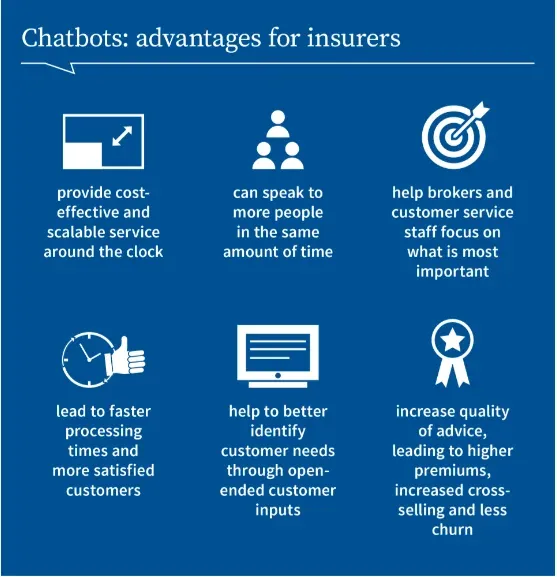

Insurance companies increasingly adopt AI-powered chatbots to improve customer experience and streamline operations. According to Juniper Research, using chatbots to simplify insurance claims will generate over $142 million in global cost savings by 2023. Chatbots automate repetitive administrative tasks, enable 24/7 self-service, and personalize engagement.

Recent stats by Accenture show that chatbots improve insurance customer satisfaction by over 10 percentage points. They can handle 200 policy-related questions in the time a human agent takes to handle just one, dramatically improving response times. Over 75% of customers prefer chatbot assistance for basic queries, according to Salesforce research.

By developing intelligent chatbots customized for key insurance workflows, insurers can automate lead generation, underwriting, policy management, and claims assistance.

Key benefits include faster query resolution, improved CSAT scores and Net Promoter Scores, higher agent productivity, and increased cost efficiency.

The right chatbot strategy can truly transform legacy insurance businesses into agile, digital-first insurers!

In this article, you will understand the challenges of the insurance business and how custom AI chatbots can help solve those issues.

Understanding the Challenges in the Insurance Business

Navigating through the complexities of insurance policies can be overwhelming for customers.

