Introduction

The insurance industry has undergone a significant transformation in recent years, with the integration of cutting-edge technologies like chatbots becoming increasingly prevalent. According to a 2023 report by Allied Market Research, the global chatbot market for the insurance sector is expected to grow at a CAGR of 25.4% from 2023 to 2028, reaching a value of $871.8 million by 2028. This surge in adoption can be attributed to the numerous benefits that AI-powered chatbots provide for insurance companies and their agents.

Chatbot for insurance agents and companies have revolutionized the way customers interact with their insurers, offering 24/7 support, streamlining claims processing, and enhancing overall customer satisfaction. AI chatbots for the insurance sector can handle a wide range of tasks, from answering frequently asked questions to guiding customers through the policy selection process.

These AI-powered chatbot for insurance have become an indispensable tool for insurance agencies, enabling them to provide superior service and stay competitive in the rapidly evolving market.As the insurance industry continues to embrace innovative technologies, the implementation of AI chatbots has emerged as a strategic imperative for forward-thinking organizations seeking to enhance their customer experience and operational efficiency.

Key Features of a Good Insurance Chatbot

A good chatbot for insurance companies should have several key features to ensure it meets the needs of both the company and its customers.

User-Friendly Interface

A chatbot for insurance should have a simple and intuitive interface. Customers should find it easy to use without needing technical knowledge.

Ease of Use: If a customer needs to know their policy details, the chatbot should provide options or prompts that guide them effortlessly. The interaction should be smooth, reducing the need for human assistance.

Accurate Responses

The chatbot for insurance should provide accurate and reliable information. Incorrect information can lead to customer dissatisfaction and potential legal issues.

Reliability: When a customer asks about their policy coverage, the chatbot should provide precise details. This accuracy builds trust and ensures the customer feels confident in the information provided.

Integration with Systems

The chatbot for insurance should integrate seamlessly with the company’s existing systems, such as CRM and databases.

System Integration: An AI-powered chatbot for insurance should access the company’s database to retrieve customer information. If a customer asks about their claim status, the chatbot should quickly pull up the relevant details from the CRM and provide an update.

24/7 Availability

Customers should be able to interact with the chatbot for insurance at any time. This availability improves customer service and ensures queries are addressed promptly.

Round-the-Clock Service: If a customer has a query at midnight, the chatbot should be available to help. Whether it’s checking policy details or answering questions, the chatbot ensures continuous support without waiting for business hours.

Personalized Interactions

The chatbot for insurance should use customer data to provide personalized responses. Personalization improves customer engagement and satisfaction.

Customer Data Utilization: When a customer interacts with the chatbot, it should address them by name and provide information based on their history. For instance, "Hi John, your policy number 12345 is due for renewal next month."

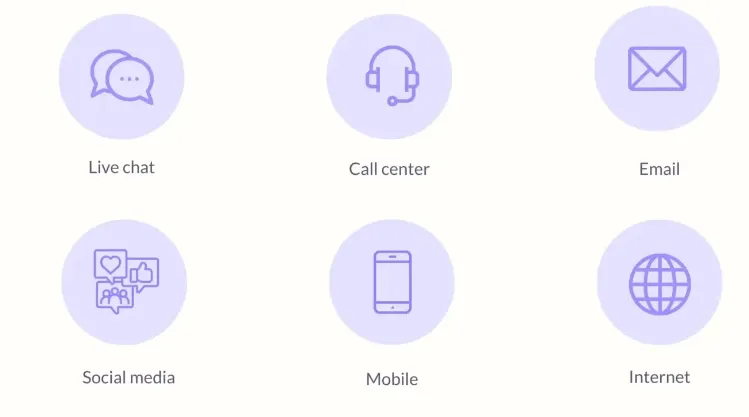

Multi-Channel Support

A good chatbot for insurance should be accessible through various channels like the company website, mobile app, and social media.

