Introduction

Chatbot for insurance agents have emerged as game-changing tools for streamlining client interactions and boosting productivity.

According to McKinsey's 2024 Insurance Technology Report, insurance companies implementing AI Chatbot for insurance agents have witnessed a remarkable 45% reduction in response time and a 32% increase in customer satisfaction rates.

Moreover, a recent study by Deloitte reveals that AI-powered chatbots for the insurance sector have helped agents increase their policy conversion rates by 28% while handling 63% of routine client queries automatically.

The integration of chatbot for insurance companies has revolutionized how agents manage their daily operations. Whether it's leveraging AI chatbots for insurance claims processing or utilizing intelligent automation for policy recommendations, these digital assistants are transforming the traditional insurance business model.

This comprehensive guide will explore how chatbot for insurance agents are reshaping the industry, from enhancing customer service to automating routine tasks.

Discover how these AI-powered solutions can help you stay competitive in an increasingly digital insurance marketplace.

What is an AI Chatbot for Insurance Agents?

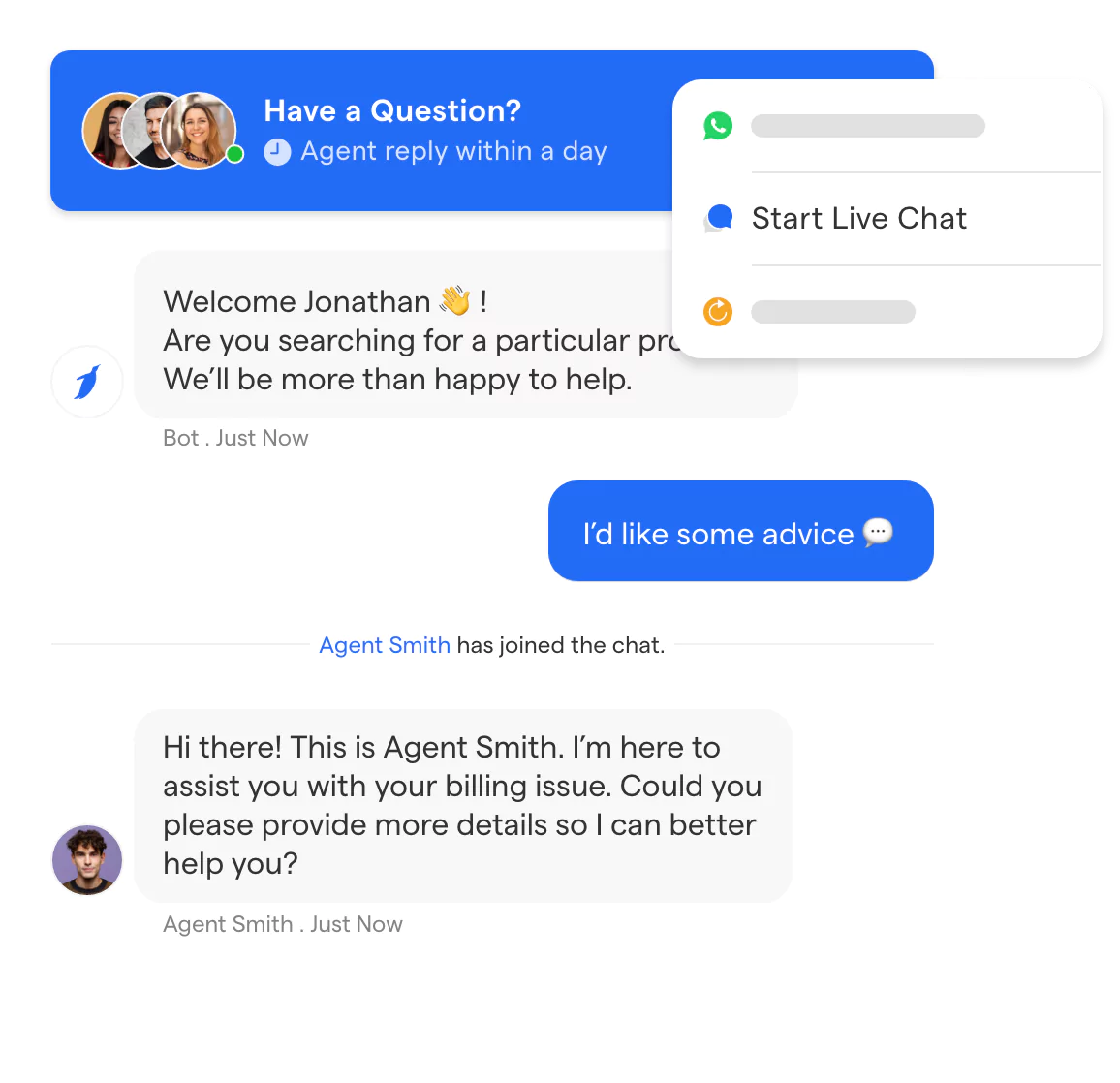

Chatbot for insurance agents is an automated system designed to simulate conversation with human users, especially over the internet.

These chatbots help insurance agents handle routine tasks, offer policy information, and improve customer engagement.

AI-powered chatbot for insurance companies are becoming indispensable for their ability to provide 24/7 support, streamline claims processing, and enhance customer satisfaction.

How AI Chatbot for Insurance Agents Work

Chatbot for insurance agents work by using predefined rules or advanced artificial intelligence. They interact with users via text or voice, understanding queries, and providing appropriate responses.

A chatbot for insurance agents can access customer data and policy information to answer questions accurately. Chatbot for insurance agents can assist in filing claims, updating personal details, and providing quotes, making the customer experience seamless and efficient.

Types of AI Chatbot For Insurance Agents

There are two main types of chatbot for insurance agents: rule-based and AI-based.

- Rule-based Chatbots: These operate on predefined rules and scripts. They follow a set path to answer specific queries. While they are simple and straightforward, they can be limited in handling complex or unexpected questions.

- AI-based Chatbots: These use artificial intelligence and machine learning to understand and respond to user queries. They can handle a broader range of questions and learn from interactions to improve over time.

AI chatbots for insurance can provide personalized recommendations and more sophisticated support, adapting to user needs and preferences.

Benefits of AI Chatbots for Insurance Agents

Implementing a chatbot for insurance agents brings numerous advantages, enhancing both efficiency and customer satisfaction.