Complex Customer Queries and Interactions

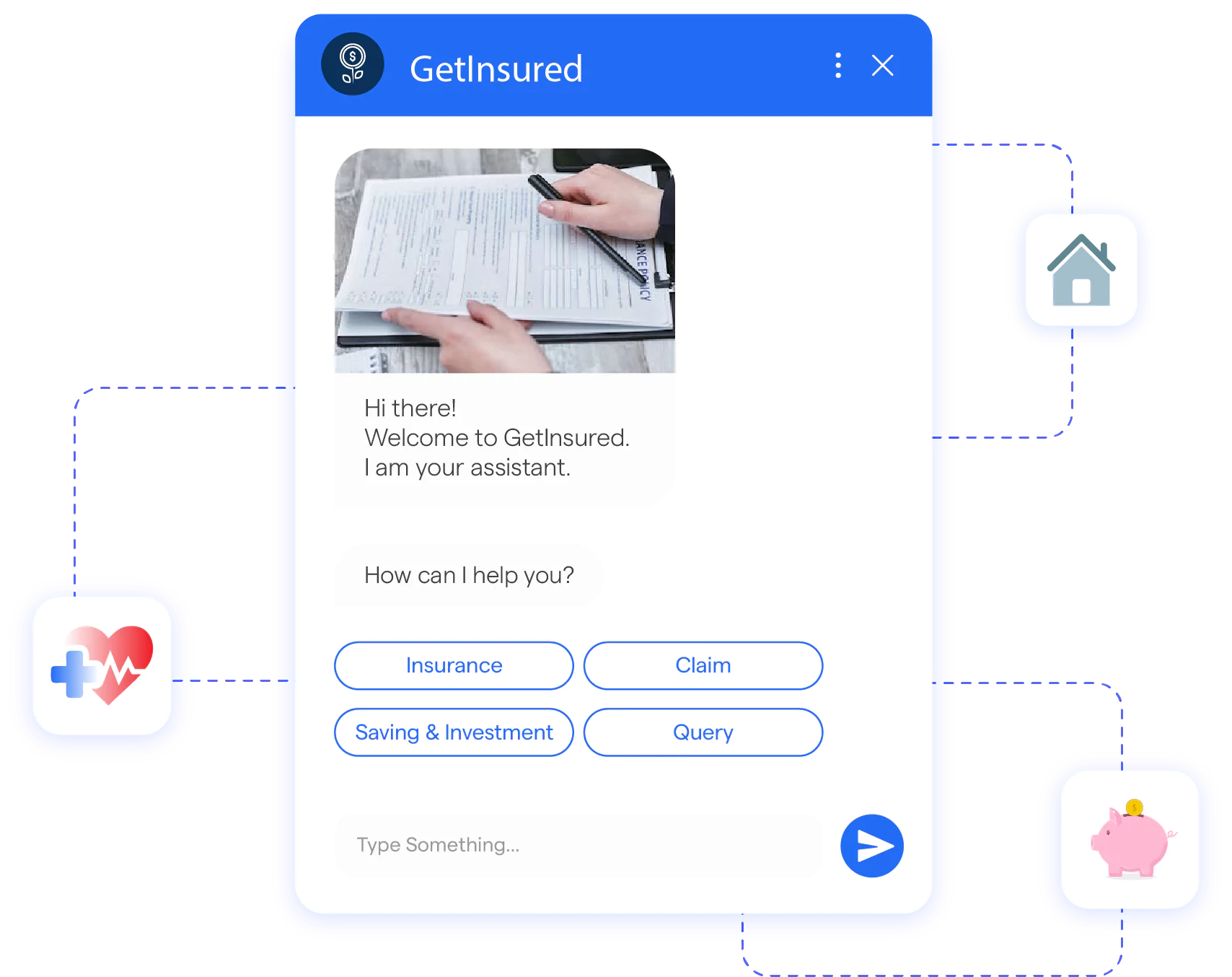

Custom AI chatbots for insurance can address diverse customer needs by providing accurate and instant responses to their queries. These chatbots are equipped with advanced natural language processing capabilities that help understand customer requirements.

Addressing Diverse Customer Needs

Custom AI chatbots for insurance can handle a wide range of customer queries, including coverage details, claim processes, and policy explanations. With their ability to quickly retrieve and present relevant information, custom AI chatbots for insurance ensure customers receive comprehensive answers tailored to their specific needs.

Handling Policy Inquiries and Explanations

Insurance policies often involve complex terms and conditions. AI chatbots can simplify policy inquiries by providing easy-to-understand explanations. Through interactive conversations, chatbots can guide customers through policy details, ensuring they have a clear understanding of their coverage.

Streamlining Customer Service and Support

Insurance companies face the challenge of delivering prompt and efficient customer service. AI chatbots can significantly reduce response time, enhance efficiency, and improve overall customer experience.

How Custom AI Chatbots Can Transform the Insurance Business?

Providing impeccable customer service is vital in the insurance industry.

Enhancing Customer Interaction and Support

Custom AI chatbots have the power to revolutionize customer interaction and support.

- Instant and Accurate Response to Customer Queries

Gone are the days of waiting on hold for customer support. With custom AI chatbots, customers receive instant and accurate responses to their queries. These chatbots are equipped with advanced natural language processing algorithms that enable them to understand customer inquiries and provide relevant answers promptly.

- Availability 24/7 for Personalized Assistance

Custom AI chatbots for insurance are available round the clock, always ready to assist customers. Customers appreciate the convenience of reaching out for support at any time. These chatbots can offer personalized assistance based on each customer's unique needs, ensuring a delightful and engaging experience.

