Introduction

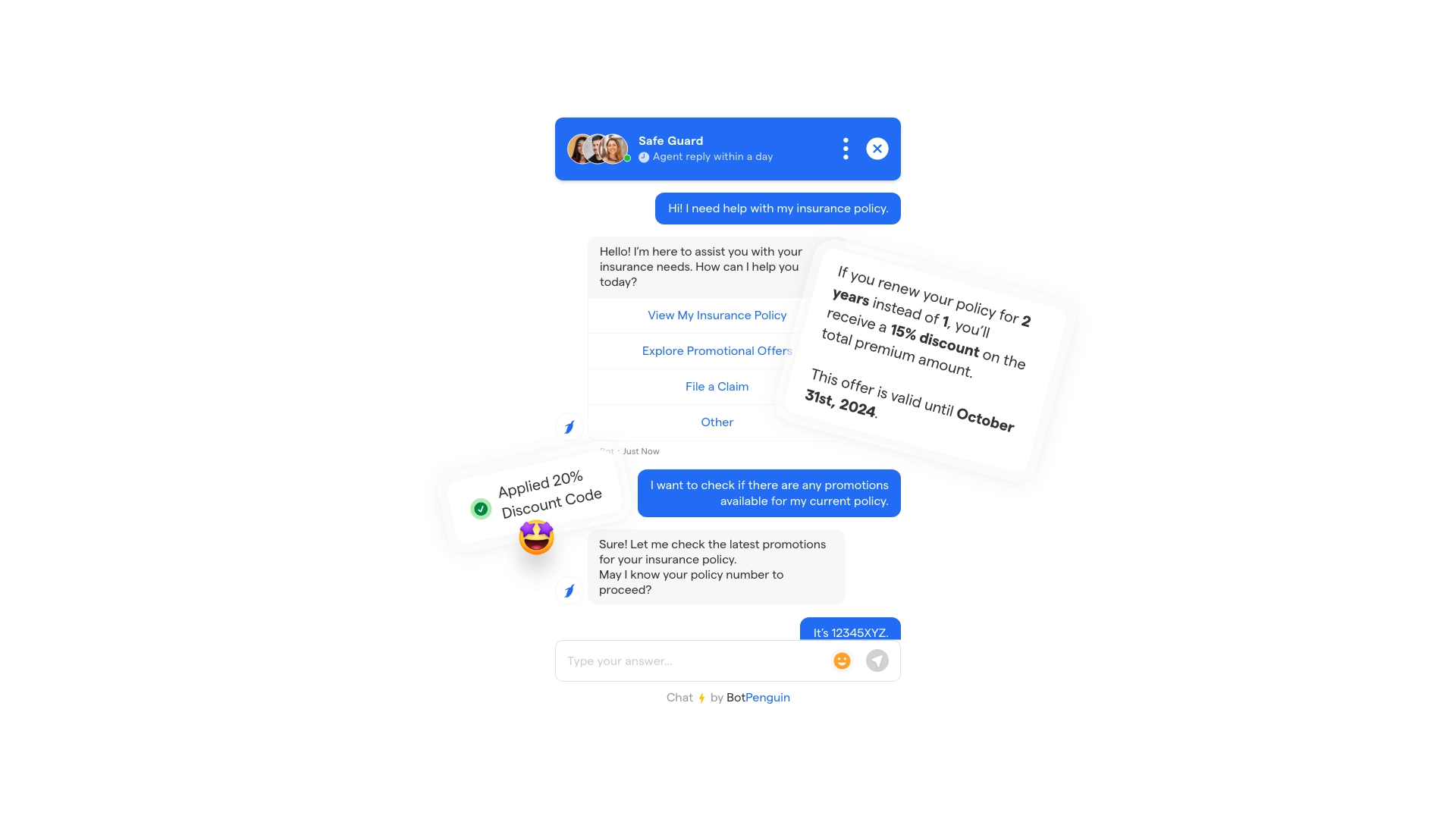

In 2024, the use of chatbots for insurance agents has become essential, transforming how insurance companies engage with customers.

AI-powered chatbots for insurance agencies can now automate claims processing, policy management, and customer service inquiries, providing seamless and round-the-clock support.

According to a recent study by Juniper Research, the chatbot for insurance companies market is expected to save the industry up to $2.3 billion annually by 2026 due to increased automation and efficiency.

Furthermore, Gartner predicts that by 2025, AI-powered chatbots for insurance will handle 75% of all customer interactions in the sector.

This surge in adoption underscores the growing importance of having a chatbot for insurance agents that streamlines operations and personalizes customer interactions, giving insurance companies an edge.

Top 10 Chatbot Platforms for Insurance Agents in 2024

AI chatbots for insurance are revolutionizing how insurance providers interact with policyholders, from automated claims processing to instant policy quotes.

AI-powered chatbots for insurance sector deployment have become essential tools, helping agents simultaneously handle routine inquiries and complex insurance calculations.

Integrating AI chatbots for insurance companies has remarkably reduced response times. In contrast, AI-powered chatbots for insurance sector operations enhance customer satisfaction by providing 24/7 support and personalized policy recommendations.

