Want to streamline online payments and tap into the trillion-dollar market? Integrating Stripe could be your ticket.

This comprehensive guide will explain everything you need to know, from setting up your Stripe account to testing transactions.

You'll learn how to connect your bank account, understand the different Stripe integration options, and leverage key benefits like seamless payments, security, flexible subscriptions, and powerful analytics.

We know payments can be complex, so we're sharing insider tips to help you avoid common pitfalls as you integrate Stripe into your website or app.

Whether you're a startup or an enterprise, this guide provides actionable steps to integrate Stripe and delight your customers while boosting revenue seamlessly.

Ready to transform your business? Let's dive in. Reading this could be a game-changer for processing online payments.

What is Stripe, and Why is it Important for Businesses?

Stripe is a leading online payment platform that allows businesses to accept and manage payments securely and efficiently.

It provides a developer-friendly infrastructure and powerful tools for processing payments, subscriptions, and more.

Here's why Stripe is important for businesses:

Seamless Payment Experience

Integrating Stripe into your business website ensures a smooth and hassle-free payment experience for your customers.

With Stripe payment integration, you can accept various payment methods, including credit cards, digital wallets, and even local payment options, providing convenience and flexibility to your customers.

Enhanced Security

Stripe prioritizes payment security and employs robust measures to protect your business and customers' sensitive information.

Using Stripe's secure infrastructure, you can mitigate the risk of data breaches and fraud, giving your customers peace of mind when making transactions on your website.

Streamlined Management

Stripe's intuitive dashboard provides comprehensive insights and tools to manage your payments, customers, subscriptions, and more.

It empowers businesses to handle refunds, analyze payment data, and automate recurring billing effortlessly, saving you time and effort.

Next, we will examine the benefits of integrating Stripe into a business website.

Benefits Of Stripe Chatbot Integration Into A Business Website

Stripe payment integration into your business website offers numerous benefits that can help you streamline your operations and boost your revenue.

Here are some key advantages:

Increased Conversion Rates

With Stripe Chatbot Integration, you can provide a seamless checkout experience, reducing friction and increasing the likelihood of conversions.

By offering a variety of payment methods and a user-friendly payment process, you remove barriers that could discourage potential customers from completing their purchase.

Improved Cash Flow

Stripe's fast payout schedule ensures that your funds reach your account quickly.

This enables better cash flow management, allowing you to reinvest in your business or meet financial obligations more efficiently.

Flexible Subscription Management

If your business offers subscription-based products or services, Stripe's subscription management tools make creating, updating, and managing recurring billing easy.

You can customize subscription plans, handle upgrades or downgrades, and automate payment collection, simplifying the management of your subscription business model.

Powerful Analytics and Insights

Stripe Chatbot Integration, reporting and analytics features, provide valuable insights into your business's financial performance. By analyzing payment data, customer behavior, and trends, you can make data-driven decisions to optimize your business strategies and drive growth.

Developer-Friendly Integration

Stripe Chatbot Integration offers extensive documentation, APIs, and client libraries that make it easy for developers to integrate Stripe into your website or application. Whether you're building a custom integration or using popular e-commerce platforms, Stripe ensures a seamless development process.

Next, we will cover the setting process after looking into the benefits of Stripe Chatbot integration.

Suggested Reading:

Setting up a Stripe Account

This section shows you through setting up a Stripe account. Whether you're new to Stripe or transitioning from another payment provider, we've got you covered!

Here are the steps.

Step 1

Creating a Stripe Account

Creating a Stripe account is quick and straightforward. Follow these steps to get started:

- Visit the Stripe website at www.stripe.com and click on the "Sign Up" button.

- Provide your email address and create a password. Make sure to choose a strong password to protect your account.

- Select your country and fill in your business details, including your business name and website (if applicable).

- Review and agree to the Stripe terms of service and privacy policy.

- Click on the "Create Account" button to complete the process.

Exploring the Different Types of Stripe Accounts

Stripe offers different types of accounts to suit various business needs. The main account types are:

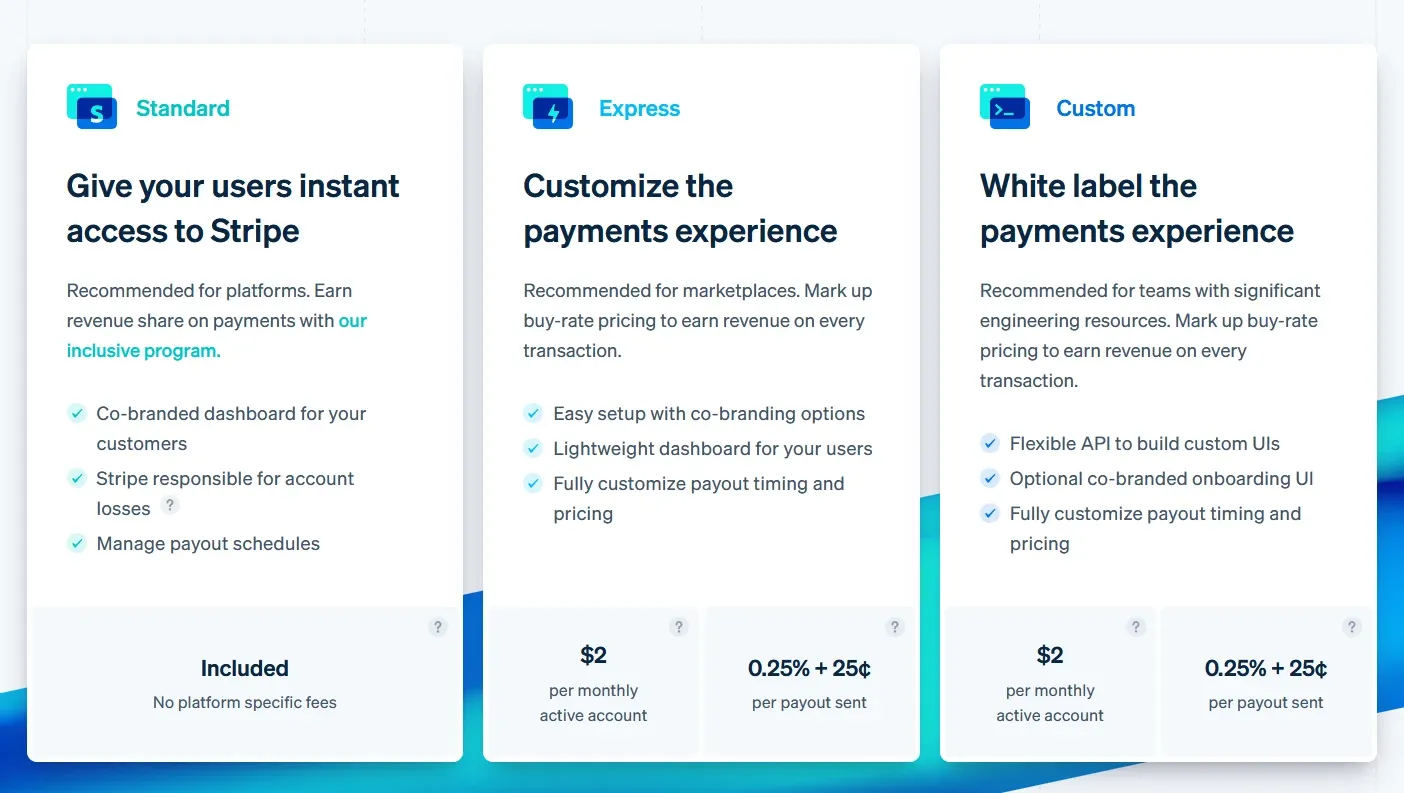

- Stripe Express Account

Ideal for businesses and platforms looking for a quick and easy way to get started with a basic payment integration. It provides a simplified onboarding process and handles most compliance requirements.

- Custom Accounts

Suitable for businesses that require more control over the user experience. With a custom account, you can fully customize the onboarding process, user interface, and branding.

Step 2

Verifying Your Identity

Once you've created your Stripe account, you must verify your identity to increase your account limits and access additional features. Here's how:

- Login to your Stripe account and navigate to the "Settings" tab.

- Click on "Verification" and follow the instructions to start the process.

- You'll be prompted to provide personal information, such as your legal name, date of birth, and address.

Documents Required for Identity Verification

Stripe may require you to submit specific documents to verify your identity. These documents typically include:

- Proof of Identity: You must provide a scanned copy of a government-issued identification document, such as a passport or driver's license.

- Proof of Address: Stripe may request a recent utility bill or bank statement clearly showing your name and address.

- Business Documentation: If you operate a business, additional documentation, such as articles of incorporation or a business license, may be required.

Ensure that clear and legible copies of these documents are uploaded to facilitate verification.

Step 3

Connecting a Bank Account

To receive funds from your Stripe account, you'll need to connect a bank account. Here's how:

- Login to your Stripe account and navigate to the "Settings" tab.

- Click "Connect bank account" and provide the requested information, such as your account holder details and bank account number.

- Depending on your country, Stripe may require you to verify your bank account by confirming small deposit amounts made by Stripe. This step helps ensure that the account details provided are accurate.

Purpose of Connecting a Bank Account

Connecting a bank account lets Stripe deposit funds directly into your chosen account. It ensures a seamless and efficient transfer of funds to access your revenue without delays. Connecting a bank account also enables Stripe to process refunds and handle any possible chargebacks.

Stripe Chatbot Integration Into a Business Website

Now that you have set up your Stripe account and configured the settings, it's time to integrate Stripe into your business website.

This section will explore the different integration methods, step-by-step instructions for installing plugins, and an overview of Stripe API integration.

Choosing the Integration Method

There are multiple ways to integrate Stripe into your website, such as plugins, API, or custom integration.

