Conversational artificial intelligence is enabling the automation of financial services. Advanced chatbots and voice assistants can now understand natural language, derive meaning, and communicate like humans.

This allows them to handle many financial workflows traditionally done by agents, such as providing account information, processing payments, and addressing customer queries.

According to a recent study by Forrester, 62% of financial institutions plan to increase their investment in Conversational AIs over the next year.

By deploying intelligent conversational platforms, financial institutions can operate 24/7, improve compliance, scale operations, and optimize the customer experience. Conversational AI analyzes interactions to uncover needs and opportunities.

Technology is transforming the financial sector by personalizing services through automated, human-like interfaces. Intelligent conversational agents are the future of efficient, automated financial services.

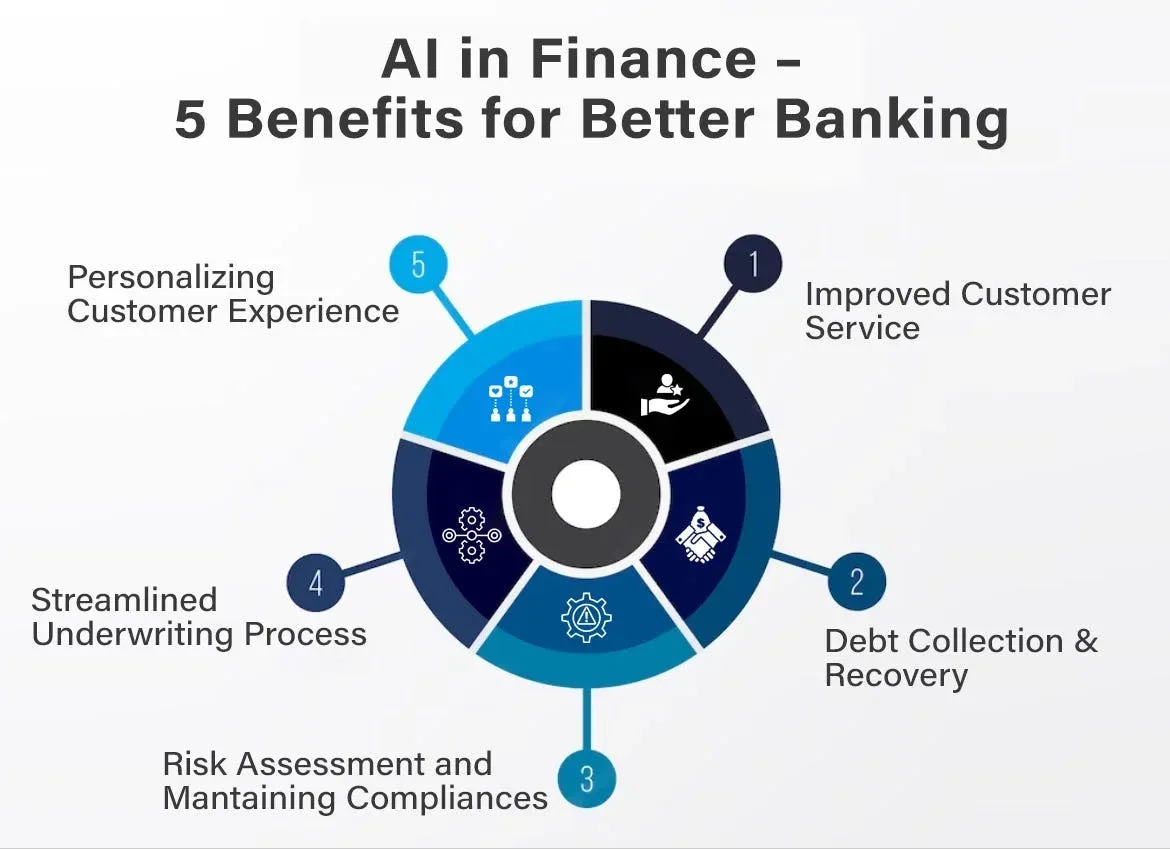

Benefits of Conversational AI in Financial Services

Moreover, Conversational AI can engage customers proactively, reaching out with relevant offers, updates, or reminders, creating a more interactive and customer-centric experience.

As a result, customer satisfaction and engagement are enhanced, increasing customer loyalty and retention.

Streamlining Customer Service

Conversational AI can streamline customer service by providing immediate and personalized responses to customer inquiries.

With Conversational AI, customers can engage in real-time conversations and get accurate information about their accounts, transactions, or any other required financial services.

This leads to faster issue resolution, reduced wait times, and improved customer service experience.

Automating repetitive tasks and processes

One of the critical advantages of Conversational AI is its ability to automate repetitive tasks and processes.

For instance, Conversational AI can handle routine inquiries like checking account balances, transferring funds, or providing basic financial advice. By automating these tasks, financial institutions can reduce manual workloads, save time, and allocate resources to more complex activities that require human expertise.