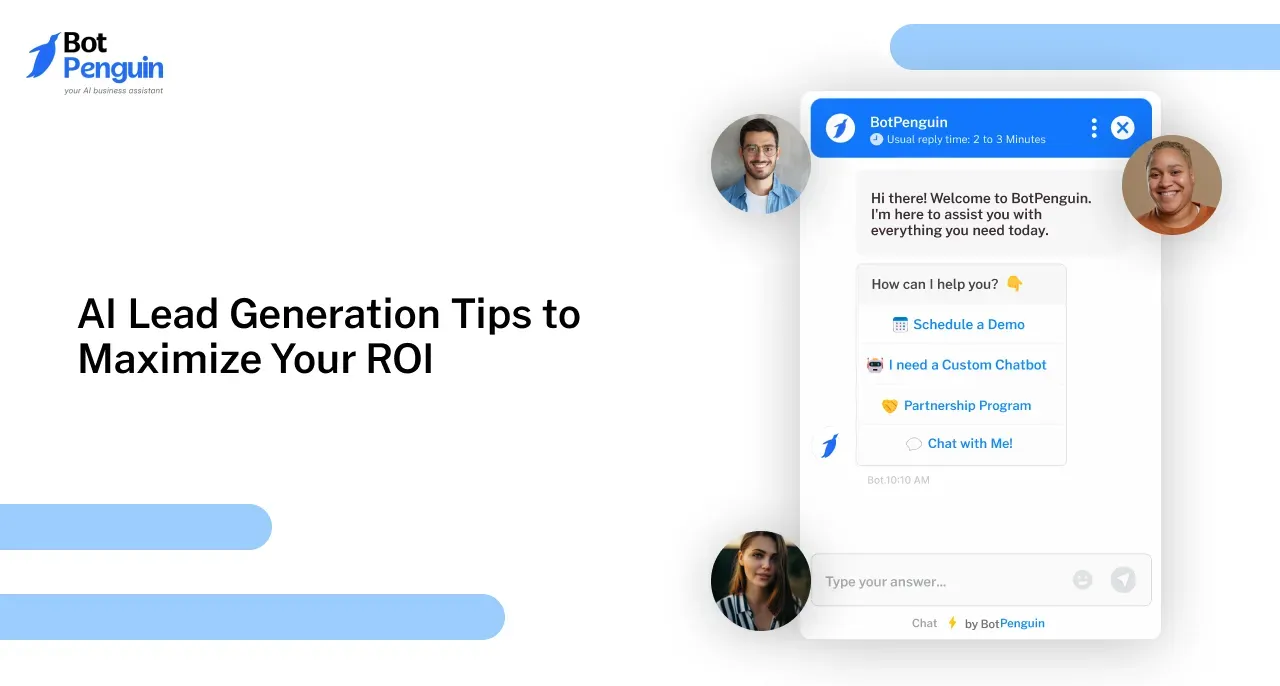

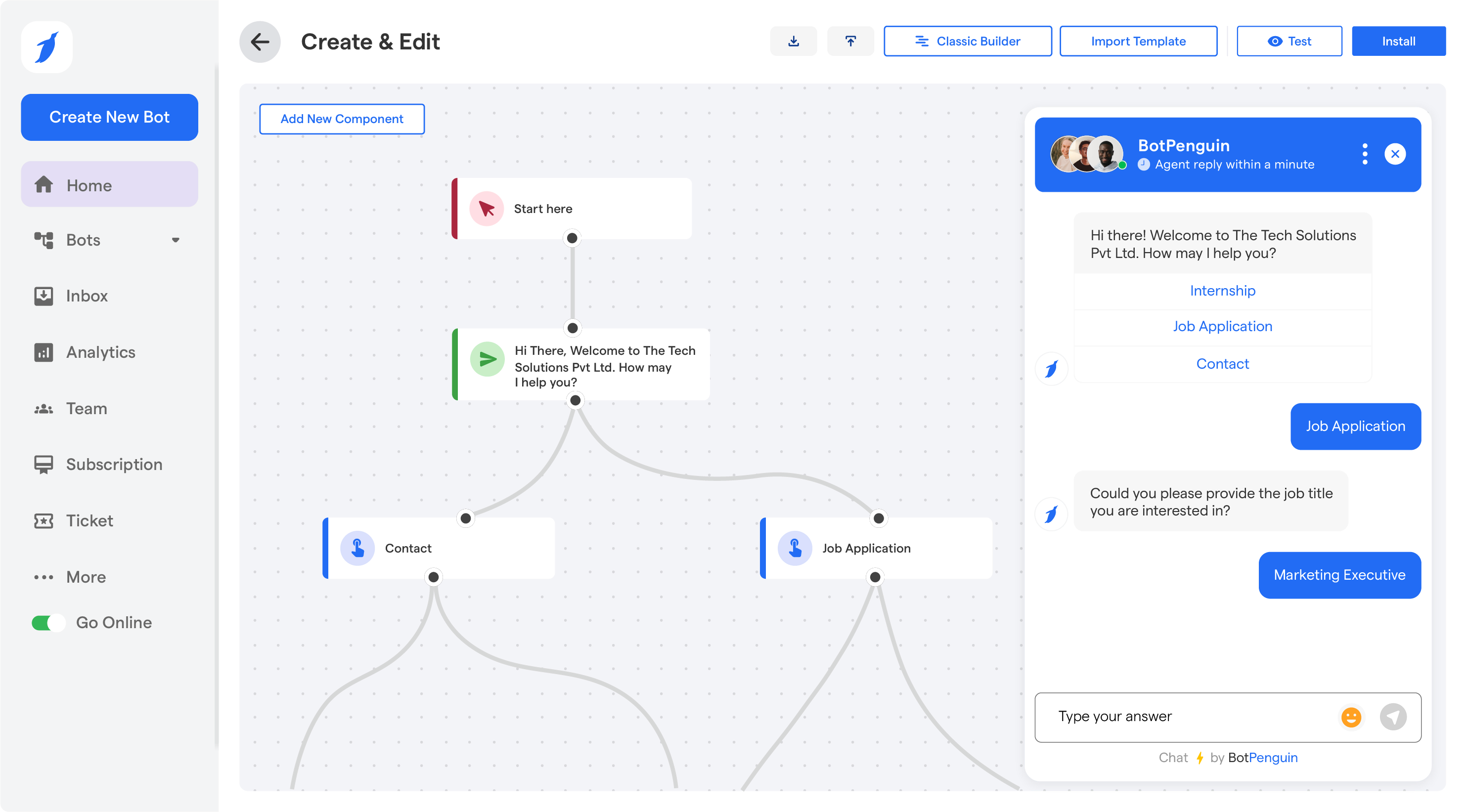

1. BotPenguin- Best AI Chatbot for Insurance

BotPenguin allows insurance agents to create chatbots for platforms like WhatsApp, Facebook, Instagram, Telegram, websites, etc.

With over 60+ integrations, it simplifies CRM, customer support, scheduling, and task management processes. BotPenguin is designed to meet the unique needs of insurance agents, making it a valuable asset in enhancing client interactions and operational efficiency.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- No Code Required: Build and manage chatbots without any technical skills.

- Integration With ChatGPT: Enables smarter, more natural conversations.

- Easily train your chatbot on custom data: Ensures personalized responses.

- Custom Chatbot and Whitelabel solutions: Tailored to personalized needs.

- 60+ Native Integrations: Includes CRM, customer support, and more.

- Native Live Chat Feature: Allows real-time customer interactions.

- Unlimited Chatbot Creation: No limits on the number of chatbots.

- Voice support: Integrated with Twilio for voice interactions.

- Analytics: Provides insights into chatbot performance.