Below, we explore the key benefits the Chatbot for insurance agents offer, transforming the way insurance agents work and interact with clients.

Improved Customer Service

A chatbot for insurance agents significantly enhances customer service. The AI powered chatbots for insurance sector provide quick, accurate responses to customer inquiries, reducing wait times.

They can handle multiple queries simultaneously, ensuring every customer gets timely assistance. This efficiency leads to higher customer satisfaction and loyalty.

24/7 Availability

One of the biggest advantages of a chatbot for insurance agents is its ability to provide round-the-clock service. Customers can get help anytime, day or night.

This continuous availability ensures that urgent issues are addressed promptly, without waiting for business hours. For insurance companies, this means fewer missed opportunities and more satisfied customers.

Efficiency and Time Savings

AI powered chatbots for insurance sector streamline various tasks, freeing up time for insurance agents to focus on more complex issues. They can handle routine inquiries, process claims, and provide quotes quickly.

This automation reduces the workload on agents, increasing their productivity. AI-powered chatbots for the insurance sector are especially adept at managing large volumes of interactions efficiently.

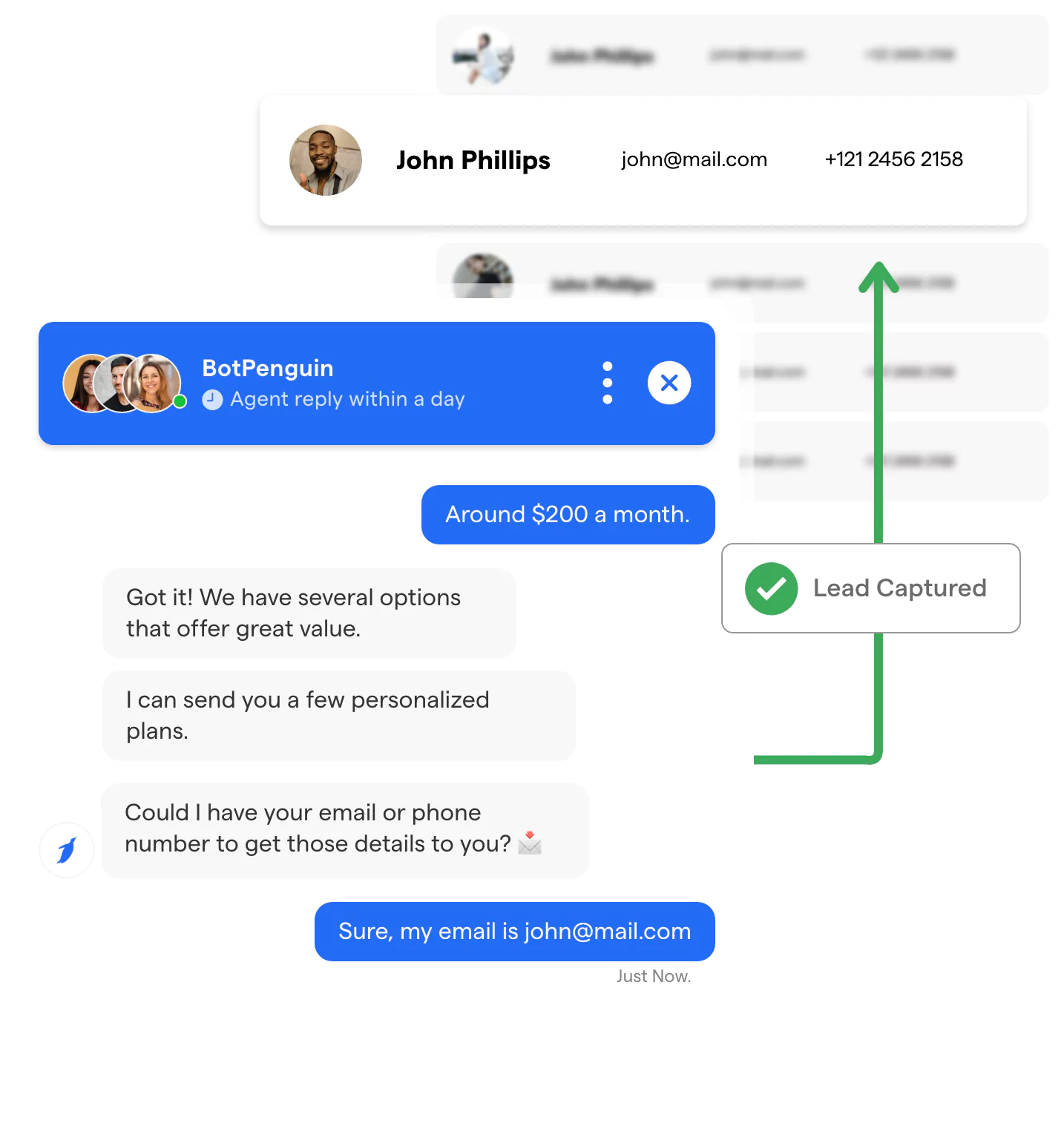

Personalized Customer Interaction

Advanced AI chatbot for insurance agents can offer personalized interactions based on customer data. Chatbot for insurance agents can remember past interactions, preferences, and policy details, providing a tailored experience.

This personalization helps build stronger relationships with customers, making them feel valued and understood.

Common Use Cases for AI Chatbots in Insurance

In the insurance industry, chatbot for insurance agents are becoming indispensable tools for enhancing customer interactions and streamlining operations.

Below, we explore some of the most common use cases for a chatbot for insurance agents, illustrating how these digital assistants can transform everyday tasks.

Answering Frequently Asked Questions

A chatbot for insurance agents can handle a wide range of frequently asked questions. Customers often have queries about policy details, payment options, and coverage terms.

Chatbot for insurance agents provide instant, accurate answers, reducing the need for human intervention. This not only saves time for agents but also ensures customers receive timely information.