Automation also minimizes the chances of human errors, ensuring accuracy and efficiency in routine operations.

Improved customer satisfaction and engagement

With Conversational AI, financial services can provide personalized and engaging experiences to customers. By leveraging AI technologies like natural language processing, Conversational AI can understand customer preferences and tailor responses accordingly. This level of personalization helps build stronger customer relationships, and fosters trust.

Moreover, Conversational AI can engage customers proactively, reaching out with relevant offers, updates, or reminders, creating a more interactive and customer-centric experience.

As a result, customer satisfaction and engagement are enhanced, increasing customer loyalty and retention.

Successful Implementation of Conversational AI in Financial Institutions

Several financial institutions have successfully implemented Conversational AI to improve customer service and efficiency.

For example, Bank of America utilizes its virtual assistant, Erica, to provide personalized financial advice, assist with transactions, and answer customer queries.

Erica has helped Bank of America customers easily navigate their accounts, increasing customer satisfaction and engagement.

Another example is ING Bank, which implemented a chatbot called "Inge" to handle customer inquiries and guide them through the mortgage application process. ING has significantly reduced the time and effort required for mortgage applications, benefiting both customers and the bank.

Measurable Outcomes and Impact on Business Operations

Implementing Conversational AI in financial institutions has shown measurable outcomes and a positive impact on business operations.

For instance, by automating routine inquiries and transactions, financial institutions have reduced the volume of calls and interactions with human customer service agents, resulting in cost savings and operational efficiency.

Additionally, Conversational AI has helped financial institutions simultaneously handle a larger volume of customer inquiries. This scalability allows for faster response times and improved customer satisfaction.

Furthermore, by leveraging AI capabilities, financial institutions have seen increased cross-selling and upselling opportunities, leading to revenue growth.

Suggested Reading:

Best Practices for Implementing Conversational AI in Financial Services

Financial institutions can successfully implement Conversational AI by considering these best practices, improving customer service, optimizing operations, and enhancing overall customer satisfaction.

Considerations for Choosing the Right Conversational AI Solution

Several factors should be considered when selecting a Conversational AI solution for financial services.

First, assessing the solution's natural language processing capabilities is crucial to ensure an accurate and contextual understanding of customer inquiries.

Additionally, the solution should support integration with existing systems and processes, allowing seamless access to customer data and information.

Consider the scalability and flexibility of the solution to accommodate future growth and changing customer needs.

Lastly, evaluate the security and compliance features of the solution to ensure the protection of sensitive financial data.

