Introduction

Not all chatbots in finance do the same thing.

Some are built to answer questions. Others are built to help you take action — like sending money, applying for a loan, or managing your spending. These are called fintech chatbots.

They’re becoming more common as digital finance grows. You’ve probably used one without even realizing it.

In this guide, you’ll learn what fintech chatbots are, how they work, where they’re used, and why they matter. We’ll also look at real examples, use cases, and how AI is shaping their future.

What are Fintech Chatbots?

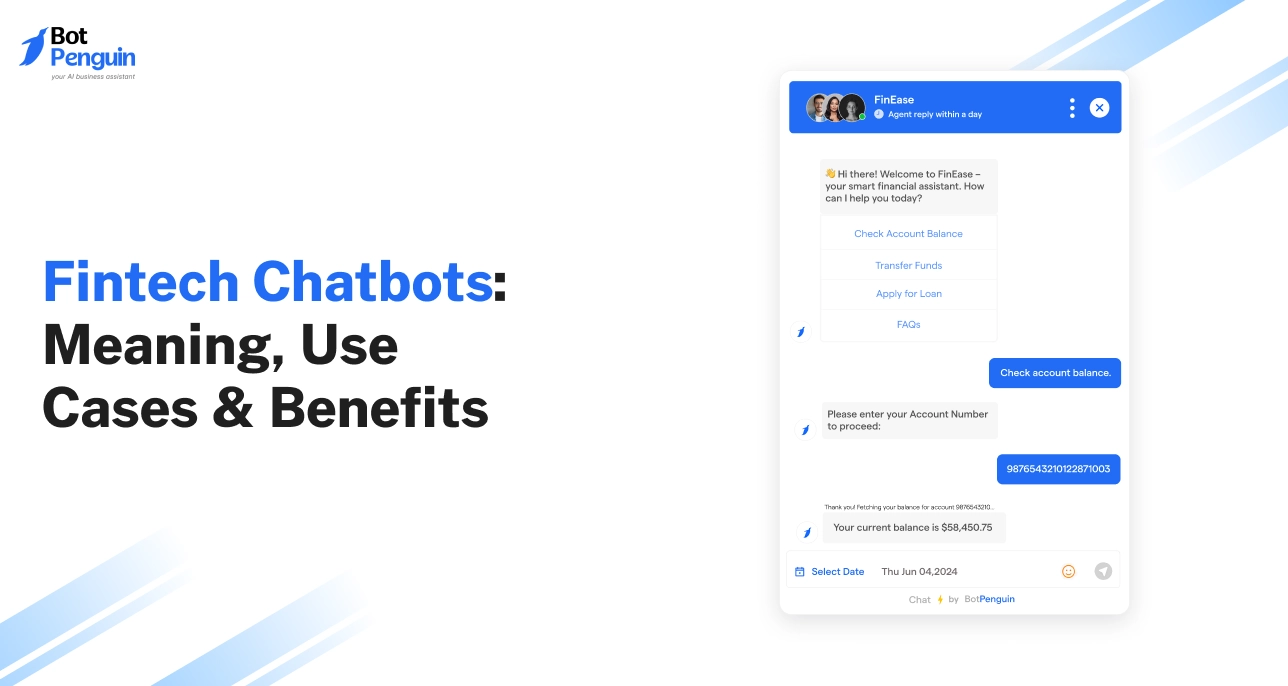

A fintech chatbot is a digital assistant built into financial technology products.

Unlike basic customer service bots, these are designed to do more than answer FAQs.

They can help users send money, track expenses, apply for loans, or even receive investment tips — all within a simple, conversational interface.

They work behind the scenes in banking apps, lending platforms, payment systems, and digital wallets. Whether you're asking about your recent transactions or trying to get a quick loan quote, these bots can make that process fast, easy, and frictionless.

Many are powered by AI, natural language processing (NLP), or rule-based logic, depending on how complex the task is.

How Fintech Chatbots Work

Let’s say you ask your banking app, “What’s my account balance?” or “Send $50 to Max.” The chatbot reads your request, understands the intent, and responds — all within seconds.

It does this using a mix of predefined rules or AI-based models trained on financial data. The response might come from your bank’s internal system, a third-party API, or a customer relationship management (CRM) platform.

Some chatbots are simple — they follow a script.

Others are intelligent, capable of learning and adapting based on how you talk and what you need.

The result? Fast, personalized service without switching apps or waiting on hold.