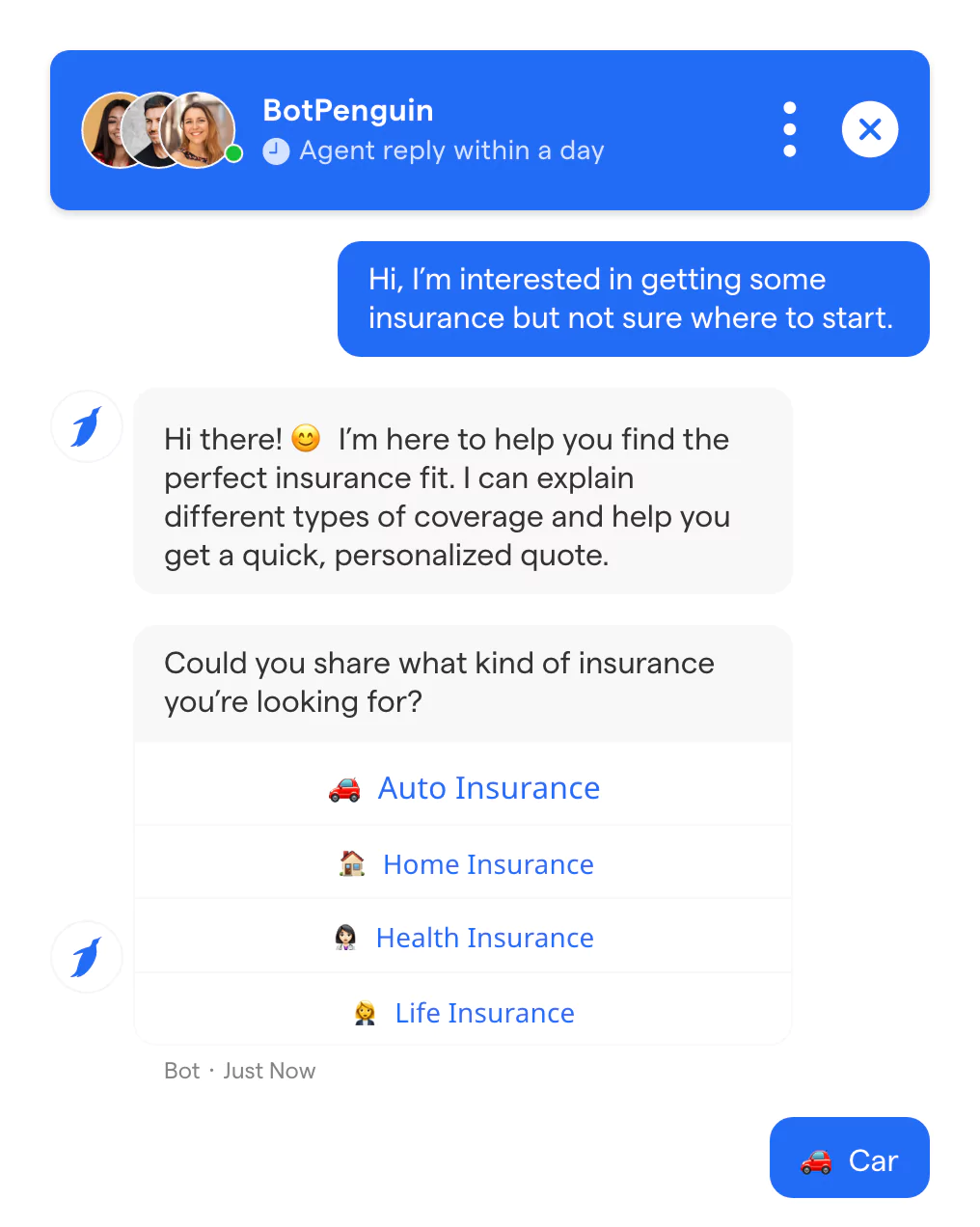

Policy Information and Quotes

Chatbot for insurance agents are highly effective at providing policy information and generating quotes. Customers can interact with the chatbot to get details about different insurance products, coverage options, and pricing.

By using an AI chatbot for insurance agents can offer personalized quotes based on the customer's inputs, making the process quick and efficient.