Pros

Here are the pros of this chatbot for insurance agents platform:

- User-Friendly: No coding knowledge required, making it accessible for all agents.

- Affordable Plans: Cost-effective solutions for small and large businesses.

- Extensive Integrations: Supports various tools and platforms, enhancing versatility.

- Customizable: Offers tailored solutions and easy customization.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Scalability Options: While the free plan is great for starting out, growing businesses might find the higher-tier plans beneficial as they expand.

- Advanced Features: Some advanced features, like voice support, require additional setup, which can enhance the chatbot’s functionality further.

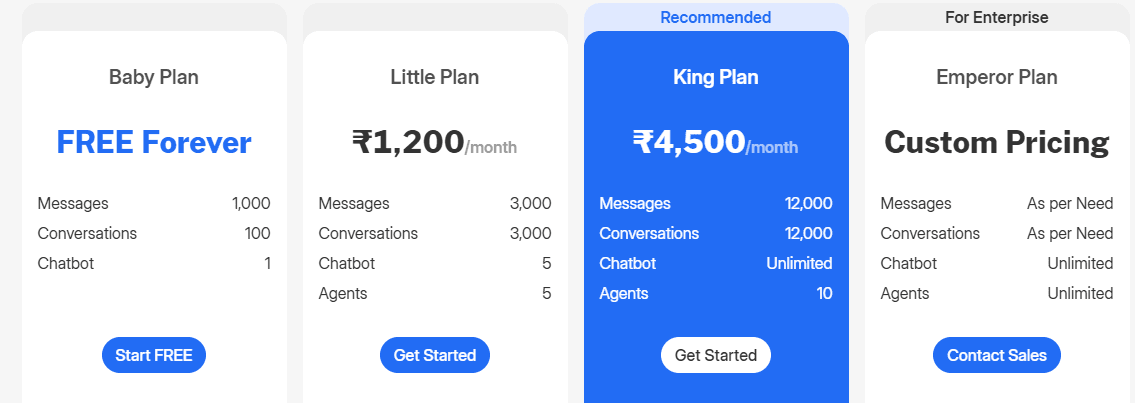

Pricing

- Free plan: Basic features

- Professional: $49/month (unlimited contacts)

- Enterprise: Custom pricing for advanced insurance features

2. ManyChat

ManyChat is a versatile chatbot platform designed to help businesses automate conversations on Facebook Messenger, Instagram, and WhatsApp. Its user-friendly interface and powerful automation features make it a popular choice across various industries, including insurance.

