Your customers don’t like filling out forms.

They don’t enjoy switching between websites, apps, or popups just to pay you. The longer it takes, the more likely they’ll drop off. That’s not a tech issue. It’s a trust and convenience issue.

Now imagine if the payment happened right inside a conversation. No redirection. No loading pages. Just a simple “Yes, pay now” — and done.

That’s the power of chatbot payments. Whether it’s WhatsApp, Messenger, or a website chat, users can complete purchases, pay bills, or book appointments without leaving the chat window.

This guide explains exactly how chatbot payments work. You’ll learn what they are, how to set them up, and where they’re used across industries. We’ll also walk through tools, real use cases, and security best practices so you know what’s possible — and how to do it right.

What are Chatbot Payments and How Do They Work?

Customers already chat with businesses. They ask about products, book appointments, and check availability. The only thing left is making a payment right there — and that’s exactly what chatbot payments solve.

This shift removes the need for extra steps. No switching tabs. No waiting for a page to load. The transaction happens inside the same conversation where the user started. It’s fast, simple, and built for how people already behave online.

Chatbot payments don’t just improve convenience. They change how payments fit into the overall customer experience. They take something disconnected and make it feel like a natural extension of the chat.

Simple Definition with Examples

A payment chatbot allows users to complete a transaction inside a chat interface like WhatsApp, Messenger, or a website widget. The chatbot handles the entire flow — from prompting the user to pay, to opening a secure checkout, to confirming the payment in real time.

Imagine chatting with a food delivery brand on Messenger. You select your meal, confirm your address, and then the chatbot asks, “Would you like to pay now?” One tap later, your payment is processed, and your order is confirmed — all inside the chat.

Or consider a telecom company that sends monthly reminders through WhatsApp. Instead of following a link, the user taps “Pay Now” inside the chat and clears their bill instantly. No friction. No back and forth.

That’s what chatbot payments are about. Removing delays. Making the payment feel like part of the conversation. A few lines of text. One click. Transaction done.

As more businesses adopt this model, the benefits grow on both sides — for the customer and the brand. But what exactly makes this approach better than traditional methods? That’s what we explore next.

Top Benefits of Chatbot Payments for Businesses and Customers

A smooth payment experience directly affects how fast customers act, how likely they are to complete a purchase, and how often they return. That’s why chatbot payments are doing more than reducing friction — they’re reshaping how businesses convert and retain users.

Unlike traditional methods, where users are taken through multiple pages or redirected to an external site, payments inside chat feel immediate. They fit naturally within the flow of conversation and remove the usual blockers like loading delays or login screens.

For businesses, this means fewer abandoned checkouts and more completed transactions. For users, it means faster service without needing to repeat themselves or start over.

Here’s how this shift is driving measurable gains across industries.

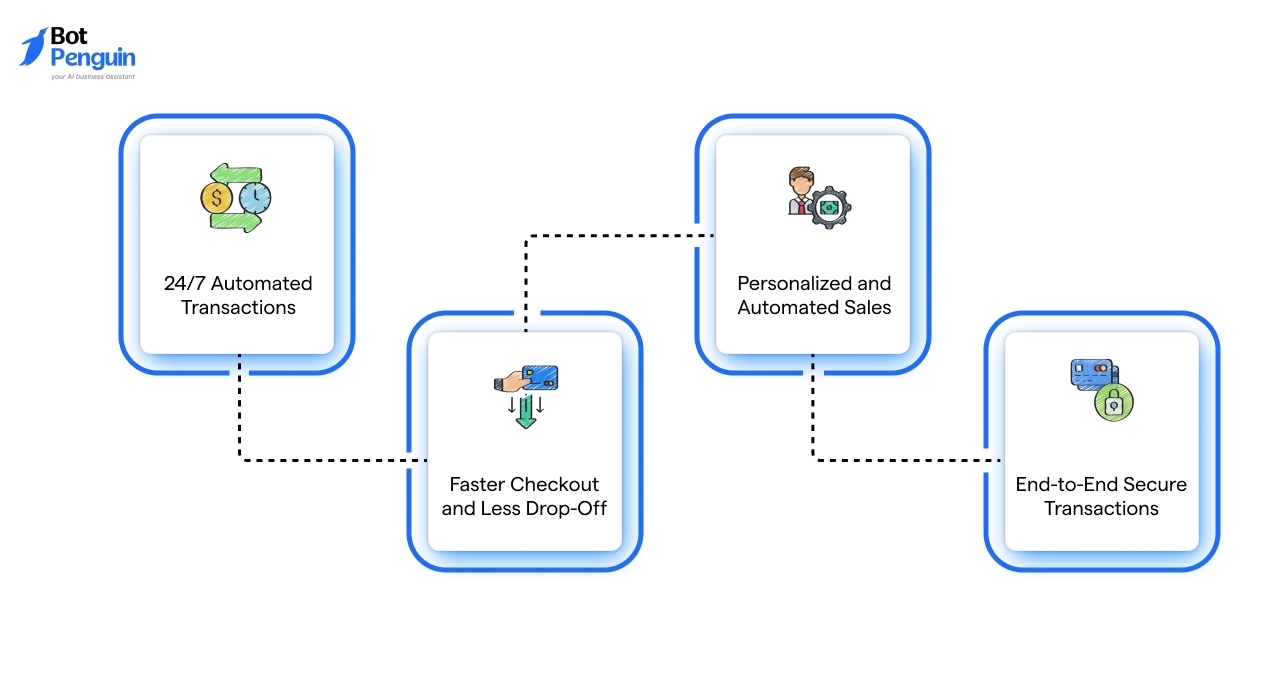

24/7 Automated Transactions

One of the biggest advantages of chatbot payments is their ability to collect money without human intervention — any time of the day.

