Introduction

Conversational AI is revolutionizing customer interactions in the financial sector, particularly through conversational AI solutions.

Conversational AI in insurance, banking, and finance is transforming how institutions engage with their clients, offering personalized, efficient, and round-the-clock service.

But what is conversational AI? Conversational AI is an advanced technology that enables human-like interactions between computers and users through voice or text, powered by natural language processing and machine learning.

Recent statistics highlight the growing importance of conversational AI in finance. According to a report by Juniper Research, the global value of successful banking transactions via conversational AI will reach $524 billion by 2027, up from $29 billion in 2022.

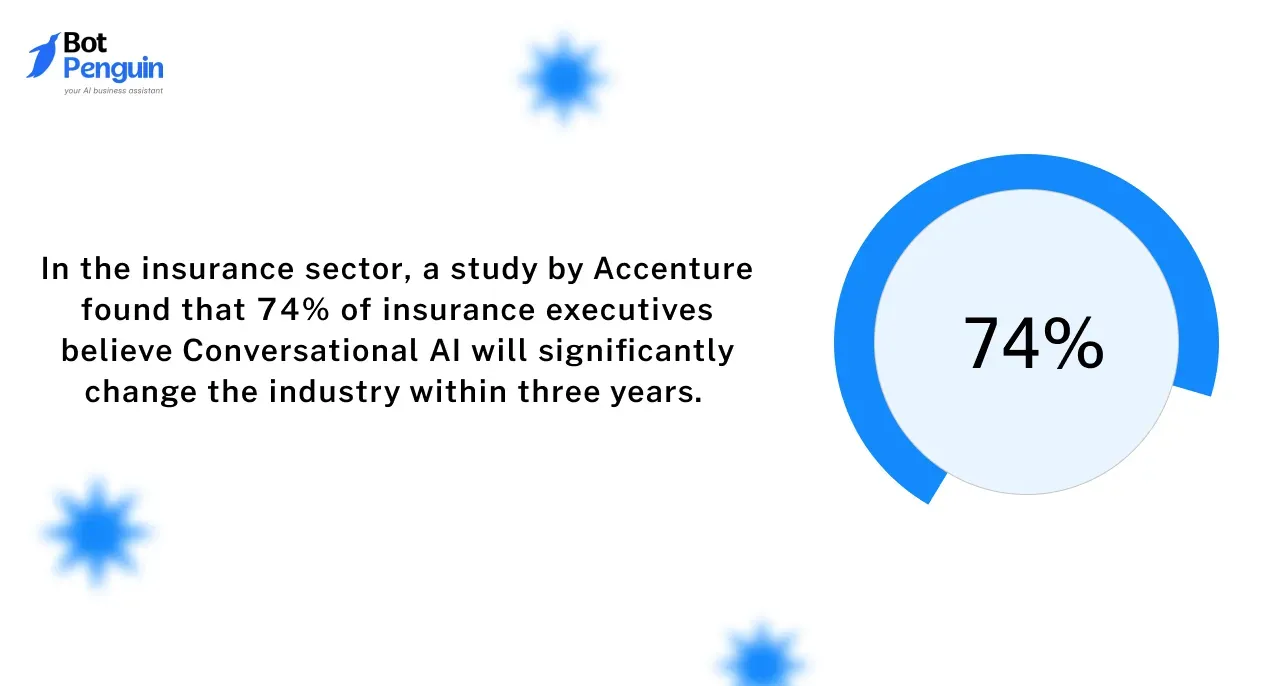

In the insurance sector, a study by Accenture found that 74% of insurance executives believe Conversational AI will significantly change the industry within three years.

The best conversational AI solutions are driving this change, with chatbots and virtual assistants handling increasingly complex queries and transactions.

As financial institutions seek to enhance customer experience and operational efficiency, conversational AI for finance is becoming an indispensable tool. From answering basic inquiries to providing personalized financial advice, conversational AI banking is setting new standards for customer service.

So continue reading to know more about how Conversational AI enhances financial customer interactions.