Channel Flexibility: Whether a customer is on the company’s website or their Facebook page, the chatbot should be available to assist. This multi-channel support ensures the customer can get help wherever they are.

Security and Privacy

Ensuring the chatbot for insurance handles customer data securely is crucial. Customers must trust that their information is safe.

Data Protection: An AI chatbot for insurance should comply with data protection regulations. When a customer provides their personal details, the chatbot should ensure this information is secure and used appropriately.

Continuous Improvement

The chatbot for insurance should continuously learn and improve from interactions. Regular updates and improvements ensure it stays effective.

Ongoing Learning: An AI-powered chatbot for insurance sector should analyze past interactions to identify areas for improvement. Regular updates based on this analysis keep the chatbot efficient and responsive.

This phase involves setting clear objectives, understanding your audience, defining the chatbot's tasks, and selecting the right platform. Proper planning will help you create a chatbot that enhances customer service and streamlines operations.

Suggested Reading:What is an AI Agency and How to start your Own?

Planning Your Chatbot for Insurance

Planning your chatbot for insurance is crucial to ensure it meets your business needs and customer expectations.

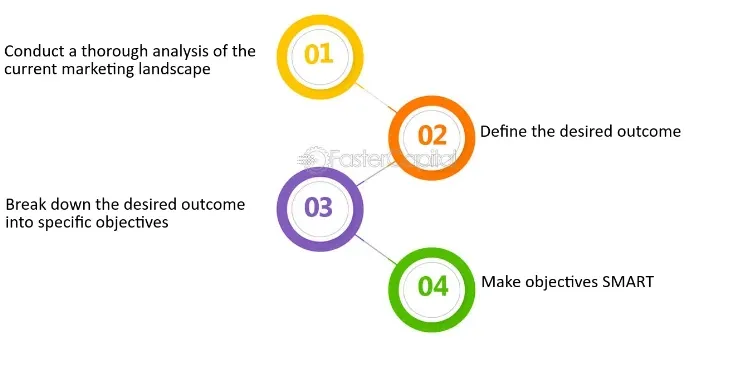

Identifying Objectives and Goals

The first step in planning your chatbot for insurance is to identify your objectives and goals. Knowing what you want to achieve will guide the development process.

Enhancing Customer Service: If your goal is to improve customer service, focus on features that address common customer queries. For instance, a chatbot for insurance companies can answer frequently asked questions about policy details, reducing the workload on human agents.

Streamlining Claims Processing: If you aim to streamline claims processing, design the chatbot to handle initial claim submissions. This allows customers to start their claims online, speeding up the process.

Increasing Policy Sales: If increasing sales is a goal, include features that help customers understand and purchase policies. The chatbot can provide quotes and suggest suitable products based on customer needs.

Understanding Your Target Audience

Knowing your target audience is essential for creating a chatbot for insurance that meets their needs. Different customers have different expectations and preferences.

Existing Customers: If your primary audience is existing customers, the chatbot for insurance should focus on policy management. It can help customers check their policy status, renew policies, and update personal information. This makes managing their insurance easier.

Potential Customers: If you are targeting potential customers, the chatbot for insurance should provide information about your products. It can guide them through the process of selecting and purchasing a policy. This helps convert leads into customers.

Claims-Focused Users: For customers primarily interested in claims, the chatbot for insurance should offer easy access to claim submission and status updates. This reduces the hassle of managing claims and improves customer satisfaction.

Mapping Out Key Functions and Tasks for the Chatbot

Define the key functions and tasks your chatbot for insurance will perform. This step ensures the chatbot is equipped to handle the necessary interactions.

Answering Common Questions: A primary function of any chatbot for insurance is to answer common questions. This might include policy coverage details, premium amounts, and payment methods. By handling these inquiries, the chatbot reduces the burden on human agents.

Providing Quotes: If your chatbot for insurance aims to generate sales, it should be able to provide quotes. Customers can enter their details, and the chatbot calculates a quote. This feature simplifies the buying process and encourages more people to get insured.

