Streamlined claims processing, faster renewals

AI Agents for Insurance

Transform claims, renewals, underwriting, and customer support with AI Agents for Insurance.Go beyond chatbots: agents that understand context, complete tasks, and keep every step compliant.

Trusted by 50,000+ Global Brands

Conversational AI in Insurance: From Scripted Chatbots to Intelligent Agents

Insurance chatbots were built for FAQs, reminders, and policy lookups. Useful, but they stop short when claims get complex or compliance kicks in. AI agents for insurance go further.

Deeper conversational understanding tuned for insurance

Embedded compliance with IRDAI, HIPAA, GDPR

Continuous learning that improves accuracy and customer satisfaction

Automated fraud detection, real-time risk scoring

Intelligent document processing with AI-powered OCR

Personalized upsell and cross-sell customer engagements

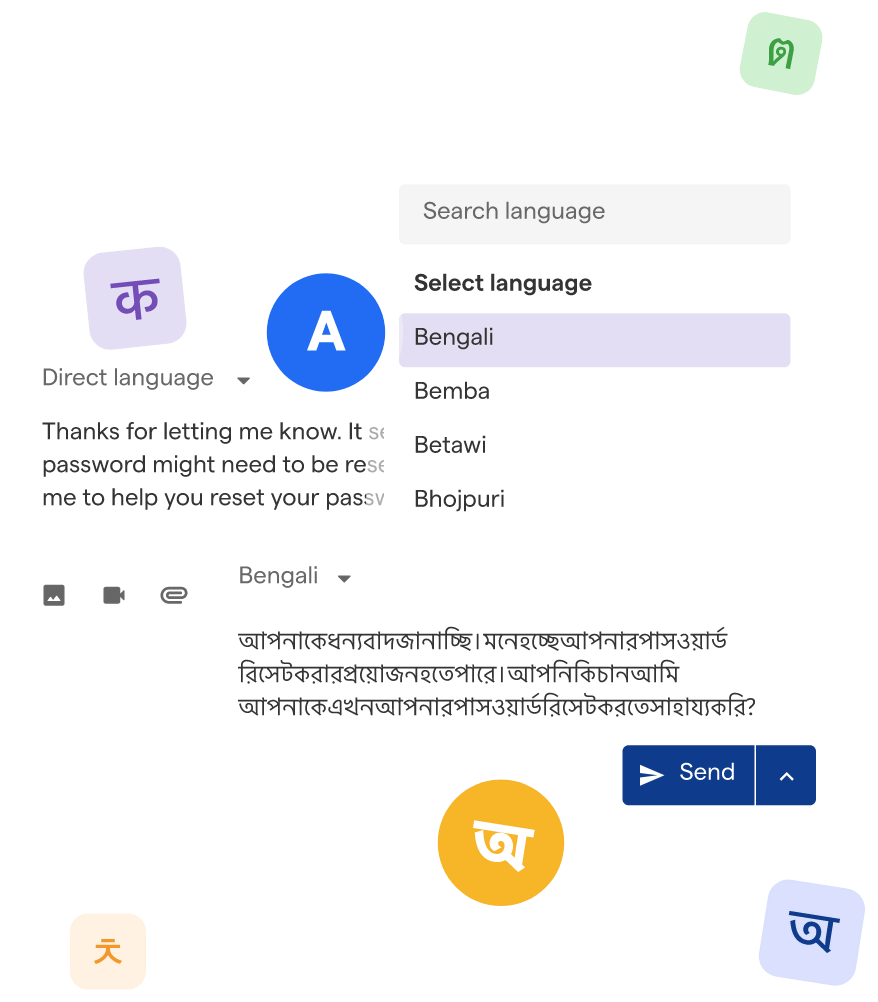

Multilingual support for global insurers and policyholders

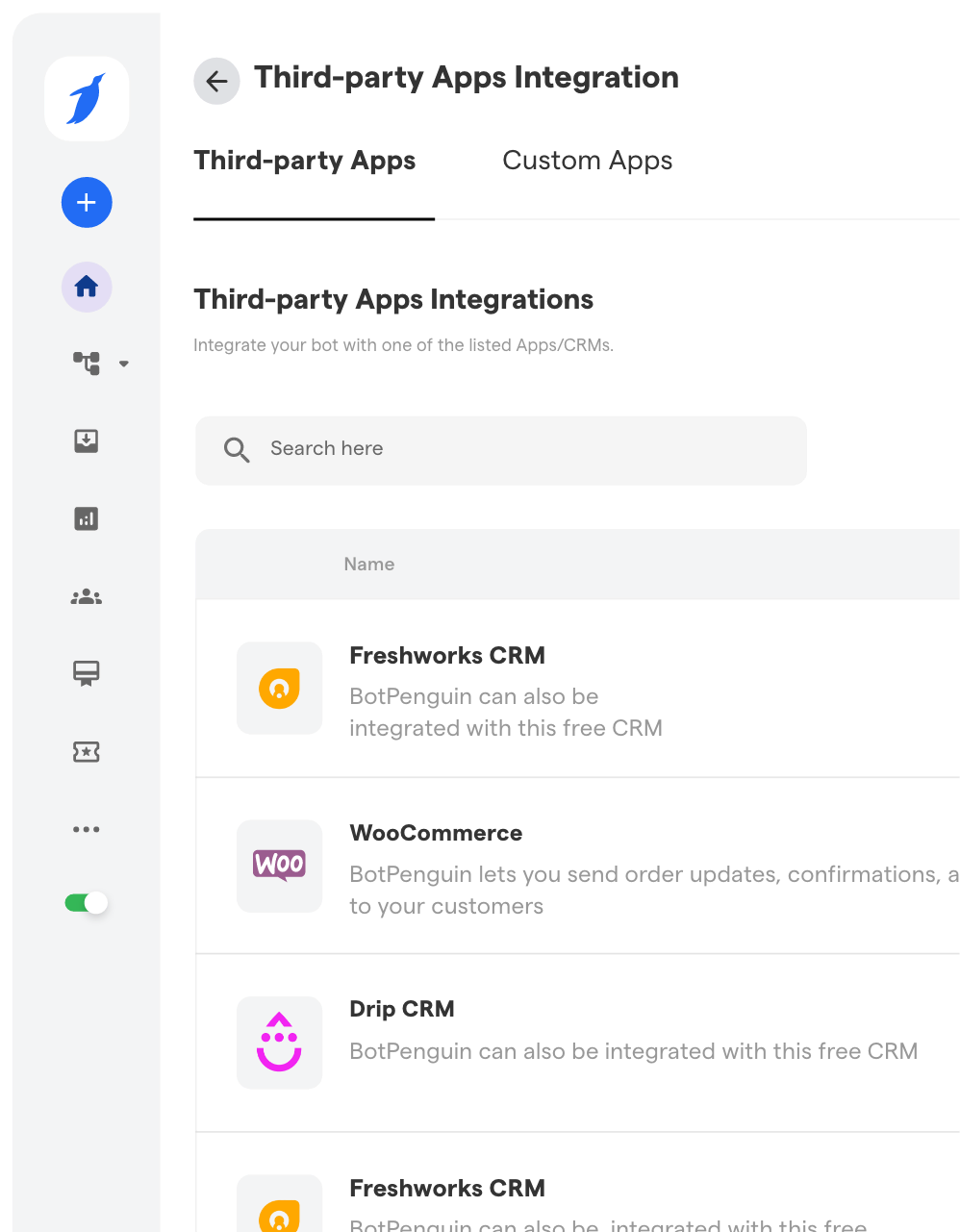

Full integration with Guidewire, Salesforce, Oracle

Real-time analytics dashboards with actionable insights

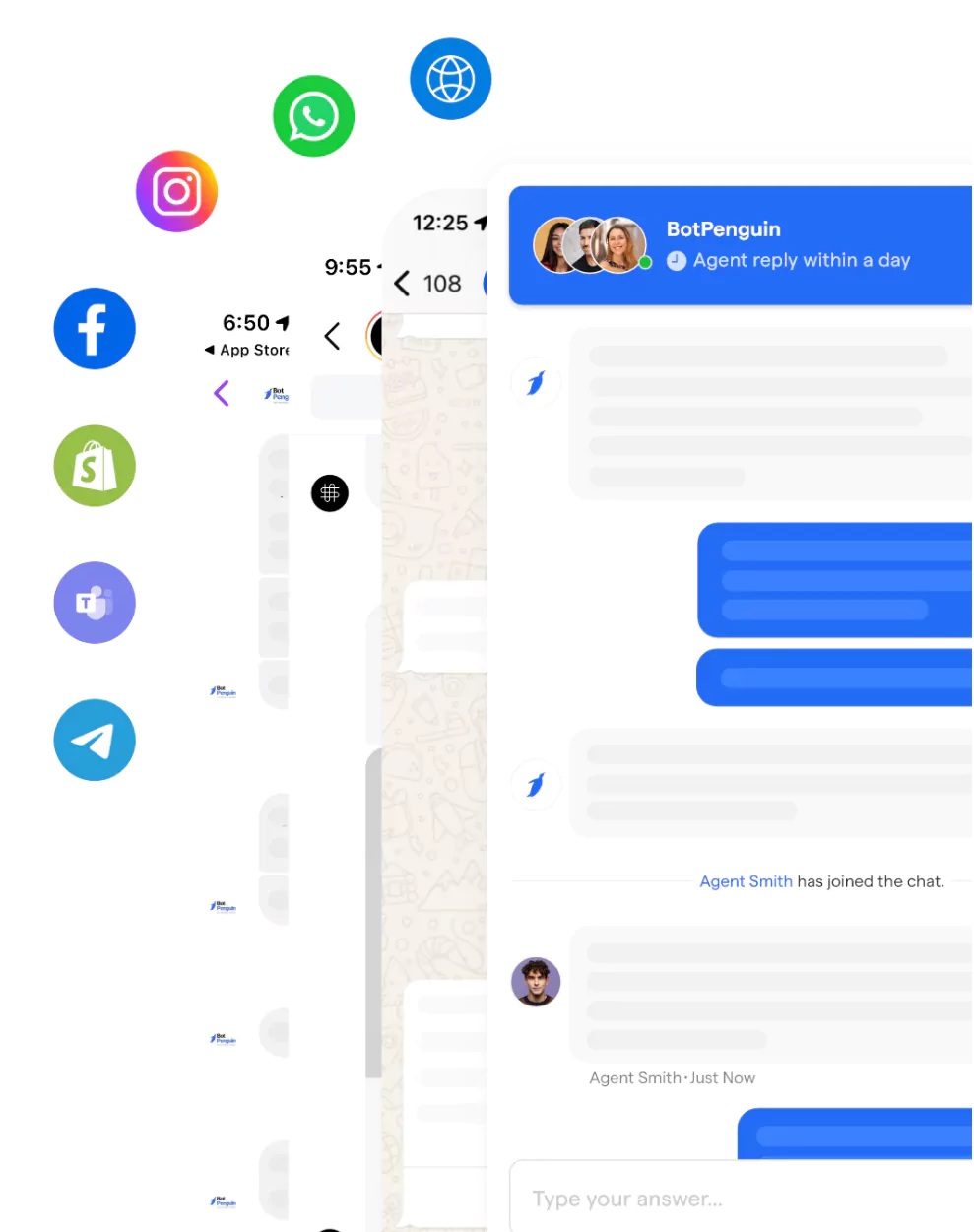

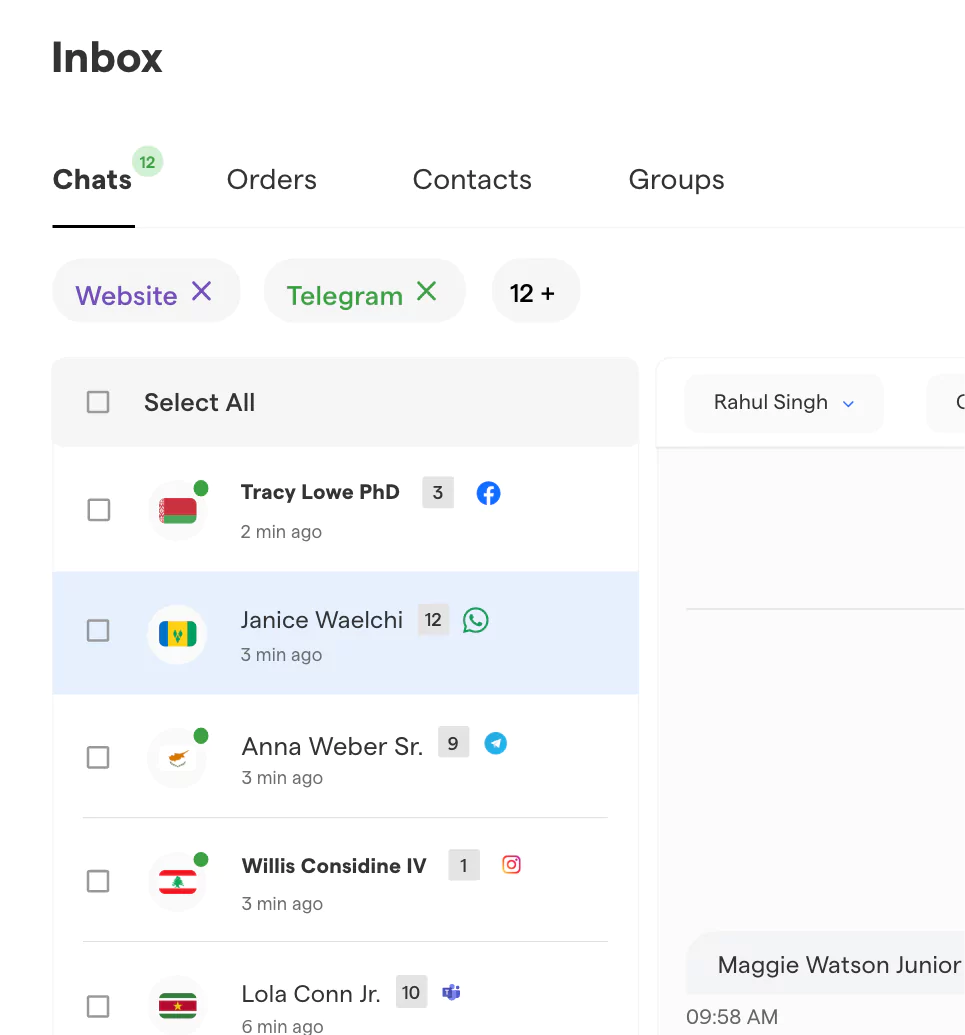

Omnichannel deployment across WhatsApp, web chat, IVR, SMS, and more

Insurance Chatbot Evolution: The Intelligent Upgrade Your System Needs

We transform insurance chatbots into proactive AI agents that redefine customer engagement:

Evolve FAQ bots into claim journey guides

Convert reminder bots into automated renewal assistants

Advance claim status bots into fraud-detecting, payout-authorizing agents

Support every channel: mobile, web, and social platforms

Unlock analytics that improve every stage of the lifecycle

Empower multilingual support for global reach

Top Use Cases of AI Agents in Insurance: Covering FNOL Through Final Settlement

Discover AI chatbot solutions that generate leads, enhance support, and boost sales - fueling growth for modern insurers.

AI Agents for Claims Processing

Accelerate FNOL, validate claims, detect fraud, and cut cycles by 70% with seamless AI automation.

AI Agents for Policy Administration

Automate issuance and endorsements, enforce compliance, and streamline policy lifecycle management in one solution.

AI Agents for Customer Engagement

Upsell and cross-sell products, deliver instant personalized support, and manage escalations with AI-human collaboration.

AI Agents for Insurance Agents

Prefill forms, summarize policies, and suggest next-best actions for faster, smarter customer journeys.

AI Agents for Underwriting Support

Validate application data, score risks fairly, and calculate premiums in seconds for streamlined underwriting.

Additional Use Cases Include

Automate broker onboarding, ensure regulatory compliance with AI audit trails, and capture feedback with sentiment analysis.