Think of a user browsing a clothing brand’s Instagram at midnight. They ask about a product, get size suggestions from the bot, and pay immediately within the same chat. There’s no agent involved, no store hours, and no delay. The payment goes through and the order is confirmed — all while the team sleeps.

This level of automation frees up internal teams and ensures that revenue doesn’t wait for working hours.

Faster Checkout and Less Drop-Off

The longer the payment process takes, the more likely it is that users will drop off. Traditional payment flows often involve 3–4 screens, account logins, or form filling.

A payment chatbot cuts that down to one simple prompt and a secure link. The chatbot shows a summary, asks for confirmation, and triggers the payment inside the same window. Users don’t lose context. They don’t lose trust. And they rarely bounce.

For example, an online beauty store using chatbot payments saw users move from cart to checkout 2x faster than their old web process.

Personalized and Automated Sales

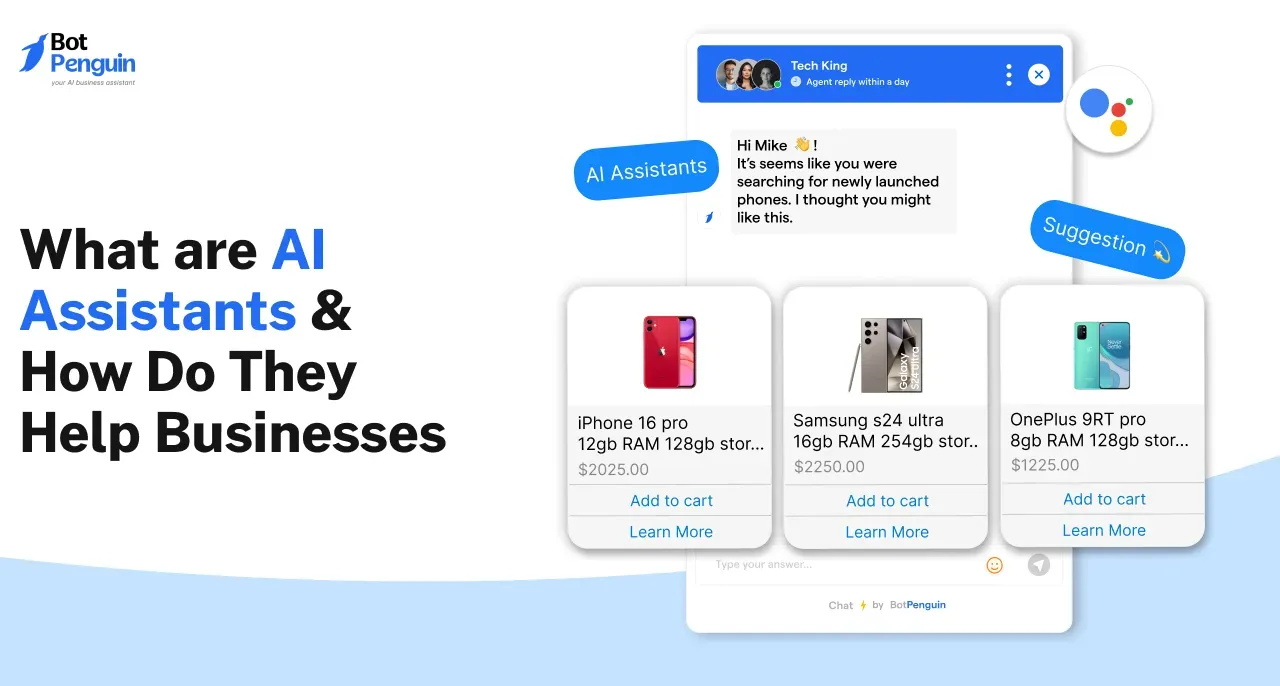

An AI chatbot payment platform isn’t just transactional. It can also learn.

It can remember what users bought last time, suggest complementary products, or trigger a timely reminder for a subscription renewal. It can even greet returning users with a custom offer tied to their past orders.

This creates a personalized, sales-driven experience — all without needing a sales rep. For businesses, that means more upsells. For users, it feels less like marketing and more like help.

End-to-End Secure Transactions

Speed means nothing without safety. That’s why secure chatbot payments are designed with compliance and encryption built in.

Chatbots don’t store sensitive data. Instead, they trigger verified gateways like Stripe or Razorpay, which handle the payment using encrypted tokens. The entire process follows PCI DSS standards and uses SSL-secured windows or webviews.

Users get clarity and trust. They see who they’re paying, what they’re paying for, and receive confirmation instantly — without ever sharing raw card details inside the chat.

From automation to personalization and security, chatbot payments improve every step of the transaction journey. But understanding how they work behind the scenes makes it easier to trust and implement them. That’s what we’ll explore next.

How Do Chatbot Payment Systems Work Behind the Scenes?

The chatbot experience feels effortless to the user, but there’s a lot going on in the background to make that happen. From showing a product to confirming a payment, the process is carefully structured to be fast, reliable, and secure.

Businesses that understand how this flow works can troubleshoot issues faster, build better user journeys, and choose the right tools more confidently. The good news is that you don’t need to be a developer to grasp the basics. The structure is simple once you break it down.

Here’s how a chatbot payment system flows from message to money in the bank.

Step-by-Step Breakdown of the Payment Flow

The user experience typically follows this path:

- The customer chats with the business — either through WhatsApp, Messenger, or a website widget.

- The chatbot responds with available options, like pricing, quantity, or booking times.

- Once the user confirms their selection, the bot triggers a payment prompt.

- The customer clicks a button that opens a secure gateway like Stripe or Razorpay inside the chat.

- After successful payment, the bot confirms and logs the transaction.