Handling Claims: An important task for an AI chatbot for insurance is managing claims. The chatbot can guide users through the initial claim submission, ask for necessary details, and provide updates on claim status. This makes the process faster and more efficient.

Policy Management: For existing customers, the chatbot for insurance should offer policy management services. Users can check their policy details, renew policies, and make changes to their information. This self-service capability improves customer satisfaction.

Suggested Reading:How to Launch Your Chatbot Agency in 2024: Expert Guide

Selecting the Right Chatbot Platform

Choosing the right platform is critical for the success of your chatbot for insurance companies. The platform determines the chatbot's capabilities and integration options.

Platform Compatibility: Ensure the platform you choose is compatible with your existing systems. If your company uses a specific CRM, the chatbot platform should integrate seamlessly with it. This integration allows the chatbot to access and update customer information easily.

AI Capabilities: If you want an AI-powered chatbot for insurance sector, select a platform with strong AI capabilities. These platforms use natural language processing to understand and respond to complex queries. This makes the chatbot more effective and user-friendly.

Customization Options: Look for platforms that offer customization. You should be able to tailor the chatbot to your specific needs. This might include adding unique features, customizing conversation flows, and branding the chatbot to match your company’s identity.

Support and Maintenance: Choose a platform that offers good support and maintenance services. Regular updates and troubleshooting are essential to keep the chatbot running smoothly. This ensures the chatbot remains effective and responsive to customer needs.

Designing the Chatbot

.Designing your chatbot for insurance is a critical step that determines how effectively it will serve your customers. The design involves creating a user-friendly interface, writing natural conversation scripts, including FAQs, and ensuring a seamless user experience.

Creating a User-Friendly Interface

A user-friendly interface is essential for any chatbot for insurance. It ensures customers can easily interact with the chatbot and get the help they need without frustration.

Simplicity: The interface should be simple and intuitive. If a customer needs to check their policy status, they should be able to navigate through the options effortlessly. The design should minimize the steps required to get to the desired information.

Visual Clarity: Use clear and readable fonts, appropriate colors, and simple graphics. For instance, a chatbot for insurance agents can use icons and buttons that are easy to understand. This makes the interaction straightforward, even for users who are not tech-savvy.

Accessibility: Ensure the chatbot is accessible to all users, including those with disabilities. This might involve supporting screen readers or offering text-to-speech options. Accessibility ensures that every customer can use the chatbot effectively.

Writing Effective and Natural Conversation Scripts

The conversation scripts are the backbone of any chatbot for insurance companies. They need to be written in a way that feels natural and helpful.

Conversational Tone: Use a friendly and conversational tone. If a customer asks about renewing their policy, the chatbot should respond with clear and polite language. For example, “Sure, I can help with that. Please provide your policy number.”

Clarity and Precision: Avoid using jargon. Responses should be clear and to the point. If a customer asks about coverage details, the chatbot should provide a straightforward answer without unnecessary complexity. This keeps the interaction efficient.

Adaptability: Scripts should handle various ways customers might ask the same question. An AI chatbot for insurance should recognize different phrasings and provide consistent answers. This adaptability improves the user experience.

Including FAQs and Common Queries

Including a comprehensive list of FAQs and common queries is crucial for the effectiveness of a chatbot for insurance.

Common Customer Questions: Identify and include answers to the most common questions customers ask. These might include inquiries about policy coverage, claim status, and premium payments. Having these ready helps the chatbot provide quick and accurate information.

Updated Information: Regularly update the FAQs to reflect any changes in your services or policies. If your insurance company introduces a new product, ensure the chatbot includes information about it. This keeps the chatbot relevant and useful.

Interactive Responses: Instead of just listing FAQs, make the responses interactive. If a customer asks, “What does my policy cover?” the chatbot should guide them through the coverage details step-by-step. This interactive approach enhances understanding.

Ensuring a Seamless User Experience

A seamless user experience is essential for customer satisfaction. The chatbot should work smoothly across all interactions.