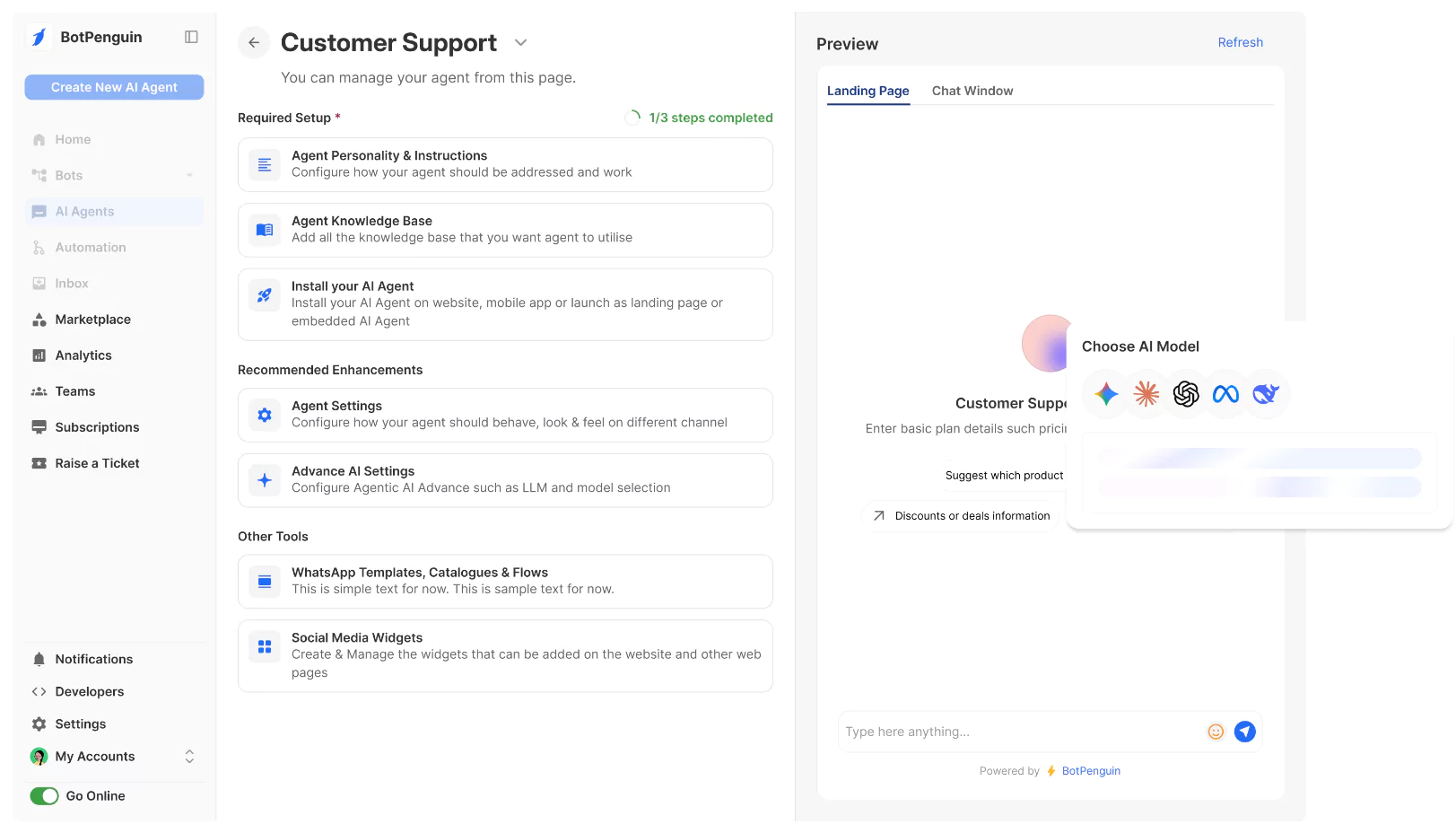

Building AI Agents for Insurance: Workflow Mapping to Scalable Deployment

We build AI agents for insurance that go live fast, scale with ease, and deliver measurable ROI.

Workflow Mapping Across Claims, Policies, and Compliance

Spot automation gaps in FNOL, renewals, servicing, and approvals. Replace repetitive tasks with clear, measurable workflows.

AI Insurance Agent Brain Design

Train NLP models for adjusters, policy assistants, and underwriters. Align intents, tools, and rules with compliance guardrails.