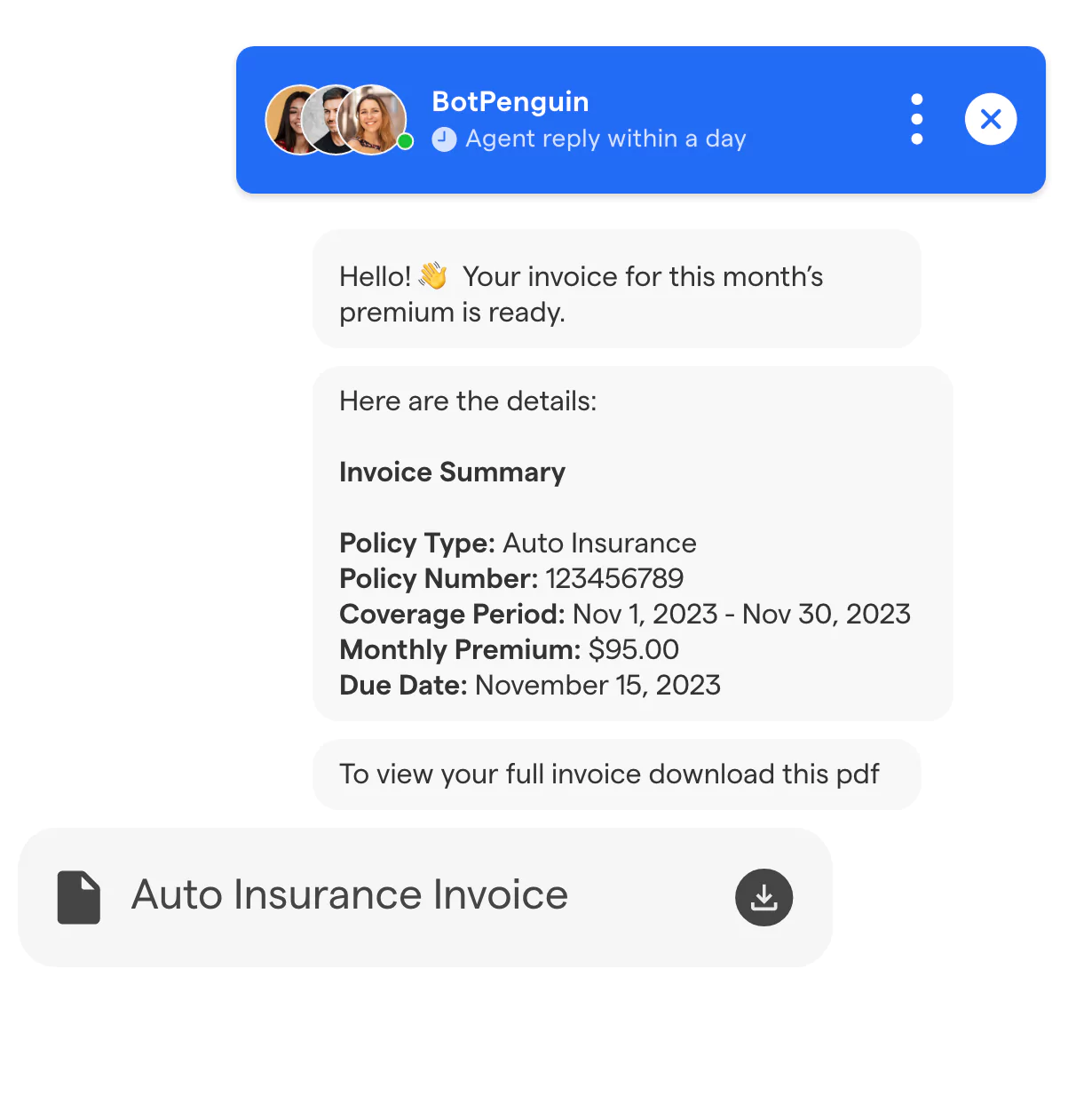

Claim Processing and Status Updates

One of the significant benefits of AI-powered chatbots for the insurance sector is their ability to assist with claim processing.

Chatbots can guide customers through the initial filing steps, collect necessary information, and provide real-time status updates. This streamlines the claims process, making it more efficient and less stressful for both agents and customers.

Appointment Scheduling

Scheduling appointments is another area where chatbots excel. A chatbot for insurance agents can handle the entire scheduling process, from suggesting available times to confirming appointments.

This automation ensures that agents can focus on more critical tasks while customers enjoy a seamless scheduling experience.

How to Implement an AI Chatbot for Insurance Agents in Your Insurance Business

Implementing a chatbot for insurance agents can transform customer interactions and streamline operations.

Using BotPenguin, a no-code platform, makes this process straightforward. Follow these steps to create and deploy an effective chatbot tailored for insurance use cases.

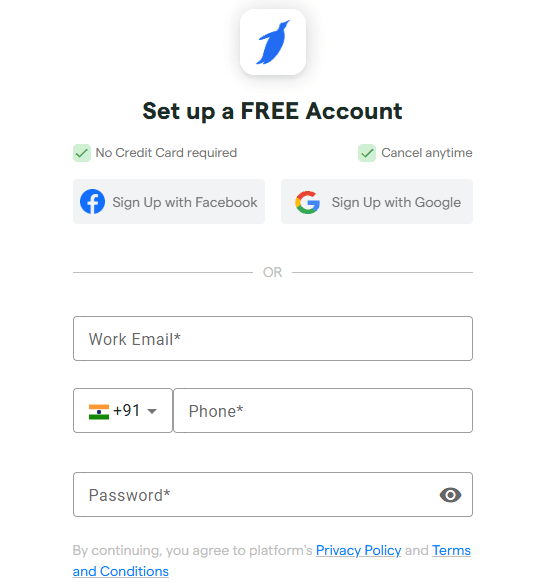

Step 1

Sign up for BotPenguin

Begin by signing up for the BotPenguin chatbot for insurance agents. Visit the BotPenguin website and create an account. This platform simplifies chatbot creation without requiring coding skills.

After signing up, you will gain access to various tools and templates that can assist in building your chatbot for insurance needs. This initial setup is crucial for accessing all the features and integrations BotPenguin offers.

Step 2

Select the Platform

Choose the platform where you want to deploy your chatbot. BotPenguin supports various platforms like websites, mobile apps, WhatsApp, Facebook, and Telegram.

For insurance agents, deploying the chatbot on multiple platforms can enhance customer reach and service accessibility.

Decide which platforms your customers use most frequently and start there. Ensuring your chatbot is available where your customers are most active will maximize its effectiveness and user engagement.

Step 3

Choose Chatbot Type

Before creating your chatbot, decide whether to build a rule-based chatbot or an AI chatbot using ChatGPT integration. Rule-based chatbots follow predefined paths, ideal for simple queries.

An AI chatbot can handle more complex interactions and learn from customer interactions, making it more suitable for dynamic insurance queries.

An AI-powered chatbot can provide more personalized and efficient service by understanding nuanced questions and providing relevant policy information, claims status, and appointment scheduling assistance.