This is what most users see: a clean flow with little to no friction. A well-built chatbot payment system makes it feel conversational, not transactional. Every message fits naturally within the dialogue, even though it’s handling something as sensitive as money.

What Happens Behind the Scenes?

While the user interacts with a clean front-end, several things are happening in the background.

When the chatbot detects a payment trigger — like a confirmed selection or invoice agreement — it makes an API call to a connected payment gateway. That call contains details like amount, user ID, transaction ID, and the return URL for confirmation.

From there, the payment gateway handles the secure checkout. Once the transaction is completed or fails, it sends a response back to the chatbot system using a webhook. The chatbot then updates the user with success or failure status, logs the payment, and continues the flow.

This is possible because chatbots can be interfaced into payment systems using lightweight integration points like APIs, SDKs, or platform-native plugins. You don’t need to build a payment system from scratch — most of the heavy lifting is already handled by third-party providers.

The real work lies in connecting these services smoothly, so users never feel the system underneath.

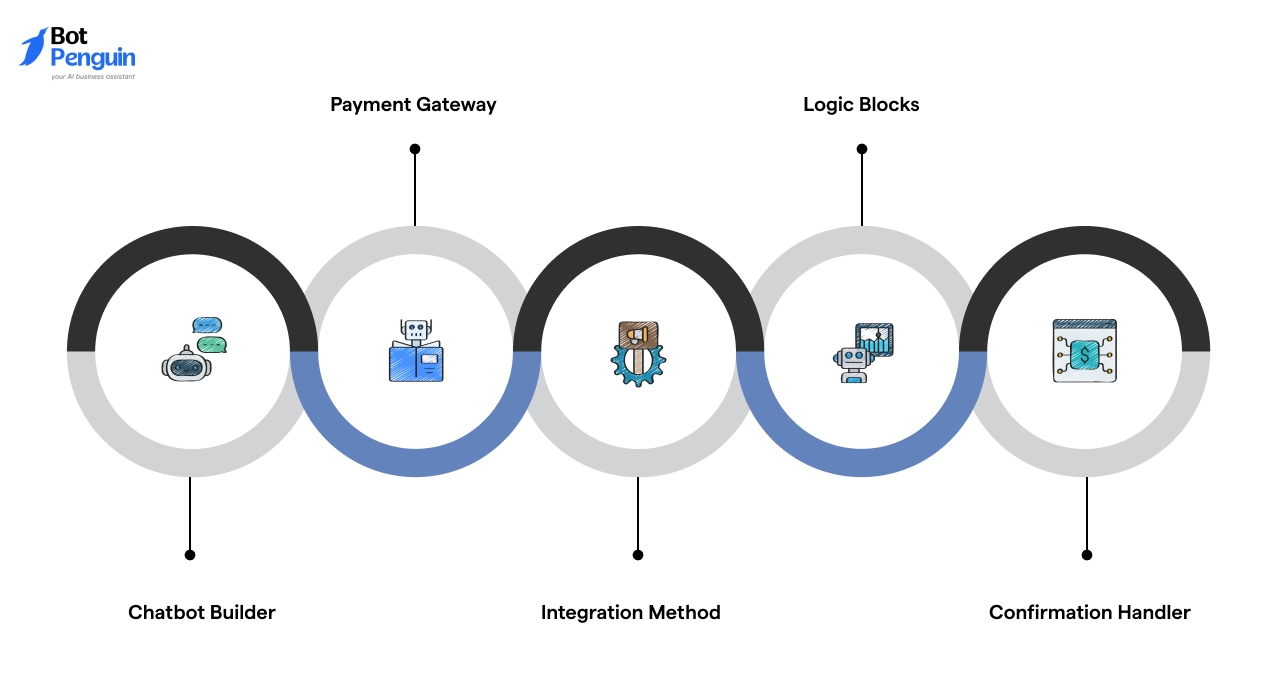

Key Components of a Chatbot Payment Gateway

To make this entire system work, you need a few moving parts in place:

- A chatbot builder that supports dynamic flows and external API calls

- A trusted payment gateway in chatbot setup (like Stripe, Razorpay, or PayPal)

- A method to connect the two — usually via prebuilt plugins or manual webhook/API setup

- Logic blocks that track user responses and trigger payment requests

- A confirmation handler to catch responses and update the chat

A well-configured chatbot payment gateway ensures that all these components sync together. It’s not just about collecting money. It’s about delivering a fast, stable, and secure payment experience — inside a conversational flow.

Understanding this behind-the-scenes structure gives you more control. You can design smarter flows, reduce errors, and create experiences that actually convert. In the next section, we’ll look at why so many businesses are shifting to chatbot payments in the first place.

Why More Businesses are Switching to Chatbot Payments

The way people shop and pay has evolved. They no longer want to jump across apps, forms, and payment links to complete a simple transaction. Instead, they expect the action to happen right where the conversation starts. That’s where chatbot payments are stepping in.

From browsing products to making a payment inside a chat—businesses are realizing how efficient, seamless, and high-converting this flow can be. Whether it’s retail, utilities, travel, or food delivery, chatbot-based payments are changing how brands interact with customers.

Let’s break down why this shift is happening across industries.

Customers prefer chat-first experiences

Modern users don’t want to click around or fill long forms. They prefer asking a question, getting a response, and completing actions — all in the same chat thread. It feels natural, fast, and efficient.

- Instead of navigating a website, users message brands directly

- Payment chatbots respond instantly with the bill, options, and secure links

- Transactions happen right there, without redirection or confusion

This seamless flow improves user satisfaction and drives repeat engagement, making chatbot payments a preferred checkout method for today’s digital audience.