Insurance agents find ManyChat particularly useful for managing client interactions seamlessly across multiple social media platforms.

The platform’s capability to handle high volumes of inquiries and provide instant responses significantly improves customer satisfaction.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- User-friendly interface with no coding required: ManyChat's intuitive design allows insurance agents to set up and manage chatbots without needing technical skills.

- Automated responses to common inquiries: ManyChat can handle frequently asked questions, freeing agents to focus on more complex issues.

- Appointment scheduling: Clients can book appointments directly through the chatbot, streamlining the process.

- Detailed analytics and reporting: Insights into customer interactions help agents optimize their services and improve engagement.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Ease of use: The intuitive interface is suitable for users with no technical background.

- Integration: Seamlessly integrates with various CRM systems, enhancing data management.

- Automation: Efficiently handles routine inquiries, freeing agents to focus on complex tasks.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Platform limitations: Primarily supports Facebook Messenger, Instagram, and WhatsApp, which may limit reach for some agents.

- Learning curve: Despite its ease of use, some advanced features may require time to master.

Pricing

- Free plan: Limited features

- Pro: $15/month

- Premium: $75/month for advanced automation

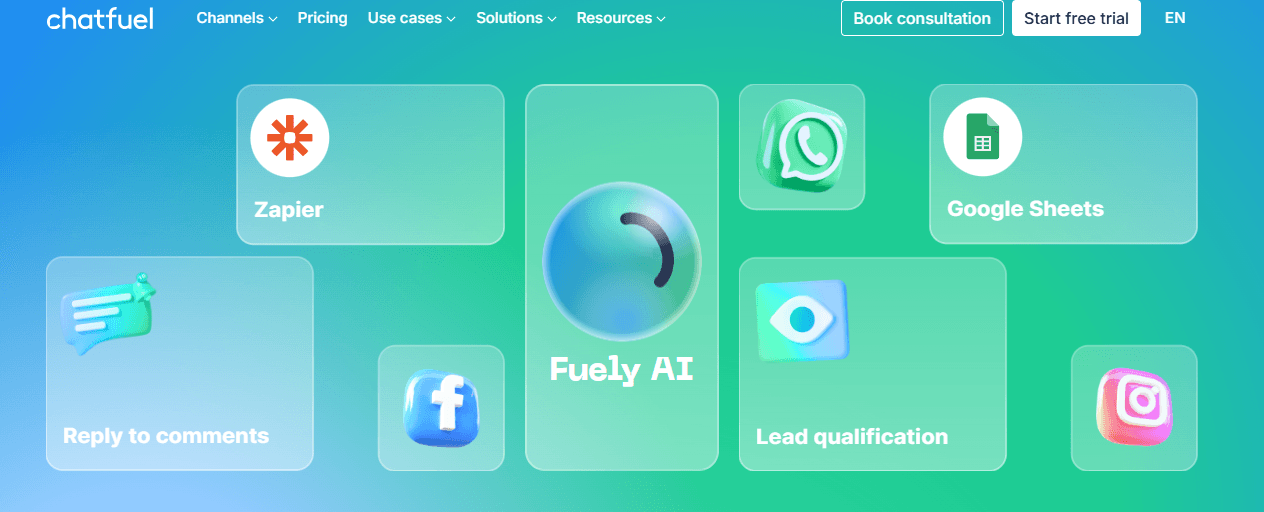

3. Chatfuel

Chatfuel excels in creating AI-driven chatbots for Facebook Messenger. It helps businesses engage customers more effectively and automate numerous tasks, making it ideal for insurance agents.

The platform is particularly beneficial for capturing leads and nurturing client relationships through personalized, automated interactions. Its ability to integrate with various applications makes it a versatile tool for agents aiming to enhance their digital presence.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- Drag-and-drop interface for easy bot creation: No coding skills are needed, making it accessible for all agents.

- Automated lead generation: Chatfuel helps capture and qualify leads automatically, ensuring no potential client is missed.

- Analytics tools for customer interaction insights: Detailed reports provide valuable data on customer behavior and interaction quality.

- Multi-language support: Allows agents to engage with clients in their preferred language.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Ease of creation: Simple drag-and-drop interface allows quick chatbot development.

- Lead generation: Effective tools for capturing and qualifying leads.

- Customization: Highly customizable templates to meet specific needs.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Platform focus: Limited primarily to Facebook Messenger, which may not cover all communication needs.

- Cost: Advanced features can become costly, especially for small agencies.

Pricing

- Starter: $15/month

- Pro: $49/month

- Premium: $99/month (insurance-specific features)

4. Drift

Drift focuses on conversational marketing, connecting businesses with potential customers through real-time, personalized conversations. It is a valuable tool for insurance agents aiming to improve customer interactions.