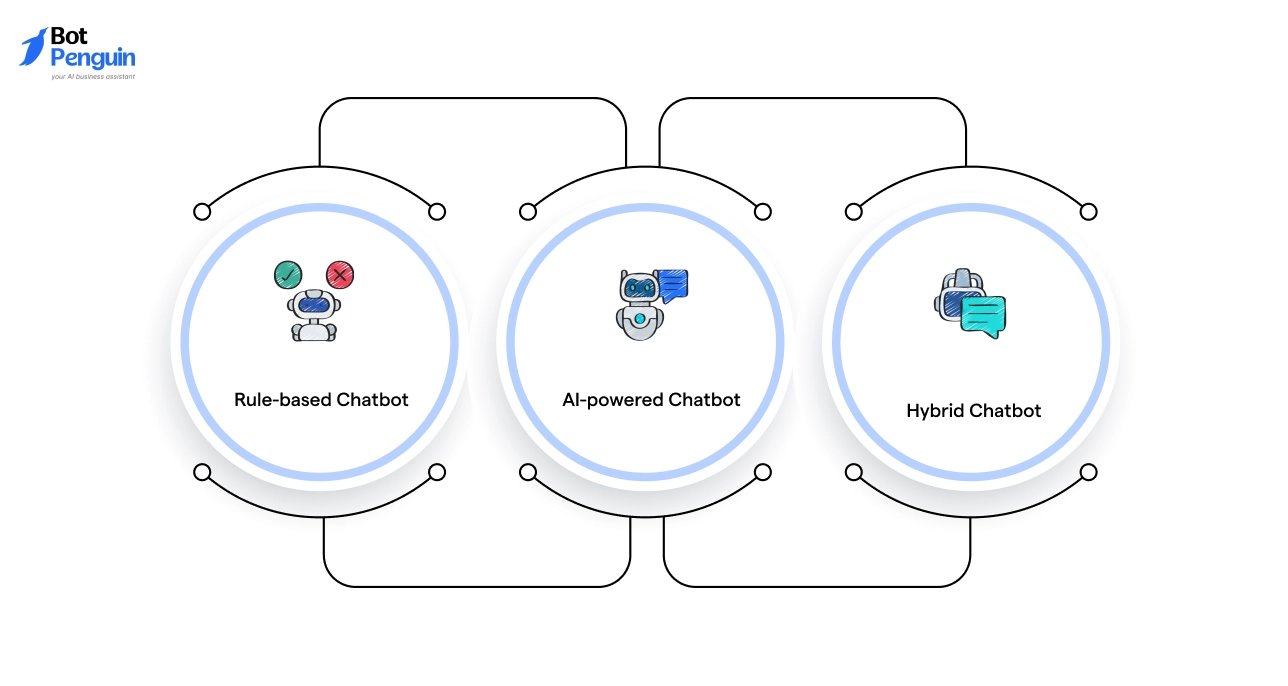

Types of Chatbots in Fintech

Not all fintech chatbots are the same. Here’s how they differ:

- Rule-based chatbots follow decision trees. They respond based on keywords and predefined flows.

- AI-powered fintech chatbots understand language better. They can interpret user intent, even when phrased differently.

- Hybrid chatbots combine both — using rules for routine tasks and AI for more complex queries.

Many chatbots in fintech today use hybrid systems to balance reliability with intelligence.

Where They’re Used

You’ll find chatbots for fintech in almost every digital touchpoint:

- Mobile apps: Chatbots are often embedded right into your bank or finance app.

- Websites: Common on dashboards and landing pages for quick help.

