Introduction

Merchant services providers (MSPs) are companies that offer businesses the ability to accept credit card and other electronic payments. To know more continue reading.

Overview of Merchant Services Provider

Merchant services providers help businesses handle payments. They let customers pay with credit cards, debit cards, and other methods. This is key for any business that wants to grow.

Importance of Merchant Services Provider

A merchant services provider makes these payments possible. They offer the tools and support needed for smooth transactions. This ensures businesses can serve their customers better.

Types of Merchant Services Provider

Merchant services provider are essential for businesses that want to accept electronic payments. Let's break down the different types of providers.

Traditional Banks

Traditional banks have been offering merchant services for a long time. They are reliable and secure. When you choose a bank for your payment processing, you get the trust and stability that come with a well-known institution. However, they can be a bit slow and have strict requirements.

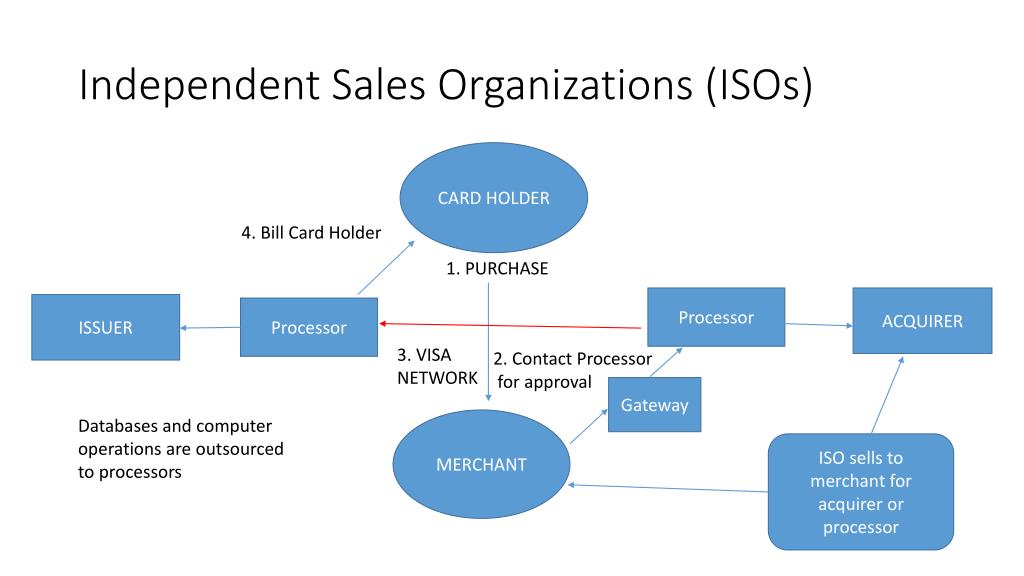

Independent Sales Organizations (ISOs)

Independent Sales Organizations, or ISOs, are third-party companies. They work with multiple banks and offer more flexible options than traditional banks. ISOs can be more responsive and may offer better rates. They are a good choice for businesses that need flexibility and personalized service.

Payment Facilitators (PayFacs)

Payment Facilitators, known as PayFacs, make it easy for small businesses to start accepting payments. They bundle multiple merchants under one account. This setup speeds up the approval process and simplifies management. PayFacs are great for startups and small businesses looking for a quick and easy solution.

Online Payment Gateways

Online Payment Gateways specialize in processing online transactions. They are essential for e-commerce businesses. An online payment gateway acts as a virtual cash register, ensuring that payments are processed smoothly and securely. They support various payment methods, making them ideal for businesses selling products and services online.

Key Features of Merchant Services Providers

Merchant services providers offer a range of features to help businesses manage payments. Let's look at some key features that can make a big difference.

Payment Gateway

The first features of merchant services provider is payment gateway:

- Secure Online Transactions: A payment gateway ensures that online transactions are safe and secure.

- Multiple Payment Methods: Accept credit cards, debit cards, and digital wallets.

- Real-Time Processing: Payments are processed instantly, reducing wait times for customers.

- Fraud Detection: Built-in tools help identify and prevent fraudulent transactions.

Virtual Terminal

This feature, of merchant services provider, includes:

- Phone and Mail Orders: Take payments over the phone or through mail orders easily.

- No Physical Terminal Needed: Process transactions without needing a physical card reader.

- Flexible Payment Options: Accept various payment types, including credit cards and e-checks.

- Easy to Use: Simple interface that makes processing payments quick and easy.

Mobile Payment Solutions

Next merchant services provider feature is mobile payment solutions:

- On-the-Go Payments: Accept payments anywhere, whether at a market, event, or on-site service.

- Smartphone and Tablet Compatible: Use mobile devices to process transactions.