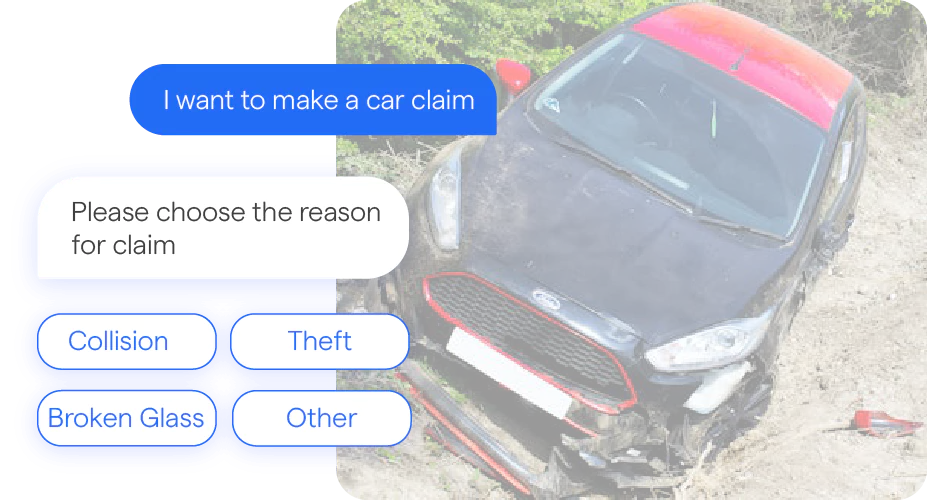

Providing Seamless Claims Processing

Claim processing is a crucial aspect of the insurance business. Custom AI chatbots can streamline and simplify this process, improving efficiency for both customers and insurers.

- Streamlining Claim Submissions and Documentation

Custom AI chatbots for insurance can guide customers through the entire claim submission process. They can gather the necessary information, assist with uploading required documents, and ensure all relevant details are captured accurately. This eliminates the need for lengthy and complicated paperwork, making the claims process more user-friendly.

- Automating Claim Status Updates and Settlements

Custom AI chatbots for insurance can automate claim status updates for customers. They can provide real-time information on the progress of claims, giving customers peace of mind and reducing the need for manual follow-ups. Furthermore, chatbots can facilitate the settlement process by calculating and processing payouts efficiently.