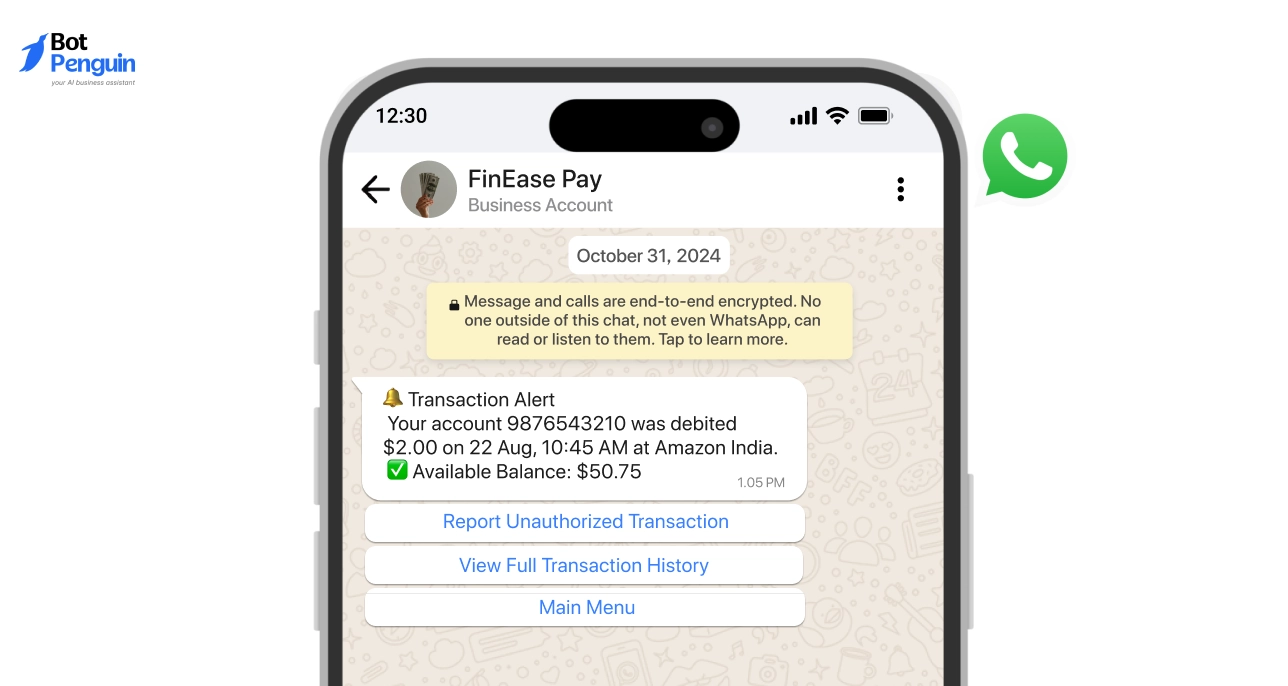

- Messaging platforms: WhatsApp, Messenger, and Telegram bots allow users to transact without opening a separate app.

- Voice assistants: Some fintech tools are now compatible with Alexa or Google Assistant.

As fintech becomes more conversational, users expect their banking tools to work like their favorite messaging apps.

Fintech chatbots are changing how we interact with money. They make financial tools more accessible, fast, and user-friendly — especially for digital-first users.

But how did we even get here? What made fintech such fertile ground for this shift in user experience? That’s what we’ll explore next.

How Fintech Became Popular (And Why Chatbots Fit In)

Fintech didn’t rise slowly — it surged.

In just a few years, banking moved from branches to apps, and payments went from swipe machines to QR codes. The shift wasn’t just technological — it was cultural.

People wanted faster, simpler, and more personal ways to manage money. Traditional banks couldn’t keep up, but fintech did.

That same expectation for speed and simplicity is what made chatbots in fintech not just useful — but necessary.

They solved a growing need in a fast-changing space.

The Shift to Digital Finance

Traditional banks were built for in-person service. But users were moving online — fast.

They didn’t want to stand in lines or wait for statements.

They wanted to open accounts from their phones, transfer money instantly, and track spending in real time.

This is where fintech stepped in — with digital wallets, app-based lenders, neobanks, and investment tools. Products were mobile-first, intuitive, and ready to scale.

Rising User Expectations

As fintech platforms grew, so did the pressure to support users around the clock.

Someone checking a failed transaction at midnight doesn’t want to wait until morning. A user stuck during a loan application doesn’t want to email support.

The demand for 24/7 answers became the norm.

Human agents alone couldn't handle that kind of scale. That’s where chatbot fintech tools became essential — helping platforms serve more users, faster, and without delay.

Why Chatbots for Fintech Make Sense

Fintech is built on automation, efficiency, and data. And chatbots check all three boxes.

They’re automated, so they can scale without adding new staff. They’re fast, delivering instant replies. And they’re connected — pulling data from CRMs, APIs, and backend systems to respond in real time.

In short, chatbots are a natural fit for digital finance — especially as tools become more conversational and user-driven.

Fintech didn’t just need support tools. It needed tools that feel like part of the product. That’s exactly what chatbots became.

But not all chatbots are built the same, and not all belong in fintech.

Next, let’s break down what makes fintech chatbots different from other types of bots.

What Makes Fintech Chatbots Different from Other Chatbots

Not all chatbots are created equal. A shopping assistant that tracks your delivery isn’t built the same way as one that handles your money.

Fintech chatbots work in an environment that demands precision, security, and trust. A wrong response could mean a lost transaction or a compliance issue.

That’s why they’re designed differently — not just in how they talk, but in what they’re allowed to do.

This section explores what sets them apart from bots in retail, healthcare, or customer support.

Industry-Specific Functionality

Chatbots in fintech aren’t just answering questions — they’re completing transactions.

They help users move money, check account limits, pay bills, or even invest. These actions require accuracy and real-time validation.

A chatbot fintech product must not only understand the question but also confirm identity, access secure data, and initiate the right action.

For example, if a user says, “Send ₹5,000 to Maya,” the chatbot must verify who Maya is, confirm the account balance, and ensure the transaction follows banking rules — all in one flow.

This kind of action-driven functionality is rare in other industries.

Regulatory Demands

The financial sector is heavily regulated. That means chatbots built for fintech need to comply with laws like GDPR, PCI-DSS, and local financial regulations.

They must store data securely, handle privacy with care, and offer audit trails for any action taken.

Even the language they use might be regulated — for example, in how they explain loan terms or interest rates.

AI fintech chatbots also require more rigorous testing than other types of chatbots. A wrong recommendation in banking isn’t just a UX issue — it could be a legal one.

Integration with Core Banking & Finance Tools

A key difference lies in how deeply fintech chatbot systems are integrated.

They often connect with APIs for identity verification (KYC), fraud detection tools, payment gateways, credit scoring systems, and more. This level of integration enables them to move beyond surface-level tasks and provide actual functionality.

