Home Loan Whiz - Case Study

Home Loan Whiz automates 100% of WhatsApp inquiries and boosts lead qualification with BotPenguin

Actions that bring Impact

The result of implementing BotPenguin's chatbot solution.

40%

faster lead qualification

60%

lower consultant workload

24/7

automated client support

About Company

Home Loan Whiz is a leading mortgage advisory firm in Singapore that helps property buyers find the most competitive home loan options across over 20 banks. Known for providing free, unbiased advice and quick responses, the firm simplifies the mortgage process for clients through expert guidance and transparent comparisons.

Industry:

Financial Services / Mortgage Advisory

Key features used:

WhatsApp Chatbot

Size:

10–50 employees

Started Year:

2019

Website:

Home Loan WhizCountry of Origin:

Singapore

Challenges Faced

As Home Loan Whiz grew, so did the flood of messages on WhatsApp. Each day, the team handled hundreds of client inquiries, ranging from loan eligibility checks to document requirements, all of which were answered manually.

The process was slow and overwhelming, and during peak periods, many potential leads slipped away before getting a reply.

Clients, on the other hand, expected instant responses, especially when making time-sensitive mortgage decisions. The delay not only affected service quality but also risked losing high-intent buyers.

To make things harder, most chatbot tools on the market didn't fit their needs. They lacked financial compliance features and couldn't replicate the consultative tone crucial for a mortgage advisory.