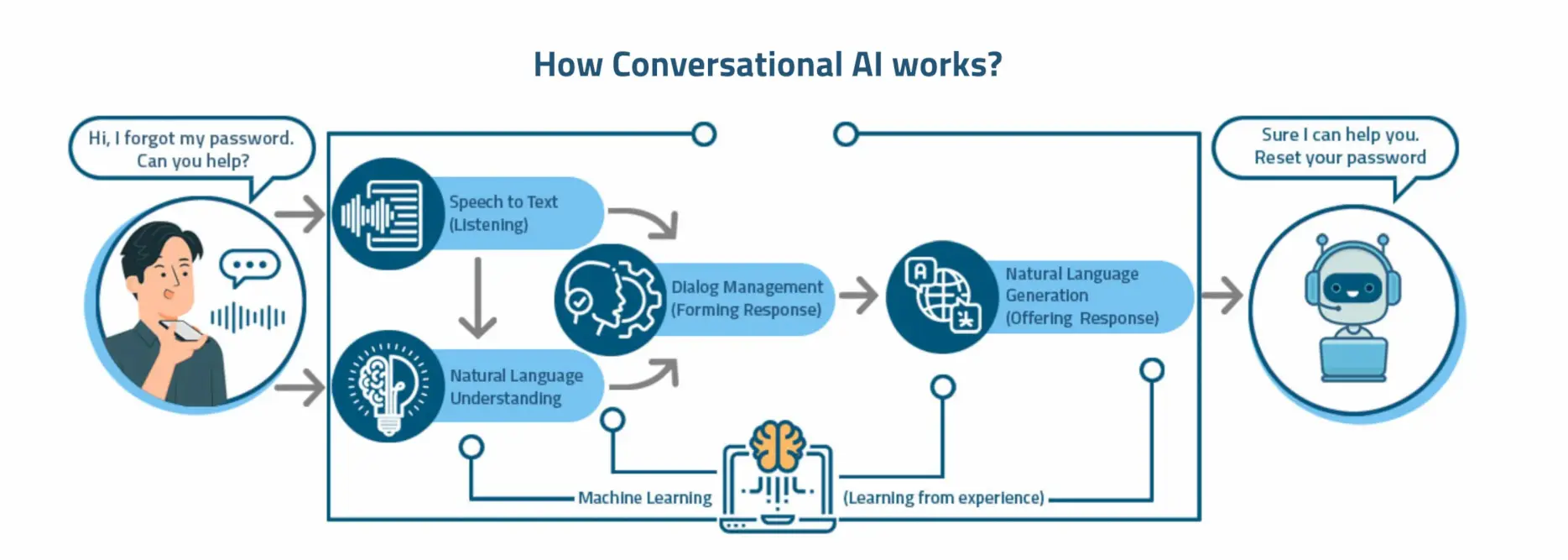

How Conversational AI Works

Conversational AI is a type of artificial intelligence that can create new content.

It learns patterns from vast amounts of data and uses this knowledge to generate responses, images, or even entire articles. Here’s a breakdown of its core components:

- Data Collection and Training: Generative AI models require massive datasets to learn from. For example, a conversational AI for finance might be trained on thousands of customer service interactions.

- Natural Language Processing (NLP): NLP allows the AI to understand and generate human language. It breaks down sentences, understands context, and constructs meaningful responses.

- Model Deployment: After training, the AI model is deployed into real-world applications like chatbots, virtual assistants, or fraud detection systems.

Current Challenges in Financial Customer Interactions

Understanding these challenges is essential to appreciate how Generative AI can transform the sector.