Quick Response Time: The chatbot should respond quickly to customer inquiries. If a customer asks about claim status, the chatbot should provide an answer within seconds. This responsiveness keeps the user engaged and satisfied.

Consistent Performance: Ensure the chatbot performs consistently well. If a customer interacts with the chatbot on the website and later on a mobile app, the experience should be the same. This consistency builds trust in the chatbot’s reliability.

User Feedback Mechanism: Include a way for users to provide feedback on their experience. If a customer feels the chatbot didn’t answer their question, they should be able to report it. This feedback helps improve the chatbot over time.

Developing the Chatbot

Developing your chatbot for insurance involves several critical steps to ensure it functions effectively and meets your business needs. This includes setting up the chatbot on your chosen platform, integrating it with existing systems, adding AI capabilities, and thoroughly testing it for functionality and performance.

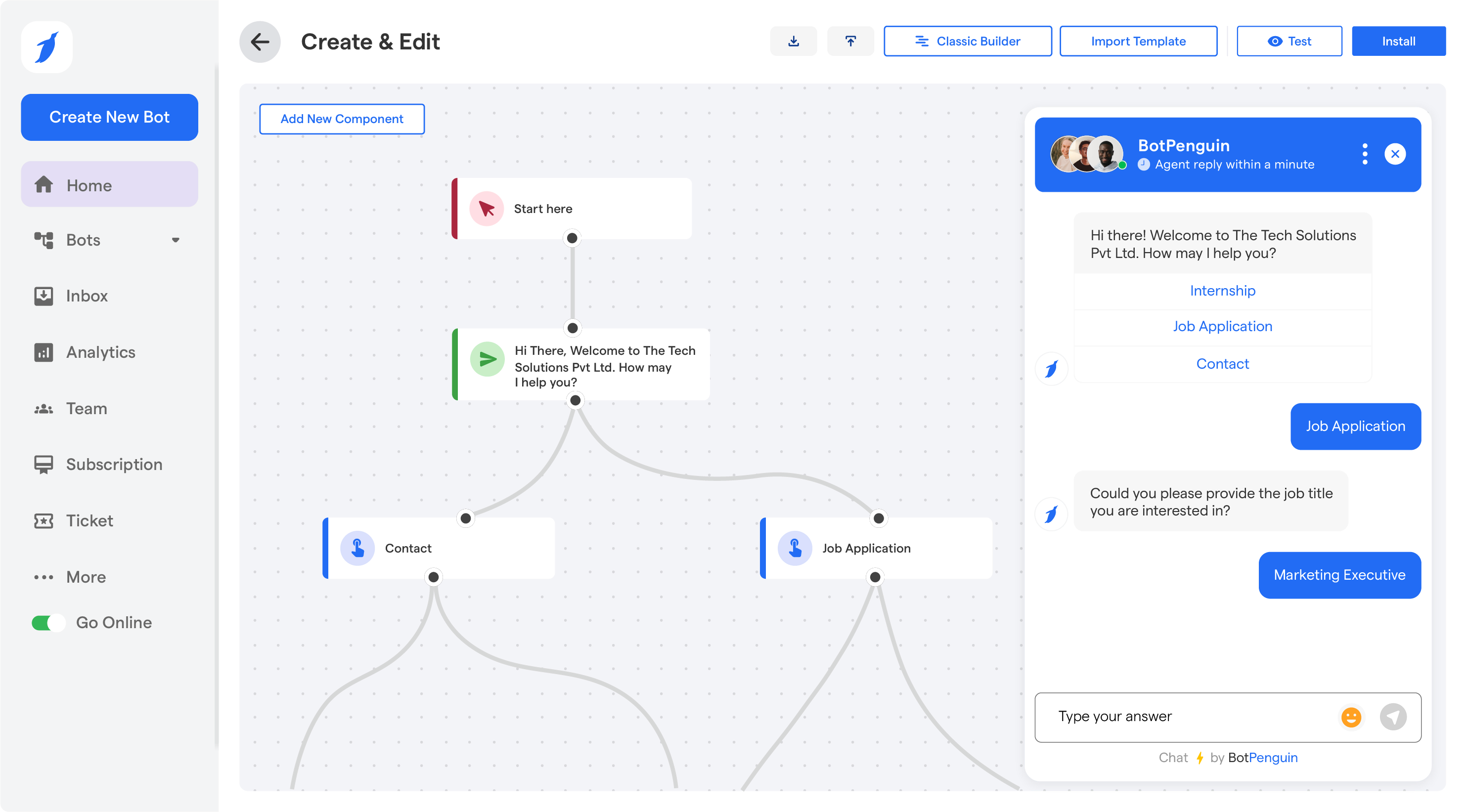

Setting up the Chatbot on Your Chosen Platform