High engagement on platforms like WhatsApp

Messaging platforms like WhatsApp, Messenger, and Instagram DMs see stronger engagement than most websites or mobile apps. Users open messages faster, interact more frequently, and are often ready to act when prompted.

When businesses deploy chatbots for bill payments on these platforms, they gain from:

- Over 80% open and read rates

- Reduced drop-offs at checkout

- Faster response-to-conversion times

Imagine a scenario where a user receives a payment reminder from a fitness brand. The chatbot provides the due amount, a one-tap payment option, and a confirmation—all within WhatsApp. It simplifies the journey and increases the chance of successful payments.

Perfect for quick checkout, reorders, or recurring payments

Chatbot payments work exceptionally well for repeat and fast-moving purchases. The system remembers user preferences, reducing the need to re-enter information each time. This helps shorten the path from intent to conversion.

Brands offering subscriptions, frequent reorders, or micro-transactions can benefit the most. Use cases include:

- Food box reorders every Friday

- Automatic monthly bill clearance

- Weekly appointment bookings

With an AI chatbot payment platform, the chatbot already knows the product, user, and payment method. A single message is all it takes to complete the transaction.

The move to chat-based payments is not a trend. It’s a response to how users behave and buy today. In the next section, we’ll walk you through how chatbot payment systems actually work behind the scenes—from the first tap to final confirmation.

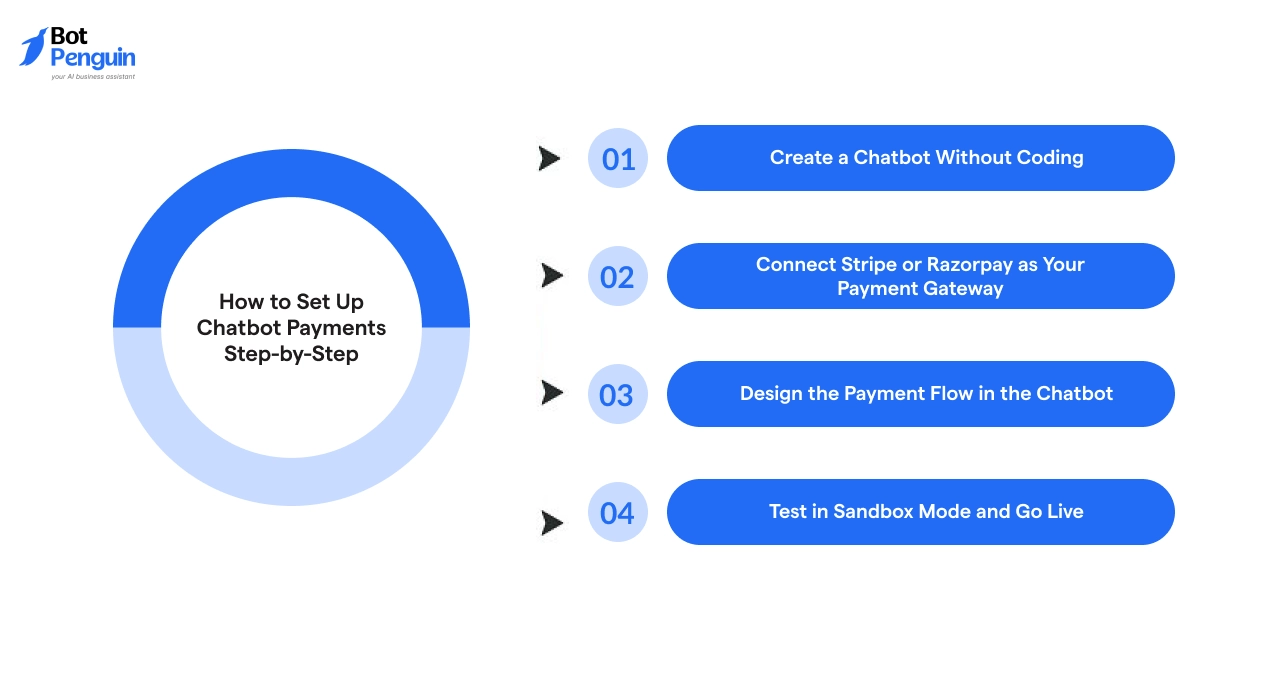

How to Set Up Chatbot Payments Step-by-Step

Businesses want quick setups, not lengthy code. That’s why BotPenguin simplifies chatbot payment integration into four easy steps. You can accept payments via chat without hiring developers or handling complex APIs.

From building your bot to going live, the process is streamlined to save time and reduce errors.