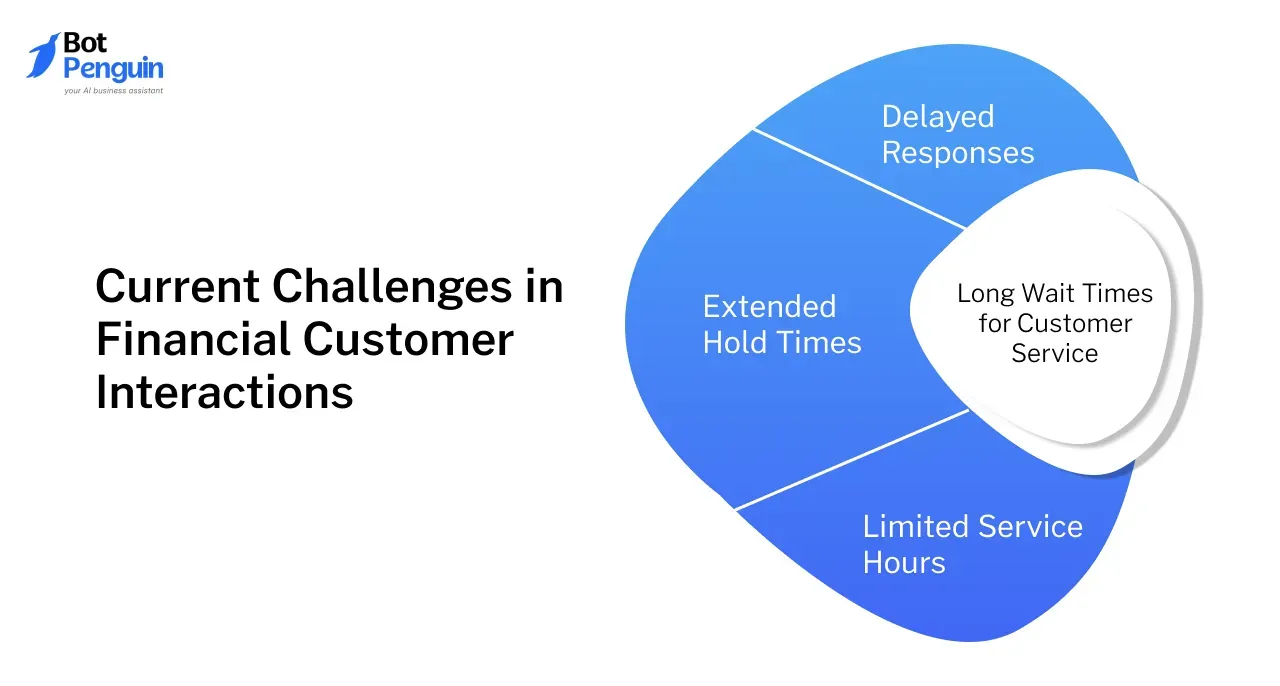

Long Wait Times for Customer Service

One of the most common complaints from customers is the long wait time when seeking assistance.

- Extended Hold Times: Customers often wait for extended periods to speak with a human agent, especially during peak hours.

This can lead to frustration and dissatisfaction when trying to resolve even simple issues.

- Delayed Responses: Email and web inquiries can take days to get a response, leaving customers anxious and impatient.

The delay in addressing concerns or queries can negatively impact customer trust.

- Limited Service Hours: Traditional customer service is typically available only during business hours, which can be inconvenient for many customers.

This limitation means customers often have to wait until the next business day for help, causing delays in resolving urgent matters.

Difficulty in Accessing Personalized Financial Advice

Personalized financial advice is valuable but often hard to obtain through conventional means.

- Generic Advice: Banks provide generic advice that may not suit individual needs, leading to suboptimal financial decisions.

Customers receive one-size-fits-all recommendations that don't account for their unique financial goals and situations.

- Inaccessible Expert Advice: Access to financial advisors can be expensive and limited to high-net-worth individuals.

Many people are unable to afford professional financial advice, leaving them to navigate complex financial decisions on their own.

- Complex Financial Products: Customers struggle to understand complex financial products and services without personalized guidance.

Without expert help, they may find it difficult to choose the best options for their needs, potentially making costly mistakes.

Limited Availability of Human Agents

Human agents are crucial but limited in number, affecting service quality and availability.

- High Workload: Agents are often overworked, leading to burnout and reduced service quality. The high volume of calls and queries can result in rushed interactions and occasional errors, affecting customer satisfaction.