Choosing the right platform is the foundation of a successful chatbot for insurance companies. Once you have selected a platform, the next step is to set up the chatbot.

Platform Installation: Begin by installing the chatbot software on your chosen platform. This could be a website, mobile app, or social media channel. Ensure that the setup process aligns with your business's technical infrastructure.

Customization: Customize the chatbot to reflect your brand’s identity. This includes using your company’s logo, colors, and tone of voice. If your brand is friendly and approachable, the chatbot should communicate in the same manner. For example, a chatbot for insurance agents could greet users with, “Hi! How can I assist you today?”

Initial Configuration: Configure the basic settings of the chatbot. This involves setting up initial conversation flows, greeting messages, and basic commands. Ensure the chatbot is ready to handle simple queries from the start.

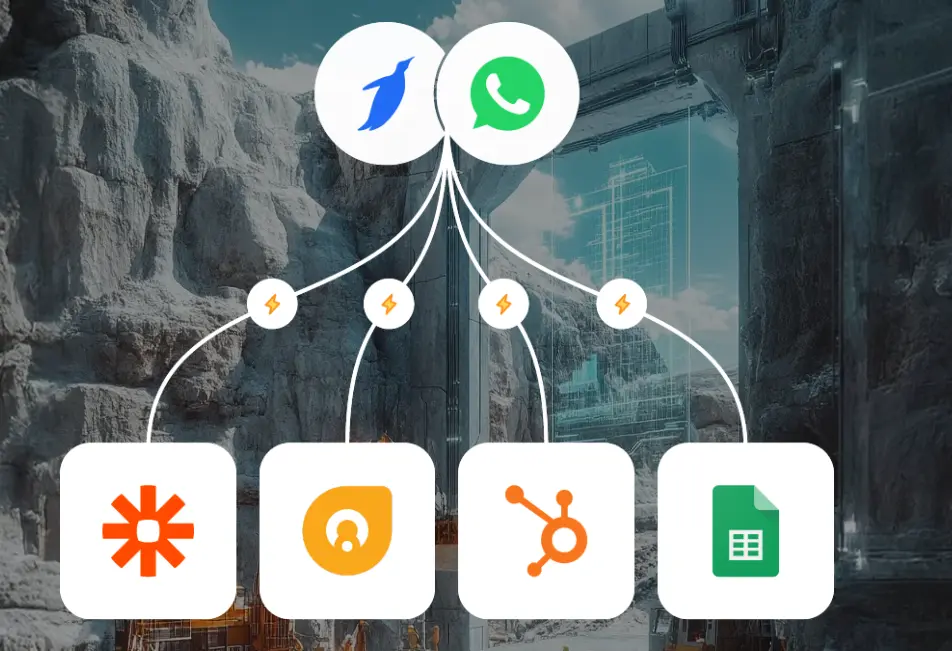

Integrating the Chatbot with Existing Systems (CRM, Databases)

Integration with existing systems like CRM and databases is essential for providing accurate and personalized responses.