Drift’s emphasis on real-time engagement makes it ideal for agents who want to provide immediate assistance and build stronger client relationships.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- Lead qualification and meeting scheduling: Drift can qualify leads and schedule meetings, automating critical parts of the sales process.

- Real-time customer engagement: Ensures clients receive immediate responses to their inquiries.

- Integration with CRM and marketing automation systems: Seamlessly integrates with existing systems to provide a holistic view of customer interactions.

- Powerful analytics and reporting tools: Provides in-depth insights into bot performance and customer engagement.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Real-time interaction: Provides immediate responses, enhancing customer satisfaction.

- Lead management: Efficiently qualifies leads and schedules meetings.

- Integration: Works well with CRM and marketing systems, improving workflow.

- Analytics: Detailed reporting helps optimize chatbot performance.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Complexity: May be overwhelming for users without prior experience.

- Cost: Premium features can be expensive for small businesses.

Pricing

- Premium: $400/month

- Enterprise: Custom pricing

- Advanced: $1,500/month for full insurance suite

5. TARS

TARS is known for its simplicity and effectiveness in creating chatbots that handle various tasks, from lead generation to customer support, tailored to the needs of insurance agents.

Its straightforward design and powerful features make it a favorite among agents looking to automate routine tasks and improve client interactions.

Key Features

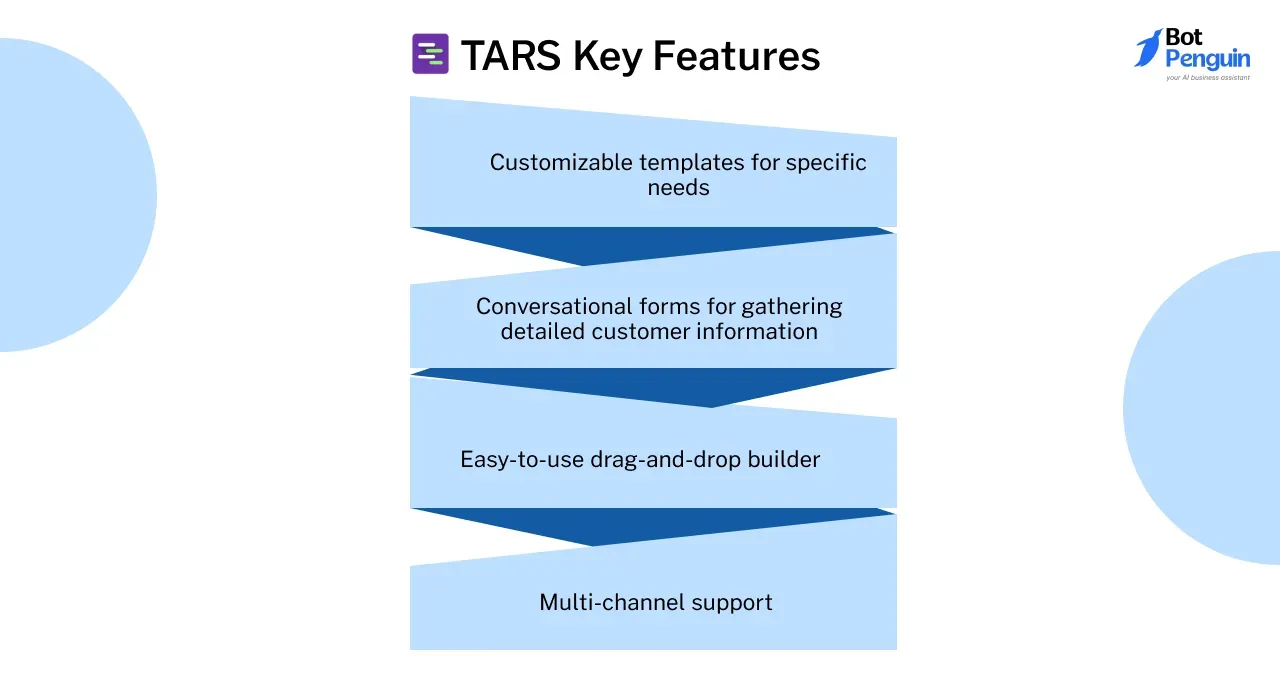

Given below are key features of this chatbot for insurance agents platform:

- Customizable templates for specific needs: Pre-built templates can be easily adapted to fit insurance agents' unique requirements.

- Conversational forms for gathering detailed customer information: Helps in collecting necessary client details seamlessly.

- Easy-to-use drag-and-drop builder: Allows agents to create bots without any technical knowledge.

- Multi-channel support: Ensures clients can interact via web, mobile, and social media.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Ease of use: Simple drag-and-drop builder requires no coding.

- Customization: Pre-built templates can be easily adapted.

- Multi-channel support: Engages clients across various platforms.

- Automation: Streamlines policy quotes and claims processes.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Scalability: May not be suitable for larger agencies with more complex needs.

- Integration: Limited third-party integrations compared to other platforms.