For example, checking a credit score or verifying a PAN card — all from within a chatbot interface — is only possible when tied into core systems securely and in real time.

Fintech chatbots aren’t just more intelligent — they’re more deeply embedded into financial systems.

They’re built to act, not just inform. And now that we’ve seen what makes them unique, let’s explore what they actually do.

10 Powerful Use Cases of Fintech Chatbots

These bots go far beyond answering support queries.

They help users take action, make decisions, and stay in control of their finances — all in a conversational flow. As AI fintech chatbots grow more advanced, their use cases expand across nearly every part of the financial journey.

Let’s break down the most valuable, real-world use cases.

1. Customer Support and FAQs

This is where most people first meet a fintech chatbot.

Whether you’re asking about interest rates, card fees, or how to reset a password, chatbots for fintech are always available. They don’t wait on hold. They don’t transfer you five times. They just give you what you need — fast.

For example, a user could type, “What’s the late fee for my credit card?” and get an instant, accurate answer without searching or calling.

This kind of 24/7 availability is handy in digital-first banks that don’t have physical branches.

2. Transaction Notifications and Alerts

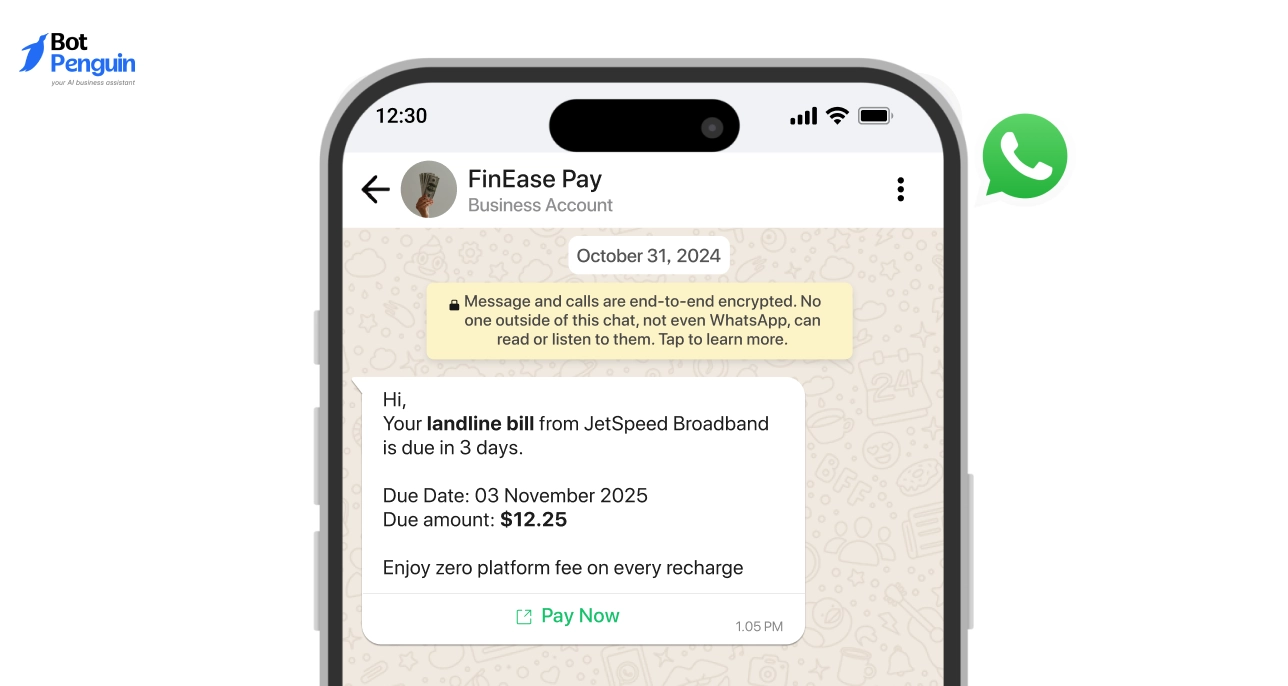

A core function of any fintech chatbot is keeping users informed in real time.

They can send alerts about completed transactions, failed payments, low balances, or login attempts from unknown devices.

Instead of pushing these alerts through email or SMS alone, chatbots deliver them in the same channel where users already engage — like WhatsApp or a banking app.

This allows users to respond immediately, reducing the risk of fraud or missed payments.

3. Account Management

Chatbots make daily account tasks simple.

Users can check balances, download statements, transfer funds, or change passwords — if the system allows it. No need to open five tabs or wait for app updates.

For example, a user might say, “Send ₹2,000 from my savings to checking,” and the chatbot completes it (this only works when backend systems are integrated and the user is authenticated).

This seamless experience improves customer satisfaction and reduces app abandonment.

4. Loan Application Assistance

Applying for a loan can be confusing and time-consuming. A chatbot fintech experience changes that.