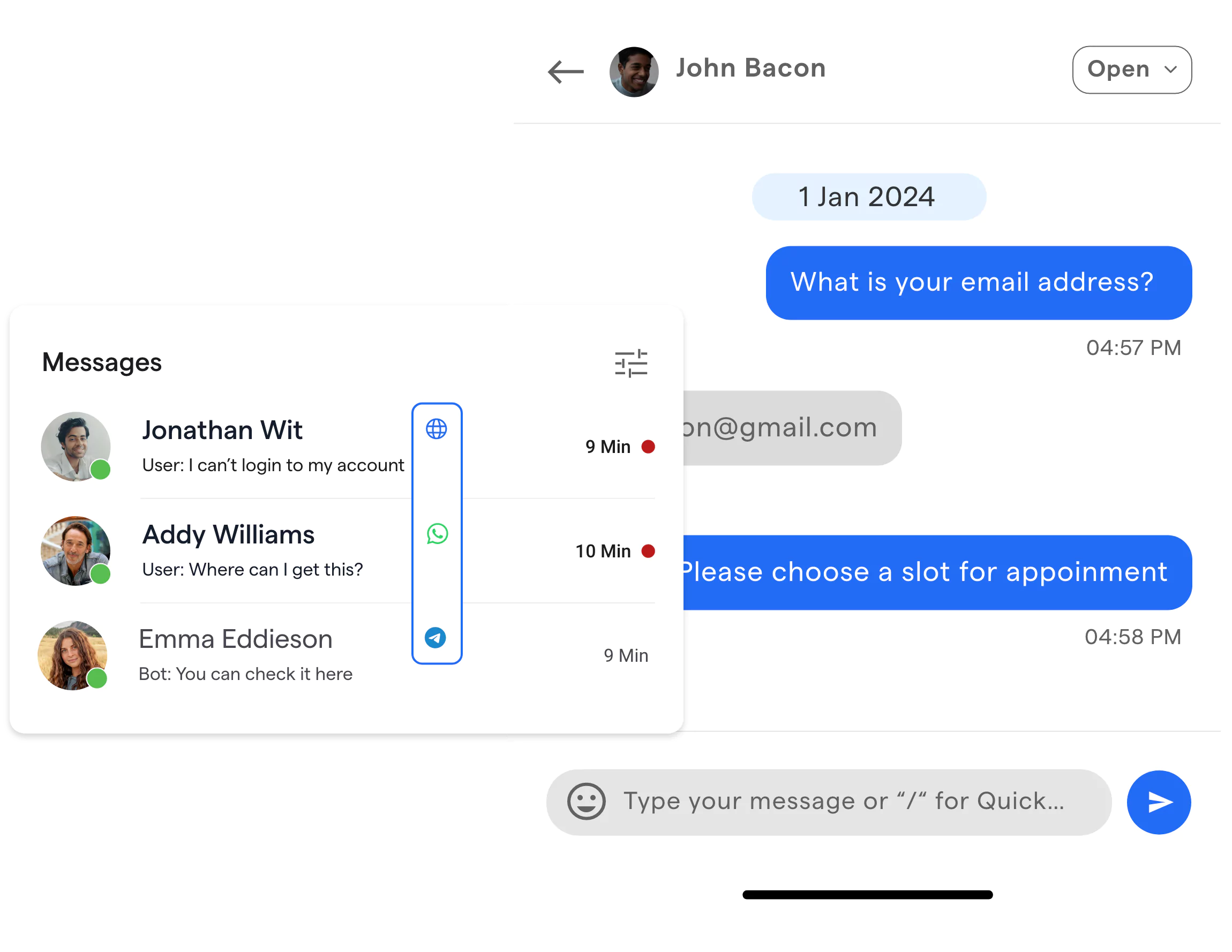

For example, BotPenguin a free custom chatbot development platform aces in providing CRM integrations that include popular CRM platforms like ZOHO, Hubspot, Salesforce, Insightly, and many more.

With the combined benefits of CRM and Chatbots, BotPenguin makes automation services like lead generation and customer support more effective by unifying marketing and sales efforts in one place:

- Marketing Automation

- WhatsApp Automation

- Customer Support

- Lead Generation

- Facebook Automation

- Appointment Booking

Integration with existing systems and processes

Successful implementation of Conversational AI in financial services requires integration with existing systems and processes.

Ensuring the Conversational AI solution seamlessly integrates with core banking systems, customer relationship management platforms, and other relevant databases is essential.

This integration facilitates easy access to customer information, transaction history, and other relevant data to provide personalized and accurate responses to customer inquiries.

Moreover, integration with workflow management systems can enable automated routing of complex inquiries to human representatives when necessary.

Training and support for employees

Implementing Conversational AI requires providing training and support to employees. Training customer service agents and employees to use the Conversational AI system effectively and handle complex inquiries that may require human intervention is crucial.

Additionally, invest in ongoing training and upskilling programs to ensure employees are up to date with the Conversational AI capabilities and can provide seamless assistance to customers.

Regular feedback and support channels should be established to address challenges or issues from implementing the Conversational AI system.

Suggested Reading:

Challenges and Limitations of Conversational AI in Financial Services

Financial institutions can maximize the benefits of Conversational AI by addressing these challenges and adopting appropriate strategies while mitigating potential limitations and risks.

Potential issues and limitations of using Conversational AI

Limited understanding of complex queries: While conversational AI has significantly advanced in natural language processing, it may still need help understanding complex or ambiguous customer queries. This limitation can lead to inaccurate or inadequate responses, potentially frustrating customers.

Lack of empathy and emotional intelligence: Conversational AI cannot typically understand and demonstrate empathy. This can be a challenge in financial services, where customers may seek emotional support or deal with sensitive issues. The AI's inability to respond compassionately may limit customer satisfaction in such scenarios.

Security and privacy concerns: Financial institutions handle sensitive customer data, making security and privacy essential. While Conversational AI systems are designed with security measures, there is always a risk of data breaches or unauthorized access. Implementing robust security protocols and compliance measures to safeguard customer information is crucial.

Strategies to overcome challenges and maximize benefits

Continuous training and improvement: Regularly update and enhance the underlying algorithms of Conversational AI to improve its understanding of complex queries. Continuously train the AI system using real customer interactions to enhance its natural language processing capabilities and accuracy.

Hybrid approach integrating human assistance: Financial institutions can combine Conversational AI with human assistance to handle complex or emotionally sensitive situations. Implement a seamless handover process that allows the AI to recognize when human intervention is required and smoothly transfer customers to human agents.

Transparent communication about AI limitations: Set customer expectations by clearly communicating the capabilities and limitations of Conversational AI. Inform customers that there may be instances where human assistance is necessary, but assure them that the AI system is continuously learning and improving.

Robust security measures: Implement robust security protocols to protect customer data and prevent unauthorized access. Encrypt sensitive information, use secure authentication mechanisms, and regularly audit and update security measures to ensure data privacy and compliance with regulations.