Step 4

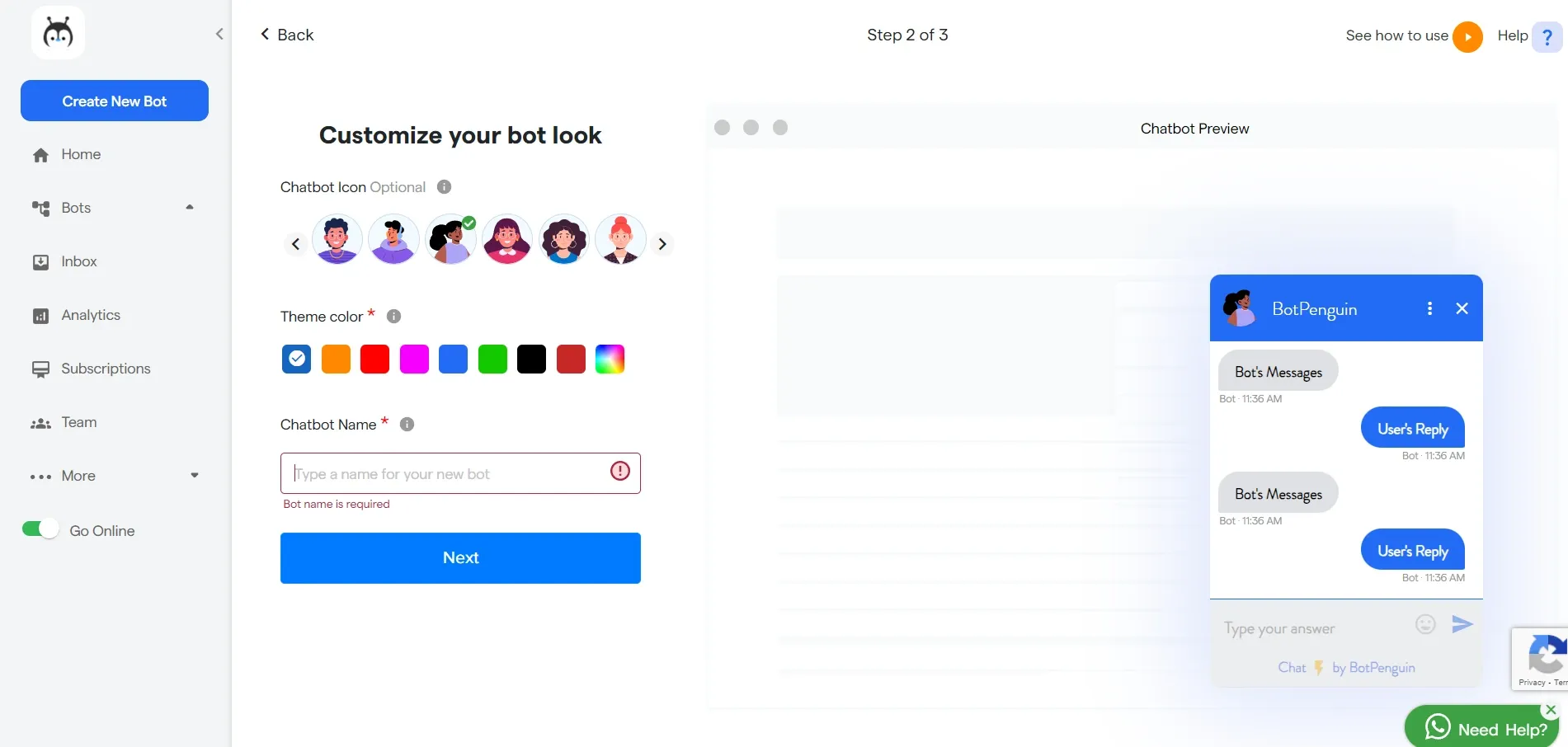

Customize Appearance and Name

Customize your chatbot’s appearance to match your brand. Choose colors, fonts, and a friendly avatar that resonates with your insurance business.

Give your chatbot a name that reflects its purpose, such as “InsuranceHelper” or “PolicyGuide,” making it recognizable and approachable for customers.

Customizing your chatbot helps maintain brand consistency and makes the chatbot more engaging for users.

Step 5

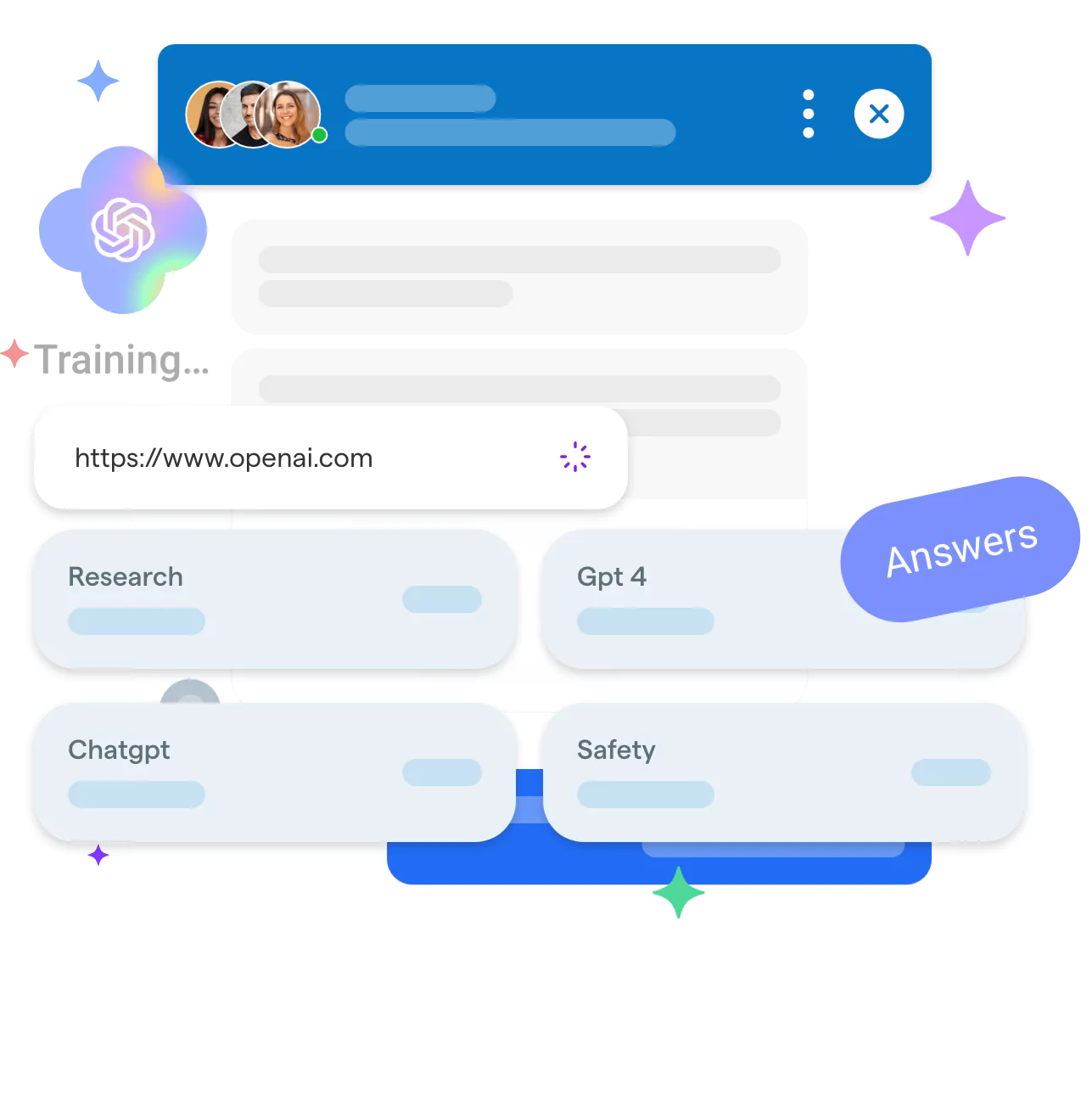

Provide a Database

Equip your chatbot for insurance agents with relevant databases, including policy details, FAQs, and customer information. This ensures the chatbot can provide accurate and timely responses.