Pricing

- Starter: $99/month

- Professional: $499/month

- Enterprise: Custom pricing

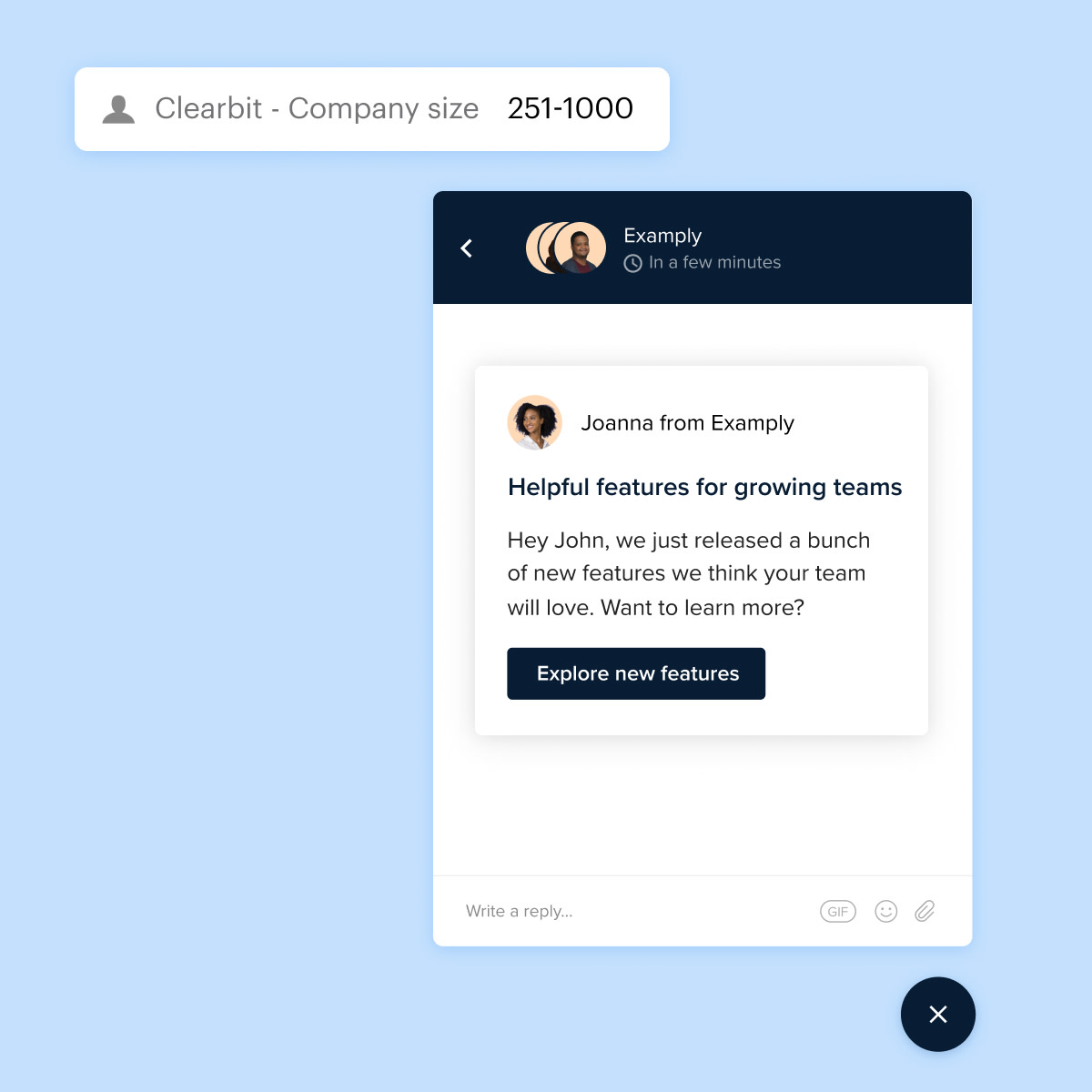

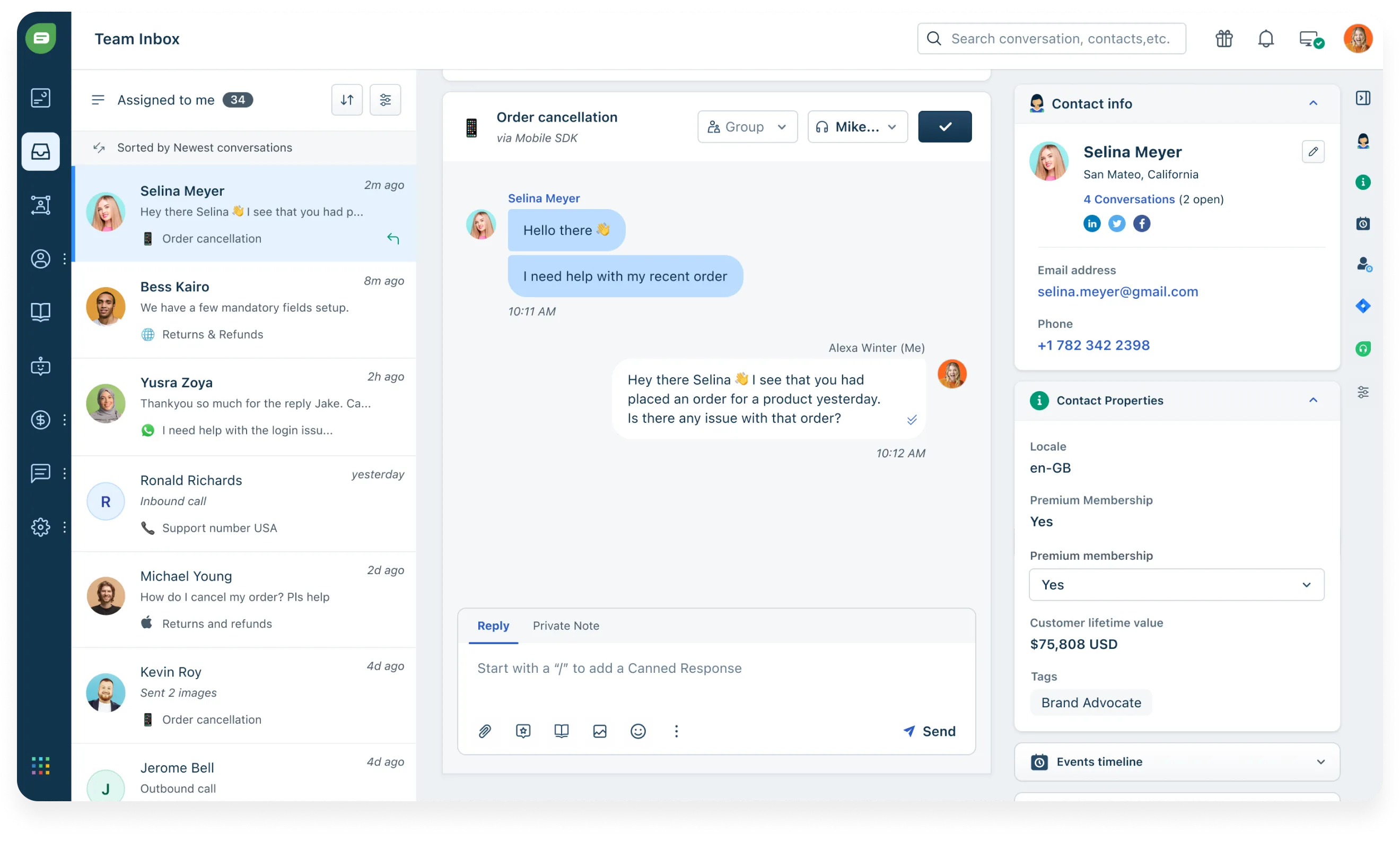

6. Intercom

Intercom is a comprehensive customer messaging platform that includes powerful chatbot capabilities. It helps businesses build better customer relationships through personalized, real-time interactions.

For insurance agents, Intercom’s robust features enable efficient client management and enhanced service delivery.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- Automated responses to common questions: Frees up agents to handle more complex client issues.

- Integration with CRM systems: Ensures all customer interactions are logged and easily accessible.

- Robust analytics and reporting tools: Offers deep insights into chatbot performance and client engagement.

- Multi-channel communication (web, mobile, email): Clients can choose their preferred method of communication.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Integration: Seamless CRM integration enhances data management.

- Personalization: Tailored responses based on customer data.

- Multi-channel support: Engages clients through their preferred channels.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Cost: Higher pricing may be a barrier for smaller agencies.

- Complexity: Advanced features can be challenging to master without technical expertise.

Pricing

- Starter: $74/month

- Pro: $499/month

- Enterprise: Custom pricing (full insurance features)

7. Zendesk

Zendesk is a well-known customer service platform that includes a chatbot component. It provides seamless support across multiple channels, making it a valuable tool for insurance agents.

Zendesk’s robust features and integrations help agents deliver exceptional customer service efficiently.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- Automated responses to common inquiries: Handles routine questions, allowing agents to focus on more critical tasks.

- Integration with CRM systems: Keeps track of all customer interactions for a unified view of client history.

- Powerful analytics tools: Provides detailed insights into customer interactions and bot performance.

- Multi-channel support: Clients can reach out via their preferred communication channels.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Multi-channel support: Engages clients across various platforms.

- Integration: Works well with CRM systems for better data management.

- Customization: Easily adaptable templates for insurance-specific needs.

- Automation: Efficiently handles routine inquiries.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Cost: Advanced features can be expensive for smaller agencies.

- Complexity: May require training to use effectively.

Pricing

- Suite Team: $49/agent/month

- Suite Growth: $79/agent/month

- Enterprise: Custom pricing

8. Freshchat

Freshchat is a modern messaging software that includes AI-powered chatbot capabilities. It engages customers through personalized, real-time conversations, suitable for the insurance sector.

Freshchat’s advanced features help agents manage client interactions more effectively and provide superior service.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- AI-powered chatbots for handling FAQs and lead generation: Automates routine inquiries and captures potential leads.

- Integration with CRM systems: Ensures all customer data is consolidated for easy access.