Improving Sales and Lead Generation

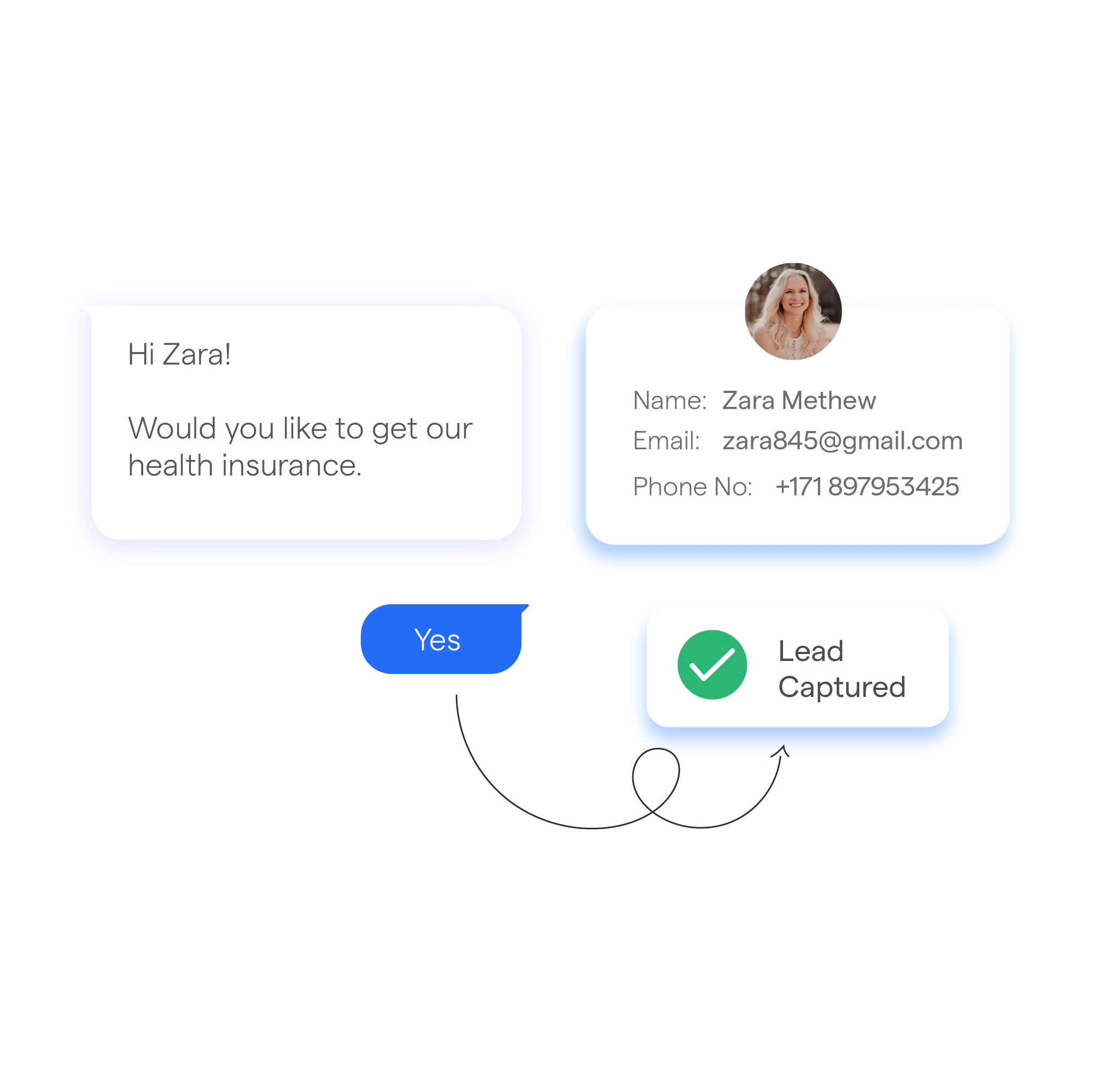

Custom AI chatbots can act as proactive sales assistants, nurturing potential leads and increasing conversion rates.

- Proactive Lead Nurturing and Engagement

AI chatbots can engage with website visitors and social media users, providing product information, answering queries, and collecting customer data. By proactively engaging with leads, chatbots can nurture them through the sales funnel, boosting the chances of conversion. This personalized and interactive approach creates a positive impression of the insurer.

- Tailored Product Recommendations and Cross-selling Opportunities

With access to customer data and insights, AI chatbots can make tailored product recommendations based on individual needs. By analyzing customer preferences, chatbots can identify upselling and cross-selling opportunities, resulting in increased sales.

These personalized recommendations create a sense of trust and convince customers of the value of additional coverage.

Suggested Reading:

How can insurance agents use Facebook Chabot for more leads?

Implementing Custom AI Chatbots in Insurance Companies

Implementing custom AI chatbots requires thorough planning and careful consideration of specific business requirements.

Identifying Key Use Cases and Scenarios

To maximize the impact of AI chatbots, insurance companies need to identify key use cases and scenarios where chatbots can provide the most value. This involves assessing customer pain points and needs, understanding common inquiries and challenges, and identifying opportunities for improvement.

- Assessing Customer Pain Points and Needs

Analyzing customer feedback, conducting surveys, and studying common customer inquiries can help identify pain points and areas in which chatbots can provide significant support. Understanding customer needs is crucial to designing chatbots that can effectively meet their expectations.

- Understanding Specific Business Goals and Objectives

Insurance companies must align the implementation of chatbots with their specific business goals. Whether it's improving customer satisfaction, increasing sales, or streamlining operations, defining clear objectives ensures that the chatbot solution is tailored to meet those goals.

Choosing the Right AI Chatbot Solution

Selecting the right AI chatbot solution is crucial to ensure successful implementation and integration into existing systems.