Users can ask questions like, “Am I eligible for a personal loan?” or “What’s my EMI for ₹5 lakhs over 2 years?”

The chatbot instantly calculates, explains, and even walks them through document submission.

This reduces drop-off rates and helps lenders qualify leads faster — all without needing a human agent in the first interaction.

5. Investment Advice and Robo-Advisory

Many users want to invest but don’t know where to start. That’s where AI-powered fintech chatbots help.

These bots ask simple questions about income, goals, and risk tolerance. Based on the input, they suggest mutual funds, stocks, or SIPs. Some can even explain the pros and cons of each option in plain language.

They’re not replacing human advisors — but they lower the barrier for entry, making investing more accessible.

6. Fraud Detection and Risk Alerts

Security is where chatbots in fintech truly prove their value.

They monitor accounts and flag unusual behavior — like login attempts from a new device, sudden large withdrawals, or changes in user location.

The chatbot can alert the user instantly and ask, “Did you make this transaction?” before the damage is done.

It can also escalate the issue to a human support agent if needed.

This proactive layer helps prevent fraud and boosts user trust.

7. Bill Payments and Reminders

Nobody likes paying late fees. Fintech chatbots help reduce that risk by keeping users informed.

These bots send timely reminders for upcoming bills — whether it’s a utility payment, credit card due date, or monthly EMI. Instead of just relying on emails or app notifications, the chatbot surfaces these reminders in real time, inside the user’s chat interface.

In some cases, where the system is securely integrated and the user is authenticated, the chatbot can even initiate the payment process.

For example, the chatbot might say, “Your mobile bill is due tomorrow — would you like to pay now?”

When the user replies “Yes,” the bot either triggers the payment directly (if permissions are in place) or redirects the user to a secure payment flow.

While not all chatbots in fintech support direct payments, many are evolving toward this level of functionality — making the billing process smoother, faster, and more user-friendly.

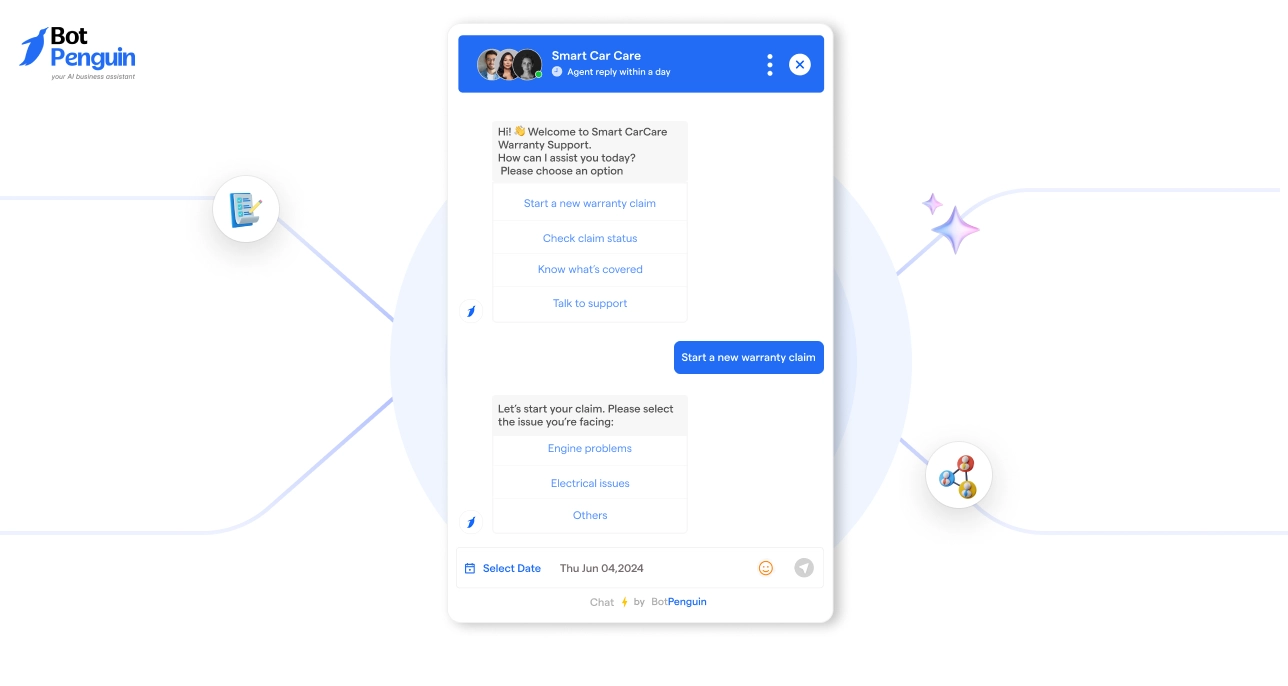

8. Insurance Support and Claims

Insurance is full of complex forms and fine print.

Chatbot fintech solutions simplify this by guiding users through policy info, coverage limits, and claim status.