- Real-time customer engagement: Immediate responses enhance client satisfaction.

- Customizable conversation flows: Tailors interactions based on client needs.

Pros

Here are the pros of this chatbot for insurance agents platform:

- AI capabilities: Enhances interaction quality with intelligent responses.

- Integration: Works seamlessly with CRM systems.

- Customization: Conversation flows can be tailored to specific needs.

- Multi-channel support: Engages clients through their preferred platforms.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Cost: Premium features may be costly for small agencies.

- Complexity: Some advanced features may require technical knowledge.

Pricing

- Free plan available

- Growth: $15/agent/month

- Pro: $39/agent/month

- Enterprise: Custom pricing

9. Elsen

Elsen is a highly effective chatbot platform designed specifically for the financial services industry. It offers tailored solutions to meet the unique needs of insurance agents.

Elsen’s specialized focus ensures that it addresses the specific requirements of the insurance sector, making it a valuable tool for agents.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- Automation of policy information and claims inquiries: Streamlines the process of providing policy details and handling claims.

- Integration with financial and CRM systems: Ensures seamless data flow and access to client information.

- Industry-specific features: Tailored to meet the needs of the financial and insurance sectors.

- Customizable chatbot templates: Easily adaptable to the specific needs of insurance agents.

Pros

Here are the pros of this chatbot for insurance agents platform:

- Industry-specific: Designed specifically for financial services, including insurance.

- Integration: Works well with financial and CRM systems.

- Automation: Efficiently handles policy and claims inquiries.

- Customization: Easily adaptable templates for insurance-specific needs.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Cost: Specialized features may come at a higher price.

- Niche focus: May not be suitable for non-financial industries.

Pricing

- Basic: $29/month

- Professional: $99/month

- Enterprise: Custom pricing for insurance solutions

10. Ada

Ada is an AI-powered chatbot platform designed to help businesses automate customer interactions. It is known for its powerful AI capabilities and user-friendly interface.

Ada’s advanced features make it an excellent choice for insurance agents looking to enhance their customer service.

Key Features

Given below are key features of this chatbot for insurance agents platform:

- AI-powered responses to FAQs and lead generation: Automates common inquiries and captures potential clients.

- Integration with CRM systems: Ensures all client data is easily accessible.

- Robust analytics tools: Provides insights into bot performance and customer interactions.

- Multi-channel support: Clients can engage via their preferred communication methods.

Pros

Here are the pros of this chatbot for insurance agents platform:

- AI capabilities: Provides intelligent, personalized responses.

- Integration: Seamlessly integrates with CRM systems.

- Ease of use: User-friendly interface requires no coding skills.

- Multi-channel support: Engages clients through various platforms.

Cons

Here are the cons of this chatbot for insurance agents platform:

- Cost: Advanced AI features may be costly for smaller agencies.

- Learning curve: Some features may require time to master.

Pricing

- Growth: Starting at $250/month

- Scale: Custom pricing

- Enterprise: Custom pricing for large insurance providers

Conclusion

In conclusion, integrating a chatbot for insurance agents is no longer optional but essential for success in 2024.

As insurance companies strive to improve customer service, reduce operational costs, and increase efficiency, adopting an AI chatbot for insurance becomes a key strategic move.

These AI-powered chatbots for insurance allow agents to manage claims, provide instant quotes, and handle inquiries efficiently, ensuring seamless customer experiences. The automation offered by a chatbot for insurance companies saves time and enhances customer satisfaction.

With the rise of AI, chatbot for insurance agents can personalize interactions, providing tailored solutions based on customer needs. As the insurance industry continues to evolve, the use of AI-powered chatbot for insurance will become even more prevalent, empowering agents to focus on more complex tasks.

Overall, investing in a chatbot for insurance companies is an effective way to stay competitive, streamline processes, and improve client relationships.

Frequently Asked Questions (FAQs)

What are the benefits of using chatbots for insurance agents?

Chatbots streamline customer service, handle routine inquiries, provide instant quotes, and automate claims processes, enhancing efficiency and client satisfaction for insurance agents.

Which chatbot platforms are best for insurance agents in 2023?

Top platforms include ManyChat, TARS, Intercom, Zendesk, Freshchat, and BotPenguin, each offering unique features tailored to the insurance industry's needs.

How do chatbots improve customer service in insurance?

Chatbots offer real-time, 24/7 support, personalized interactions, and quick responses to common inquiries, significantly enhancing customer service quality and satisfaction.

Can chatbots handle complex insurance queries?

Yes, advanced AI-powered chatbots like those integrated with ChatGPT can handle complex queries, providing accurate and detailed responses based on custom data and client history.

Are there affordable chatbot options for small insurance agencies?

Yes, platforms like BotPenguin offer affordable plans, including a free option for up to 2000 messages, making it accessible for small insurance agencies.

How do chatbots integrate with existing insurance systems?

Most chatbot platforms provide seamless integration with CRM and other third-party applications, ensuring all client interactions are logged and accessible, facilitating personalized and efficient service.