A well-fed database enhances the efficiency of your chatbot for insurance agents, enabling it to handle queries about policies, claims, and more.

Regularly updating the database with the latest information ensures that your chatbot remains reliable and useful. Connecting your chatbot for insurance agents to your existing CRM or database systems can streamline this process.

Step 6

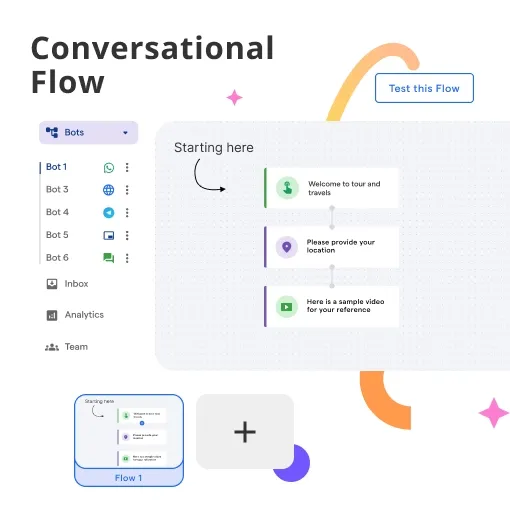

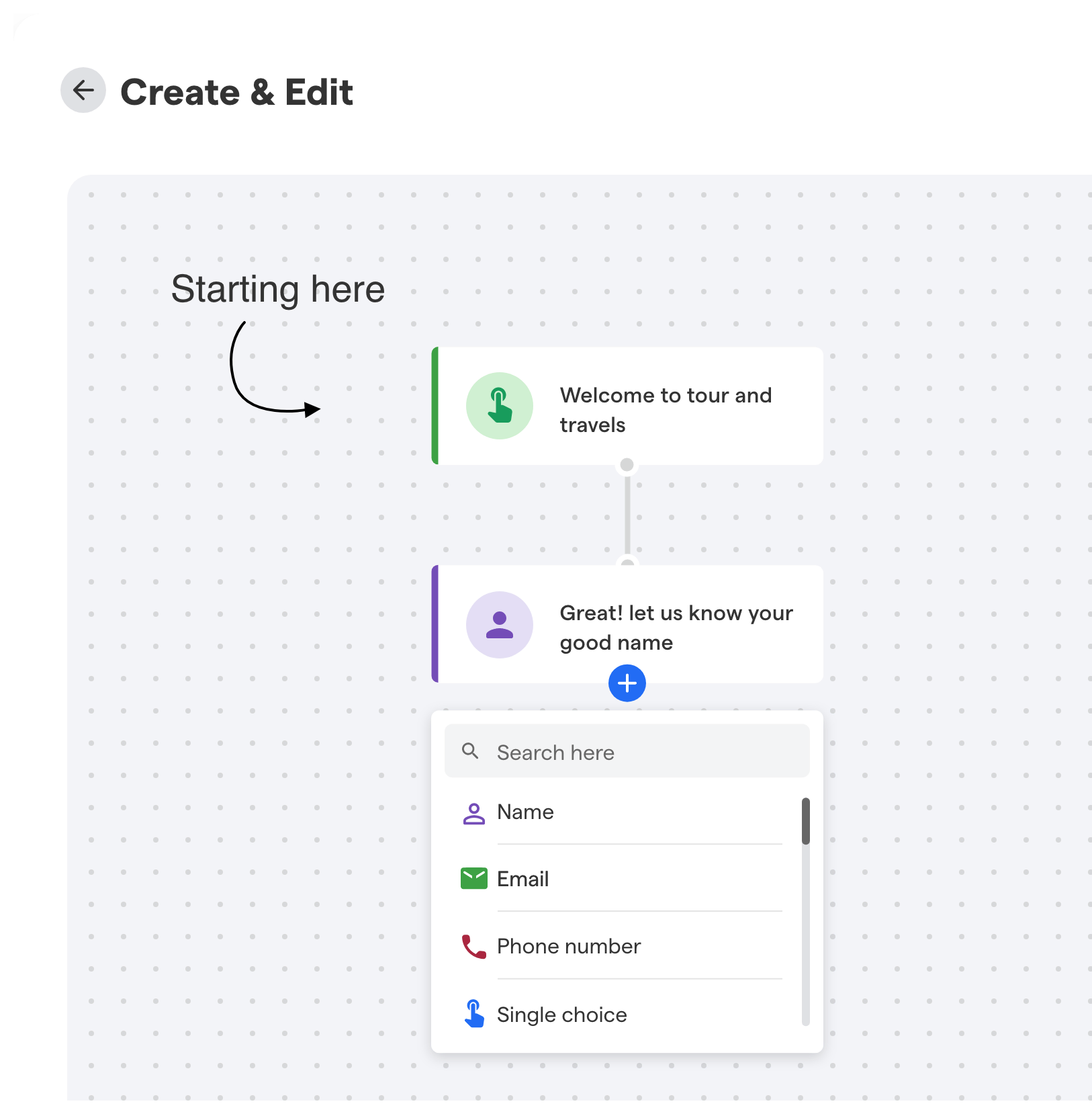

Create Conversational Flow

Design the conversation flow for your chatbot. Map out common customer interactions, such as policy inquiries, claim status updates, and appointment scheduling.

Use BotPenguin’s intuitive interface to create a seamless flow that guides users through these processes, enhancing their experience and satisfaction.

Consider potential customer queries and design logical, clear responses. This planning ensures that users can navigate the chatbot easily and get the information they need without frustration.

