What is Absorption Costing?

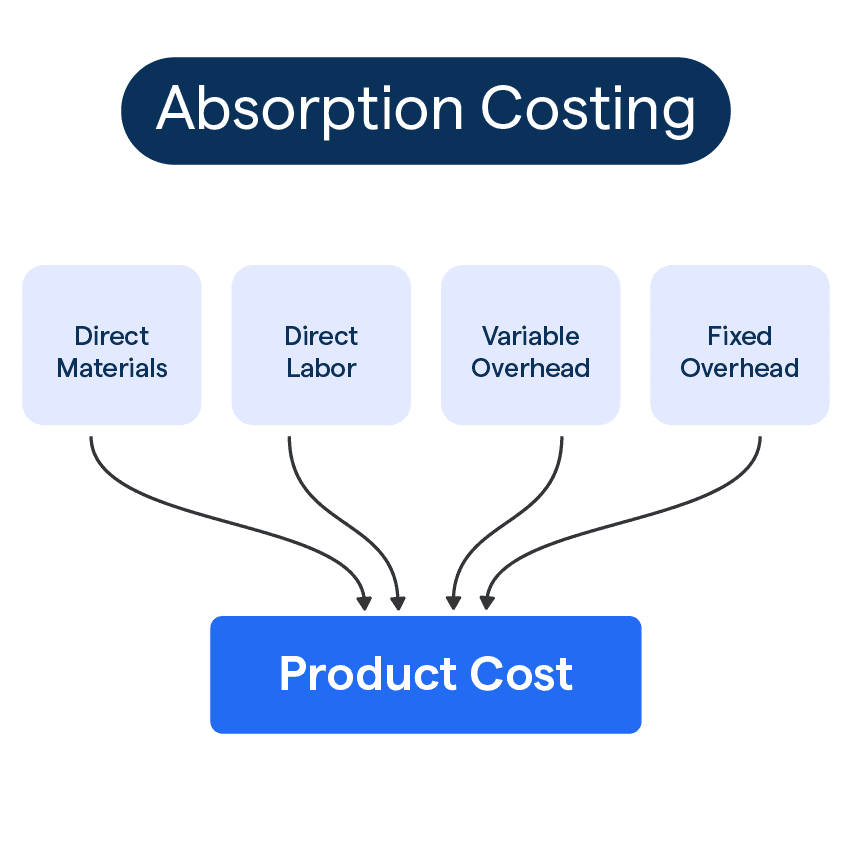

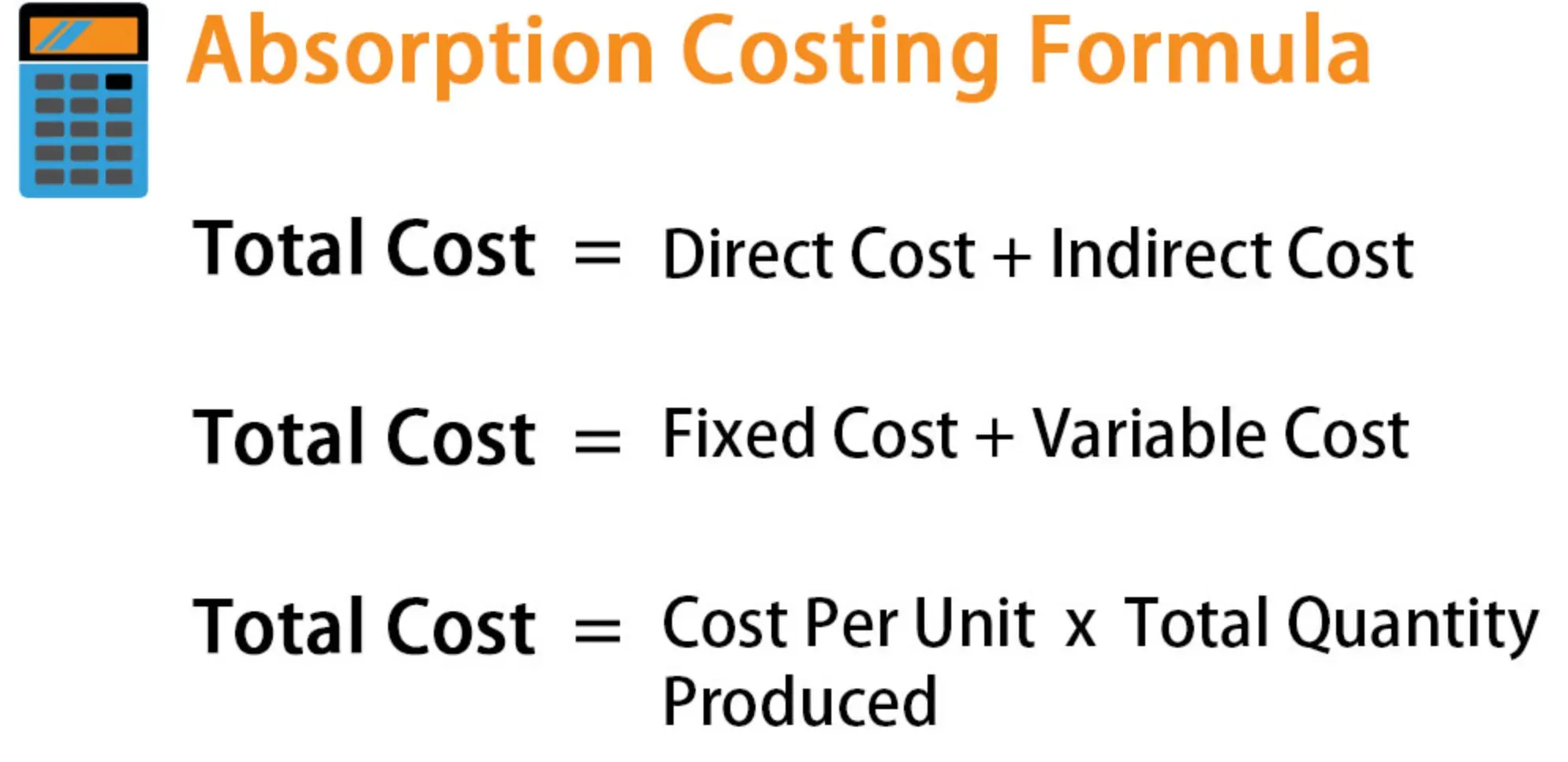

An accounting method that takes all costs into account—both variable and fixed—is known as absorption costing. This method charges all direct, indirect, and fixed manufacturing costs to individual units of production.

Having a clear understanding of absorption costing can help businesses better manage their finances. In absorption costing, all costs that were incurred while manufacturing a product—be it costs related to materials, labor, or overhead—are included in the final price.

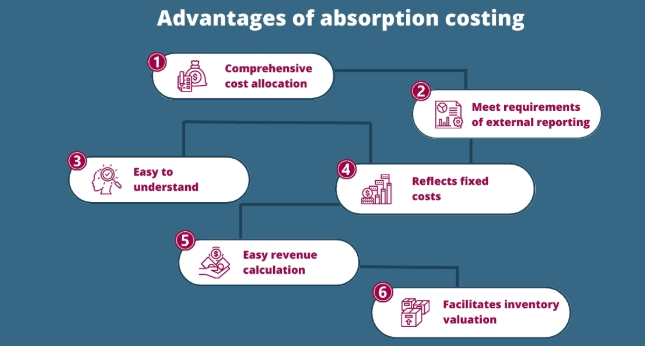

Advantages of Absorption Costing

Just like every other method, absorption costing also comes with its share of advantages. These are some areas where it performs exceptionally well:

Provides a Holistic View

Absorption costing takes into account all production costs so you can see the bigger picture. It's a comprehensive method, giving a more accurate measure of profitability.

Facilitates Better Planning

Looking at all costs helps managers plan more confidently. You can set better pricing strategies and budget forecasts based on comprehensive cost information.

Ensures Tax Compliance

In many jurisdictions, absorption costing is required for tax reporting. By adhering to this method, businesses can easily comply with tax regulations.

Disadvantages of Absorption Costing

However, absorption costing isn't without its downsides. Here's where it falters:

- Can Obscure True Costs: While it’s beneficial to consider all costs, combining variable expenses and fixed costs can sometimes obscure the actual cost incurred per unit.

- Provides a Chance for Profit Manipulation: Because fixed overhead is spread across all units, a sudden increase in production can, on paper, decrease the cost per unit and artificially inflate reported profit.

- Differences with Variable Costing: Absorption costing treats fixed overhead differently than variable costing. This lack of uniformity can lead to discrepancies in financial reporting.

Absorption Costing in Practice

How is absorption costing used in real-world settings? Let’s dive into that.

Impact on Profit

When production quantities and sold units differ, absorption costing can significantly impact reported profit. This is because unsold stock treated as assets includes a portion of fixed overhead costs.

In Production Environments

Absorption costing works well in production environments where understanding the total cost of manufacturing a product is crucial for pricing and profitability analysis.