- Insufficient Staffing: Many financial institutions struggle with understaffing, especially during busy periods. This can lead to longer wait times and slower resolution of customer issues, as there aren't enough agents to handle the demand efficiently.

- Human Error: Even the best-trained agents can make mistakes, which can significantly impact customers. Errors in processing transactions or providing information can cause delays and complications, leading to customer frustration.

Applications of Conversational AI in Financial Customer Interactions

In this section, you'll find the applications of Generative AI in financial customer interactions.

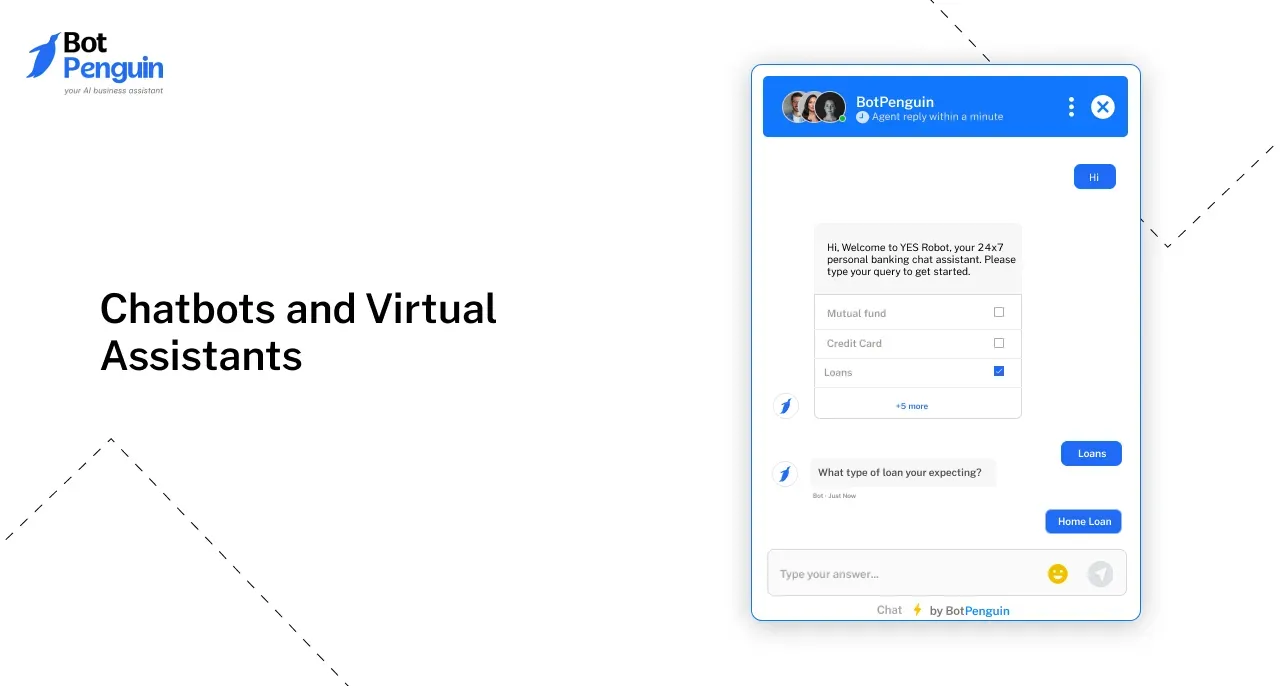

Chatbots and Virtual Assistants

Conversational AI plays a pivotal role in customer service through chatbots and virtual assistants. These tools offer several benefits:

- Instant Responses to Customer Queries: Chatbots, like BotPenguin, can respond to customer inquiries immediately, providing quick resolutions and enhancing customer satisfaction. Customers no longer have to wait on hold or navigate through automated phone menus to get answers to their questions.

- 24/7 Availability: AI tools are available around the clock, ensuring customers receive assistance at any time of the day or night.

This continuous availability eliminates the inconvenience of limited service hours and ensures that problems are addressed promptly, regardless of the hour.