Step 7

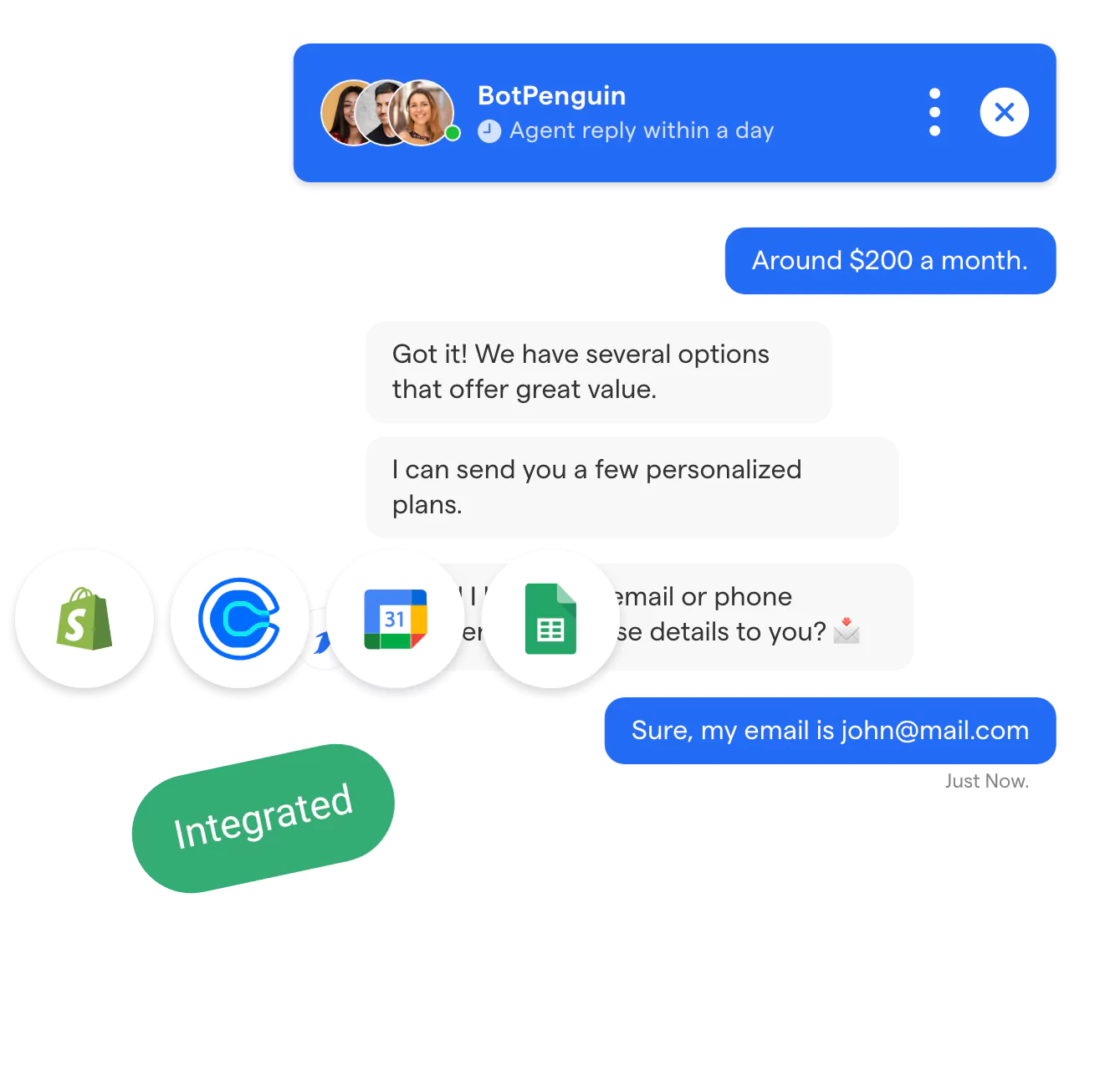

Choose Integrations

Select from BotPenguin’s 60+ native integrations to enhance your chatbot’s functionality. Integrations with CRM systems, automation tools, and customer support platforms are particularly useful for insurance companies.

These integrations ensure your chatbot can access and update information in real-time, improving operational efficiency. For instance, integrating with a CRM system allows the chatbot to pull customer details and update records as interactions occur.

Step 8

Install Your Chatbot for Insurance Agents

Deploy your chatbot for insurance agents on your chosen platform. BotPenguin supports various CMS options like WordPress, Wix, WooCommerce, Shopify, and Squarespace.

You can also embed the chatbot on custom websites or landing pages. For mobile apps, follow BotPenguin’s simple installation guidelines to ensure seamless integration.

Ensuring your chatbot is easily accessible on your primary customer touchpoints will maximize its usage and effectiveness.

Step 9

Test and Refine

Now your chatbot for insurance agents is ready for use. Conduct thorough testing to ensure it functions as expected. Simulate various customer interactions to identify any issues or areas for improvement.

Regularly refine your chatbot based on customer feedback and performance metrics to ensure it continues to meet user needs effectively.

Testing should cover different scenarios, including common queries, complex questions, and error handling.

Best Practices for AI Chatbot for Insurance Agents

Designing an effective chatbot for insurance agents requires attention to several best practices.

These guidelines ensure the chatbot provides value to both the agents and their customers. Here are some essential best practices to consider.

Keep it Simple

Simplicity is key in chatbot design. A chatbot for insurance should be straightforward, with easy-to-understand language and concise responses.

Avoid complex jargon and keep the interactions as simple as possible. This ensures users can quickly get the information they need without confusion.

Ensure Easy Navigation

Navigation should be intuitive. Users should easily move through different options and find what they need.

For a chatbot for insurance agents, include clear menus and quick replies that guide users through the process. This helps in reducing the time spent searching for information and enhances the overall user experience.

Provide Clear Instructions

Always provide clear instructions. Let users know what kind of information the chatbot can provide and how to interact with it.

For example, when users start a conversation with an AI chatbot for insurance, the initial greeting should outline the available options and how to proceed. This sets the right expectations and helps users navigate the chatbot more effectively.

Regular Updates and Improvements

Regularly updating and improving your chatbot for insurance agents is crucial. The needs of users and the information provided can change over time.

Continuously monitor the chatbot's performance and gather user feedback. This will help you identify areas for improvement and ensure the chatbot remains useful and relevant.

For insurance companies, this might involve updating policy information or refining the claims process.

Challenges and Solutions of AI Chatbots For Insurance Agents

Implementing a chatbot for insurance agents presents various challenges, but with effective solutions, these hurdles can be successfully navigated.

Here are the common challenges and their solutions.

Handling Complex Queries

- Challenge: Handling complex queries that require detailed, nuanced answers can be difficult for AI chatbots for insurance.

- Solution: Ensure your chatbot for insurance agents can seamlessly escalate complex issues to a human agent. This hybrid approach guarantees customers receive accurate answers while keeping the interaction efficient.

Maintaining Data Privacy

- Challenge: Data privacy is critical in the insurance sector, and chatbots for insurance companies must handle sensitive information securely.