CRM Integration: Connect the chatbot to your CRM system. This allows the chatbot to access customer data and provide personalized service. For instance, if a customer asks about their policy details, the chatbot can pull up their information from the CRM and give a specific answer.

Database Connectivity: Ensure the chatbot is connected to your databases. This is crucial for retrieving up-to-date information on policies, claims, and other customer data. An AI-powered chatbot for insurance sector can access the latest policy terms to answer queries accurately.

System Updates: Keep the integrated systems updated to ensure the chatbot for insurance operates with the most current data. Regular updates help maintain the chatbot’s reliability and accuracy.

Adding AI Capabilities for More Complex Interactions

Adding AI capabilities transforms a basic chatbot for insurance into a more intelligent and responsive chatbot for insurance.

Natural Language Processing (NLP): Implement NLP to allow the chatbot to understand and interpret natural language. This enables the chatbot to handle more complex queries. For example, an AI chatbot for insurance can understand and respond to a customer saying, “I need help with my car insurance claim.”

Machine Learning: Incorporate machine learning algorithms to help the chatbot learn from interactions and improve over time. This allows the chatbot to recognize patterns and provide better responses. If customers frequently ask about policy renewal procedures, the chatbot learns to provide more detailed and helpful information.

Context Awareness: Develop the chatbot to be context-aware. This means it can remember previous interactions and provide relevant follow-ups. If a customer previously inquired about adding a family member to their policy, the chatbot can follow up with additional information on family coverage options.

Testing the Chatbot for Functionality and Performance

Thorough testing is crucial to ensure the chatbot for insurance operates smoothly and effectively.

Functional Testing: Test the chatbot’s functionality to ensure it performs all tasks correctly. This includes checking if it can handle common queries, provide accurate information, and complete transactions. An AI chatbot for insurance should be tested on various queries to ensure it responds accurately and promptly.

Performance Testing: Evaluate the chatbot’s performance under different conditions. This includes testing its response time, stability, and ability to handle multiple interactions simultaneously. For instance, test how the chatbot handles peak times when many users interact with it at once.

User Testing: Conduct user testing to gather feedback from real users. This helps identify any usability issues and areas for improvement. If customers find the chatbot’s responses unclear, this feedback can be used to refine the conversation scripts.

Continuous Monitoring: After deployment, continuously monitor the chatbot’s performance. Use analytics to track its effectiveness and identify any issues that need addressing. Regular monitoring ensures the chatbot remains efficient and effective over time.

Deploying the Chatbot

Deploying your chatbot for insurance involves several key steps to ensure a successful launch and effective integration into your business operations. This phase includes launching the chatbot on your website and/or mobile app, training your staff to use and manage it, and promoting the chatbot to your customers.

Launching the Chatbot on Your Website and/or Mobile App

The first step in deployment is to make the chatbot available to your customers through your website and mobile app.

Website Integration: Embed the chatbot on your website. Place it prominently on pages where customers are likely to need assistance, such as the homepage, support page, and policy information pages.

Ensure that the chatbot for insurance icon or widget is easy to find and accessible from any page on the site. This visibility ensures customers can quickly get help whenever they need it.

Mobile App Integration: If your insurance company has a mobile app, integrate the chatbot into the app as well. Make sure it is accessible from the main navigation menu. For instance, a chatbot for insurance agents can assist customers with policy details or claim statuses directly within the app. This convenience encourages more interactions and enhances the customer experience.

Cross-Platform Consistency: Ensure that the chatbot for insurance provides a consistent experience across both web and mobile platforms.

The responses, interface, and functionality should be the same, making it easy for customers to switch between platforms without any confusion.

