and improvement ensure the system's effectiveness and efficiency.

What are the common challenges in integrating automated claims processing?

Common challenges include data integration issues, system compatibility, and resistance to change from staff.

Overcoming these involves thorough planning, selecting compatible software, and providing comprehensive training and support.