If someone is in an accident, they can type, “I need to file a claim,” and the bot walks them through the process — document upload, verification, and submission — step by step.

This not only reduces pressure on support teams but also improves claim completion rates.

9. KYC and Onboarding

Know Your Customer (KYC) processes are required by law, but they can be a pain for users.

With the help of AI chatbot fintech systems, users can upload ID proof, verify addresses, and complete onboarding inside a conversational flow.

The chatbot checks for completeness, flags missing info, and even helps fix common errors in real time.

This leads to faster account activation and fewer dropped applications.

10. Personalized Financial Tips

Smart chatbots don’t just follow orders — they offer helpful insights.

They track user spending, categorize expenses, and share tips like, “You spent 40% more on food this month — want help setting a budget?”

Over time, this builds a more personal, assistant-like experience. It’s not just about automation — it’s about coaching, too.

By using the data already available, chatbots provide real value without overwhelming the user.

As you can see, fintech chatbots don’t just answer — they do. Their power lies in helping users take meaningful action in real time, often with zero friction.

But how do these use cases actually look when real companies use them? Let’s explore!

Examples of Fintech Chatbots in Action

Fintech chatbots aren’t just a concept — they’re live, running inside the apps and platforms people use every day.

Some of the most advanced banks and startups are already using them to improve service, drive engagement, and automate tasks at scale.

From global banks to fintech startups, here are some standout fintech chatbot examples showing what's possible today.

Erica by Bank of America

Erica is one of the most well-known AI-driven chatbots in fintech.

It helps customers with balance checks, upcoming bills, credit card due dates, and even personalized insights based on spending.

For instance, if your grocery bill goes up one month, Erica might flag it and offer budgeting tips.

It’s built into the mobile banking app and interacts with over 25 million users.

Cleo

Cleo is a UK-based AI fintech chatbot built for budgeting and financial literacy.

It connects with your bank account and breaks down your spending in a playful, human way — often with humor and memes.

Ask it, “Can I afford this?” and it’ll calculate whether your budget agrees. It even roasts your spending habits if you want to be held accountable.

Cleo is especially popular with Gen Z users looking for a more engaging financial experience.

HDFC’s Eva

Eva is India’s first banking AI chatbot, launched by HDFC Bank.

It’s built to answer thousands of customer queries — from checking account status to explaining banking services.

Eva integrates with HDFC's core systems to offer real-time responses. For a bank serving millions, it helps reduce call center load while improving customer experience 24/7.

Kasisto’s KAI

Kasisto’s KAI platform powers AI assistants for digital banking. It’s used by banks like DBS (Singapore), Standard Chartered, and more.

Unlike simpler bots, KAI enables deeper functionality: balance checks, fund transfers, contextual answers, and more — all via natural language.

It’s often used in white-label solutions, meaning banks deploy it under their own branding.

This platform demonstrates how enterprise-level chatbot fintech can transcend surface-level conversations.

Other Notable Chatbots in the Fintech Industry

- Eno by Capital One: Monitors transactions and flags unusual activity.

- Amex bot: Lets users track purchases through Facebook Messenger.

- Plum: A savings and investment bot used in the UK.

- Nomi by RBC: Offers personalized insights based on transaction history.

These chatbots for fintech vary in design and use case, but they all share a common goal: to make managing money easier, faster, and more accessible.

Fintech companies aren’t just using chatbots for support — they’re building them into the core product experience. That’s why the benefits they offer go far beyond saving time.

Key Benefits of Fintech Chatbots

The rise of fintech chatbot solutions isn’t just a trend — it’s a response to real user needs and business demands.

These bots do more than chat. They reshape how people interact with money.

They offer the speed users expect from fintech platforms while helping companies manage costs, grow engagement, and meet regulatory needs.

Let’s look at the biggest advantages these chatbots bring to both users and businesses in the financial ecosystem.

Better User Experience

No one wants to wait on hold or dig through a banking app just to check their balance.

Fintech chatbots fix that.

They provide instant replies to questions like “What’s my balance?”, “When is my EMI due?”, or “What’s my credit card limit?” Users no longer need to navigate through apps or call support.

With chatbots integrated in mobile apps, websites, or platforms like WhatsApp, the interface feels familiar.

It’s fast, simple, and requires zero learning curve. And for digital-native users, that’s a big win.

Reduced Operational Costs

For financial institutions, customer service is expensive.

A call center can only handle so many conversations at once.

A fintech AI chatbot, on the other hand, can manage thousands of interactions in parallel — without the overhead of human support staff. It doesn’t take sick days, doesn’t need training once set up, and runs around the clock.

This makes it incredibly cost-efficient, especially for high-volume use cases like balance checks, transaction histories, or basic loan queries.

Higher Engagement and Retention

Chatbots don’t just answer questions — they drive conversations.

By sending personalized finance tips, payment reminders, or even investment nudges based on user behavior, they keep users actively engaged with the platform.

These gentle nudges increase retention and turn passive users into regular ones.