Let's look at each option for stripe chatbot integration:

- Plugins

Plugins provide an easy way to integrate Stripe into your website. They are pre-built software components that can be installed and configured in minutes. Stripe offers plugins for popular content management systems like WordPress, Shopify, and Magento.

- API

API integration provides complete control and customization over your payment process. It allows you to develop custom payment flows, automate complex tasks, and use Stripe's flexible API to tailor the payment experience to your business needs.

We at BotPenguin offer API integration.

Suggested Reading:

How to Integrate Stripe with BotPenguin?

Integrating Stripe payment processing into your BotPenguin chatbot allows you to accept payments from users within conversational interactions easily.

Here are the key steps for setting up Stripe with BotPenguin:

Step 1

Set Up Your Stripe Account

- Sign up for a Stripe account if you don't already have one.

- Gather your Stripe API keys for testing and live modes. These will be needed to connect Stripe to BotPenguin.

Step 2

Enable the Stripe payment Integration in BotPenguin

- In your BotPenguin account, go to the Integrations section.

- Find the Stripe integration and click to configure it.

- Enter your Stripe API keys when prompted.

Step 3

Design Your Payment Flow

- Map out the conversation flow leading to a payment.

- Decide where users will be prompted for payment info.

- Include confirmation messages and error handling.

Step 4

Collect Payment Details

- Use BotPenguin's built-in Stripe elements to collect payment info securely.

- Customize the elements to match your branding.

Step 5

Create Products or Services

- In Stripe, create Products to represent items users can purchase.

- Set prices, descriptions, images, etc. for each Product.

Step 6

Implement Payment Logic

- Trigger payment charges from relevant points in the conversation flow.

- Handle success and failure scenarios.

Step 7

Test and Refine

- Thoroughly test the full payment flow.

- Refine the conversation design and error handling as needed.

Implementing API Integration

Stripe API integration allows for complete customization over the payment process. Here's an overview of how to implement Stripe API integration for custom integration:

- Create a Stripe account if you haven't already.

- Generate a Stripe API key and test API key from within the Stripe dashboard.

- Use the Stripe API documentation to set up the API endpoint, integrate payment processing, handle webhooks, and manage customer and transaction data.

- Test the API to ensure that it is working correctly.

Next, we will cover how to go live and test Stripe Chatbot Integration.

Testing and Go-Live

You're almost ready to start accepting payments with Stripe! Before you go live, test your payment transactions thoroughly ensuring a smooth transition.

In this section, we'll guide you through the process of testing payment transactions and provide a checklist for going live with Stripe chatbot integration.

Test Payment Transactions

Conducting test transactions to verify the payment flow and functionality before allowing real payments is essential.

Follow these step-by-step instructions for testing payment transactions:

- Use Test Mode

Switch your Stripe payment integration to test mode within the Stripe dashboard. This will allow you to process transactions with test card numbers instead of real ones.

- Conduct Test Transactions

Simulate various payment scenarios, such as successful payments, failed payments, and refunds. Use Stripe's test card numbers to simulate different payment outcomes.

- Verify Payment Flow

Ensure that the payment process flows smoothly from when the customer selects their payment method to the confirmation of a successful payment. Test features like order creation, email notifications, and customer account creation if applicable.

Conclusion

Integrating payments should be easy and efficient.

This guide breaks down everything you need to know to get Stripe up and running. Now, you're armed with the tools to provide a seamless checkout, gain insights, and manage subscriptions.

Imagine the time and revenue gains. Don't tackle this alone - leverage BotPenguin's chatbot expertise.

Our customizable bots integrate seamlessly with Stripe, providing intelligent payment processing.

Let us handle the technical lift so you can focus on your customers. Want to boost conversions overnight? Sign up for BotPenguin to build your chatbot today.

Our team makes integration simple for businesses of all sizes.

Suggested Reading:

Frequently Asked Questions (FAQs)

How to get started with Stripe Integration for business?

Getting started with Stripe payment Integration is easy. Simply sign up for a Stripe account, connect your website or app to the API, and start accepting payments online!

How to customize the payment experience for customers using Stripe Integration?

Stripe chatbot Integration allows you to customize the payment experience for your customers by adding branding elements and customizing the checkout page to match your website or app's look and feel.

Is there a limit to the number of transactions to process using Stripe Integration?

No, there is no limit to the number of transactions you can process using Stripe payment Integration. Whether you're a small business or a large enterprise, Stripe catbot integration can accommodate your payment needs and scale with your business.

How to track and analyze payment data using Stripe Integration?

Stripe chatbot Integration offers powerful analytics tools that allow you to track and analyze your payment data in real-time. You can gain insights into customer behavior, revenue growth, and other key metrics to inform business decisions and optimize your payment process.

How does Stripe Integration ensure the security of transactions?

Stripe chatbot Integration prioritizes security and uses industry-standard encryption and fraud prevention technology to protect sensitive payment information. Stripe chatbot integration also complies with strict regulatory mandates, so you can trust that your business and customers' data are safe and secure.