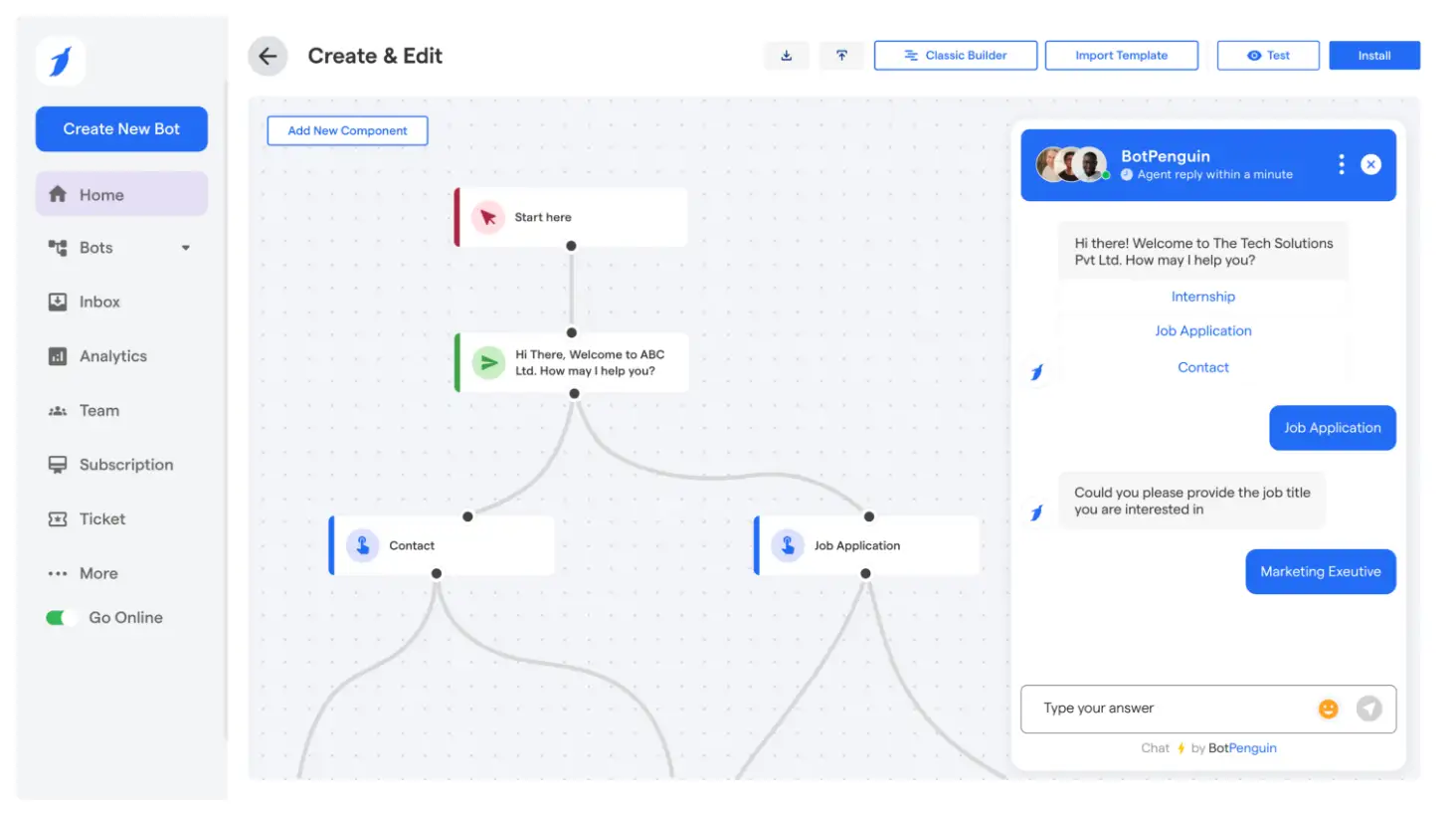

Step 1 – Create a Chatbot Without Coding

Log in to BotPenguin and click “Create Chatbot.” Choose the channel—WhatsApp, website, or Messenger—and customize it using the drag-and-drop builder. Set up basic flows like greetings, queries, and service options.

This setup becomes the base of your chatbot payment journey.

Step 2 – Connect Stripe or Razorpay as Your Payment Gateway

Go to “Integrations” in your BotPenguin dashboard. Choose Stripe or Razorpay and connect your account using API keys. Once done, the chatbot payment gateway will be active.

This allows your chatbot to trigger real-time payments from users.

Step 3 – Design the Payment Flow in the Chatbot

Use the flow builder to add triggers like “Pay now.” Capture details such as name, amount, and email. Insert a payment request node that sends the correct gateway link.

This step completes the payment integration with chatbot, enabling end-to-end transactions within the chat.

Step 4 – Test in Sandbox Mode and Go Live

Before going live, test your chatbot in sandbox mode. Verify flows, test dummy payments, and ensure the confirmation message works.

Switch to live mode once the setup is smooth. Your chatbot payments are now ready to accept real transactions.

With BotPenguin, setting up chatbot payments is fast, functional, and beginner-friendly. Next, let’s explore how secure these transactions really are.

Best Use Cases for Chatbot Payments Across Industries

Chatbot payments aren’t limited to ecommerce checkouts. They’ve become equally valuable for recurring billing, service bookings, and high-frequency orders.

From utility providers to healthcare clinics and D2C brands, businesses are shifting to payment chatbots that reduce effort for both sides.

Here’s how chatbot payments fit into everyday transactions across different industries.