For example, a bot might say, “Your spending on food is up 18% this month — want a quick tip to save?” Small touchpoints like these create long-term loyalty.

Improved Accuracy and Compliance

In finance, there’s no room for error. Users need accurate, policy-compliant responses every time.

Unlike human agents, AI chatbots for fintech can always be scripted to follow compliance guidelines. They don’t guess or go off-script. That’s crucial when it comes to sensitive tasks like KYC processes, document submission, or regulatory disclosures.

The added bonus? Every conversation can be logged for audit purposes, helping companies stay transparent and compliant.

24/7 Availability

Banks close. Chatbots don’t.

Whether it’s midnight in Mumbai or morning in New York, fintech chatbots keep working.

They support global users across time zones, ensuring help is always just a message away.

This is especially useful for users managing money while traveling, running businesses across borders, or needing urgent answers outside of regular business hours.

When you put all this together, it’s easy to see why fintech companies are doubling down on chatbots.

But even with all these advantages, it’s not a perfect solution just yet. In the next section, let’s look at the shortcomings of fintech chatbots — and what needs to be improved.

Challenges and Limitations of Fintech Chatbots

While fintech chatbot solutions have brought major breakthroughs in automation and convenience, they’re not without flaws.

Like any technology, they have limitations — some technical, others human.

It’s important to acknowledge these gaps so that businesses can set the right expectations and make smarter deployment choices.

Misunderstanding Complex Queries

Even the smartest chatbot can miss the mark on context.

When a user types, “I want to increase my credit limit like I did last year after my salary hike,” the request isn’t just about numbers — it’s layered with background the bot may not fully grasp.

AI fintech chatbots can manage structured queries well, but nuanced or emotionally driven conversations still trip them up.

Without clear training data, the bot might give irrelevant responses or simply say, “I didn’t understand that.” This is where the experience can quickly go from convenient to frustrating.

Security & Trust Concerns

Finances are personal. Not everyone feels comfortable sharing them with a bot.

Users may hesitate to share card details or identification documents through chat.

There's also the risk of phishing — if a fraudulent chatbot mimics a trusted one, it could fool users into handing over sensitive information.

So even though chatbots in fintech can be secure on the backend, trust still needs to be earned on the frontend.

Over-Reliance on Automation

Automation is powerful — but it's not always the answer.

Some users want empathy or need help with unique edge cases. When chatbots hit a wall and there’s no clear path to human support, it can feel like being stuck in a loop.

Smart fintech implementations always build in escalation paths — giving users the option to talk to a live agent when needed.

These challenges don’t cancel out the benefits, but they do shape how fintech chatbots should be used.

That brings us to a key decision many companies face next: Should you build your own fintech chatbot or buy a ready-made one?

Choosing the Right Fintech Chatbot: Build vs. Buy

Not every fintech company needs to start from scratch. But not all off-the-shelf solutions will fit, either.

After understanding both the potential and the pitfalls of fintech chatbot solutions, the next logical question is: to build or to buy?

The answer depends on your product needs, timeline, and in-house capabilities.

This section breaks it down to help fintech teams and founders make the most practical choice.

When to Build Your Own AI Chatbot for Fintech

Custom builds are ideal when your product requires deep personalization.

For instance, if you're running a neobank with unique workflows — say, combining crypto wallets with standard savings accounts — an in-house chatbot can mirror your exact processes.

You control every detail: conversation tone, feature depth, integrations, and even data routing.

But that control comes at a cost. Building a chatbot for fintech takes time, talent, and a sizable budget. You'll need data scientists, NLP engineers, testers, and ongoing support.

If your goal is differentiation and you have the resources — building makes sense.

When to Buy or Use a Chatbot Fintech Platform

Not every fintech startup needs to reinvent the wheel.

If your chatbot use case is standard — handling FAQs, sending reminders, or helping with onboarding — a pre-built chatbot fintech platform can speed things up significantly.

These platforms are often white-label, customizable, and pre-trained on financial data. Many also come with compliance support, analytics, and plug-and-play integrations. That means fewer dev hours and faster time to market.

Buying is a smart choice if you're at an early stage, testing chatbot ROI, or want to launch fast without hiring a full AI team.

Key Features to Look for in a Fintech Chatbot

Whether you build or buy, your chatbot must meet fintech-grade standards.

- Security-first design (especially for handling user data and PII)

- Multilingual NLP to engage diverse customer bases

- APIs for KYC, transaction tracking, CRM sync, and real-time alerts

- Fallback to a human agent when needed

Also, make sure your chatbot platform offers compliance-friendly features like audit logs, encryption, and data privacy settings.

Choosing the right approach — build or buy — lays the groundwork for everything else: performance, scale, and user trust. But regardless of how the chatbot is built, one thing can’t be compromised: security.

In fintech, safety and compliance aren’t just features — they’re essentials.

Up next, we’ll look at how chatbot fintech solutions stay secure and regulation-ready.