Financial institutions can enhance customer experiences and optimize their operations by proactively addressing these challenges and leveraging the benefits of AI.

Future Trends and Potential of Conversational AI in Financial Services

The future of Conversational AI in financial services looks promising. Emerging technologies such as improved Natural Language Understanding (NLU), multimodal interfaces, emotional intelligence, and explainable AI will revolutionize customer interactions, personalization, risk management, and automation in the finance industry.

Financial institutions should stay informed about these advancements and consider integrating Conversational AI into their operations to enhance customer experience, optimize processes, and navigate the evolving landscape of digital finance.

Emerging Technologies and Advancements in Conversational AI

Natural Language Understanding (NLU): Emerging advancements in NLU aim to improve Conversational AI's ability to understand and interpret customer queries accurately. This includes developing more sophisticated language models, improved contextual understanding, and better handling complex or ambiguous queries.

Multimodal Conversational Interfaces: The future of Conversational AI may involve integrating multiple modalities such as voice, text, and video interactions. This can provide customers with a more immersive and personalized experience, allowing them to interact with the AI system through their preferred mode of communication.

Emotional Intelligence: Research in emotional AI aims to enable Conversational AI systems to recognize and respond to customers' emotions effectively. This can help financial institutions provide more empathetic and tailored support, understanding customer sentiments and delivering appropriate responses.

Explainable AI: Future Conversational AI systems may focus on providing transparent and explainable customer responses. This involves building AI models that articulate their decision-making processes, helping customers understand why a recommendation or action is being suggested.

Predictions for the Future of Conversational AI in Finance

Increased Adoption: The adoption of Conversational AI in financial services is expected to grow significantly in the coming years. As AI technology improves and customer expectations evolve, financial institutions will prioritize implementing Conversational AI to enhance customer service and streamline operations.

Enhanced Personalization: With advancements in NLU and emotional intelligence, Conversational AI systems can provide highly personalized customer interactions. This includes understanding customer preferences, tailoring responses to individual needs, and delivering targeted recommendations or offers.

Improved Risk Management: AI-powered conversation systems can play a vital role in risk management for financial institutions. By continuously analyzing and monitoring customer interactions, Conversational AI can assist in identifying potential fraud, detecting unusual activities, and proactively managing risk in real time.

Seamless Integration and Automation: Future Conversational AI systems will seamlessly integrate with existing financial platforms and systems. This integration enables the automation of various processes, such as account inquiries, transaction monitoring, and essential customer support, freeing human agents to focus on higher-value tasks.

Conclusion

The financial industry embraces intelligent conversational platforms to improve customer satisfaction while reducing costs and friction.

Conversational AI enables the automation of services by interacting naturally with customers at scale without human intervention.

Financial institutions are already seeing significant benefits from personalized banking to insurance advisors that identify needs. Seamless voice and chat interfaces increase engagement and trust. Automating repetitive tasks improves operations.

Analyzing conversations provides valuable insights. Most importantly, customers get quick resolutions and customized financial advice anytime, anywhere.

With continual advances in natural language processing, Conversational AI will become integral to delivering efficient, accessible financial services.

Intelligent conversational agents have firmly established their position as the future of automated, humanized interactions between financial institutions and their customers.

Also, if you want a financial chatbot, head onto the BotPenguin website.

Suggested Reading:

Frequently Asked Questions (FAQs)

What is a Conversational AI in financial services?

A Conversational AI is an artificial intelligence-driven technology that simulates human conversations through various communication channels such as voice and text. Conversational AI can assist customers with basic queries, process transactions, and provide personalized services in financial services.

What are the benefits of Conversational AI in financial services?

The benefits of Conversational AI in financial services include increased customer satisfaction, streamlined operations, cost efficiencies, and enhanced risk management. Conversational AI can automate routine tasks, provide personalized interactions, and proactively detect potential fraud and unusual activities.

What are the ethical considerations for implementing Conversational AI in finance?

Ethical considerations for Conversational AI in finance include ensuring fairness, transparency, and bias-free processes. Financial institutions should monitor and mitigate the risks of any unintended consequences of using AI for customer interactions and decision-making processes.

How can financial services businesses implement Conversational AI?

Financial services businesses can implement Conversational AI by partnering with technology providers that offer ready-to-use automation solutions or building in-house expertise. A thorough evaluation of use cases, regulatory requirements, and customer needs can help businesses choose the right approach.

What are some of the limitations of Conversational AI in financial services?

Limitations of Conversational AI in financial services include limited language support, difficulty in accurately interpreting natural language, and reliance on structured data. Financial institutions should evaluate these limitations and develop strategies to address them.

What impact will Conversational AI have on the future of financial services?

Conversational AI is set to revolutionize customer experience and operational efficiency in financial services. With further technological advancements, Conversational AI will provide more sophisticated and personalized services, enabling financial institutions to stay competitive in the digital age.