- Solution: Implement robust encryption protocols and comply with data protection regulations. Regular audits and updates help maintain the highest standards of data privacy, ensuring customer trust and compliance with legal requirements.

Ensuring Human Touch

- Challenge: AI-powered chatbots for the insurance sector can sometimes feel impersonal, which can affect customer satisfaction.

- Solution: Design your chatbot’s responses to be friendly and empathetic. Use personalization features, such as addressing customers by name and recalling past interactions, to enhance the user experience.

Measuring Success

- Challenge: Measuring the success of your chatbot for insurance agents is vital for continuous improvement but can be difficult without proper metrics.

- Solution: Track key performance indicators (KPIs) such as response time, resolution rate, and customer satisfaction scores. Regularly review these metrics to identify areas for improvement and ensure that the chatbot meets business goals.

Industry-Specific Use cases of AI Chatbot for Insurance Agents

Implementing a chatbot for insurance agents can greatly enhance efficiency and customer service across various types of insurance.

Below are industry-specific uses of chatbot for insurance agents that illustrate their versatility and effectiveness.

Health Insurance

Insurance chatbots streamline health insurance processes by assisting customers with policy comparisons, claim submissions, and answering coverage-related questions in real-time.

- Managing Policy Details: A chatbot for insurance agents can help customers easily access and manage their health insurance policy details. Users can check coverage, update personal information, and review policy benefits.

- Scheduling Doctor Appointments: Chatbots can assist in scheduling doctor appointments. They can integrate with medical systems to find available slots and book appointments, making the process seamless for users.

- Providing Health Tips and Reminders: AI chatbots for insurance can offer personalized health tips and reminders, such as medication alerts or wellness advice, enhancing customer engagement and promoting healthier lifestyles.

Auto Insurance

Chatbots in the auto insurance industry simplify tasks like instant policy quotes, accident reporting, and guiding customers through claims processing with 24/7 support.

- Reporting Accidents: Chatbots can guide users through the process of reporting accidents. They can collect necessary information, provide instructions on what to do immediately after an accident, and ensure accurate reporting.

- Processing Claims: Chatbots for insurance companies streamline the claims process by collecting details, verifying information, and updating users on the status of their claims, making the process faster and more efficient.

- Offering Safety Tips: AI-powered chatbots for the insurance sector can provide safety tips to drivers, such as advice on safe driving practices and vehicle maintenance reminders, helping to reduce the risk of accidents.

Home Insurance

Home insurance chatbots provide instant assistance for property coverage queries, claim tracking, and personalized policy recommendations based on user needs.

- Assisting with Policy Renewals: Chatbots can remind customers about policy renewals and assist in the renewal process, ensuring that coverage does not lapse and that the process is hassle-free.

- Managing Claims for Damages: When damages occur, chatbots can help users file claims quickly by guiding them through the necessary steps and ensuring that all required information is collected accurately.

- Offering Home Safety Advice: Chatbots can provide home safety advice, such as tips for preventing fires or securing the home against theft, helping customers protect their property and reduce the likelihood of claims.

Real-Life Examples of AI Chatbot for Insurance Agents

The use of chatbots for insurance agents has been increasingly adopted by leading insurance companies to improve efficiency and customer service.

Here are real-life examples of how major insurance companies are utilizing chatbot for insurance agents.

Allstate Business Insurance

Allstate has implemented an AI chatbot for insurance that helps small business owners manage their policies. The chatbot assists with common queries, policy updates, and claims processing.

By providing instant support, chatbot for insurance agents reduces the need for direct interaction with agents, freeing up their time for more complex issues.

GEICO

GEICO's virtual assistant, Kate, is a prominent chatbot for insurance companies. Kate helps customers with a wide range of services, from providing quotes to answering policy-related questions.

This AI-powered chatbot for the insurance sector enhances customer service by offering quick and accurate responses, thus improving customer satisfaction and operational efficiency.

Liberty Mutual Fund

Liberty Mutual’s chatbot, "LUCI," is designed to assist customers with claims processing and policy management. LUCI can handle initial claim filings, provide updates on claim status, and answer frequently asked questions.

This chatbot for insurance agents helps streamline processes and ensures customers receive timely support.

Conclusion

With this all-encompassing guide, the end clearly shows that chatbot for insurance agents are no longer a nicety but a necessity.

Whether it's some simple chatbot for an insurance company or an advanced AI-powered chatbot for insurance companies, the secret lies in aligning solutions to meet their specific needs and customer expectations. Artificial intelligence and automation are undoubtedly the future of insurance, unmistakably so.

Remember, when chatbot for insurance agents are implemented well, it is not about technology, but rather delivering seamless personalized experiences that increase agent productivity and client satisfaction.

So, embracing AI-powered chatbots in insurance sector actually means you get to modernize and to a certain extent future-proof your insurance practice.

Step today into the intelligent automation-enabled insurance business of tomorrow. It will be the agents who embrace and leverage these technological developments who will thrive in tomorrow's marketplace.

Frequently Asked Questions (FAQs)

What are the main benefits of using chatbots for insurance agents?

Chatbots improve customer service, offer 24/7 support, streamline routine tasks, and enhance operational efficiency, allowing insurance agents to focus on more complex issues and provide personalized service.

How do AI powered chatbots for insurance sector handle complex insurance queries?

For complex queries, chatbots escalate the issue to a human agent, ensuring accurate and detailed responses while maintaining efficiency in handling simpler tasks.

Are AI powered chatbots for insurance sector secure for handling sensitive insurance information?

Yes, chatbot for insurance agents employ robust encryption protocols and comply with data protection regulations to ensure sensitive insurance information is handled securely and confidentially.

Can AI powered chatbots for insurance sector be integrated with existing insurance systems?

Yes, chatbot for insurance agents can be integrated with CRM, policy management, and claims processing systems to provide real-time data access and seamless operations.

How do chatbot for insurance agents improve customer service in the insurance sector?

Chatbot for insurance agents provide instant, accurate responses to customer inquiries, reduce wait times, and offer 24/7 support, significantly enhancing customer satisfaction and loyalty.

What are some real-life examples of chatbots used by insurance companies?

Allstate, GEICO, and Liberty Mutual use chatbot for insurance agents for policy management, claims processing, and customer support, demonstrating the practical benefits and effectiveness of this technology.