Integration with Insurance Systems

Connect seamlessly to Guidewire, Salesforce, Oracle, CRMs, PAS, and APIs. Enable secure read–write actions across platforms.

Compliance-First AI Agent Development

Embedded IRDAI, HIPAA, GDPR, PCI DSS, and SOC 2 standards from day one. Enforce encryption, role-based access, and full audit logs.

Safe Launch

Deploy in shadow mode, monitor live traffic, and refine with human-in-the-loop checks before scaling.

Continuous Learning and Optimization

Track CSAT, AHT, FCR, and ROI. Retrain on real conversations and refine workflows for compounding results.

Compliance-Ready AI Agents for Insurance: Secure and Regulation-Ready

Regulation defines insurance. Our compliance-ready AI agents for insurance make every workflow secure, transparent, and privacy-first.

Aligned with IRDAI guidelines to ensure transparent, secure claims

HIPAA compliant with encrypted PHI and role-based access

GDPR-ready with consent management, encryption, and erasure rights

PCI DSS certified for fraud-safe premium transactions

Built on SOC 2 and ISO 27001 certified infrastructure for confidentiality and uptime

Optional on-premise deployment for data residency requirements

Real-time audit logs and monitoring for full accountability

Why Choose Us for Custom AI Development for Insurance

Insurance is complex. Your AI partner shouldn’t be. We build AI agents for insurance that deliver - no overpromises, no failed deployments, no headaches.

200+ successful projects with proven results

5+ years of AI insurance expertise building and scaling solutions

Deep knowledge of insurance workflows and compliance

Expertise across IRDAI, HIPAA, GDPR, SOC 2, PCI DSS

Proven ROI: faster claims, higher renewals, lower costs

Flexible models: pilots, MVPs, prototypes, enterprise rollouts

Seamless integration with Guidewire, Salesforce, Oracle, CRMs

Support in 40+ languages across web, mobile, WhatsApp, IVR, and more

Dedicated teams of AI researchers + insurance domain experts

Continuous post-launch support: training, updates, optimization

Transparent milestones, reporting, and collaboration at every step

Industry-leading security and privacy standards by default

Tailored builds for unique insurer needs - never one-size-fits-all

Frequently Asked Questions

What is the difference between insurance chatbots and AI agents?

Traditional insurance chatbots are rule based, designed for scripted FAQs. Our AI agents for insurance use NLP, workflows, real-time data, and AI tools to automate complex tasks like claims, renewals, and underwriting.

How secure are AI insurance agents?

Our AI agents comply with IRDAI, HIPAA, GDPR, PCI DSS, SOC 2, and ISO 27001, using encryption, access controls, and thorough audit trails to protect PHI and PII.

Can AI tools for insurance agents integrate with legacy systems?

Yes. We support integration with Guidewire, Oracle, Salesforce, CRMs, document management systems, and custom APIs.

What are examples of insurance chatbot upgrades?

Basic FAQ or claim status bots can evolve into AI agents guiding claims, detecting fraud, and automating renewals end to end.

How long does it take to deploy a custom AI agent for insurance?

Deployment typically ranges from 6 to 10 weeks, depending on scope and integration complexity.

Do AI agents replace human insurance agents?

No. They serve as digital copilots, automating repetitive work so human agents focus on complex advice and resolutions.

Which channels can AI agents support?

Web chat, WhatsApp, IVR, SMS, Instagram, Facebook Messenger, Telegram, Microsoft Teams, and more.

Do you support multilingual conversational AI?

Yes. Our AI agents support 20+ languages to serve policyholders worldwide.

How do you measure ROI from automation in insurance?

We track metrics including Customer Satisfaction (CSAT), Average Handle Time (AHT), First Contact Resolution (FCR), claim cycle time, and renewal lift.

Do you offer white label options for partners?

Yes. We provide white label AI agent delivery and partner enablement programs.

What our Customers Say

Delivering value, earning trust. Hear good words about BotPenguin on these platforms.

Get Started with AI Agents for Insurance

Your customers deserve personalized, fast, and compliant responses. Your teams deserve AI tools that do the heavy lifting. Embrace automation and conversational AI designed specifically for insurance workflows.