- Evaluating Available Chatbot Platforms and Providers

There are numerous chatbot platforms and providers on the market, each offering different features and capabilities. Insurance companies should evaluate these options based on their specific requirements and choose a solution that aligns with their needs and budget.

- Customization Options and Integration with Existing Systems

Customizability and integration capabilities are important factors to consider when selecting an AI chatbot solution. The chatbot should be customizable to reflect the company's brand and voice. Additionally, seamless integration with existing systems and databases ensures efficient data exchange and improved overall operations.

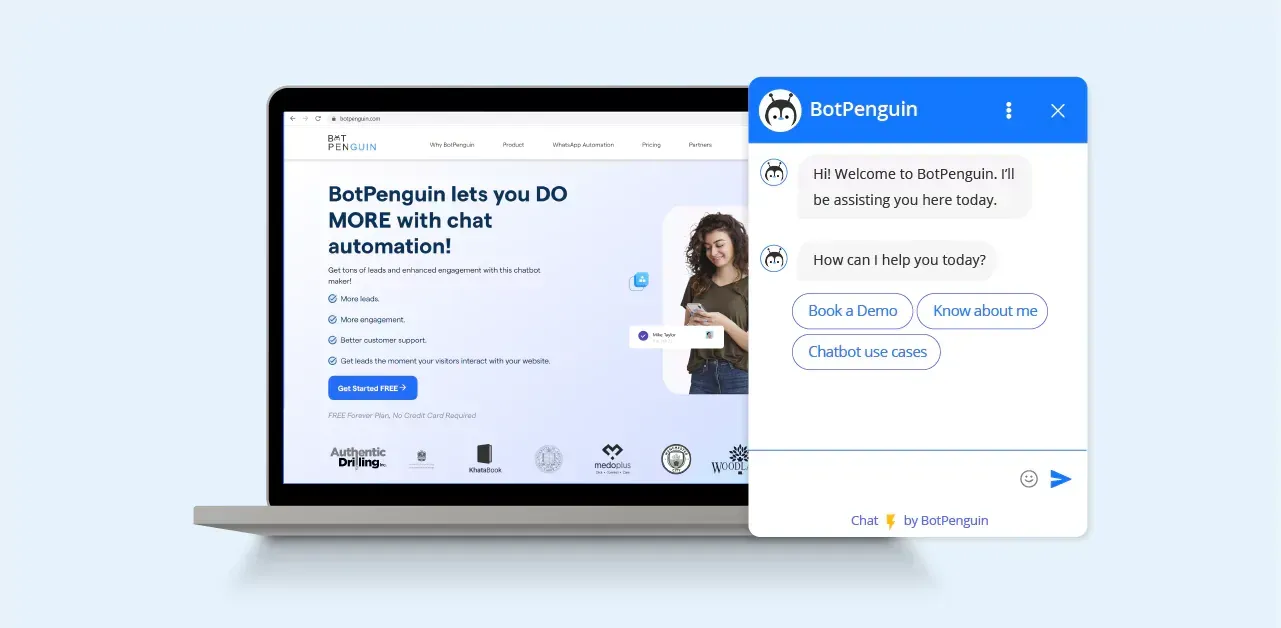

And, if you want to begin with chatbots but have no clue where to start from, then check out the NO-CODE chatbot platform, named BotPenguin.

With all the heavy work of chatbot development already done for you, effortlessly manage applications, promote policies, and process claims with BotPenguin's AI Chatbot for Insurance, powered by generative AI.

And that's not it! BotPenguin makes sure that you reach your customers where they are by offering chatbots for multiple platforms, thus making omnichannel support look easy:

- WhatsApp Chatbot

- Facebook Chatbot

- WordPress Chatbot

- Telegram Chatbot

- Website Chatbot

- Squarespace Chatbot

- woocommerce Chatbot

- Instagram Chatbot

Designing and Training the Chatbot

Designing and training the chatbot involves defining conversational flows and dialogues and training the AI model with relevant insurance data.