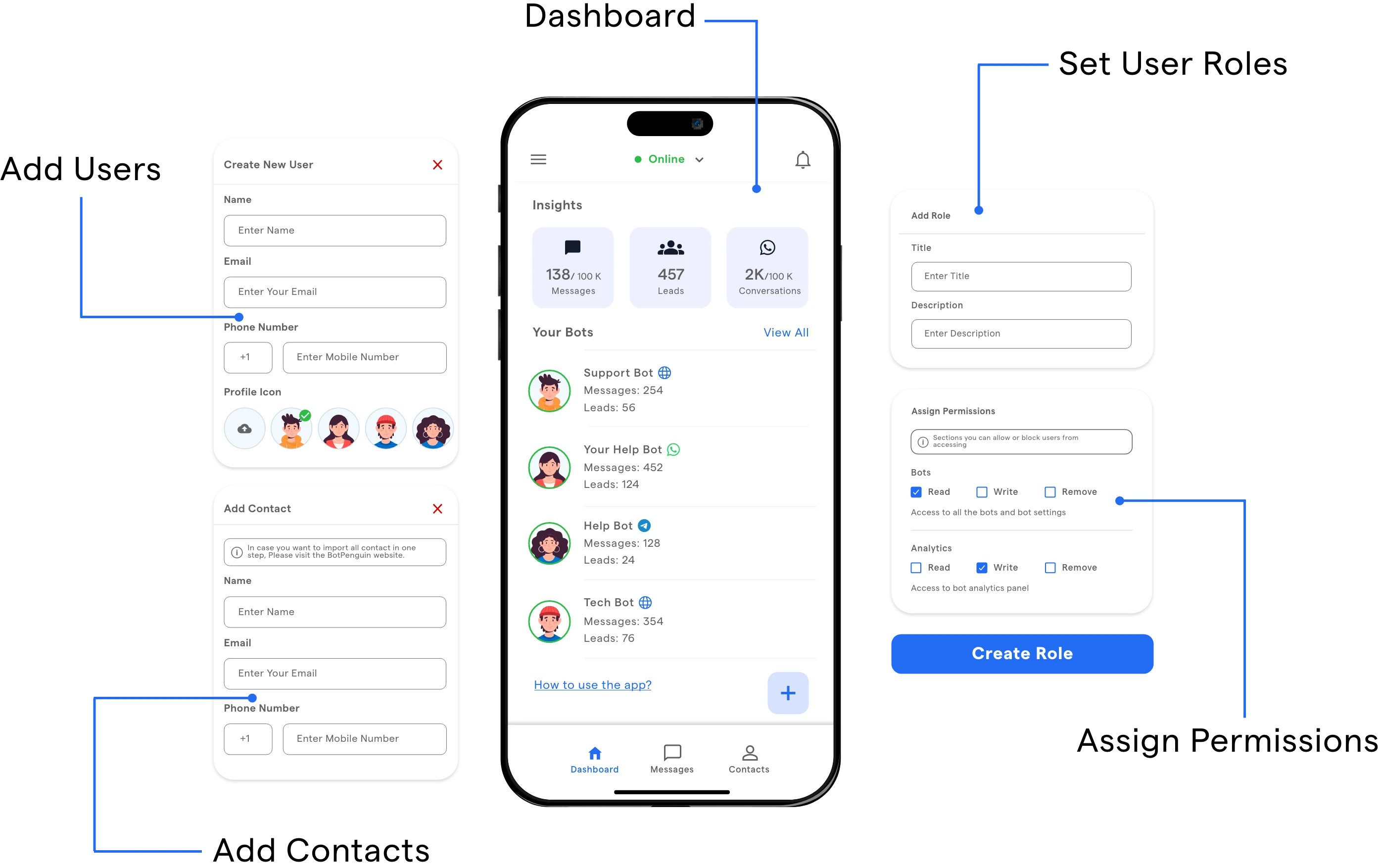

Training Staff to Use and Manage the Chatbot

Training your staff to use and manage the chatbot for insurance is crucial for its successful operation. Well-trained staff can ensure the chatbot runs smoothly and efficiently addresses customer needs.

Understanding Functionality: Train staff on the chatbot’s capabilities and limitations. They should know what the chatbot can handle and when to step in for more complex queries. For example, if the chatbot cannot resolve a claim issue, staff should know how to take over and assist the customer directly.