Security and Compliance in Chatbot Fintech Solutions

For fintech companies, it’s not enough for a chatbot to be smart or fast. It has to be secure, private, and fully compliant with financial regulations.

Unlike casual retail or support bots, fintech chatbot solutions operate in a sensitive space — one where user trust can’t be taken lightly.

Security is baked into every interaction, and compliance isn’t optional. It’s mandatory.

Let’s look at how leading fintech bots stay safe and audit-ready.

Secure Data Handling

Every data point a chatbot processes — from account numbers to spending habits — is a potential vulnerability if not handled right.

That’s why top-tier fintech bots use end-to-end encryption, secure APIs, and multi-layered authentication protocols.

For example, when a user checks their balance or initiates a transfer, the chatbot validates their identity via OTPs or biometric triggers, not just passwords.

No data sits exposed. Everything is routed through secure, monitored channels — just like any banking infrastructure.

Compliance-Ready Features

Compliance isn’t just a checklist. It’s an ongoing discipline.

Fintech bots must comply with a wide range of laws, such as GDPR, PCI-DSS, FINRA, and region-specific financial regulations.

They’re also expected to maintain detailed audit trails, store chat logs securely, and offer tools for consent and data retrieval.

That means if regulators ask, the fintech company can prove exactly what the bot said, when it said it, and to whom — all in a compliant format.

User Privacy and Consent

Trust starts with transparency.

Chatbots in fintech routinely ask for opt-in confirmations before performing sensitive actions — like sharing investment data or initiating account changes. They also present clear, upfront privacy notices about how data is stored, used, and protected.

A fintech bot doesn’t just act on behalf of a company. It communicates on behalf of its ethics.

Security isn’t just a backend concern — it’s part of the user experience. When chatbots are secure and compliant by design, users don't just interact — they trust.

And with that trust, chatbots aren’t just supporting the fintech experience — they’re helping to shape what comes next.

Are AI Chatbots the Future of Fintech?

As fintech grows more sophisticated, so do the tools supporting it.

AI chatbots are no longer just helpful add-ons — they’re becoming foundational to how users interact with financial services.

What started as basic FAQ bots has evolved into AI-powered fintech chatbot platforms capable of handling end-to-end banking tasks. And their capabilities are expanding fast.

Growing Role of AI in Finance

With the rise of large language models (LLMs), chatbots can now understand context better, offer relevant advice, and even make predictions.

For example, a user asking, "Can I afford a vacation next month?" could soon get a real-time answer based on spending habits, income patterns, and upcoming bills — all analyzed instantly.

As these chatbot fintech solutions get smarter, their role in daily finance is set to grow, from spending insights to proactive fraud alerts.

Human + Bot Hybrid Models

That said, the future isn’t bots versus humans — it’s bots plus humans.

Many fintech platforms are moving toward hybrid support models. Bots handle routine queries, while humans step in for emotional or high-stakes conversations.

Think of it like this: A chatbot can explain why a loan was declined, but a human can guide the user through other financial options.

This blend ensures efficiency without losing the human touch.

AI in fintech is still evolving. But one thing’s clear — chatbots are no longer just part of the system. They're helping shape where the industry is heading next.

Conclusion

As financial services become increasingly digital, fintech chatbots are quietly becoming one of the most transformative tools in the space.

What started as simple support bots are now intelligent, action-oriented assistants. Throughout this blog, we’ve seen how they’re streamlining everything — from customer support and transactions to fraud detection and financial planning.

Their growth isn’t just a trend; it reflects a deeper shift in how we expect to interact with our money — instantly, securely, and conversationally.

As these chatbots continue to evolve alongside AI and user behavior, they’re likely to become a standard part of every financial app and platform.

Frequently Asked Questions (FAQs)

Can fintech chatbots replace human financial advisors entirely?

Not entirely. While they handle routine queries and tasks efficiently, human advisors are still essential for emotional, complex, or high-stakes financial decisions.

The future likely lies in a hybrid model where bots support—not replace—human experts.

What’s the difference between fintech chatbots and regular banking app features?

Banking apps often require navigation and form-filling. Fintech chatbots simplify this with conversational flows, making actions like checking balances or tracking expenses quicker and more user-friendly, especially on mobile.

Do fintech chatbots support multiple languages and regional regulations?

Many advanced fintech bots offer multilingual support and can adapt to regional compliance needs. This helps global fintech companies serve diverse user bases while staying within regulatory boundaries.

Can chatbots handle fraud detection as well as traditional systems?

They complement traditional systems by flagging suspicious activity in real-time. While not perfect, they speed up detection and reduce damage by keeping users informed instantly through chat interfaces.

How do fintech chatbots personalize user experiences?

They analyze user behavior, past queries, and financial activity to offer tailored advice, reminders, or offers. Over time, they become more context-aware, helping users make smarter money decisions without asking.

Do fintech chatbots store my financial conversations?

They typically store data temporarily for context and compliance purposes, often in encrypted formats. Top-tier providers also offer options to view or delete stored data as per privacy policies.