Personalized Financial Advice

Conversational AI excels in providing personalized financial advice, tailored to individual needs and goals.

- Tailored Recommendations: AI analyzes a customer’s financial situation and goals to offer personalized advice, enhancing the relevance and effectiveness of the guidance provided. Customers receive recommendations that are specifically suited to their financial goals and situations.

- Automated Portfolio Management: AI can manage investment portfolios automatically, adjusting asset allocations based on market conditions and individual preferences.

This automation helps maintain optimal investment strategies, ensuring that investments are regularly rebalanced to maximize returns and minimize risks.

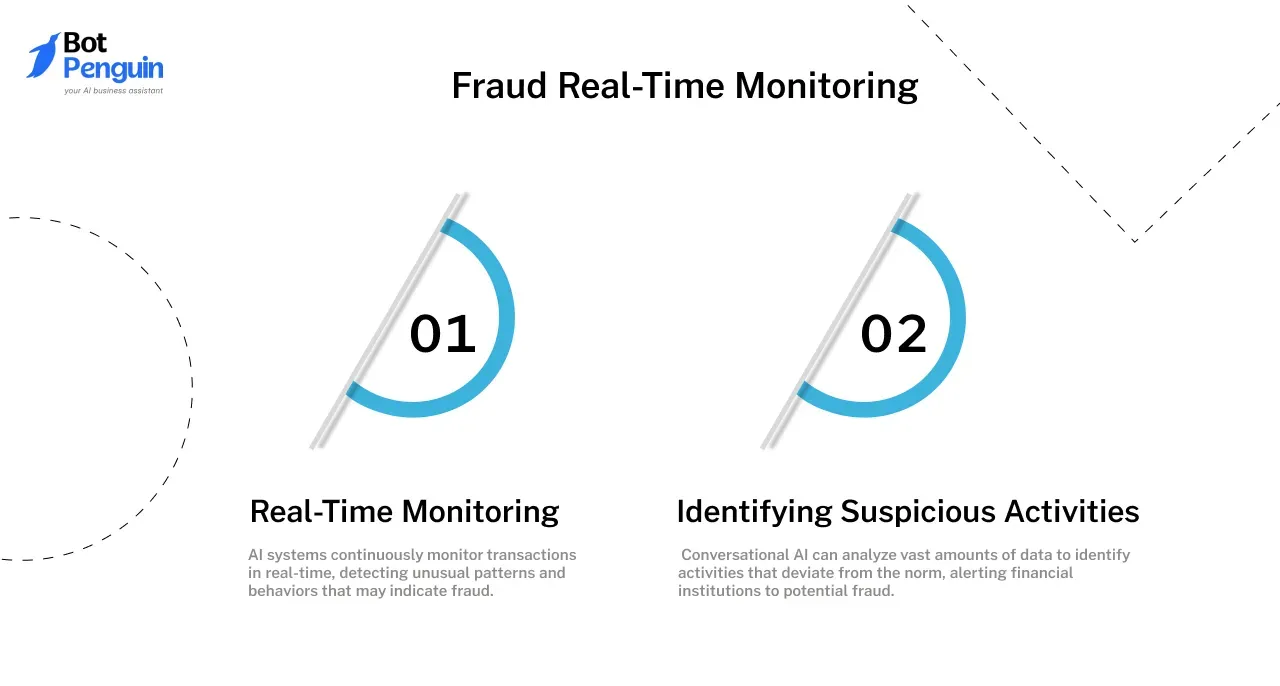

Fraud Detection and Prevention

Conversational AI enhances security in the financial sector by identifying and preventing fraudulent activities.

- Real-Time Monitoring: AI systems continuously monitor transactions in real-time, detecting unusual patterns and behaviors that may indicate fraud.

This real-time vigilance helps prevent unauthorized access and loss of funds, providing an extra layer of security.

- Identifying Suspicious Activities: Conversational AI can analyze vast amounts of data to identify activities that deviate from the norm, alerting financial institutions to potential fraud. By identifying suspicious patterns, banks can take swift action to protect the customer’s assets and prevent financial crimes.