- Contactless Payments: Accept tap-and-go payments, making the process faster for customers.

- Instant Receipts: Send digital receipts immediately to customers.

Recurring Billing and Subscriptions

Billing and subscriptions is another crucial feature of merchant services provider:

- Automated Payments: Set up recurring payments for subscription services or regular billing.

- Customer Convenience: Customers enjoy hassle-free, automatic billing.

- Revenue Predictability: Businesses can predict cash flow more accurately.

- Flexible Plans: Offer various subscription plans and billing cycles.

Suggested reading : Customer Experience

Multi-Currency Support

Last feature of MSP is multi-currency support:

- Global Sales: Accept payments in different currencies, expanding your customer base.

- Automatic Conversion: Convert currencies automatically at current exchange rates.

- Localized Pricing: Display prices in customers' local currencies for a better shopping experience.

- Reduced Conversion Fees: Save on conversion fees with direct multi-currency acceptance.

Suggested reading : Customer Support Automation

Benefits of Using a Merchant Services Provider

Using a merchant services provider offers many benefits that can help your business thrive. Let's explore these benefits in detail.

Improved Cash Flow

The first benefit of merchant services provider includes:

- Faster Payments: Payments are processed quickly, which means you get your money faster.

- Consistent Income: Regular payment processing leads to a more predictable cash flow.

- Less Handling of Cash: Reduces the need for handling large amounts of cash, making your operations smoother.

- Automatic Deposits: Funds are automatically deposited into your account, saving you time.

Access to Analytics and Reporting

Having anytime access to analytics and reporting is always an advantage:

- Sales Insights: Detailed reports help you understand your sales trends and customer behavior.

- Track Performance: Monitor your business performance with real-time data.

- Identify Opportunities: Find out what products or services are doing well and where there’s room for improvement.

- Simplify Accounting: Easy access to transaction records simplifies your accounting processes.

Enhanced Security Measures

With growing cyber threats, having enhanced security measures in merchant services provider is always a bonus:

- Fraud Prevention: Advanced security features help protect against fraud and chargebacks.

- Secure Transactions: All transactions are encrypted, ensuring your customers' data is safe.

- Compliance: Helps you stay compliant with industry standards and regulations.

- Peace of Mind: Knowing your payments are secure gives you and your customers peace of mind.

Understanding Managed Security Services Provider (MSSP) in Merchant Services

A Managed Security Services Provider offers outsourced monitoring and management of security devices and systems. Managed security services provider in MSPs provide a range of security services, including:

- Threat Detection and Response: Managed security services provider monitors networks and systems for potential security threats and responding to incidents.

- Vulnerability Management: Identifying and addressing vulnerabilities in the business’s IT infrastructure.

- Compliance Management: Managed security services provider ensures that the business meets industry standards and regulations (e.g., PCI DSS for payment processing).

- Security Information and Event Management (SIEM): Collecting and analyzing data from various sources to identify and respond to potential security incidents.

- Firewalls and Intrusion Detection Systems (IDS): Managed security services provider manage and monitor these critical security components.

The Role of IT Services Provider in Merchant Services

An IT Services Provider offers a broad range of technology-related services to support the business’s IT infrastructure. These services can include:

- Network Management: Network management of IT services provider ensures the business’s network is reliable and secure.

- Technical Support: The technical role of an IT services provider is to provide helpdesk and troubleshooting services for IT-related issues.

- System Integration: The IT services provider implements and integrates various IT systems and software.

- Cloud Services: An IT services provider manages cloud infrastructure and services, such as data storage and cloud computing resources.

- Software Development: Creating custom software solutions to meet the specific needs of the business.

- IT Strategy and Consulting: An IT services provider in MSPs offers advice and strategic planning for technology investments and improvements.

Frequently Asked Questions(FAQs)

What are merchant services and how do they work?

Merchant services allow businesses to accept and process electronic payment transactions, typically through credit/debit card processing, online payments, and mobile payments, using technology and a service provider.

How do I choose the right merchant services provider for my business?

Select a provider based on your business size, transaction volume, specific needs like mobile or online payments, and compare fees, security features, and customer support.

What are the typical fees associated with merchant services?

Fees can include transaction fees, monthly or annual service fees, setup fees, and potentially equipment rental or purchase costs, varying greatly among providers.

How can merchant services enhance customer experience?

Offering multiple payment options, including seamless online and mobile payments, improves convenience and speeds up transactions, enhancing the overall customer experience.

Are there any risks involved with using merchant services?

Risks include potential data breaches and fraud, but these can be mitigated with providers that offer robust security measures and comply with PCI DSS standards.

Can I use merchant services for an online-only business?

Yes, merchant services are adaptable to online-only businesses, providing payment gateways and processors that integrate with websites and e-commerce platforms for secure transaction processing.