- Defining Conversational Flows and Dialogues

Insurance companies need to plan the conversational flow of their chatbots to ensure a seamless user experience. Designing dialogues that anticipate and address various customer scenarios ensures that the chatbot can effectively handle a wide range of inquiries and interactions.

- Training the AI Model with Relevant Insurance Data

The AI model behind the chatbot needs to be trained with accurate and up-to-date insurance data. This ensures that the chatbot can provide accurate answers and recommendations. Ongoing training and updates are essential to maintaining the chatbot's performance and relevance as insurance policies and regulations evolve.

Suggested Reading:

Why BotPenguin is the best Custom Chatbot Development provider

Overcoming Challenges and Ensuring Success

One common concern with AI technology is data privacy and security.

Ensuring data privacy and security

Insurance companies need to prioritize the protection of customer information when implementing custom AI chatbots. By adopting robust security measures, including encryption and access controls, insurers can assure customers that their data is safe and secure.

Continuous Monitoring and Improvement

AI chatbots require continuous monitoring and improvement to deliver the best possible experience. Insurers must regularly analyze chatbot performance and gather feedback from both customers and employees. This feedback is invaluable in identifying areas for improvement and refining the chatbot's capabilities over time.

Gathering Customer Feedback for Enhancement

Listening to customer feedback is key to enhancing the AI chatbot experience. Insurers should actively encourage customers to provide feedback on their interactions with the chatbot. This feedback can uncover pain points, identify areas for improvement, and inform future updates and enhancements.

Conclusion

Insurance companies have a massive opportunity to evolve through AI-powered conversational interfaces. Custom chatbots can resolve customer queries instantly, simplify processes, and reduce costs enterprise-wide. By leveraging bots, insurers can boost CSAT scores, increase user retention, and build competitive advantage.

With deep insurance domain expertise and advanced conversational AI capabilities, BotPenguin is at the forefront of driving this transformation. Our intelligent bots handle thousands of unique user queries and scenarios.

By integrating seamlessly with insurers' existing systems, our chatbots augment human agents and underwriters. Policyholders enjoy quick, 24/7 support. Documentation is automated and overall efficiency improves dramatically.

As processes become more streamlined, insurers can focus on value-added services that improve engagement. The possibilities with custom insurance chatbots are immense.

BotPenguin is committed to continued innovation in insurance conversational AI and emerging technologies. Together with forward-thinking clients, we will shape the future of how policies are sold, serviced, and claimed.

The next era of insurance is conversational!

Suggested Reading:

How to Generate Insurance Leads: Everything you want to know!

Frequently Asked Questions (FAQs)

What benefits can custom AI chatbots bring to the insurance industry?

Custom AI chatbots can improve customer service, streamline claims processing, provide instant answers to FAQs, offer personalized policy recommendations, and enhance overall efficiency and customer satisfaction.

How can AI chatbots help in automating insurance claims processing?

Custom AI chatbots for insurance can automate various steps in the claims process, such as collecting information, validating claims, and providing updates on claim status, resulting in faster and more accurate claim settlements.

Can custom AI chatbots for insurance provide personalized insurance policy recommendations?

Yes, by leveraging AI algorithms, chatbots can analyze user data, preferences, and risk profiles to suggest personalized insurance policy options that meet the specific needs of customers.

How do custom AI chatbots for insurance improve customer experience in the insurance industry?

Custom AI chatbots for insurance offer 24/7 availability, instant responses to customer queries, guided assistance in policy selection, proactive reminders for premium payments, and efficient handling of policy renewals and endorsements.

Are AI chatbots capable of handling complex insurance queries and calculations?

Yes, custom AI chatbots for insurance can be trained with advanced machine learning algorithms to handle complex insurance queries, perform calculations, and provide accurate information regarding coverage, premiums, and policy details.

What security measures are in place to protect sensitive customer information with custom AI chatbots for insurance?

Custom AI chatbots for insurance implement strong data encryption, secure communication protocols, compliance with data protection regulations, and strict access controls to ensure the confidentiality and security of customer information.