Benefits of Conversational AI in Financial Customer Interactions

There are many benefits of conversational AI in financial customer interactions, like:

Fast Service and Consistent Support

Conversational AI significantly enhances customer satisfaction by delivering faster service and consistent support.

Faster Service:

Conversational AI provides instant responses to customer inquiries, reducing wait times and resolving issues quickly.

This immediate assistance helps build trust and satisfaction, as customers do not have to endure long hold times or delays in getting their questions answered.

Consistent Support:

AI systems offer reliable and uniform support across all interactions. Unlike human agents who might vary in performance, AI ensures that every customer receives the same high level of service every time.

This consistency is crucial for maintaining customer confidence and satisfaction.

Suggested Reading:

5 Things to look for in a Conversational AI Platform

Enhanced Efficiency

Conversational AI improves the efficiency of financial institutions by reducing the workload on human agents and streamlining operations.

Reduced Workload for Human Agents:

AI handles routine inquiries and tasks, freeing up human agents to focus on more complex and high-value activities. This reduces burnout and allows agents to be more effective and productive in their roles.

For example, while AI can manage balance inquiries and transaction details, human agents can dedicate their time to addressing more complicated financial issues and providing personalized advice.

Cost Savings

The implementation of Conversational AI leads to significant cost savings for financial institutions through lower operational costs and increased profitability.

Lower Operational Costs:

By automating routine tasks and customer interactions, AI reduces the need for a large customer service workforce.

This automation cuts down on salary expenses, training costs, and the need for extensive customer service infrastructure. For instance, banks that utilize conversational AI solutions can operate with fewer staff while maintaining or even improving service levels.

Suggested Reading:

Why is BotPenguin the best Conversational AI Platform?

Increased Profitability:

AI-driven efficiency and customer satisfaction translate into higher profitability. Satisfied customers are more likely to use additional services and remain loyal to their financial institution, boosting revenue.

Additionally, AI can optimize financial products and services, identifying cost-saving opportunities and enhancing overall financial performance.

Conclusion

In conclusion, the adoption of conversational AI in the insurance, banking, and finance sectors is not just a trend, but a fundamental shift in how financial institutions interact with their customers.

The best conversational AI solutions are proving to be game-changers, offering 24/7 support, personalized experiences, and efficient problem-solving capabilities.

As we've explored, conversational AI for finance is revolutionizing customer service, from handling routine inquiries to providing complex financial advice.

The impact of conversational AI banking is particularly significant, streamlining operations and enhancing customer satisfaction. Insurance companies leveraging conversational AI in insurance are seeing improved claim processing times and more personalized policy recommendations.

Conversational AI can understand context, learn from interactions, and provide human-like responses setting new standards for service quality. As technology continues to evolve, we can expect even more sophisticated conversational AI solutions to emerge.

Financial institutions that embrace these technologies will likely see increased customer loyalty, reduced operational costs, and improved efficiency. The journey of conversational AI in finance is just beginning, and its potential to transform the industry is immense.

Frequently Asked Questions (FAQs)

How do AI chatbots improve financial customer service?

AI chatbots provide instant, 24/7 responses to customer queries, reducing wait times and improving satisfaction. They handle routine tasks efficiently, allowing human agents to focus on complex issues.

What benefits does Conversational AI offer financial institutions?

Conversational AI enhances customer satisfaction, improves operational efficiency, reduces costs, and increases profitability by automating tasks, providing personalized services, and detecting fraud in real-time.

How does Conversational AI ensure data security in financial services?

Conversational AI continuously monitors transactions for unusual patterns, identifying and preventing fraudulent activities. It also complies with data privacy regulations, ensuring customer data is secure.

Can Conversational AI provide personalized financial advice?

Yes, Conversational AI analyzes individual financial data to offer tailored recommendations and automated portfolio management, helping customers make informed financial decisions.

How can financial institutions implement Conversational AI effectively?

Financial institutions should select integrated AI solutions, focus on data privacy, train human agents for complex tasks, and continuously monitor and adjust AI performance for optimal results.