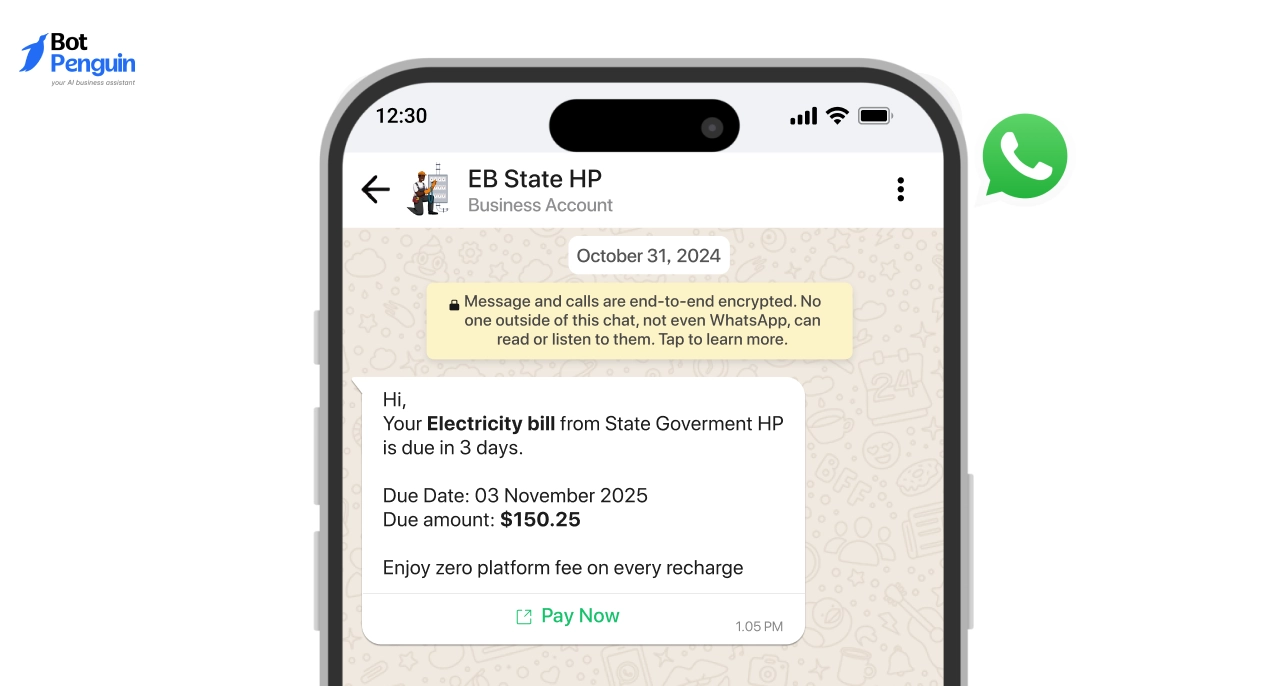

Utility Bill Payments (Electricity, Broadband, Subscriptions)

A chatbot for bill payments helps customers settle dues on time — without downloading an app or logging into a portal.

- Sends automated bill reminders via WhatsApp or SMS

- Accepts payments instantly through integrated gateways

- Issues real-time digital receipts upon payment completion

- Supports recurring billing cycles like monthly or quarterly

This reduces late payments and improves customer experience without needing manual follow-ups.

🛒 Ecommerce and D2C Checkouts

For product sellers, chatbot payments replace the clutter of multi-step checkouts with simple chat-led buying journeys.

- Recommends products based on user preferences and inputs

- Adds selected items to the cart inside the chat window

- Collects payments using a secure chatbot payment link

- Sends order confirmations and shipping updates instantly

This improves mobile conversions and reduces drop-offs across campaigns.

📅 Appointment and Event Booking

From beauty salons to healthcare clinics, collecting payments during booking ensures better commitment and less no-shows.

- Lets users browse time slots or events inside the chat

- Shares payment details and optional discount codes

- Confirms bookings only after successful payment

- Sends reminders with options to reschedule if needed

With a payment chatbot, service businesses keep operations tight and predictable.

🍔 Food, Grocery, and Alcohol Delivery

High-volume ordering needs a frictionless experience — and chatbot payments deliver exactly that.

- Lets customers reorder items using saved data or prompts

- Displays real-time menus, delivery zones, and pricing

- Processes payments instantly via WhatsApp or Messenger

- Sends tracking updates and delivery confirmations

A great fit for businesses that rely on speed, ease, and repeat orders.

Whether it's paying a broadband bill or checking out with groceries, chatbot payments blend convenience with functionality. With growing adoption across sectors, the next logical concern is security — and we’ll break that down in the upcoming section.

What Does the User Experience Look Like in a Payment Chatbot?

Once chatbot payments are set up, what does the experience actually feel like for users?

In one word—effortless. Customers no longer have to go through multiple steps, open separate apps, or wait for email confirmations. Everything from initiating a request to completing a transaction happens within the same chat thread.

Whether it's WhatsApp, Messenger, or a website widget, the experience is intuitive and fast. No redirects, no confusion—just a single, flowing conversation designed for instant action.

With that in mind, here's how a payment chatbot works from the user’s point of view.

From Message to Payment in Seconds

The best part about using a payment chatbot is how quickly a transaction happens without leaving the chat window. It feels less like a checkout and more like a conversation.

A user types something like “pay electricity bill” or taps a preset option in WhatsApp or Messenger.

↓

The chatbot instantly pulls up the relevant bill or product and displays the amount, service name, and due date—ready for approval.

↓

Once the user confirms, the chatbot generates a secure payment link or embedded button directly inside the conversation.

↓

Tapping the link opens a payment screen—fully integrated with Stripe, Razorpay, or other gateways. The user inputs their card, wallet, or UPI details.

↓

After authentication (OTP or biometric), the payment is processed instantly.

↓

Once successful, the chatbot shows a confirmation message and drops the receipt inside the same thread.

This streamlined flow removes friction. There’s no redirection, no logins, and no juggling between apps—just an intuitive, secure way to make a payment through chatbot in real time.

Example: Stripe Integration in WhatsApp or Messenger

When Stripe is used as the payment provider, the process remains equally fluid. A make a payment through chatbot Stripe flow would look like this:

- The chatbot detects the user intent to pay and generates a Stripe payment link

- That link opens directly within the chat interface (no app-switching)

- Stripe handles card, wallet, or UPI processing securely

- Once the payment is successful, the user is instantly redirected back to the chat

- The chatbot then sends a confirmation message and receipt—all in the same window

This reduces drop-offs, builds trust, and improves completion rates. More importantly, it creates a conversational checkout that aligns with how users already interact—especially on chat platforms they use daily.

How to Keep Chatbot Payments Safe and Secure

After understanding the user flow and the ease of making payments through chat, one common question that surfaces is: “Is it safe?” The short answer is yes—but only when implemented with the right guardrails.

Secure chatbot payments aren’t about adding more steps. They’re about making users feel confident while keeping transactions watertight under the hood. From using verified providers to following industry-grade compliance, every layer must support safety without breaking the seamless experience.