Inventory Valuation

When it comes to valuing inventory, absorption costing is often the preferred method as it applies part of the fixed manufacturing overhead costs to the unsold units.

Absorption Costing vs Other Methods

No two accounting methods are created equal. How does absorption costing compare to alternatives?

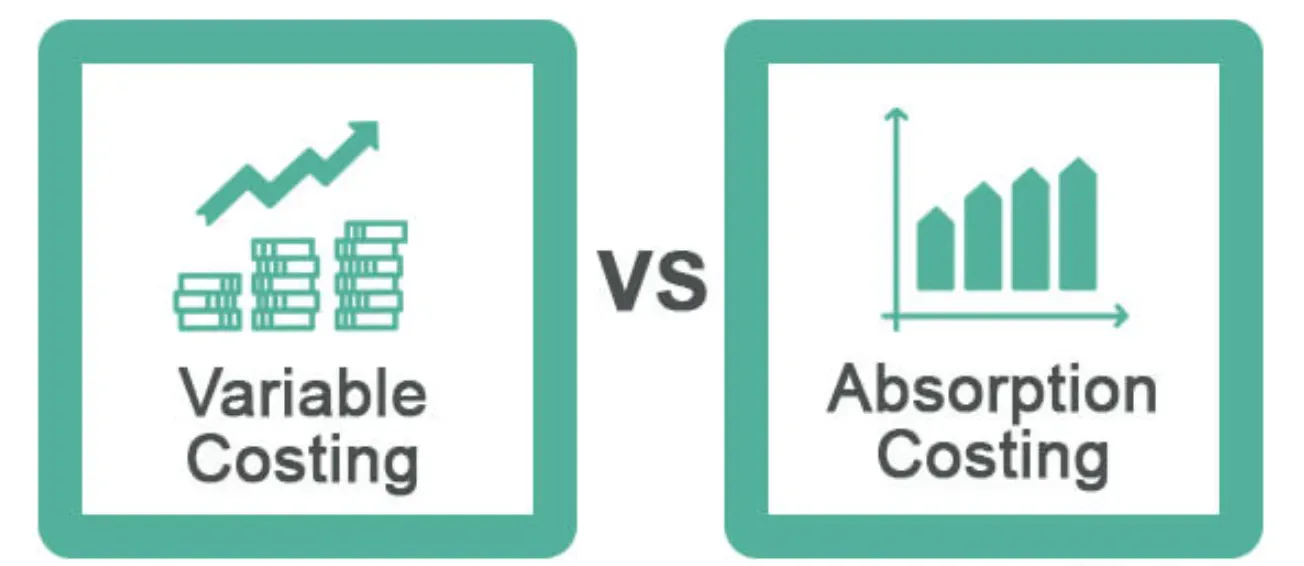

Absorption Costing vs Variable Costing

While absorption costing takes into account variable and fixed costs, variable costing only considers variable costs directly attributable to a product.

Absorption Costing vs Activity-Based Costing

Activity-Based Costing (ABC) offers a more detailed and nuanced approach by assigning costs to specific activities involved in production.

However, this can be more time-consuming and complex than absorption costing.

Absorption Costing vs Throughput Accounting

Throughput Accounting focuses only on truly variable costs and treats fixed overhead as a period expense.

The simplicity of this method can be a boon, but it might not give a complete picture of costs like absorption costing.

Frequently Asked Questions (FAQs)

What is absorption costing?

Absorption costing is a method of accounting for manufacturing costs that assigns all direct and indirect production costs to the units produced.

These costs include direct materials, direct labor, and both variable and fixed manufacturing overhead expenses. Absorption costing is commonly used for external financial reporting purposes.

What does absorption costing mean in accounting?

Absorption costing is an accounting method that assigns all production costs, both variable and fixed, to the individual units being produced.

What is an advantage of absorption costing?

Absorption costing provides a comprehensive view of production costs, making it beneficial for planning, pricing, budgeting, and tax purposes.

What is the disadvantage of absorption costing?

Absorption costing can obscure the true cost per unit and provide opportunities for profit manipulation. It also yields different results compared to variable costing because of how fixed overhead is treated.

When is absorption costing typically used?

Absorption costing is mainly used for external financial reporting, income tax computation, and inventory valuation.

How does absorption costing compare to other methods?

Versus variable costing, absorption costing includes fixed costs. Against Activity-Based Costing (ABC), it is less complex but also less nuanced. Compared to Throughput Accounting, it takes into account both variable and fixed costs.