Solution by BotPenguin

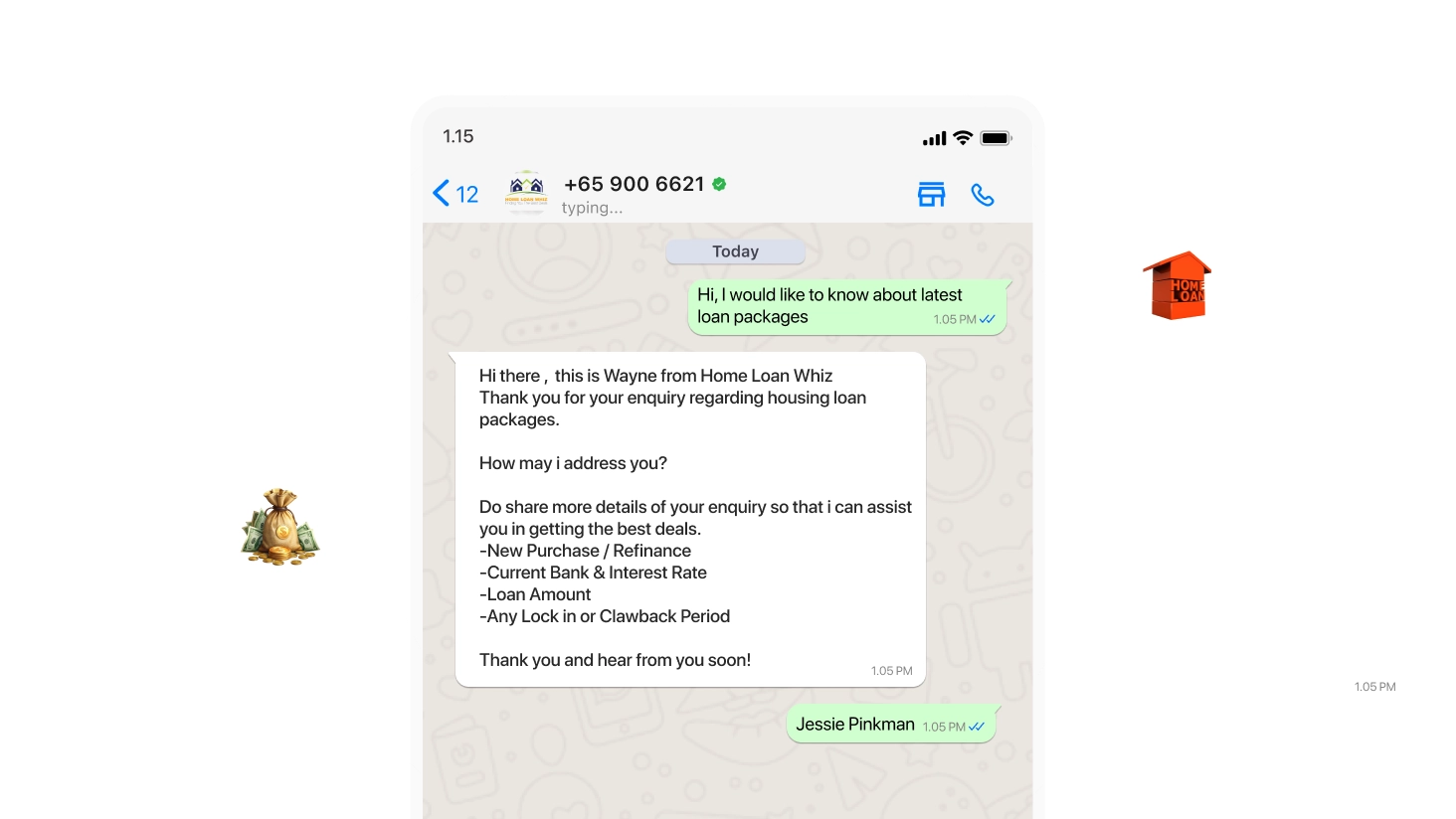

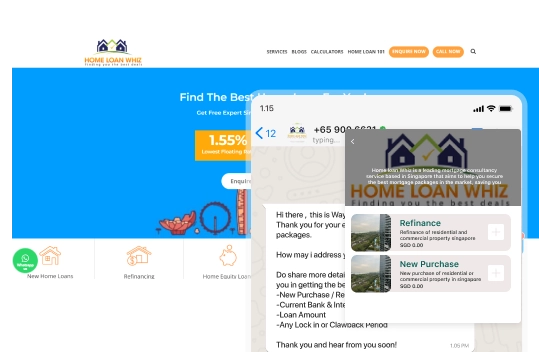

To address these challenges, Home Loan Whiz partnered with BotPenguin to build a custom WhatsApp chatbot tailored to the mortgage industry.

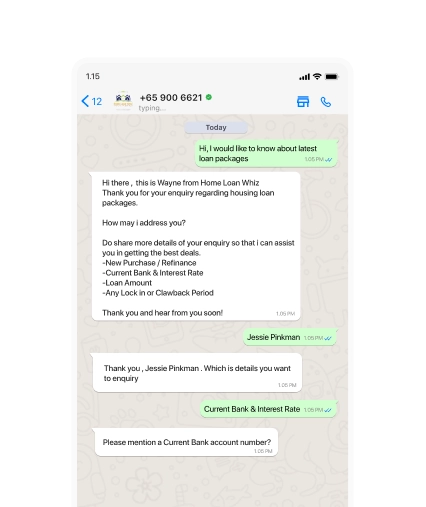

The chatbot instantly responded to client inquiries, answered common questions, and gathered key details, such as income, loan amount, and eligibility, before passing qualified leads to the right consultant.

Active 24/7, it ensured that every message received a timely response, even after office hours. The chatbot mirrored the firm's consultative tone, creating natural, trust-building conversations while automating repetitive tasks.

This allowed consultants to focus on loan approvals and meaningful client interactions rather than spending hours on routine replies.

Use cases

Platform

Integrations

Lead Qualification

Client Data Collection

24/7 Customer Support

Live Chat Routing

Impact on Business Objectives

After implementing BotPenguin's chatbot, Home Loan Whiz completely transformed its client communication.

Every WhatsApp inquiry now receives an instant response, and lead qualification has become faster and more reliable, ensuring no potential client is overlooked.

The team saved hours each day, redirecting their time toward meaningful consultations and follow-ups that truly drove conversions.

Clients, too, noticed the difference—receiving accurate answers within seconds instead of waiting for manual replies.

By automating routine interactions, the firm achieved higher engagement, smoother operations, and greater customer satisfaction across every stage of the loan journey.

Why Home Loan Whiz Chose BotPenguin

Home Loan Whiz chose BotPenguin because it offered an automated solution tailored to the needs of financial advisory firms.

Competing tools struggled with complex client interactions and compliance standards, making them unfit for the mortgage sector.

BotPenguin delivered a custom WhatsApp chatbot that handled financial inquiries confidently while maintaining the firm's professional and empathetic tone.

Its no-code flexibility, 24/7 availability, and smart lead management made it the perfect fit for a fast-growing advisory business.

With BotPenguin, Home Loan Whiz improved response speed, reduced workload, and built a more reliable client communication system.

BotPenguin changed how we handle client inquiries. Every WhatsApp message now gets an instant, professional response — it feels like having an assistant who never sleeps.

— Team Home Loan Whiz

Conclusion

Partnering with BotPenguin transformed how Home Loan Whiz connects with clients. The WhatsApp chatbot now handles first-level engagement, securely captures essential client data, and qualifies leads with precision, all while maintaining a conversational, human touch. This freed consultants to focus on high-value advisory discussions and personalized mortgage solutions.

Building on this success, Home Loan Whiz plans to integrate CRM automation, expand into multilingual communication, and adopt voice-enabled assistance, making its mortgage advisory process even more accessible, efficient, and client-centric.

Ready to take the next step?

Contact sales now

Talk to one of our specialist and explore use cases for your Industry.

Get Started Free

Explore our platform and upgrade as you scale

(No Credit Card Required).