Here’s how you can build trust, ensure security, and protect user data when implementing a chatbot payment gateway.

Use Trusted Gateways Only

The first step to secure chatbot payments is choosing the right payment gateway. Solutions like Stripe, Razorpay, and PayPal are PCI-compliant, highly encrypted, and widely trusted.

Avoid unverified or local gateways that lack international certifications. With BotPenguin, you can easily integrate these trusted providers directly into your chatbot—ensuring every transaction is secured and compliant from the start.

- Stick with PCI-DSS-certified providers

- Choose gateways with fraud detection and tokenization

- Make sure the gateway supports HTTPS and SSL by default

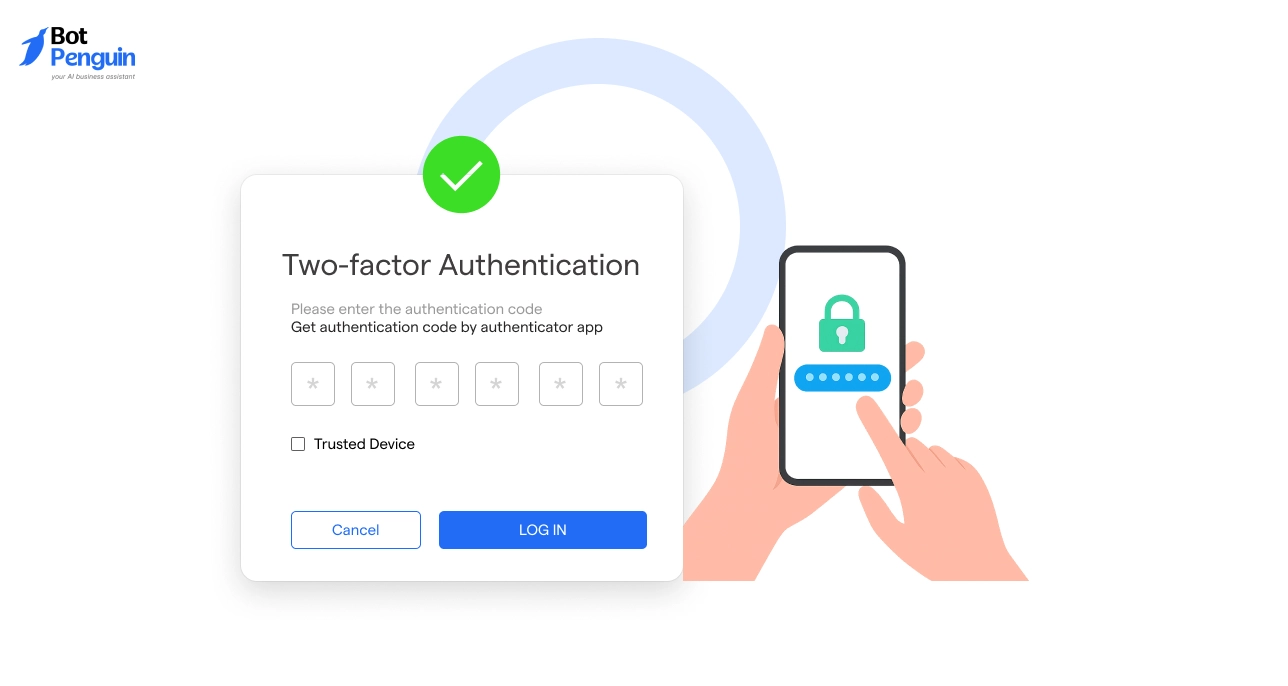

Enable Verification and Transparency

Security is not just technical—it’s also about the user’s perception.

To reduce drop-offs and build confidence, add two-factor authentication (2FA), OTP verifications, and clear payment summaries before users make a payment. It reassures users that they’re in control and makes transactions traceable in case of disputes.

This is especially important for industries dealing with recurring payments or high-ticket orders where fraud risks are higher.

- OTP before payment confirmation

- Display itemized breakdown with taxes and fees

- Share instant receipts with payment ID and timestamp

Follow Compliance Guidelines

For long-term sustainability, your chatbot must comply with established financial data policies.

Start by ensuring PCI-DSS compliance from your payment provider. Additionally, make sure SSL encryption is active throughout the chat interface. Most importantly, never store raw payment data, like card numbers or CVVs, inside chatbot logs or databases.

Even if you’re using secure gateways, skipping compliance measures can expose your system to unnecessary risk.

- Enable SSL on your chatbot and hosting infrastructure

- Avoid storing sensitive payment data

- Keep up with region-specific payment regulations (e.g., CCPA or GDPR)

When done right, chatbot payments can be as safe as any top-tier eCommerce platform. And now that security is covered, it’s time to talk about results. What kind of benefits can businesses expect from integrating chatbot payments? That’s next.

Here’s the final section that aligns with the previous flow, keeps tone and formatting consistent, and adds a forward-looking perspective:

What’s Next for AI Chatbot Payment Platforms?

With chatbot payments already transforming how businesses and customers interact, the next wave of innovation is just getting started.

The shift from traditional web checkouts to messaging-based payments is only the beginning. We’re now entering a phase where AI chatbot payment platforms are evolving to support more intuitive, localized, and frictionless experiences.

From voice assistants handling payments to wider gateway integrations tailored for mobile-first economies, businesses can expect smarter and more accessible solutions across the board.