Managing Updates: Teach staff how to update the chatbot’s content and scripts. This includes adding new FAQs, updating existing information, and refining conversation flows based on customer feedback. An AI chatbot for insurance will require regular updates to stay accurate and effective.

Monitoring Performance: Train staff to monitor the chatbot’s performance using analytics tools. They should track metrics such as response times, resolution rates, and customer satisfaction. Regular monitoring helps identify any issues and areas for improvement, ensuring the chatbot remains efficient and responsive.

Handling Escalations: Equip staff with protocols for handling escalations. If a customer is unhappy with the chatbot’s response, staff should know how to take over the conversation seamlessly and provide the necessary assistance. This ensures that customer satisfaction is maintained even when the chatbot encounters limitations.

Promoting the Chatbot to Your Customers

Once the chatbot for insurance is deployed, it’s essential to promote it to ensure your customers are aware of this new tool and its benefits.

Website and App Announcements: Use banners, pop-ups, and notifications on your website and mobile app to announce the launch of the chatbot. Highlight its features and how it can help customers with their queries. For instance, inform customers that the chatbot for insurance companies can provide instant policy details and claim statuses.

Email Campaigns: Send out email campaigns to your customer base announcing the chatbot for insurance. Explain its benefits, such as 24/7 availability and quick responses. Include a direct link to the chatbot on your website or app to encourage immediate use. This direct approach reaches customers who may not visit your site regularly.

Social Media Promotion: Leverage your social media channels to promote the chatbot. Create posts, stories, and ads highlighting its features and benefits. Social media is a powerful tool to reach a broad audience and encourage interactions with the chatbot. Use engaging content to capture attention and drive traffic to your site or app.

In-App Tutorials: Provide in-app tutorials and guides to help customers understand how to use the chatbot for insurance. These tutorials can walk users through common tasks, such as checking policy details or filing a claim. This hands-on approach helps customers get comfortable with the chatbot quickly.

Conclusion

As the insurance industry continues to evolve, the integration of chatbots for insurance agents and companies has become a strategic imperative. AI-powered chatbots have revolutionized the way customers interact with their insurers, offering personalized support, streamlining claims processing, and enhancing overall customer satisfaction.

The implementation of AI chatbots for the insurance sector has proven to be a game-changer, enabling insurance companies to stay competitive and responsive to the changing needs of their clients. These AI-powered chatbots have become indispensable tools, handling a wide range of tasks with efficiency and precision, from answering frequently asked questions to guiding customers through the policy selection process.

As the insurance industry continues to embrace technological advancements, the adoption of AI-powered chatbots is set to grow exponentially. Insurance companies and agents that invest in these cutting-edge solutions will be well-positioned to deliver exceptional customer experiences, improve operational efficiency, and stay ahead of the competition in the rapidly evolving insurance landscape.

The future of the insurance sector is undoubtedly intertwined with the continued advancement of AI-powered chatbots, making them an essential component of any successful insurance agency's digital transformation strategy.

Frequently Asked Questions (FAQs)

What are the key steps to setting up a chatbot for an insurance agency?

Identify objectives, understand your audience, map out key functions, select a platform, design the interface, integrate with systems, add AI capabilities, test functionality, deploy, train staff, and promote the chatbot.

How can a chatbot benefit an insurance agency?

A chatbot for insurance enhances customer service by providing instant responses, streamlining claim processes, reducing workload on human agents, and offering 24/7 support, ultimately improving customer satisfaction and operational efficiency.

What features should an insurance chatbot have?

An insurance chatbot should have a user-friendly interface, accurate response capabilities, integration with CRM and databases, 24/7 availability, personalized interactions, multi-channel support, and strong security and privacy measures.

How do you integrate a chatbot with existing insurance systems?

Connect the chatbot to your CRM and databases to access and update customer information. Ensure seamless data flow and regular updates to maintain accuracy and efficiency in responses and operations.