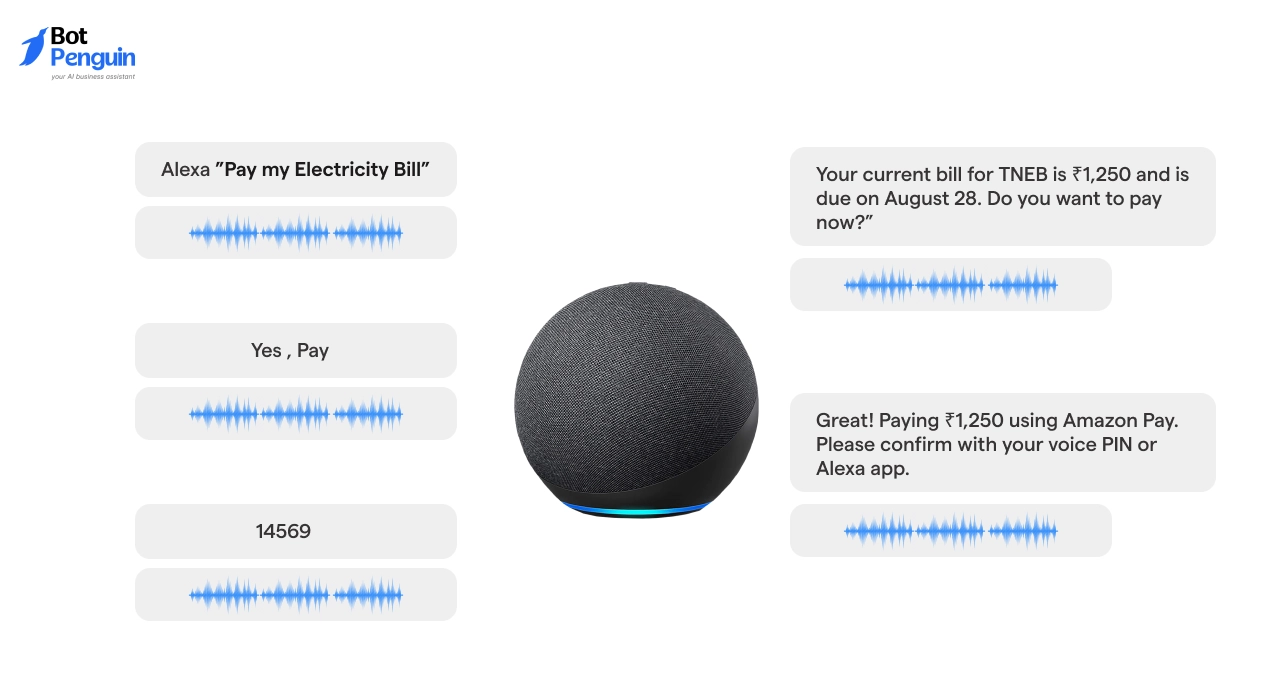

Voice-Based Payments via AI Assistants

The line between conversation and transaction is blurring. Soon, saying “Pay my electricity bill” to Alexa or Google Assistant will be all it takes.

Voice-led actions are becoming a core part of the AI chatbot payment platform stack. These platforms will link voice recognition with secure checkout flows, eliminating the need for clicks altogether.

- Hands-free payments through AI assistants

- Secure voice commands linked to verified accounts

- Ideal for smart home setups and elderly users

UPI, QR, and Wallet-Based Expansions

In fast-growing digital markets like SEA, MENA, and India, convenience isn’t tied to cards—it’s tied to local methods like UPI, QR codes, and wallets.

Payment gateway chatbot integrations are now being built to support these region-first channels. Whether it’s scanning a code, clicking a UPI link, or paying through a wallet app inside the chat—everything stays mobile-first and native to the user.

- Chatbots sending dynamic QR codes for offline payments

- Seamless UPI links inside WhatsApp or Messenger

- Wallet payments for microtransactions or daily orders

The future of chatbot payments lies in adaptability—being wherever the customer already is and speaking their digital language, whether that’s a typed message, a voice command, or a QR scan.

What started with chat is now scaling toward full-spectrum commerce.

Ready to Enable Chatbot Payments in Your Business?

From browsing to buying, chatbot interactions are quickly becoming the fastest path to conversion. With reduced friction, real-time support, and secure checkout flows, chatbot payments are no longer a nice-to-have — they’re becoming a standard.

Whether you're in eCommerce, utilities, healthcare, or food delivery, automating payments inside chat builds user trust, boosts completion rates, and reduces manual effort. The process is not only faster but also easier to manage across channels.

And the best part? You don’t need to build anything from scratch.

Platforms like BotPenguin let you get started in just a few steps. From creating a no-code chatbot to integrating gateways like Stripe or Razorpay, the journey is smooth and support-ready.

If your business values speed, ease, automation, and customer satisfaction, then it’s time to rethink checkout. It’s time to enable chatbot payments and meet customers where they already are — in conversation.

Frequently Asked Questions (FAQs)

How secure are chatbot payments when using Stripe or Razorpay?

Chatbot payments using Stripe or Razorpay are PCI-DSS compliant and encrypted end-to-end, ensuring your customers’ financial data is handled with maximum security and no data is stored.

Can I use a payment chatbot on both WhatsApp and Messenger?

Yes, a payment chatbot can be integrated with both WhatsApp and Messenger, enabling seamless transactions across platforms while maintaining a consistent checkout experience for your customers.

What industries benefit most from chatbot for bill payments?

Industries like telecom, utilities, streaming, and education benefit heavily from chatbot for bill payments, especially for automated reminders, instant payment links, and real-time confirmations.

Is it possible to embed a chatbot payment gateway into a website?

Absolutely. You can embed a chatbot payment gateway into your website widget or landing page, allowing users to interact and complete transactions without switching tabs or devices.

What makes BotPenguin a strong ai chatbot payment platform?

BotPenguin offers no-code setup, Stripe and Razorpay integration, sandbox testing, and secure gateways — making it a powerful AI chatbot payment platform for growing businesses.